Insight

May 24, 2018

What You Need to Know about CBO’s Analysis of Trump’s Second Budget

What You Need to Know about CBO’s Analysis of Trump’s Second Budget

Today, the Congressional Budget Office (CBO) released an analysis of the Trump Administration’s second budget. This CBO report does not include an analysis of the growth, or macroeconomic, implications of the Trump Administration’s policies, and unfortunately CBO has punted on the effort for the year. This deferral is regrettable, because evaluating economic policies abstracted from the economic implications of those policies is a rather unsatisfying inquiry. Instead, CBO’s re-estimate tells only a basic arithmetic story: large fiscal consolidations would make the poor fiscal outlook less poor.

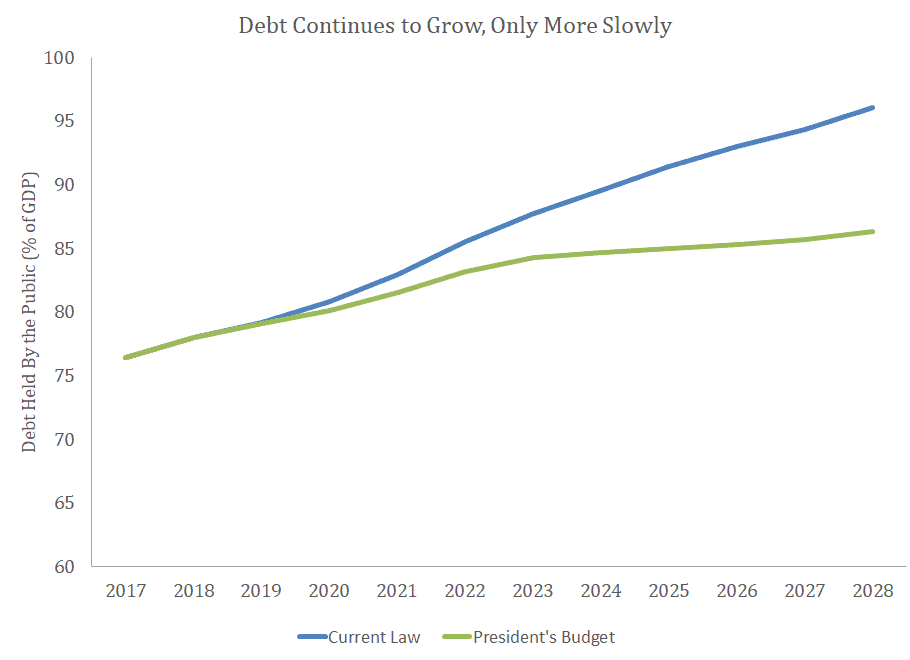

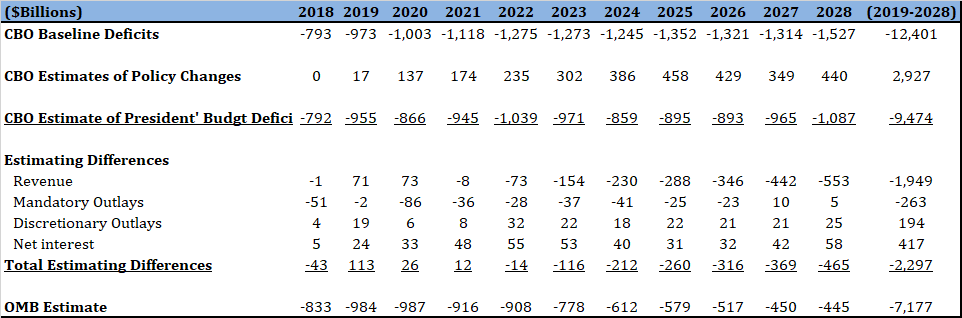

The savings estimated by CBO are measured relative to a baseline deficit projection of more than $12 trillion over the next decade. Put differently, according to CBO the Trump budget would still propose deficits totaling more than $9 trillion over the coming decade. This budget would, in nominal terms, essentially return to the deficit outlook left to the Trump Administration by the Obama Administration. Clearly, more deficit savings will be needed to return the fiscal outlook to sustainability.

Figure 1: Debt Under Current Law and Under the President’s Budget

Past CBO re-estimates under presidents Trump and Obama told a similar story. Indeed, the magnitude of the fiscal consolidations proposed by President Obama’s and President Trump’s budgets are remarkably similar – but the relative share of deficit savings that come from revenue and spending changes are mirror opposites. President Trump proposed spending cuts, while President Obama proposed spending increases. President Trump has proposed tax cuts, while President Obama proposed tax increases. On net, according to CBO they both reduced baseline deficits but these reductions are well short of that needed to return the fiscal outlook to a sustainable one.

Table 1: Net Proposed Deficit Effects of Obama vs Trump Budgets

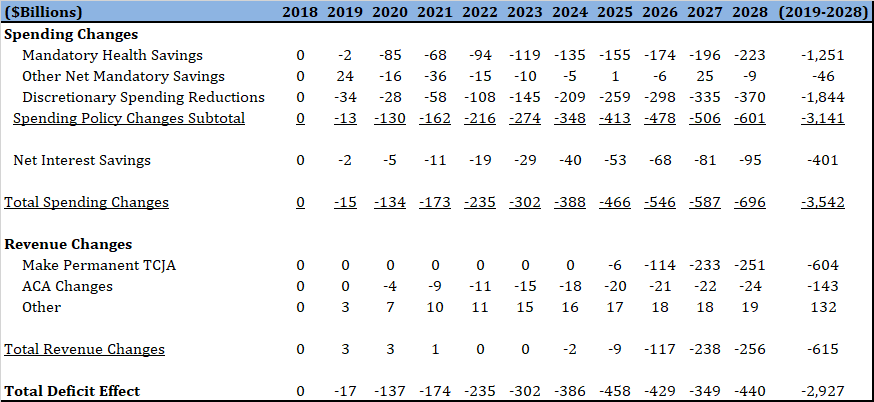

What dominates the budgetary flows proposed in the FY2019 Trump budget are spending cuts, largely falling on discretionary spending, with mandatory health savings comprising the second-largest major budget savings.

Table 1: CBO’s Estimate of Major Policy Changes in Trump Budget

The CBO re-estimate also provides a credible third-party analysis of the Trump Administration’s budgetary assumptions. A key difference between the deficits presented in the administration’s budget and CBO’s estimates relates to the economic assumptions underlying these analyses. The administration assumed much higher gross domestic product (GDP) growth in its budget estimates than CBO did – which translates into nearly $2 trillion more revenue. The higher revenue assumptions explain away most of the differences between the budget estimates of the president’s Office of Management and Budget (OMB) and CBO.

Table 2: Crosswalk from CBO to Administration’s Budget Estimates