Insight

November 18, 2021

Three Key Takeaways from the CBO Cost Estimate of the Build Back Better Act

Executive Summary

- The Congressional Budget Office (CBO) released its long-awaited cost estimate for the Build Back Better Act (BBBA).

- The estimate concludes that contrary to advocates’ claims, the BBBA is not fully paid for and would add $367 billion to the national debt.

- The upfront nature of the spending means that there will be a substantial fiscal pulse of $792 billion in the first 5 years, exacerbating inflationary pressures.

- If fully implemented, the cost of the bill could exceed the offsets by nearly $3 trillion.

The Budgetary Effects of the BBBA

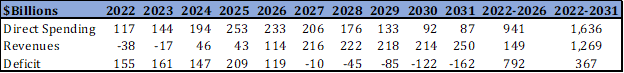

According to the Congressional Budget Office (CBO), the Build Back Better Act (BBA) would, on net, increase direct spending by $1.6 trillion over the next decade, while raising tax revenue on net by $1.3 trillion, thereby increasing the federal budget deficit by $367 billion over the next decade.

Table 1: Budgetary Effects of the BBBA

The composition of the fiscal effects varies significantly over the budget window, however. As some of the more expensive policies in the BBBA sunset, such as the increased child tax credit, this limits the apparent and estimated cost of those programs. Yet the offsets for those spending programs are substantially in force for a decade. This is a well-established gimmick – using long-term savings to pay for short-term spending that masks the costs of the programs that are plainly intended to be permanent. This mismatch has budgetary and economic consequences.

1.) Deficit Effects

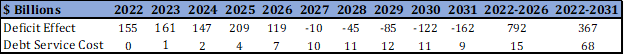

Perhaps the most conspicuous feature of CBO’s cost estimate of the BBBA is that contrary to its proponents’ advertising, the bill is not fully paid for. It will add $367 billion to the $12 trillion projected deficit over the next 10 years. Because many of the policies in the BBBA sunset, the deficit effects are particularly pronounced in the first half of the decade. Specifically, the BBBA would increase federal borrowing by $792 billion between 2022 and 20226. This also means that federal borrowing to finance this upfront spending architecture will accrue more interest expense over the next decade than would occur if the expenditures more evenly matched offsets.

Table 2: Interest Costs

Indeed, the BBBA as currently conceived would add about $68 billion to the $5.4 trillion in net interest costs projected over the next 10 years.

It is important to note that this shortfall is in part a function of non-scoreable offsets. The BBBA includes $80 billion in funding for tax enforcement at the Internal Revenue Service (IRS). CBO estimated that this policy would raise $207 billion in additional revenue over the next decade, for a net deficit decrease of $128 billion. The White House has claimed this policy would reduce the deficit by $400 billion. Regardless, the rules governing how the cost of legislation is estimated or “scored” do not allow this extra revenue to be counted.

Specifically scoring rule #14 states that, “No increase in receipts or decrease in direct spending will be scored as a result of provisions of a law that provides direct spending for administrative or program management activities.” While there may be merit to increasing IRS enforcement funding, and it is reasonable to assume that, based on past experience, this would increase tax collections, consistency and maintaining a common yardstick is central to the practice of scoring legislation. Supporters may have a point, but there are always caveats that attend to estimating complex legislation. This happens to be one of them.

2.) Frontloaded Spending would Increase Inflationary Pressure

The BBBA is substantially frontloaded, running average deficits of $158 billion in the first 5 years, compared with a 10-year deficit average of $37 billion. This obscures the cost of the policies and is a well-worn budget gimmick. In the current inflationary environment, however, a significant fiscal pulse of $792 billion over the next 5 years would, all else equal, exacerbate price increases. As a share of gross domestic product, the near-term deficit impact is 0.6 percent in the first year and averages 0.6 percent over the next 5 years. Advocates of the BBBA claim that it would reduce inflationary pressure, but critically, over the longer term. The problem with this argument is that first, the BBBA sunsets many of the policies that could arguably provide supply-side human capital investments that may reduce inflationary pressures over the long term. Second, these arguments critically assume the bill is paid for – and CBO has estimated that it is not. Observers should be cautious not to overstate the inflationary effects of this legislation – the current inflationary environment is not simply the result of U.S. fiscal policy. Nevertheless, to the extent that fiscal policy is one contributing factor to the inflationary environment, and is one over which policymakers have discretion, an additional fiscal pulse of $150 billion every year for the next 5 years would seem imprudent.

3) Program Sunsets Mask the True Cost of the BBBA

The BBBA increases the deficit more in the first 5 years than over the decade because many of the its programs sunset to reduce their apparent cost. On the other hand, the keys offsets within the BBA, such as the tax increases and savings from prescription drug policies, are in force permanently. Indeed, the most expensive policies in the BBBA are temporary, such as increased deductibility state and local taxes (SALT), increasing the child tax credit, universal preschool, additional health care subsidies, and other policies. The Committee for a Responsible Federal Budget has estimated that these policies, if extended, would add another $2.5 trillion in costs, for a net deficit increase of almost $3 trillion. If fully implemented, this additional borrowing would add roughly $200 billion in additional debt service costs.

Conclusion

As Congress has debated the BBBA, various numbers have been invoked to characterize its fiscal impacts. “Zero” was eventually invoked by its more emphatic supporters to characterize its deficit effects. This view would eventually be tested by rigorous analysis, however, and it has been found to be incorrect. According to the CBO, the BBBA will add to the deficit by hundreds of billions, even including non-scoreable savings. It does so on the heels of a nearly $2 trillion stimulus bill and in the face of growing inflation. Over the long term, the deficit effects are likely understated, as the bill relies on temporary spending policy and permanent savings to mask the true cost of the policies.