Research

May 7, 2024

The Future of America’s Entitlements: What You Need to Know About the Medicare and Social Security Trustees Reports

Executive Summary

Yesterday, the Social Security and Medicare Trustees issued their annual reports detailing the financial state of America’s two largest entitlement programs. The reports echo past conclusions: Social Security and Medicare are still facing insolvency.

At its current pace, Medicare Part A will go bankrupt in 2036 and the Social Security Trust Funds for old-aged benefits and disability benefits will become exhausted by 2035. A quick look at the data proves just how broken our current entitlement programs are. An American Action Forum analysis of the data found other startling statistics, including:

- Medicare as a whole had a deficit of $470 billion, with spending of $1,037 billion and cash revenue of $567 billion.

- Over the next 75 years, Social Security will owe $24.8 trillion more than it is projected to take in.

This paper addresses the following:

- The solvency of Medicare;

- The president’s stewardship of Medicare;

- The solvency of the Social Security Trust Fund;

- The solvency of the Social Security Disability Insurance (DI) program; and

- The solvency of the Social Security Old-Age and Survivors Insurance (OASI) program.

The Long-term Solvency of Medicare

Yesterday, Treasury Secretary Janet Yellen released the 2024 Medicare Trustees Report. This annual report delivered yet another reminder to the American public that Medicare is undeniably going bankrupt.]

The report estimates that the Medicare Hospital Insurance Trust (HI) Fund will be bankrupt by 2036. While the bankruptcy projection may snag the headlines, there are three key budgetary numbers that shouldn’t go unnoticed.

| $470 Billion | Medicare Finances in 2023

|

| $6.87 Trillion | Medicare’s Cumulative Cash Shortfall Since 1965

|

| 29 Percent | Medicare’s True Contribution to the National Debt

|

Continuing with the Medicare status quo is unsustainable. Balancing Medicare’s annual cash shortfalls under the existing system would prove devastating to seniors and failing to reform the status quo would result in the following:

| $5,449 Increase | Annual Premium Increase Needed to Balance Medicare Part B

|

| $2,092 Increase | Annual Premium Increase Needed to Balance Medicare Part D

|

The Executive Branch’s Stewardship of Medicare

An Evaluation of the Executive Branch’s Medicare Stewardship

Each year, the Trustees Report provides a non-partisan evaluation of the president’s stewardship of Medicare. Prepared annually for Congress by the Office of the Chief Actuary, the Trustees Report offers unparalleled detail on the financial operations and actuarial status of the Medicare program. In short, it’s where every administration’s soaring Medicare rhetoric meets fiscal reality. So far, President Biden has resisted undertaking significant Medicare reform. The 2024 Trustees Report provides a sense of what the future may look like should Medicare continue to remain unchanged, and why sooner or later Medicare reform is inevitable.

