Insight

March 19, 2025

What Do President Trump’s Executive Orders Mean for the U.S. Oil and Gas Market?

Executive Summary

- On January 20, 2025, President Trump signed several energy-related executive orders intended to boost U.S. oil and gas production and exports by declaring a national energy emergency, removing regulatory barriers, and expediting permitting approval for oil and gas projects.

- With the rapid growth in oil and gas production over the past two decades due to the shale boom, the United States is already the world’s largest oil and gas producer and a net exporter.

- The executive orders will likely have limited immediate impact on U.S. oil and gas production, as many of the policies must be enacted through legislation or agency rulemaking; moreover, it is demand and return on investment that are the main drivers of U.S. oil and gas production, not deregulation.

Introduction

President Trump signed several energy-related executive orders (EOs) on January 20, 2025, intended to boost U.S. oil and gas production and exports. These EOs declared a national energy emergency, aimed to “unleash America’s affordable and reliable energy and natural resources,” and lifted the Biden Administration’s restrictions on oil and gas production in Alaska. These energy-related EOs signal that the Trump Administration strongly favors and supports oil and gas production to strengthen the country’s energy independence.

Notably, the United States is already the world’s largest oil and gas producer. In 2023, it produced 22 million barrels of oil per day, accounting for 22 percent of the world’s total. The United States also recently became a net exporter of oil and natural gas.

President Trump’ energy EOs are unlikely to have substantial immediate impact on U.S. oil and gas production. Many of the EOs’ policies must be enacted through legislation or agency rulemaking. Additionally, oil and gas production is mainly driven by demand for oil and the return on new oil and gas projects rather than deregulation.

President Trump’s Energy Executive Orders

On January 20, 2025, President Trump signed dozens of executive orders, three of which were directly relevant to the oil and gas sector:

“Declaring a national energy emergency”: This EO declares a “national energy emergency,” stating that “The United States’ insufficient energy production, transportation, refining, and generation constitutes an unusual and extraordinary threat to our Nation’s economy, national security, and foreign policy.” It gives the executive branch more power to expedite approval for building infrastructure for “energy resources” defined as “crude oil, natural gas, lease condensates, natural gas liquids, refined petroleum products, uranium, coal, biofuels, geothermal heat, the kinetic movement of flowing water, and critical minerals.”

“Unleashing American energy”: This expansive EO includes numerous provisions aimed to “unleash America’s affordable and reliable energy and natural resources.” It includes two provisions directly relevant to the oil and gas market.

- Mandates all agencies to conduct immediate review of all existing regulations, orders, guidance documents, policies and other actions that “burden the development of domestic energy resources,” with a focus on “oil, natural gas, coal, hydropower, biofuels, critical mineral, and nuclear energy resources.”

- Ends the Biden Administration’s pause on approval of LNG exports and requests the secretary of Energy to “restart reviews of applications for approvals of liquified natural gas export projects as expeditiously as possible.”

“Unleashing Alaska’s extraordinary resource potential”: Lifts the Biden Administration’s restriction on oil and gas production (including canceling oil leases sold by the Trump Administration during his first term) in Alaska and opened areas for oil and gas development including the Arctic National Wildlife Refuge. It also emphasizes developing Alaska’s liquid natural gas (LNG) potential including accelerating the permitting of infrastructure related to Alaska LNG export projects.

There are additional energy-related EOs that might have an indirect impact on U.S. oil and gas production. For example, withdrawal from the Paris Agreement (an international treaty that aims to limit global warming and address greenhouse gas emissions from fossil fuel consumption), a rollback of regulations and subsidies supporting the development of electric vehicles, and temporary withdrawal of all areas on the outer continental shelf from offshore wind leasing.

These EOs made clear an important signal that the administration prioritizes and supports oil and gas production. They also convey the administration’s strong preference for developing fossil fuels rather than renewable energy such as solar or wind.

Overview of the U.S. Oil and Gas Market

Oil and gas are important energy sources for the United States, accounting for 74 percent of U.S. total primary energy consumption in 2023. For perspective, nuclear electric power, coal, and renewable energy (such as wind, solar, geothermal, biofuels) each account for about 9 percent of total U.S. energy consumption.

