Insight

April 10, 2024

The Economics of Renewable Energy: An Offshore Wind Case Study

Executive Summary

- Even as the Biden Administration continues to place climate change policies at the top of its agenda, restrictive federal, state, and local policies threaten the viability of some renewable energy projects; offshore wind (OSW) is one example.

- Permitting inefficiencies, domestic content regulations, and shipping restrictions present roadblocks to the construction of OSW projects, making the U.S. market complex and risky to enter, thus reducing competition. These barriers have frequently stalled the development of a promising source of clean energy and have weakened government efforts to combat climate change.

- It makes sense to use OSW where it is a low-cost source of new generation, but lawmakers can have a great influence on costs by ensuring greater coordination among federal, state, and local governments to remove onerous regulations on this source of clean energy.

Introduction

The Biden Administration continues to place climate change policies at the top of its agenda. Meanwhile, artificial intelligence (AI) and new manufacturing are further increasing demand for new electricity generation capacity. Going forward, population centers will require a lot more electricity for heating, cooling, technology use, and beyond.

Yet restrictive federal, state, and local policies frustrate the speed and cost of creating more sources of renewable electricity, and offshore wind (OSW) provides a timely case study. Permitting inefficiencies, domestic content regulations, and shipping restrictions present unique domestic roadblocks to the construction of OSW projects; these barriers have delayed or slowed the development of a promising source of clean energy.

As 2023 ended, the OSW industry faced significant economic challenges. Several contracts for major wind projects were canceled and others paused due to significant roadblocks. The rising costs of these projects understandably prompted skepticism about the overall value proposition of OSW. Notably, however, other OSW projects progressed without much delay. The different outcomes of these projects were tied to the extent to which onerous governmental regulations impeded the construction of wind power.

To the extent lawmakers and regulators want to encourage the viability of OSW projects, they must ensure better coordination among federal, state, and local governments to remove unnecessarily costly and time-consuming regulations on this source of clean energy.

Background: Offshore Wind

Recently, the landscape for the construction of OSW projects has experienced great market uncertainty. Power contracts were canceled for major wind projects in New York, Massachusetts, and New Jersey, and plans for a large OSW farm in Maryland were paused. In other circumstances, however, projects saw greater success and were able to begin work quickly.

Construction of two projects in the waters between New England and New York is well underway, with a third in its early stages. The first utility-scale OSW project is delivering power to New York. A Virginia utility has begun work on a massive OSW farm that will rank as the largest renewable energy project ever built in the United States, and two projects serving New York are expected to soon break ground. Together, these projects will increase the number of turbines installed in U.S. waters from 19 to nearly 475.

The uncertainty in the construction of OSW projects cannot be attributed to a lack of political support. The Biden Administration has continued to voice its support for the industry, and has issued more leases on the East, Gulf, and West Coasts. In February 2024, the administration finalized two projects in Oregon, which could support 2.4 GW of energy production. While the Biden Administration has a goal of approving 16 construction and operations plans by 2025, as of January 2024, only seven have been approved.

States also have continued demand for OSW and have awarded contracts for the construction of these projects to further this goal. New contracts for the two canceled New Jersey projects were awarded after the price received by suppliers was roughly doubled and an accelerated fourth solicitation round was announced for 2024. In February, New York also awarded two rebid OSW projects at substantially higher prices than their original 2019 agreements, a reflection of current market conditions.

The recent uncertainty in OSW construction projects seems unrelated to the notion that wind power is immature or unreliable. Wind power is generally reliable. For example, it does not suffer the same difficulties meeting peak winter demand in New England as solar power generation does. OSW allows for clean energy generation near densely populated areas where high costs and little available real estate make other wind and solar ventures generally prohibitively expensive.

OSW also has a higher capacity factor (ratio of actual output to maximum possible output) than onshore wind – about 43 percent versus 34 percent in 2018, according to the International Renewable Energy Agency’s 2019 “Future of Wind” report, and higher than coal at 40 percent. Those markets that have integrated large amounts of wind power, such as Denmark and Iowa (both of which exceed 40 percent), have not experienced reliability issues.

