Insight

February 2, 2021

The FY2021 Budget Resolution – Teeing Up Budget Reconciliation

Executive Summary

- This week, the House and Senate will consider budget resolutions in their respective chambers.

- The budget resolution is a critical first step for the majority to pursue budget reconciliation – a powerful legislative tool that can be invoked to override Senate filibusters.

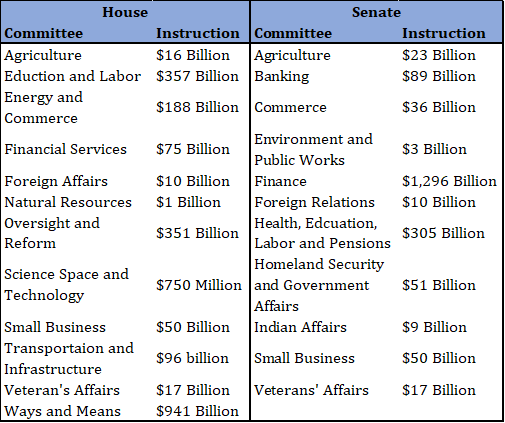

- The budget resolutions under consideration in Congress include reconciliation instructions to 12 House committees and 11 Senate committees, directing those committees to report legislation increasing the deficit by no more than $1.889 trillion over the next 10 years.

Introduction

This week, the House of Representatives and the Senate will simultaneously consider budget resolutions. Assuming both chambers pass these measures, and that outcome is essentially guaranteed, the resolutions will provide the congressional majority with an important tool – reconciliation – to allow for expedited consideration of legislation, in this case, nominally a COVID-19-related stimulus bill. Under existing rules, reconciliation has important limitations and other considerations that restrict its use, but it is increasingly the preferred route for advancing new administrations’ legislative priorities through Congress.

Reconciliation in the House and Senate

A reconciliation bill is legislation that changes laws affecting mandatory spending and/or tax revenue to achieve a specific budget outcome. It is a legislative process that reflects the long-tested notion that fiscal changes, particularly deficit reductions, can be politically perilous and therefore more difficult to pass.[1]

Reconciliation is among the most powerful procedural tools available to policymakers because bills passed through the reconciliation process are considered under expedited rules that limit the time allotted for debate, the scope of amendments, and the number of votes needed for passage. In the House, simple majorities can attach similar conditions to most legislative matters, so the unique parliamentary characteristics of reconciliation legislation are largely intended to override otherwise prevailing Senate rules.

In the Senate, a reconciliation measure is privileged, which means it requires only a simple majority to be brought to the Senate floor rather than the usual 60 votes. Thereafter, floor debate is limited to 20 hours, with further limitation on the scope and time that may be devoted to amendments. A simple majority is required for passage without the usual supermajority vote needed to advance to a vote on final passage.

Reconciliation and the FY2021 Budget Resolution

For reconciliation measures to even be taken up by the House or Senate, an identical budget resolution must be agreed to by both chambers.[2]Historically, the budget resolution has been critical to the congressional budget process for determining annual appropriations, and budget “reconciliation” was intended to ease the passage of legislation that would reconcile tax and spending levels with those assumed in the budget resolution.

But this history is functionally little more than quaint trivia. The budgetary reality of today is far different from that which prevailed over the first couple decades of the modern budget process. Today, annual appropriations are less consequential to the budget outlook, and can be determined outside of the traditional budget process. Today, the budget resolution is still important as the necessary first step in the budget reconciliation process. The budget resolutions under consideration in Congress reflect that reality. Neither the House nor Senate budget resolutions contain significant changes to assumed tax and spending levels. Rather, those figures simply reflect the budget trajectory as it currently stands.

The only critical elements of the budget resolutions are the reconciliation instructions. To initiate the budget reconciliation process, a budget resolution must include instructions to committees to achieve specific budget outcomes through legislation. These instructions must include four key elements:

- the committee to which the instruction is directed;

- the deadline by which the relevant committee or committees must comply;

- the specified dollar amount change to either revenues, outlays, the deficit, or the public debt; and

- and the time period over which those budgetary changes must be achieved.

Further, it is important to note that a reconciliation instruction does not prescribe how the specified budgetary changes must be met. Those changes remain the purview of the instructed committee.

The Fiscal Year (FY) 2021 Budget Resolutions under consideration by the House and Senate include reconciliation instructions to 12 House committees and 11 Senate committees. All of the instructions directed committees to report changes in laws within their jurisdictions that increase the deficit by a combined $1.889 trillion. [3] It is important to note that this budget resolution does not include instructions to increase the debt limit.

The committees were instructed to report legislation to their respective chambers no later than February 16.[4] Upon reporting the legislation, the recommendations will be packaged together by the Budget Committees into an omnibus reconciliation bill.

Congress may only consider one bill for each of the fiscal changes provided for in the reconciliation instructions. Thus, a budget resolution provides Congress with only one “bite at the apple” each for making changes to revenues, spending, and the debt limit through reconciliation, for a maximum of three reconciliation bills. A single bill may make changes to all three, for instance, or a bill may make changes to revenue and outlays (possibly though a “deficit” reconciliation instruction) and a separate bill may make changes to the debt limit, or some other similar combination. The important constraint is that Congress may not consider multiple bills satisfying the same instruction in a budget resolution. Accordingly, if Congress utilizes the instruction to the Finance and Ways and Means Committees to issue new rounds of economic impact payments, it cannot later pursue health care reform in a separate bill – or any other deficit reconciliation bill generated by the instructions from the FY 2021 budget resolution that would affect the deficit. As FY 2021 is already well underway, however, upon completion of consideration of the reconciliation measures that arise from the FY 2021 budget resolution, Congress can, and likely will, enact a FY 2022 budget resolution later in the year, and begin the budget reconciliation process anew.

Conclusion

Reconciliation is a powerful legislative tool that provides for expedited consideration of budget-related legislation in Congress. To employ this tool, Congress must first agree to a budget resolution with reconciliation instructions, which can only produce a maximum of three reconciliation bills. Congress will likely pass a budget resolution this week providing reconciliation instruction to multiple committees in each chamber and provide for expedited consideration of nominally COVID-19-related legislation without the concurrence of the minority in the Senate.

[1] https://www.americanactionforum.org/research/budget-reconciliation-primer/

[2] https://www.americanactionforum.org/research/the-congressional-budget-process-what-a-budget-resolution-is-and-what-it-is/

[3] Note that due to overlapping jurisdictions, the gross total of deficit instructions in the House amount to $2,103 billion: https://budget.house.gov/publications/report/budget-resolution-and-reconciliation-alternative-path-american-rescue-plan

[4] Lynch, Megan Suzanne, “Reconciliation Directives: Components and Enforcement,” Congressional Research Service, R41186, April 15, 2010