The U.S. oil sector

Prior to President Trump’s EOs, the United States was already the world’s largest oil producer. In 2023, it produced 22 million barrels of oil per day (crude oil, all other petroleum liquids, and biofuels), accounting for 22 percent of the world’s total. It is also the world’s largest oil consumer. In 2022, it consumed 20 million barrels of oil (crude oil, all other petroleum liquids, and biofuels) per day (20 percent of the world total.)

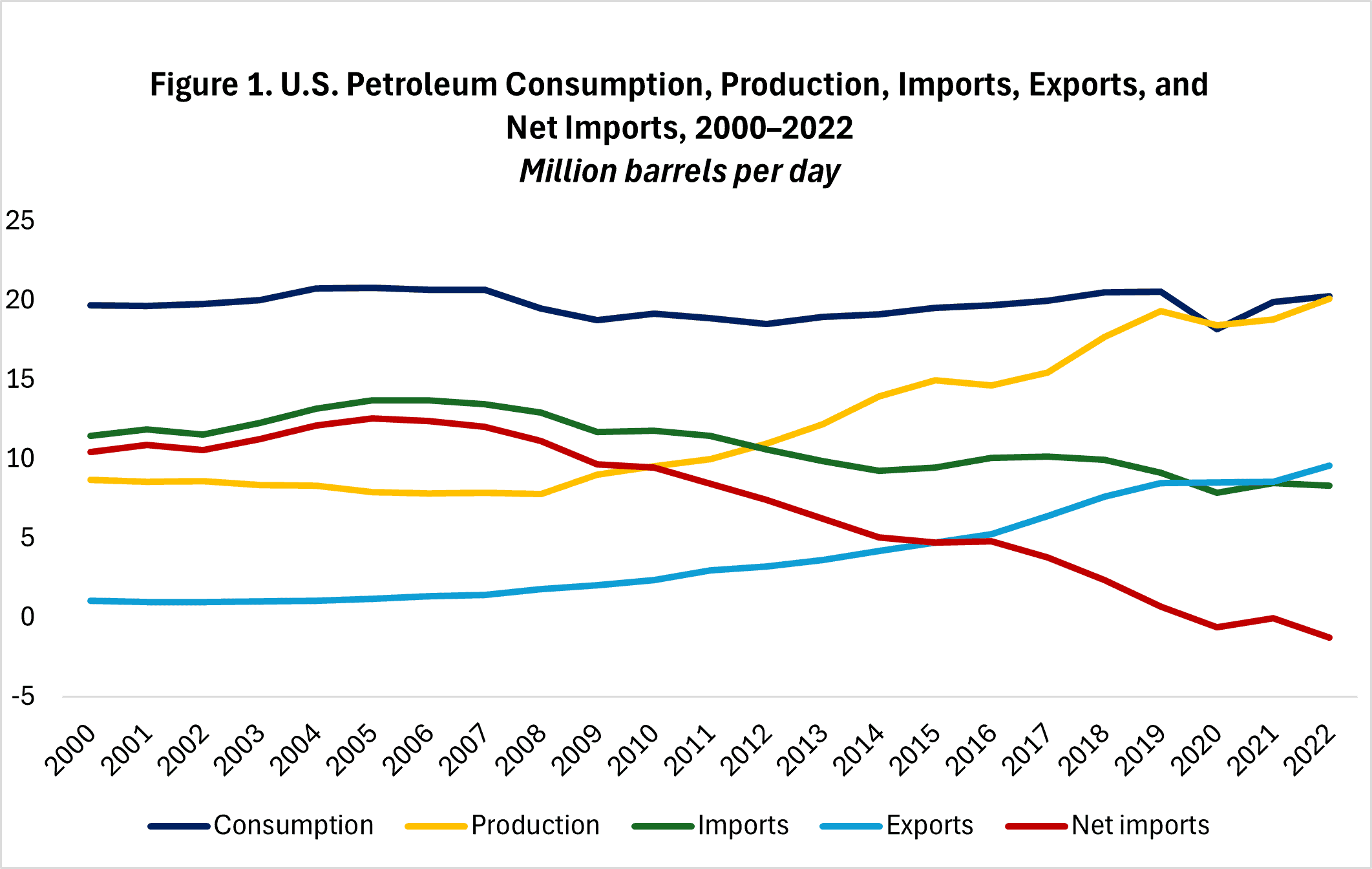

U.S. oil production has grown significantly over the past several decades. U.S. petroleum production started to rise in 2008, when it produced 8 million barrels per day, and continued to climb through 2022, when it produced 20 million barrels per day. (Figure 1) The substantial increase in production was driven by the shale boom that started in the 2000s with producers innovatively combining the use of hydraulic fracturing and horizontal drilling to extract oil and gas from shale formations. About 64 percent of the crude oil production in 2023 was from shale production.