Moreover, the United States has one of the world’s best OSW resources, with strong and steady winds blowing across thousands of miles of coastline. The East Coast’s coastline waters are relatively shallow, making them a good match for fixed-bottom turbines. In these coastal states, the viability of OSW hinges on two key questions: 1) How does the cost of building new OSW compare to building other new energy generation in that geography; and 2) once that energy generation is built, how does it impact the wholesale price of electricity in those markets?

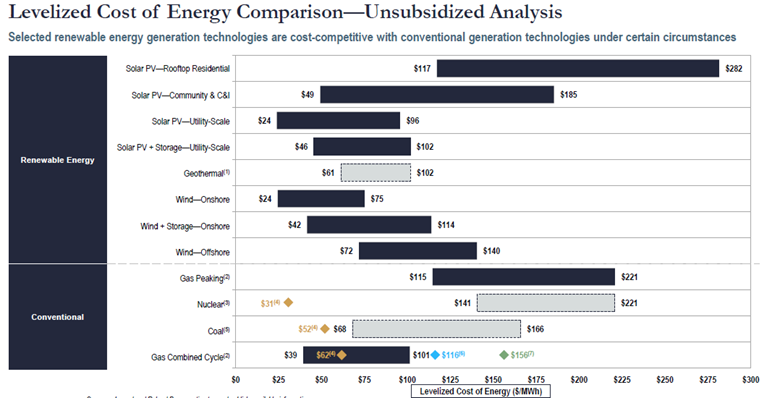

When considering whether OSW offers value, it makes sense to compare it to another new generating asset in the electricity market. Because different generation technologies have different cost structures, there is a general metric – the levelized cost of electricity (LCOE) – that is intended to make them comparable. The LCOE measurement of generation costs for a new power plant is determined by taking the ratio of the present value of plant costs to the present value of plant generation.

Generally, the LCOE for OSW indicates that it is a competitive technology for clean electricity generation. According to recent LCOE estimates from Energy Information Administration (EIA), the unsubsidized cost of OSW is around $120/MWh. In the latest Lazard research (see also this EIA study), the LCOE for OSW ranged between $72/MWh–$140/MWh. OSW compares favorably to the highest-cost natural gas generators ($115–221/MWh), new nuclear ($141–221/MWh), and coal ($68–166/MWh). Even in those ranges, EIA recognizes “the cost of building power plants in different regions of the United States can vary significantly.” (See Appendix A.) Notably, OSW advocates argue that these costs are transitory and that costs are expected to decrease over time due to large increases in scale and standardization. For example, the levelized cost of onshore wind has decreased by 63 percent from 2009 to 2023. (By comparison, coal increased by 5 percent and gas combined cycle decreased by 15 percent.) Renewable energy technologies enjoy “experience curves,” whereby their costs fall by around 30 (solar) and 16 percent (wind) for every doubling in deployment. The same downward price trajectory occurred in Europe over the past two decades, notwithstanding current supply chain and inflationary pressures.

Notably, OSW advocates argue that these costs are transitory and that costs are expected to decrease over time due to large increases in scale and standardization. For example, the levelized cost of onshore wind has decreased by 63 percent from 2009 to 2023. (By comparison, coal increased by 5 percent and gas combined cycle decreased by 15 percent.) Renewable energy technologies enjoy “experience curves,” whereby their costs fall by around 30 (solar) and 16 percent (wind) for every doubling in deployment. The same downward price trajectory occurred in Europe over the past two decades, notwithstanding current supply chain and inflationary pressures.

Once a facility is in place, the key question is how much it affects the wholesale cost of a kilowatt hour of electricity. If the marginal cost of bringing OSW to the grid is among the lowest available (compared with other sources that can be dispatched), it will be dispatched ahead of more expensive generation sources (a concept known as merit order). The lower the marginal generation cost, the more competitive OSW is, and reduces the wholesale cost of electricity, which will in turn lead OSW to have a greater share of the national energy portfolio.

Marginal costs do not radically change over short periods. OSW has generally followed relatively consistent patterns of intensity, staffing needs are relatively steady, and maintenance costs are predictable. Evidence from the larger footprints in Europe indicates that the marginal cost of electricity generation reduces wholesale electricity costs for consumers. So, while new sources such as OSW and nuclear may have large upfront capital costs, they lower the overall wholesale cost that consumers pay for electricity.