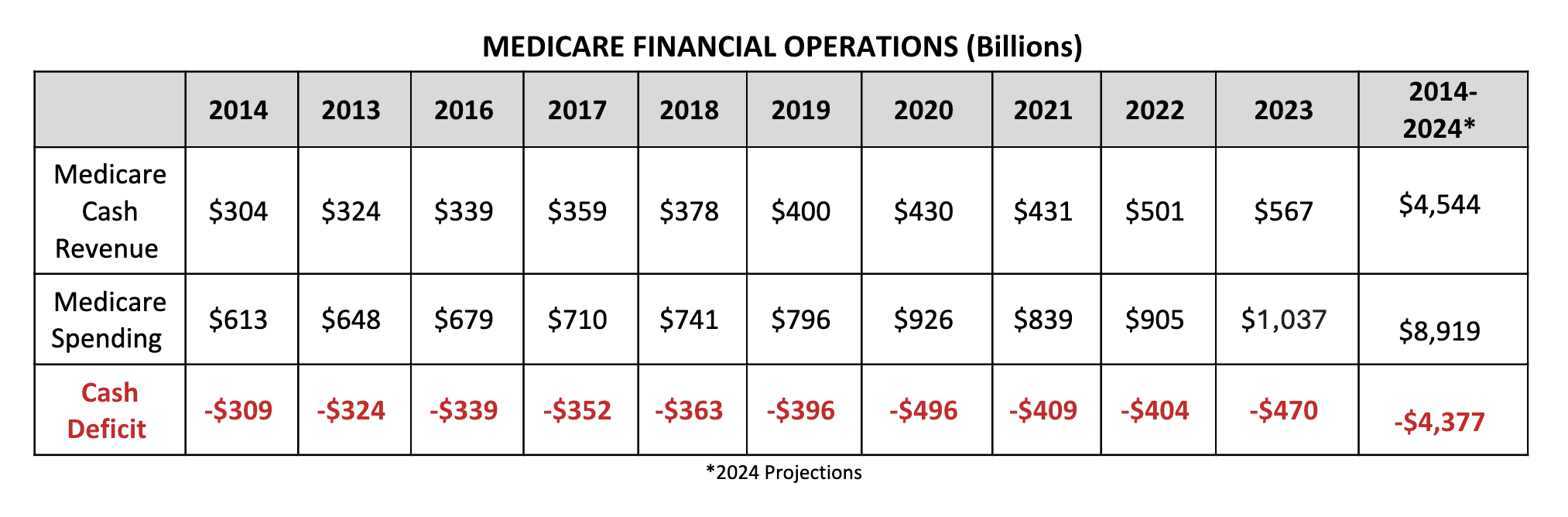

MEDICARE FINANCIAL OPERATIONS (Billions)

The Obama Administration oversaw a $2.4 trillion cash shortfall over eight years (2009–2016). The Trump Administration oversaw its own $1.6 trillion Medicare cash shortfall. The fiscal reality is that continuing the previous two administrations’ Medicare policies and leaving Medicare unchanged all but guarantees bankruptcy. President Biden had already overseen a $1.6 trillion cash shortfall thus far in is term.

With such unprecedented levels of cash shortfalls continuing through the budget horizon, maintaining the status quo ensures that Medicare will soon not exist for today’s seniors, let alone future generations of Americans. These rising costs and the measures necessary to cover them will increasingly harm seniors if Medicare reform is not undertaken.

| Medicare and Medicaid Will Cost $2 Trillion by 2024 | Medicare Costs Will Continue to Rise

|

|

The Long-term Solvency of the Social Security Trust Fund

This week, the board of trustees that oversees the Social Security program released its annual report. The report shows that the financial outlook for the nation’s primary safety net for retirees, survivors, and the disabled will fail to meet its promises to future seniors in the absence of meaningful reform.

The report estimates that the combined (retirement and disability) Social Security Trust Funds will be exhausted by 2035, one year later than last year’s estimate. The Trustees Report demonstrates the program’s structural imbalance that puts the retirement benefits of millions of working Americans at risk.

| $102.0 Billion | Social Security’s Contribution to the Debt in 2023

|

| $22.4 Trillion | Social Security’s Unfunded 75-year Liability

|

| 11 Years | Years Until the Trust Funds Are Exhausted

|

The Trustees Report paints a troubled picture of Social Security’s financial health and demonstrates that the present course is unsustainable. Social Security is now contributing to the annual deficit, while promised benefits exceed planned funding by over $24 trillion. The implications of failing to reform the status quo are:

| 21 Percent | Reduction in Benefits in 2034

|

| 27 Percent | Payroll Tax Increase

|

The Solvency of Social Security Disability Insurance

This week, the board of trustees that oversees the Social Security program released its annual report. The report reflects continued improvement in the outlook for the Disability Insurance (DI) program.

The report estimates that the DI Trust Fund is solvent over the long term. This outlook marks the third time since 1983 the program has been sustainable over the long-term. The program has faced recent solvency challenges, requiring a payroll tax reallocation in 2015.

| $0 | DI’s 10-year Contribution to the Debt

|

| -$932 Billion | DI’s Unfunded 75-year Liability

|

Solvency of Social Security Old-Age and Survivors Insurance

This week, the board of trustees that oversees the Social Security program released its annual report. The report shows that the Old-Age and Survivors Insurance (OASI) program remains unsustainable and will be unable to meet the needs of future beneficiaries absent reform.

The report estimates that the OASI Trust Funds will be exhausted by 2034. The report also makes clear several additional structural challenges that endanger the millions of current and future retirees and survivors who rely on this program.

| $133 Billion | OASI’s Contribution to the Debt in 2023

|

| $24.8 Trillion | OASI’s Unfunded 75-year Liability

|

| 11 Years | Years Until the OASI Trust Fund Is Exhausted

|

| 72 Million | Number of Beneficiaries in 2033 (Trust Fund Exhaustion Year)

|

The Trustees Report makes clear that the primary federal retirement program remains unsustainable. On its present course, the program is on track either to reduce the retirement benefits of over 72 million Americans or to raise taxes significantly on future workers.