In addition to being the largest producer, the United States also recently became a net exporter of petroleum productions (Figure 1). Over time, U.S. production of petroleum products has caught up with consumption of petroleum. By 2020, the United States was exporting more petroleum products than it imported for the first time since 1949. It continued to be a net exporter of petroleum products for the next two years, with net exports at 0.06 million barrels per day in 2021 and 1.26 million barrels per day in 2022.

Source: U.S. Energy Information Administration; Oil and petroleum products explained

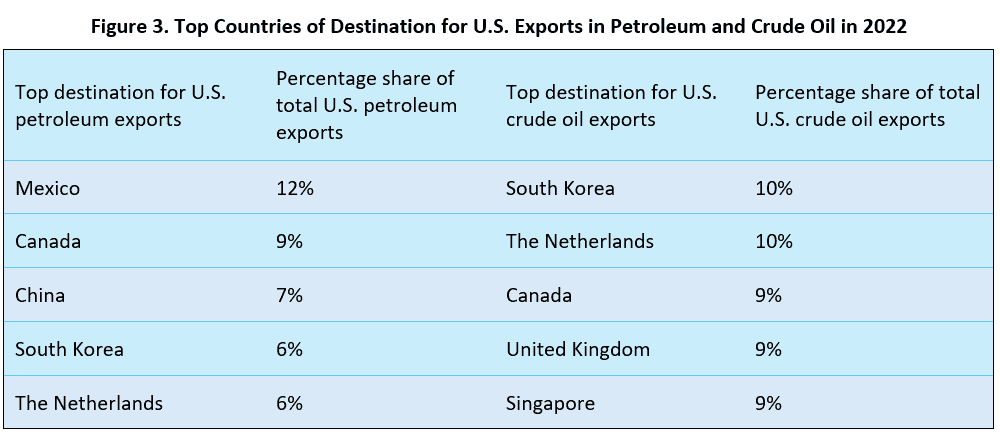

Canada, Mexico, Saudi Arabia, Iraq, and Colombia are the top five countries of origin for U.S. petroleum and crude oil imports. (Figure 2) Canada is a particularly important oil and petroleum trading partner, as the United States imported 52 percent of its petroleum and 60 percent of its crude oil from Canada in 2022. Mexico, Canada, China, South Korea, The Netherlands, United Kingdom, and Singapore are the top countries of destination for U.S. petroleum and crude oil exports. (Figure 3)

Source: U.S. Energy Information Administration.

Source: U.S. Energy Information Administration.

