Insight

October 27, 2021

The Hidden Cost of Federal Paperwork

EXECUTIVE SUMMARY

- The lack of transparency in how the federal government discloses its estimated paperwork costs highlights how stagnant and inefficient the federal paperwork management apparatus has become.

- According to the agency in charge of reviewing regulatory requirements, the current federal paperwork tally includes roughly 9,400 requirements that bring nearly 10 billion hours of paperwork each year with approximately $139 billion in estimated costs.

- The public-facing cost figure is woefully incomplete, however; analysis of estimates included in supporting documentation suggest that when the government’s own calculations of labor costs are included, the actual cost of the federal paperwork burden is at least $276.6 billion—about twice as high as the public-facing figure—and perhaps upward of $422 billion.

INTRODUCTION

If it seems that Americans face a monumental level of government paperwork, it’s because we do. The federal government’s puts the government-wide cumulative paperwork burden at nearly 10 billion hours each year (that equates to more than 1.1 million years-worth of hours). That’s a lot, but at least appears to be an accurate accounting. The listed total for annual costs from these paperwork requirements is roughly $139 billion (for reference, that’s more than the net worth of Bill Gates). That’s also a lot, but this figure provides a woefully incomplete picture of the actual paperwork costs.

One key yet unaccounted-for aspect is the calculation of “hourly costs,” the monetized version of either the direct labor costs or the opportunity costs involved in filling out the forms in question. These calculations do, in fact, exist. But they are largely hidden away in the supporting documents used to justify a given paperwork requirement. An examination of the supporting documentation for the most burdensome requirements reveals that, when including these hourly costs, the total annual cost of the federal paperwork burden is at least $276.6 billion—about twice as high as the public-facing figure—and perhaps upward of $423 billion.

THE OIRA DATABASE

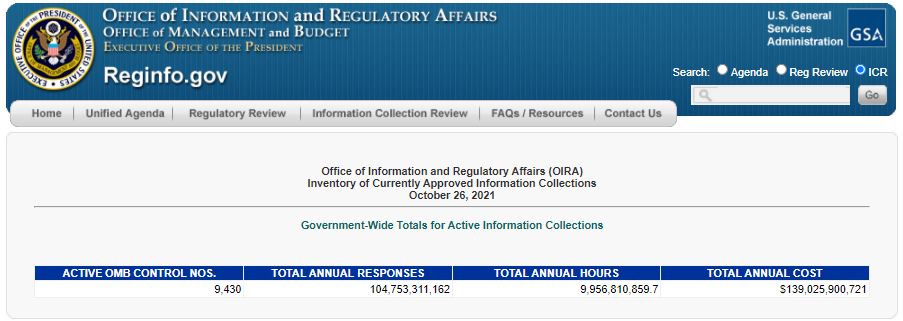

Under the Paperwork Reduction Act (PRA), proposed paperwork collections—basically, any form or set of forms put out by an agency for a specific purpose—undergo a review process through the Office of Information and Regulatory Affairs (OIRA) before they become official. As part of its role in managing the federal paperwork portfolio, OIRA maintains a daily-updated database of all the currently approved paperwork collections. The following graphic includes the current, cumulative totals for four key metrics of paperwork burdens across all agencies:

While the cost figure included here is quite substantial, it does not provide a complete accounting. That total is generally the sum of non-hourly capital costs attached to a given paperwork requirement and, outside of sparse instances, it does not include the hourly costs attached to the more than 9.96 billion hours of cumulative burden. Part of the PRA review process, however, involves drafting a “Supporting Statement” to justify the collection’s usage (see the document available here for an example). Unfortunately, these documents are buried away as essentially an addendum to each paperwork collection’s entry and (for unclear reasons) are not included in the public-facing cumulative count.

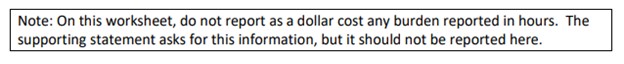

Why are the hourly labor cost calculations not included in the government-wide database? The technical instructions to agencies on how to input their data system explicitly directs agencies to exclude such calculations from their “cost” figure in the following note:

There is no easily discernable reason why this directive is in place. Since these instructions also direct agencies to prepare these calculations for their respective supporting statements, it seems odd, for transparency purposes, that they are also instructed not to report them in the OIRA database. As such, while these estimates are still technically available, they are not readily available to the casual observer.

ANALYZING THE DATA

Since there are roughly 9,400 separate paperwork collections, it is impractical to compile and examine all the supporting statements one-by-one in a timely fashion. Thus, this analysis examines the 200 paperwork collections with the highest annual hour totals. Combined, this set of 200 collections amounts to about 9.1 billion hours—approximately 91 percent of the cumulative government-wide total. As such, it stands as a relatively representative sample and, if nothing else, covers those paperwork requirements with the most pronounced burdens.

