Press Release

March 21, 2023

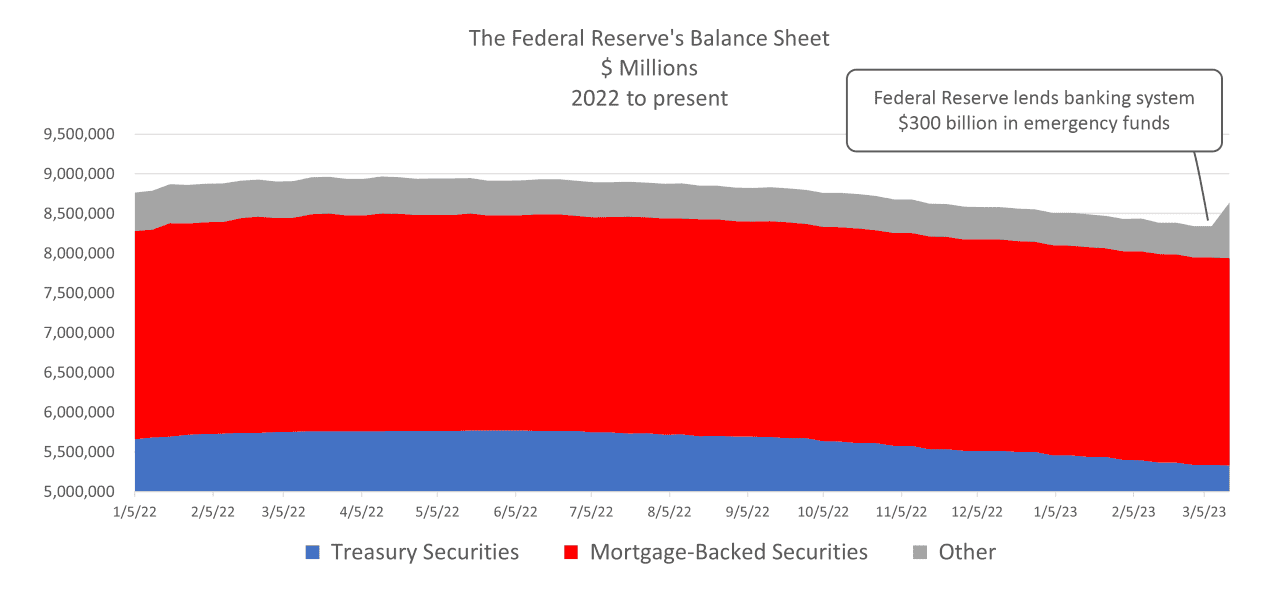

AAF Tracker Shows U-turn on Fed’s Quantitative Tightening

The Federal Reserve’s recent actions to stabilize the banking system included a $300-billion injection of liquidity into banks, reversing—in just a few days—about half of its $600-billion efforts to reduce inflation over the past year. Tomorrow the Federal Open Market Committee will announce its decision on the level of the federal funds rate, but interest rates are not the only item on the agenda.

Will the Fed double down, stay the course, or pause its quantitative tightening—or worse, will it pivot back to quantitative easing? Practically speaking: What is the likely impact of the Fed’s balance-sheet manipulation on inflation and could it reduce the likelihood of a soft landing?