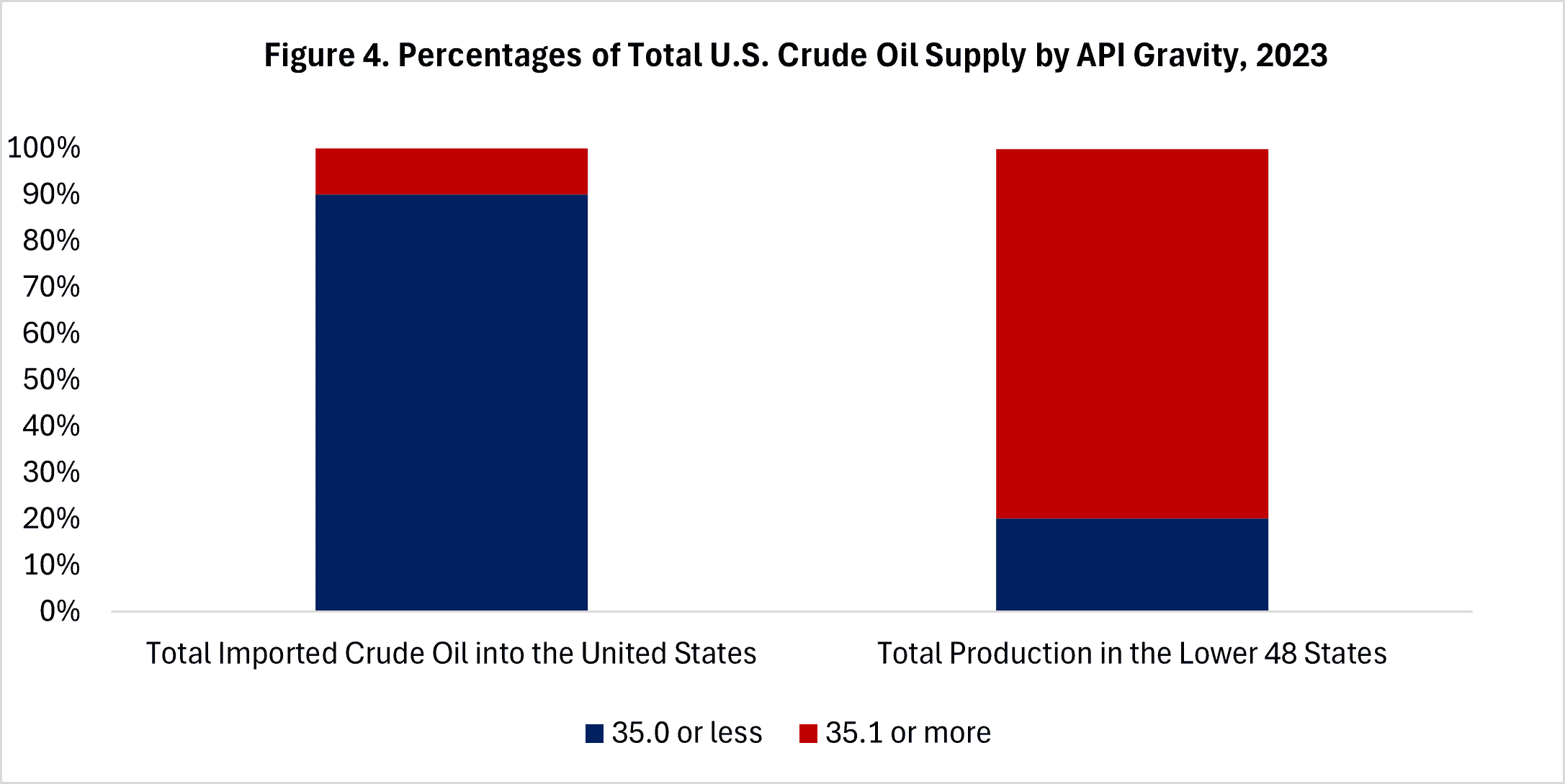

Although the United States is a net exporter of oil, it still imports a significant amount of petroleum from other countries. This is because most U.S. crude oil is lighter crudes, but domestic refineries are best suited to processing heavier crudes. More than 70 percent of U.S. refining capacity is designed to process imported, heavier crude efficiently.

There is a great variety of crude oils in terms of their density and composition. API (American Petroleum Institute) gravity (expressed in degrees) is a common metric to measure the weight of crude oil compared to water. The higher the API gravity, the lighter the crude oil. Light crudes are typically higher than 38 degrees in API gravity, whereas heavy crudes are lower than 22 degrees in API gravity. Crude oils that are between 22 and 38 degrees in API gravity are intermediate crudes. For example, in 2023, most of the imported crude oil into the United States was heavy whereas most of the crude oil produced in the lower 48 states was light (Figure 4).

Source: U.S. Energy Information Administration.

