Insight

June 27, 2018

The Economic Impact of U.S. Tariffs on China

Last week, President Trump ordered a new 10 percent tariff on $200 billion of Chinese imports—40 percent of their total exports to the United States. He also pledged to tax an additional $200 billion of imports if China retaliates, as it did after the last round of U.S. tariffs. This newest threat brings the grand total of U.S. imports from China now at risk of tariff exposure to $450 billion, or nearly 90 percent of Chinese goods imported by the United States.

This analysis aims to determine what impact increasing tariffs on China might have on economic activity and how it will affect consumers and producers. While this impact is impossible to determine without first knowing what specific products will be affected, examining current U.S. imports from China provides some insight.

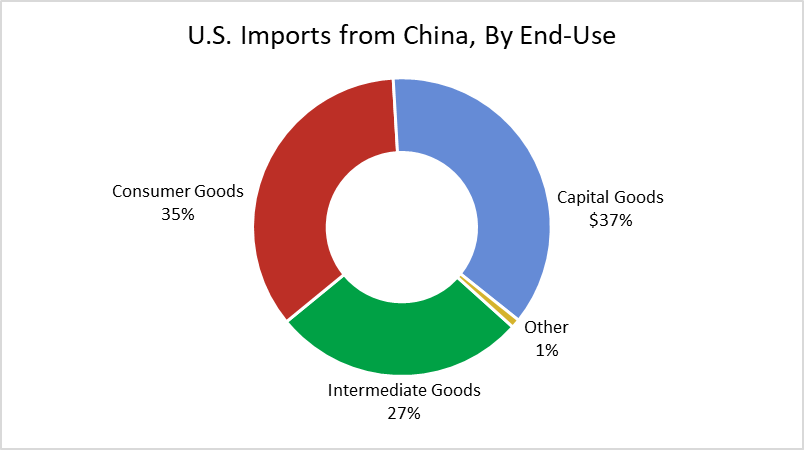

In 2017, the United States imported $505 billion of goods from China. Using data on 2017 import levels from the International Trade Commission, the following chart breaks down these imports into economic categories. To do so, this analysis applied product classifications from the United Nations and a crosswalk to match these classifications with 2017 product codes.[i]

Of the $505 billion of U.S. imports from China in 2017, approximately $177 billion (35 percent) were consumer goods. Nearly $324 billion, or 64 percent, were either intermediate or capital goods. U.S. businesses use both intermediate and capital goods for production in the United States; the distinction between them is that intermediate goods are inputs used in the production of final goods, while capital goods are finished goods used by businesses in production. An additional $5 billion of imports could not be categorized.

Placing tariffs on nearly all of these imports, as the president has proposed, will cause prices to rise for both consumers and producers and consequently depress economic activity. Given the current distribution of Chinese imports, American manufacturers would be disproportionally impacted—even if all $177 billion of consumer imports face tariffs, $273 billion of either intermediate or capital goods would need to be exposed to new tariffs in order to reach the president’s goal of $450 billion. This tax on materials would drive up the cost of U.S. production and make it more difficult for U.S. businesses to find the materials they need. It would also place additional upward pressure on consumer prices as producers pass on the cost of the tariffs to consumers.

The escalation of new trade barriers by the United States is increasing global trade tensions and shaking economic confidence. New tariffs on $450 billion of U.S. imports will undoubtedly have wide-reaching effects. Evidence shows that tariffs negatively impact the economy by increasing the cost of living and decreasing international trade. The impact of these tariffs will be even larger when combined with the other tariffs enacted by President Trump since taking office, such as the 25 percent global tariff on steel, 10 percent global tariff on aluminum, 30 percent tariff on imported solar panels, and 20 to 50 percent tariffs on imported residential washing machines.

The president’s proposed tariffs on China are antithetical to his goal of promoting American manufacturing. A simple analysis shows that the tariffs will do more harm than good to the U.S. goods-producing industry.

[i] The crosswalk matches 2017 HS codes to the fourth revision of the Classification by Broad Economic Categories, an aggregation of product classifications produced by the United Nations.

June 20, 2018

Comments for the Record

Comments on Section 232 Investigation into Auto Imports

Jacqueline Varas

Historical evidence suggests that placing additional national security tariffs on imported automobiles and automobile parts will negatively affect the…