Insight

October 3, 2023

The Medicare Budget Implications of the Inflation Reduction Act

Executive Summary

- The Inflation Reduction Act (IRA) contains two Medicare provisions – an “inflation tax” and drug price “negotiation” – that are estimated to save the program $266 billion from 2023–2031.

- Because Medicare is part of the unified federal budget, the $266 billion in savings from Medicare do not equate to a $266 billion benefit to program participants.

- Instead, the Medicare savings are simply another means of financing the IRA’s $670 billion in clean energy tax credits and other spending on energy and the environment.

Introduction

The Inflation Reduction Act (IRA) has two primary policy initiatives: reforms to Medicare prescription drug policies and large-scale subsidies to clean (non-fossil) energy. In discussing the IRA, advocates typically keep the two separate, holding that the Medicare drug policy will yield savings for the Medicare program while clean energy subsidies will speed the transition to a new energy portfolio. Yet the two are linked by the unified federal budget. This reviews the budget impact of the IRA and finds that of the $266 billion in Medicare savings the IRA’s provisions will yield, none will benefit program participants and will instead be spent to subsidize the law’s clean energy tax credits and other related spending – and leave a residual to be borrowed. (A rough calculation by Mark Merritt in a Wall Street Journal op-ed reaches a similar conclusion.)

This is hardly the first time Medicare has been deployed as cover for another policy objective. Medicare savings were the largest pay-for in the budgeting for the Affordable Care Act (ACA). The Congressional Budget Office sent a letter to House Speaker John Boehner, detailing the budget impact of repealing the Affordable Care Act. If Congress overturned the law, “spending for Medicare would increase by an estimated $716 billion over that 2013–2022 period.” Similarly, the ACA also contained a 3.8 percent tax on net investment income that was advertised as a “Medicare surtax,” suggesting that it would fund the program. In fact, it was never directed to the Medicare trust funds.

In more recent years, there has been large scale advocacy for “Medicare for All” when, in fact, the proposal was a de novo single-payer system that had nothing to do with Medicare (and would have resulted in the elimination of Medicare). The IRA continues this tradition of using Medicare savings to finance other spending initiatives, despite the clear financial pressures that Medicare faces in the near future and the insistence by many in the political arena that savings would benefit federal health programs and lower costs to the beneficiaries.

Budgetary Implications of the IRA

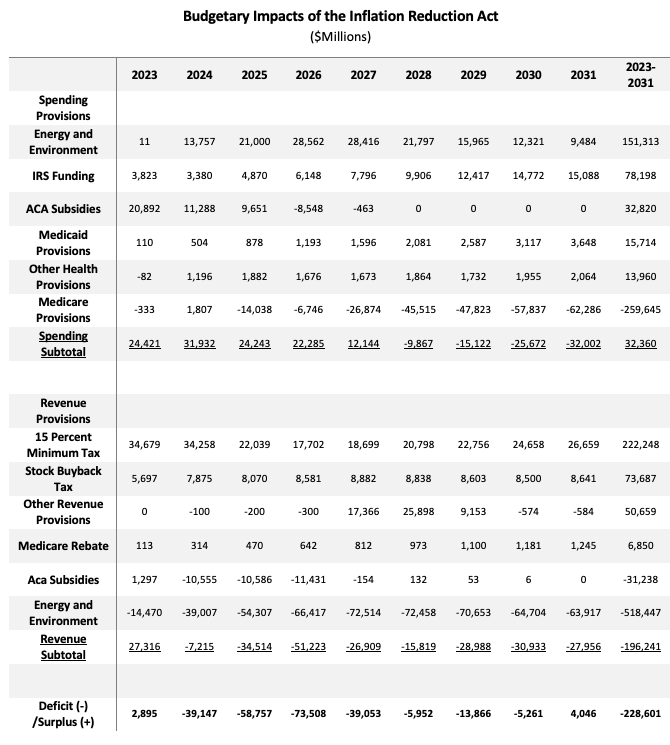

This study begins by documenting the budgetary implications of the IRA from 2023–2031. These are summarized in the table below. It is important to note that the budgetary estimates are based on the original Congressional Budget Office (CBO) cost estimate of the IRA as enacted, and more recent estimates from CBO and the Joint Committee on Taxation that reflect policy developments after enactment.[1] Most significant, the estimates presented here reflect more recent estimates of the energy and environmental tax credits, as well as minor changes to the Internal Revenue Service funding-related revenue collection.

From the perspective of Medicare, the IRA contains two key provisions. First is the Medicare Inflation Rebate – that is, the provision holding that 100 percent of any increase in the price of a drug above the general rate of inflation must be returned to the federal government as a rebate on that drug. This “inflation tax” in isolation is anticipated to generate $6.9 billion in revenue over the budget window (along with $56 billion in direct budget savings included in the $260 billion figure below).

The second and larger provision is from the drug price “negotiation” in which the Health and Human Services (HHS) secretary sets the maximum fair price (MFP) on selected drugs each year. The statute dictates that the MFP must be a maximum of between 40 and 70 percent of the average manufacturer’s price (depending on how long the drug has been on the market), but that the secretary can negotiate the price lower. If the secretary concludes that the firm did not negotiate in good faith, she can levy a tax of 95 percent on the domestic sales (including non-federal sales) of the drug. (Notice that the 95 percent rate on the tax-inclusive price translates to a 1900 percent rate on the price received by the firm.) The negotiation regime takes effect in 2025 and this, along with savings attributed to other Medicare changes like the inflation rebate, amounts to the $260 billion in savings. (The minor bump in 2024 spending stems from capping the out-of-pocket costs of seniors at $2,000.)

The other major feature of the IRA is the law’s large amount of spending on energy and the environment, as well as tax credits for clean energy – a total of $518 billion over the budget window.

Diverting Medicare Savings to Clean Energy Subsidies

A slight re-arrangement of the table makes clear what is going on. The IRA’s total spending over the 2023–2031 budget window indicates there is $141 billion in non-environment/non-energy spending and $322 billion in new taxes. In isolation, these yield a net surplus of $182 billion.

On the environment and energy side, there is $670 billion in spending and new tax credits, which more than consume the $182 billion net surplus and leave $488 billion in spending and credits to be financed. While the Medicare savings total $266 billion, the clean energy initiatives consume all of these savings (and leave a residual to be borrowed).

Conclusion

While it could be said, at least on paper, that the Inflation Reduction Act’s Medicare provisions will save an estimated $266 billion from 2023–2031, this study finds that these savings will not benefit program beneficiaries. Medicare is part of the unified federal budget, and the savings the IRA will produce for the program will be offset – indeed, outweighed – by the law’s $670 billion in clean energy tax credits and other spending on energy and the environment, and even leave a residual to be borrowed.

[1] See: https://www.cbo.gov/system/files/2022-09/PL117-169_9-7-22.pdf; https://www.taxnotes.com/tax-notes-today-federal/budgets/revised-ev-credit-estimate-further-raises-total-green-energy-costs/2023/06/05/7gtml; https://www.cbo.gov/system/files/2023-05/hr3746_Letter_McCarthy.pdf