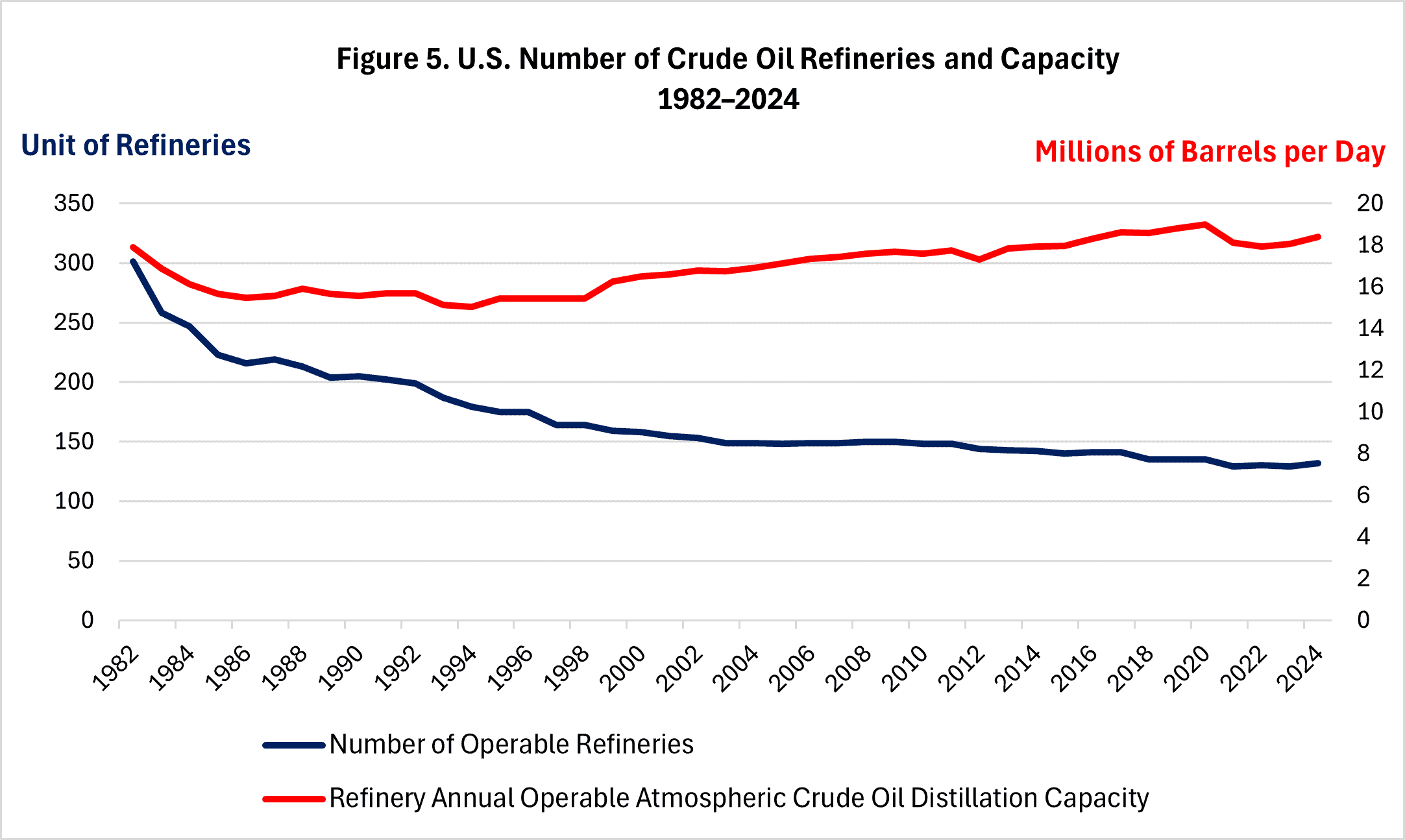

U.S. refineries were built and designed for processing heavy crudes because they were widely available in the global market before the shale boom. Meanwhile, the number of operable crude oil refineries in the United States dropped more than 50 percent from 301 units in 1982 to 132 units in 2024. (Figure 5) No new refineries have been built in the United States since 1982. Yet U.S. crude oil refining capacity has stayed relatively static over the past several decades due to technological advancements and upgrades of existing plants.

Source: U.S. Energy Information Administration.

Note: Author filled in the missing data for 1996 and 1998 using the corresponding previous year’s data.

The U.S. natural gas sector

The United States is the world’s largest natural gas producer. In 2023, it produced 37.8 trillion cubic feet and consumed 32.5 trillion cubic feet of dry natural gas (consumer-grade natural gas).