Challenges to the Construction of Offshore Wind Projects

While the marginal costs of OSW energy production are quite low, its fixed costs are a completely different animal. The costs of raising the large dollar amounts for an OSW installation can change rapidly and have done exactly that over the past two years: Inflation has raised the costs of the capital goods needed to build an installation, increased the labor cost of construction, and generally made every footprint more expensive.

The sharp recent rise in fixed costs translates into a higher LCOE for OSW, which has two implications:

- If the higher costs are permanent, the LCOE will be higher and electricity rates must be higher to cover these costs.

- If the higher costs are transitory, policymakers face a trade-off: They could wait for costs to fall but defer progress on climate objectives or adjust policies to offset the higher fixed costs, though waiting might undermine firms’ ability to solve supply chain bottlenecks caused by inadequate investment.

These fixed costs must be incurred by firms and covered by electricity prices to recover firms’ investment costs. Unfortunately, as the adage says, time is money, and in the current high interest rate environment, the multiple years of delay produced by the inefficient policy environment translates into a lot of money.

The Disconnect in the Offshore Wind Permitting Process

A key component of OSW costs is the time and resources spent on the permitting process. As interest in building out more renewable energy resources has grown both politically and economically, one aspect of the construction process that has received greater attention is the often opaque and complex permitting process these potential projects face. Undue delays in this process mean that such projects are not built in a timely fashion, thus delaying their potential climate benefits. Additionally, there are concrete examples that these delays threaten projects’ financial viability since the uncertainty associated with an ambiguous timeline complicates how firms raise and manage the necessary capital.

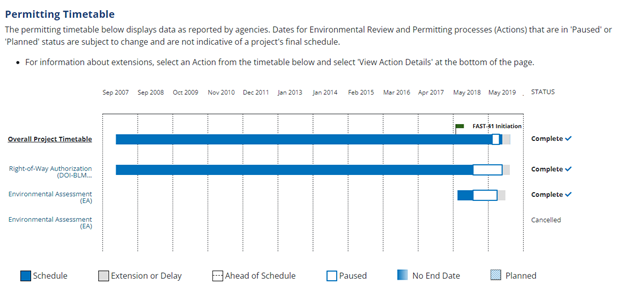

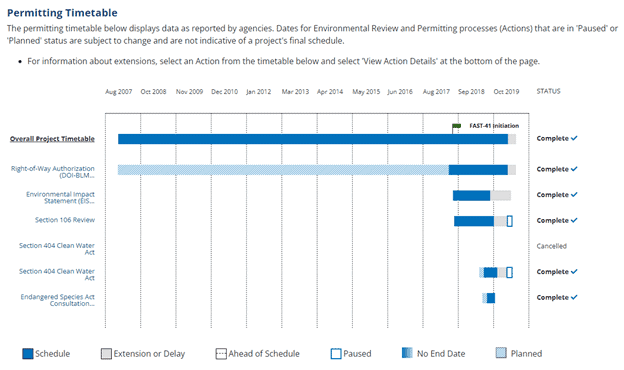

A key way to reduce the fixed costs of OSW is to speed up the permitting process. Perhaps the most notable example of policy reform in the permitting process over the past decade has been in the “FAST-41” framework – emanating from Title 41 of the Fixing America’s Surface Transportation Act (FAST Act) – that seeks to make the timetables of permit applications more transparent and standardized in length while also facilitating greater coordination among relevant agencies in the process. While FAST-41 has helped in streamlining the permitting process for some renewable energy projects, the data suggest that agencies have not applied its reforms as rigorously to OSW projects, thus leaving them needlessly languishing in regulatory limbo.

The Federal Permitting Improvement Steering Council (FPISC) – the entity created under the FAST Act to serve as a clearinghouse for permitting agencies – maintains an online dashboard with information for the public regarding timelines for various infrastructure projects. Land-based wind turbines and solar panels are among the most analogous modes of renewable energy to OSW in terms of operational capacity, scale, and other factors. According to FPISC data, there have been instances where land-based wind and solar projects were able to expedite their permitting processes after starting on the FAST-41 path (see graphic representations for the respective examples below).

