Insight

February 17, 2021

The Legacy of the Regulatory Budget

EXECUTIVE SUMMARY

- The regulatory budget, the primary mechanism for implementing the Trump Administration’s deregulatory efforts, was formally ended on the first day of the Biden Administration.

- The net economic impact of rules subject to the regulatory budget was in the range of $155-$164.7 billion in savings, based on combining Trump Administration accounting with an American Action Forum projection of actions issued over the final months of the Trump term.

- The regulatory budget successfully reduced the growth of new regulatory costs and incentivized and institutionalized regulatory reform principles in federal agencies, but at the same time it was beset by weaknesses including a lack of durability and full transparency.

INTRODUCTION

The Trump Administration staked much of its policy legacy on its efforts to reduce regulation. The primary mechanism for implementing this agenda was through its regulatory budget. With the regulatory budget officially ended, it is worth examining the legacy of the effort.

The regulatory budget was successful in reducing the growth of new regulatory costs and in incentivizing and institutionalizing regulatory reform principles in federal agencies. At the same time, it was beset by weaknesses including a lack of durability and full transparency.

STRUCTURE OF THE REGULATORY BUDGET

The regulatory budget was established through Executive Order (EO) 13,771, which contained two major provisions. The first was that “for every one new regulation issued, at least two prior regulations be identified for elimination.” This provision garnered most of the attention at the time President Trump signed EO 13,771.

This part of the order became more of a talking point than requirement. The language of the EO suggested that each new regulation would have to be accompanied by the repeal of at least two existing regulations. In practice, its implementation was more nuanced. According to Office of Management and Budget (OMB) guidance to agencies, only significant regulations were covered by the EO. In addition, there were exemptions for rules addressing national security, emergencies, statutory or judicially mandated requirements, or those with de minimis economic impacts. These exemptions were designed to ensure that critical and run-of-the-mill rules could be issued as needed. Even those rules that were covered did not need to be issued concurrently with the “eliminated” rules, identify them, or even be an outright repeal. The order also did not apply to independent agencies.

The more impactful major provision of EO 13,771 was the establishment of regulatory cost caps, which in essence established the regulatory budget. OMB, through the Office of Information and Regulatory Affairs (OIRA), set fiscal year (FY) caps on the total cost that each executive agency’s rules could impose. Most agencies had caps in negative figures, meaning the net result of their new rules had to create economic savings. Each year, OIRA also set an administration-wide target based on the sum of each agency’s cap. It was the cost cap provision of the EO that ultimately drove much of the deregulatory activity of the Trump Administration.

REGULATORY BUDGET BY THE NUMBERS

The Trump Administration’s accounting for each fiscal year included two sets of performance metrics, an estimate of the economic impact of the deregulatory and regulatory actions covered, and the number of each type of action (see appendix). This accounting is summarized below.

Estimated Economic Impact

The Trump Administration published annual accounting of the previous fiscal year’s economic impact. When these annual summaries are individually summed, for FYs 2017-2020 (the last year of official accounting) the total net impact of the regulatory budget is $188.9 billion in present value savings. At the conclusion of FY 2020, however, OIRA released a cumulative savings value of $198.6 billion that was apparently adjusted for inflation.

The American Action Forum (AAF) calculates a projected estimate for the partial FY 2021 of $33.9 billion in net present value costs. Accordingly, AAF’s estimated range of the cumulative economic impact from the regulatory budget is from $155-$164.7 billion in net savings. The table below shows each year’s final accounting (not including OIRA’s inflation-adjusted value).

| Fiscal Year | Costs/Savings ($ billions) |

| 2017 (partial) | -8.1 |

| 2018 | -23.4 |

| 2019 | -13.4 |

| 2020 | -144 |

| 2021 (partial)

AAF Estimate |

33.9 |

Number of Covered Actions

As mentioned above, the Trump Administration promised in EO 13,771 to “eliminate” two rules for each rule issued. In practice, it counted any action with a deregulatory effect (not necessarily an outright repeal) as a deregulatory action and only significant actions with a regulatory effect as regulatory actions. These distinctions made it relatively easy to achieve the one-in, two-out ratio. This note is not to diminish the deregulatory efforts of the administration but rather to place them in the proper context.