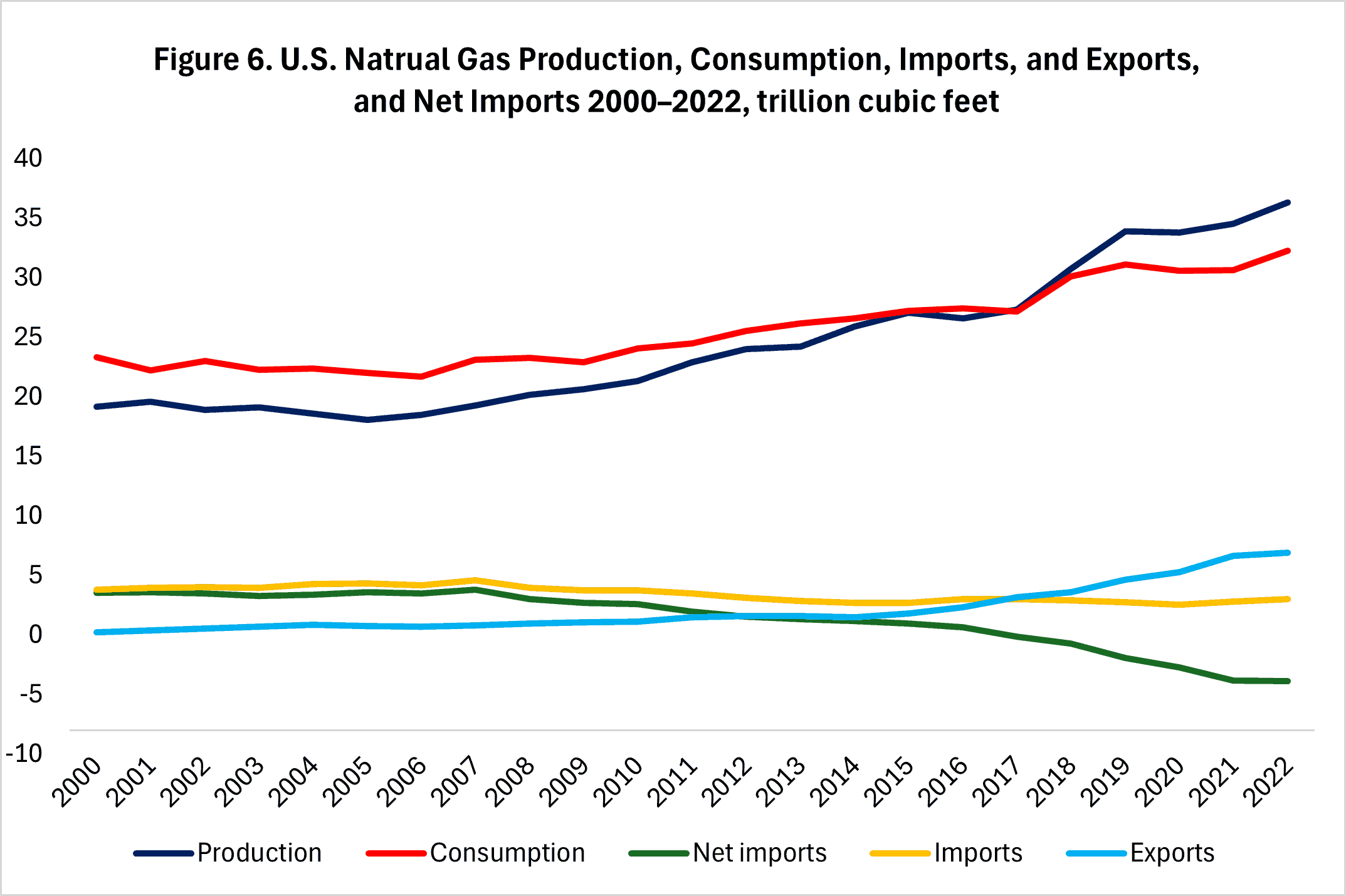

The United States became a net exporter of natural gas in 2017, with net exports of 0.12 trillion cubic feet. Its natural gas imports peaked in 2007 at 4.6 trillion cubic feet and dropped to 3 trillion cubic feet in 2022. Its natural gas exports grew significantly from 1.8 trillion cubic feet in 2015 to 6.9 trillion cubic feet in 2022. (Figure 6)

Source: U.S. Energy Information Administration

Natural gas is transported in international trade either by pipeline as gas or by ship as liquefied natural gas. Some natural gas is also transported by truck as LNG or compressed natural gas.