An examination of the supporting statements attached to this sample of paperwork collections reveals that the more accurate total annual cost figure is $276.5 billion. To help demonstrate the haphazard nature of agencies disclosing the true costs, the following table represents the top 10 in terms of actual total annual costs (measured against their public-facing cost estimates):

| Agency | Title | “Listed Costs” ($ Billion) | Total Annual Costs Provided in Supporting Statement ($ Billion) |

| HHS | Standards for Privacy of Individually Identifiable Health Information and Supporting Regulations at 45 CFR Parts 160 and 164 | 0 | 66.9 |

| Treasury | U.S. Business Income Tax Return | 44.3 | 44.3 |

| HHS | Requirement For Negative Pre-Departure COVID-19 Test Result or Documentation of Recovery from COVID-19 for All Airline or Aircraft Passengers Arriving into the United States from Any Foreign Country | 0 | 40.2 |

| Treasury | U.S. Individual Income Tax Return | 38 | 38 |

| SEC | Rule 10b-10 Confirmation of Securities Transactions (17 C.F.R. 240.10b-10) | 10.3 | 10.3 |

| Defense | Prohibition on Contracting for Certain Telecommunications and Video Surveillance Services or Equipment—FAR Sections: 52.204-24 and 52.204-25 | 8.9 | 8.9 |

| SEC | Rule 3a-4 (17 CFR 270.3a-4) under the Investment Company Act of 1940, “Status of Investment Advisory Programs.” | 0 | 3.8 |

| DOT | Hours of Service (HOS) of Drivers Regulations | 1.5 | 2.9 |

| HHS | Advance Beneficiary Notice of Noncoverage (ABN) and Supporting Regulations in 42 CFR 411.404 and 411.408 (CMS-R-131) | 0 | 2.9 |

| HHS | Investigational New Drug Regulations | 0 | 2.3 |

This $276.6 billion total is only a minimum estimate. For instance, 57 of these 200 collections failed to include an official estimate of the hourly costs. If, as in previous American Action Forum analyses of tax paperwork costs such as this one from earlier this year, one applies the average wage for a “Compliance Officer” ($36.35 per hour) to the hour totals of these collections, that yields an additional $108.4 billion in annual costs for a grand total of $384.3 billion. As noted earlier, these 200 collections account for only 91 percent of the overall hours total. If one extrapolates it out to the scale of the full 9.96 billion hours total, that yields roughly $422 billion in projected total annual costs. Such a projection would be roughly three times the total currently listed on OIRA’s site.

POTENTIAL FOR REFORM

The flawed accounting discussed above highlights the need for greater transparency and accountability in the paperwork management process writ large. The first and most obvious area for reform would be to update the procedures involved in disclosing these cost estimates. Whether by statute, regulation, or simply amending the technical instructions cited above, it should be relatively easy to direct agencies to include these calculations in the existing database. Agency officials, for the most part, are already producing these estimates for their supporting statements; including them on OIRA’s site is merely one additional data entry step.

For those instances where agencies do not currently produce such a figure, there should be another policy change that requires agencies do so barring some extraordinary circumstance. This calculation requires two main components: the number of hours and the hourly rate of those hours. The hours total is implicitly known; from there it is simply a matter of ascribing a reasonable hourly rate either to that total as a whole or to its constituent parts based upon the mix of respondents involved. The figures produced above are merely projections based upon certain assumptions; having a full root-to-branch accounting for all 9,400-something paperwork collections would provide even greater context.

The true magnitude of the actual cost involved in completing federal paperwork demands renewed attention to the overall paperwork approval process. As of this posting, the most recent “Information Collection Budget” (ICB) —the ostensibly annual report on government-wide paperwork trends required under the PRA—available is the edition covering fiscal year 2017. While it is a relatively anodyne and obscure report, the lack of attention to it further suggests a lack of interest in providing a transparent accounting of the nation’s overall paperwork burden.

Furthermore, given that the ICB’s main topics are “to report to Congress on the paperwork burden imposed on the public by the Federal Government and efforts to reduce this burden [emphasis added],” exploring measures (such as a “paperwork budget”) to help bring that potential $423 billion cost figure down. Granted, some of the largest collections pertain to necessary tasks such as filing tax returns or generally desirable measures such as corporate financial disclosures, but with a number that large there is surely space to find and produce meaningful cuts. And while policies regarding “cutting red tape” have been traditionally associated with business interests, it is important to note, as others have, that duplicative and extraneous paperwork requirements also affect individuals applying for benefit programs and non-profits applying for grants and loans. Having a fuller, more transparent understanding of the scale involved in such issue areas will be key in determining the best paths forward in addressing them.

CONCLUSION

While it fluctuates on a daily level due to the churn of the paperwork review process, the current government-wide tallies of the federal paperwork burden are roughly: 9,400 distinct paperwork requirements, 10 billion hours of time spent each year, and $139 billion in associated costs. That last number does not tell the full story, however. Diving deeper into estimates provided by supporting documentation, one finds that figure ballooning up to perhaps three times that level. Ascertaining a more transparent and complete accounting on this matter is both good policy in its own regard and key to finding ways to cut out the unnecessary and duplicative paperwork items involved.