“Chokecherry/Sierra Madre Wind, Phase II” “Gemini Solar Project”

“Gemini Solar Project” An examination of current FPISC data, however, reveals that OSW projects have not been so fortunate, even with the expected help of the FAST-41 framework. There are currently 12 OSW projects categorized as “In Progress” in the FPISC dashboard.

An examination of current FPISC data, however, reveals that OSW projects have not been so fortunate, even with the expected help of the FAST-41 framework. There are currently 12 OSW projects categorized as “In Progress” in the FPISC dashboard.

On average, from the submission of the initial permit application through the expected end-date of the process, these projects’ permits are expected to take more than 1,500 days (roughly 4.1 years) to get approved. Furthermore, it does not appear that a FAST-41 designation holds any sway over this timeline. For those projects with a publicly available FAST-41 initiation document (four of the 12 did not have this available), the initiation points for their respective FAST-41 designations came, on average, roughly 85 days after the initial overall permit application. This suggests that such a designation has no discernible effect on expediting the planned timeline.

Granted, there are unique environmental and logistical considerations that apply to OSW projects that are not necessarily applicable to their land-based counterparts. In particular, managing a given project’s effects on marine life is a novel concern. Additionally, connecting OSW generators to the overall transmission grid involves a more complicated arrangement of relevant agencies and jurisdictions. Nevertheless, there should be opportunities available to streamline the OSW review process to help mitigate delays in the permitting timelines.

For instance, FPISC has a series of reports on “Recommended Performance Schedules” over the past few years. The first two iterations provide broad-based, conceptual considerations of how best to formulate a more standardized timeline, but the report from November 2023 goes a step further and applies those considerations to specific, relevant sectors. As noted, OSW is not one of the covered sectors. Conducting a similar exercise for this sector – either through similar guidance documents or through more formalized rulemaking or legislation – would be a good place for policymakers to start.

In addition to making permitting more efficient, permitting decisions need to be durable. This requires a modest update to the underlying statute. Although Congress amended the Outer Continental Shelf Lands Act (OCSLA) in 2005 to grant the Bureau of Ocean Energy Management authority over managing renewable energy projects on federal offshore lands, the statute largely retains its original structure from the 1950s. The ambiguity in OCSLA regarding how the secretary of the Department of the Interior can and should balance different activities in federal waters impedes investment. It also does not align with the “multiple-use” approach to land management in the Federal Land Policy and Management Act, which governs onshore activities on federal land. OCSLA should be amended to clarify that while balancing considerations, the Interior secretary should not favor one factor over others. This would encourage predictable management over the long term.

Federal Regulatory Obstacles

The Jones Act

The Jones Act severely handicaps the installation of OSW projects. Section 27 of the Merchant Marine Act of 1920 regulates coastal trade and requires that all goods transported by water between U.S. ports be carried on ships constructed in the United States, fly the U.S. flag, are owned by U.S. citizens, and are crewed by U.S. citizens. While the intention of the law was to support American jobs and shipbuilding in the United States, as well as generate a ready reserve of ships in the event of the need for naval capability, it now stands as a major impediment to clean energy.

The Jones Act is particularly a challenge for OSW, which will need vessels for ferrying supplies, constructing turbines, and transporting workers. Only a few vessels (34 globally and only 19 outside of China) are large enough to lift the foundations and new turbines used offshore. One vessel is being built in Texas, but not in time for the first project expected to use it. At least five are needed to support project pipelines and to introduce price competition. As Cato’s Scott Lincicome notes:

The Jones Act has increased the cost and complexity of developing offshore wind while failing to spur the construction of WTIVs [Wind Turbine Installation Vehicles] beyond a single costly and delayed vessel. For offshore wind developers, this has to be the worst of both worlds.

While developers are investing in U.S. shipbuilding, the Jones Act cannot incentivize buildout of all specialized vessels due to insufficient industry demand signals, and efforts to put additional regulations on the industry will only delay it further.

Studies have found that the Jones Act increases the cost of installation by 30 percent. Day rates on installation vessels can run to $350,000 per day, or $127 million per year. Costs for U.S. flagged vessels can run 50 percent more.