The United States used to export a small amount of natural gas to Mexico and Canada by pipeline. It started to export LNG in 2016, and the exported volumes have continued to grow substantially. In 2021, the United States started to export more LNG than pipeline natural gas. In 2022, 44 percent of U.S. natural gas exports were by pipeline.

Canada is a critical natural gas trading partner for the United States. In 2022, about 99 percent of the natural gas the United States imported was from Canada, and almost all by pipeline.

Crude oil prices

Crude oil prices are determined by global supply and demand as it is traded in a global market. Additionally, oil inventories that store excess production, geopolitical and weather events, and oil market trading (physical quantities and future delivery of oil products) all affect crude oil prices.

West Texas Intermediate spot price was on average $30.38 per barrel in 2000, increasing to about $99.67 per barrel in 2008, then dropping dramatically to $61.95 per barrel the next year. It then shot back to $90 per barrel between 2011 and 2014. The price hit a record low of $39.16 per barrel in 2020 and was about $76.63 per barrel in 2024.

The Organization of the Petroleum Exporting Countries (OPEC), an international organization with 12 member countries, produces about 40 percent of the world’s total crude oil. OPEC plays an important role in influencing oil prices by proactively managing oil production through the use of production targets. OPEC members, especially Saudi Arabia, typically have large spare capacity, which refers to the capability to increase production within 30 days and sustain it for at least 90 days. In the case of market disruption, spare capacity helps put downward pressure on oil prices by increasing production.

Non-OPEC oil-producing countries (those of North America, regions of the former Soviet Union, and the North Sea) account for about 60 percent of world’s total oil production. In contrast to the OPEC oil producers, which are state-owned companies, non-OPEC oil producers are mostly investor-owned oil companies that deliver returns to shareholders and make investment decisions based on economic factors. As non-OPEC oil producers do not plan production centrally, they have much less influence than OPEC producers on global oil and gas prices. Unlike OPEC producers, they typically produce close to or at capacity with little spare capacity.

Economic growth is the main driver of oil demand. Growing economies require more energy for industrial production, electricity generation, and transportation of goods from producers to consumers. For example, during the COVID-19 pandemic, global economic growth slowed down, which caused oil and gas demand and prices to decrease significantly. A variety of factors could disrupt global oil and gas supply, including geopolitical conflicts and political events, severe weather events, and technological advancement.

The Implication of Trump’s Executive Action for the U.S. Oil and Gas Market

President Trump’s energy-related EOs are intended to further boost U.S. oil and gas production and exports through the declaration of a national energy emergency, removing regulatory barriers, and expediting permitting approval for oil and gas projects.

These EOs are unlikely to have substantial immediate impact on U.S. oil and gas production for several reasons.

First, it’s important to note that the Trump Administration has declared a national energy emergency when the United States already is the world’s largest oil and gas producer. It is also a net exporter of both petroleum and natural gas, with exports growing quickly over the past few years. In fact, the Energy Information Administration recently raised its forecast for U.S. oil production for 2025 from 13.55 million barrels per day to 13.59 barrels per day. The “unusual” and “extraordinary” threat claimed in the EO therefore seems questionable. It is also concerning that the administration is arbitrarily picking winners (and losers) among different energy industries by supporting specific energy industries instead of letting the market develop “diversified” energy sources as called for in the EO.

Notably, many of the EO’s policies must be enacted by Congress or federal agencies, as EOs do not have the same force or effect as legislation or agency rules. For example, to expedite permit approval of oil and gas projects, Congress must pass legislation to reform the existing permitting processes. Federal agencies may take as long as several years to repeal or modify certain agency rules following standard regulatory procedures, especially if the action is subject to legal challenge.

Demand and returns on investment are the main factors that motivate U.S. oil producers to increase their investment in production. Regulatory barriers such as permit approval has not been a major roadblock to U.S. oil and gas production. Lifting regulatory restrictions will not have an immediate impact on production.

Oil and gas production capacity and infrastructure are relatively fixed in the short term. As the United States is a non-OPEC oil-producing country, it operates at or near full capacity. It’s not feasible for U.S. oil and gas producers to suddenly increase their production substantially. It takes years to develop new production sites and change production.

Therefore, President Trump’s energy-related EOs are unlikely to have immediate impact on U.S. oil and gas production or prices.