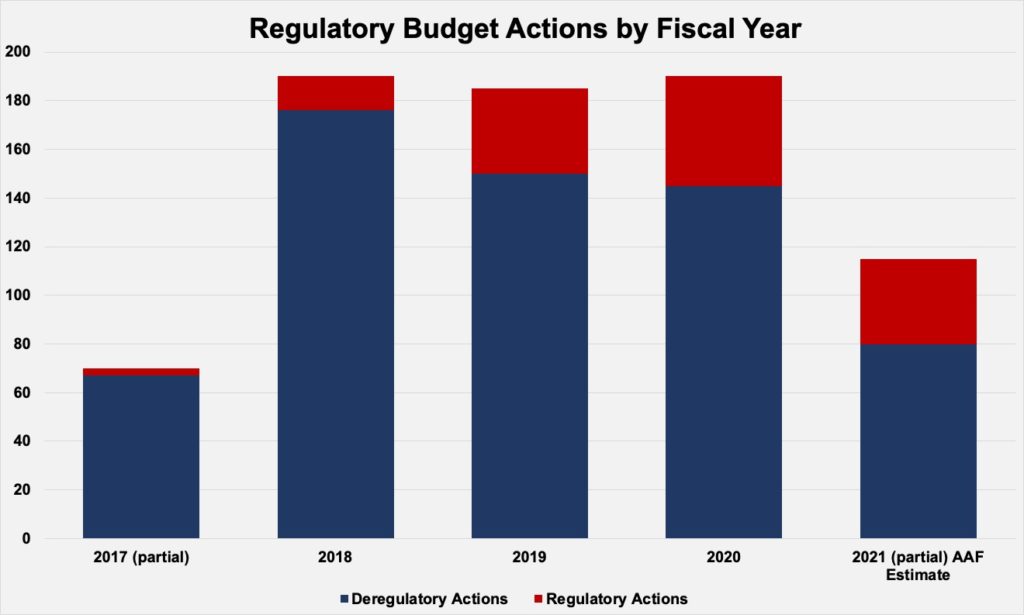

According to OIRA’s final accounting at the end of FY 2020, the Trump Administration finalized 538 deregulatory actions to 97 regulatory actions, a ratio of 5.5 to 1. Adding in AAF’s estimate of actions in FY 2021 yields a count of 618 to 132, for a ratio of 4.7 to 1.

The chart below shows the count of each fiscal year’s actions by type. Of note, regulatory actions make up a larger proportion of actions in each successive fiscal year, and FY 2021 was on pace to be its most regulatory by far – though the phenomenon of “midnight regulation” likely played a large role in increased regulatory activity.

STRENGTHS OF THE REGULATORY BUDGET

Aside from its success in achieving net economic savings, the regulatory budget had three other strengths that were all connected with each other. The budget helped institutionalize the practice of reducing existing regulations. Through OIRA guidance on EO 13,771 implementation and subsequent EO 13,777, agencies built the internal structures necessary to identify existing regulations that could be modified or rescinded. Perhaps the best example of this institutionalization was the Department of Transportation’s (DOT) rule on “Administrative Rulemaking, Guidance, and Enforcement Procedures” that codified within DOT’s own internal regulations many deregulatory principles. DOT ended with the most finalized net savings of any agency covered by the regulatory budget, with approximately $100 billion.