EPA Construction Permitting

OSW projects on the Pacific and the Atlantic coasts must obtain Environmental Protection Agency air permits for their construction and operational vessel activities. At the same time, offshore energy operations in the Western and Central Gulf of Mexico and North Slope of Alaska – namely those involved in the extraction and production of fossil fuels such as oil and gas – are exempt from such requirements. Onshore renewable energy sources also do not have their construction activities regulated in this way. This discrepancy creates a uniquely costly burden and potential regulatory delays for OSW projects. Rather than impose old regulatory frameworks on new technologies, policymakers should update the definition of the Outer Continental Shelf source in light of the new scenarios created by OSW.

Domestic Content Regulations

A central issue in the cost structure is the eligibility for energy community and domestic content tax credits. Those credits are each worth 10 percent of a project’s cost and can be claimed on top of the Inflation Reduction Act’s base credit of 30 percent for renewable energy projects (if a project meets the law’s new labor requirements). As a result, eligibility for the tax credits is central to the cost structure of an OSW installation.

Yet as currently written, the Treasury guidance for the domestic content credit contains a fatal flaw. The guidance requires that an OSW project be constructed using U.S. iron and steel from a U.S.-based tower facility. No such manufacturing facility exists – nor is one set to come online until at least 2026. Therefore, today’s first-mover projects are ineligible to qualify for the credit, even when the project meets the second half of the requirement (sourcing 20 percent of the project’s manufactured products domestically). If the credit is unachievable because of the tower requirement, developers are not incentivized to source their other components domestically, and thus the United States misses out on an opportunity to create a cycle of onshoring the OSW supply chain while driving down costs.

Onshore Transmission, Interconnection, and Other Infrastructure

As noted earlier, connecting OSW generators to the overall transmission grid, building the necessary ports and other infrastructure, and dealing with local environmental issues are fundamentally in the jurisdiction of sub-federal agencies and governments. The coordination required is unprecedented and happening at a painstakingly slow pace. A major federal challenge is developing coordinating processes that ensure these aspects of the generation environment are completed in a timely fashion. Going forward, coordination will be required as the lead OSW permitting agency, the Bureau of Ocean Energy Management (BOEM), develops its regulations.

To date, state renewable goals have been the primary drivers for OSW procurement. Of late, states are also increasingly involved in transmission development for OSW. There are activities underway in New York and several New England states, among others. Decisions made at the state level are also likely to be important factors in determining the choice among transmission options, depending on the structure of procurement contracts.

On the FERC side, transmission planning and interconnection rules will determine how efficiently OSW generation can be transported to load and how facilities will be regulated after development. There are currently areas of overlap between the BOEM process and FERC interconnection process as OSW generators will often be going through both processes at the same time. For example, as the BOEM/National Environmental Policy Act (NEPA) process remains iterative, much of the project-specific information remains in flux and generators may not be able to provide the level of control and detail required by FERC or the regional transmission operators/independent system operators within the timeframes required in the interconnection process.

In addition, if the developer proceeds with the generation interconnection study process prior to the submission of its BOEM Construction and Operation Plan application, the NEPA process would almost certainly result in changes to many of the project design elements upon which the interconnection process relies. Alternatively, if a developer waits to enter the interconnection queue until after submitting its application to BOEM, the regional study analysis may require alterations to the design components already submitted to BOEM, requiring modification to the Construction and Operations Plan, further delaying that process.

BOEM and FERC should coordinate on these issues to promote efficient development and deployment of OSW resources.

Conclusion

The costs to complete anticipated OSW projects have been rising, leading some to question the strategic value of these and other renewable energy investments. This concern is misplaced. While the fixed costs associated with OSW projects have increased, the marginal cost remains steady, indicating that the long-term value proposition of OSW is comparable to what it was prior to the recent fixed cost increase.

Many of the fixed costs of OSW projects depend on other aspects of federal, state, and local policy decisions. While economic swings and shifting investment costs are unpredictable by nature, regulatory policies don’t have to be. Redundant, unnecessary, or excessive regulatory policies raise costs more than is necessary to be effective.