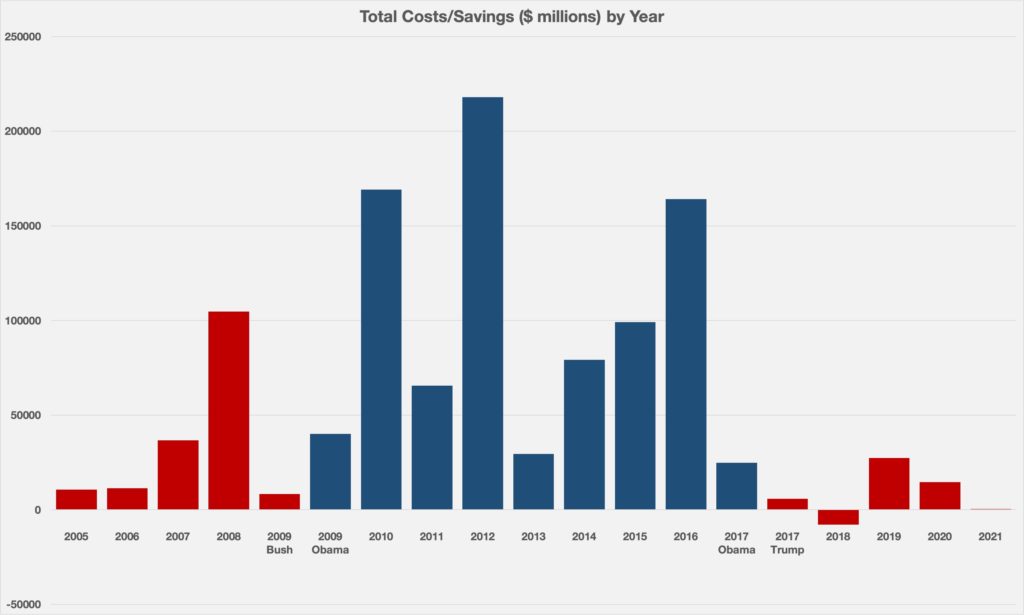

The institutionalization of deregulatory principles at agencies helped limit the growth of new regulatory costs across the federal government, including independent agencies. Whereas the Obama Administration added an average of $111 billion on an annual basis over its eight years, the Trump Administration added $10 billion on average annually. The chart below shows the amount of net economic impact of all rules available in AAF’s Regulation Rodeo database, by year by administration, through January 20, 2021.

The reduced growth in new regulatory costs in turn signaled to businesses that they did not have to worry about a lot of new regulatory requirements and associated costs, and instead could focus on operating and growing. A 2019 study by researchers at the National Federation of Independent Business found that its survey of small business optimism, which approached all-time highs during the Trump Administration, showed “a negative correlation between the Optimism Index and ‘Regulations’ as identified by owners as their single ‘Most Important Problem’ in the survey.”[1] More succinctly, as businesses worried less about regulation, their optimism about operating their business improved. The growth of key stock market indices, such as the Dow Jones Industrial Average, over the same period suggests this optimism was not limited to small businesses.

DEFICIENCIES OF THE REGULATORY BUDGET

Despite its strengths, the regulatory budget had notable deficiencies. The foremost of these was that, as it implemented through an executive order, it would never become a durable policy. Indeed, the regulatory budget was scrapped on the first day of the Biden Administration. While the executive order allowed the Trump Administration to begin immediately implementing the regulatory budget, the administration never seriously pushed Congress to legislate a budget with more durability. It is true that such a solution would have been a long shot given the need to reach 60 votes in the Senate, but the failure to pursue it weakened the regulatory budget’s staying power.

Other deficiencies could more directly be attributed to the Trump Administration. A major deficiency was the lack of full transparency. The Trump Administration provided annual accounting, the number of actions covered, and even a list of those actions. But it failed to make public the accounted value of each action, making it impossible to compare those values with what was published in the Federal Register (especially since Federal Register values were not official). This lack of clarity provided unnecessary ammunition to those opposed to regulatory budgeting, who suggested numbers could be manipulated. A similar lack of transparency plagued the cumulative savings numbers issued with the FY 2019 and FY 2020 accounting, since those numbers appeared to be adjusted for inflation without being acknowledged as such by OIRA.

The regulatory budget was also open to suggestions of manipulation in how it counted deregulatory actions and regulatory actions. As mentioned previously, OIRA counted any action with a deregulatory effect as a deregulatory action and only rules with a significant regulatory effect as regulatory action. While this perhaps made sense operationally, it led to outlandish ratios of deregulatory actions compared to regulatory actions, such as the 22 to 1 ratio in FY 2017. This undermined the credibility of the budget in the eyes of those who opposed it and allowed some to dismiss its successes.

Finally, and perhaps most problematically, the regulatory budget was subject to ideological preferences rather than economically efficient deregulation. The best example of this was in the area of immigration policy, where the regulatory budget allowed for costly rules limiting legal immigration that the Trump Administration viewed as politically beneficial despite clear economic harms. In FY 2020 alone, the Department of Homeland Security added net regulatory costs of $38.9 billion, mostly from immigration restrictions.

CONCLUSION

The regulatory budget was successful in reducing regulatory cost growth across the federal government, and specifically led to estimated savings from covered agencies of about $160 billion. It also helped remove unnecessary regulatory burdens, institutionalized regulatory reform principles at agencies, and helped the economy by boosting businesses’ willingness to invest in growing their companies.

At the same time, it was limited by certain weaknesses. The regulatory budget was not a durable reform. It lacked full transparency in how it accounted individual actions. Its comparison of deregulatory actions to regulatory actions was not commensurate. And it proved susceptible to ideological preferences on certain issues.

[1]Chow, M.J., Dunkelberg, W.C. Deregulation, tax policy, and certainty: foundations of the U.S. recovery. Bus Econ 54, 211–225 (2019). Accessible at https://doi.org/10.1057/s11369-019-00138-3

APPENDIX

Fiscal Year 2017: Accounting; List of Actions

Fiscal Year 2018: Accounting; List of Actions

Fiscal Year 2019: Accounting; List of Actions

Fiscal Year 2020: Accounting; List of Actions