Research

February 6, 2025

2025 Block Grant/Per Capita Cap Estimation

Executive Summary

In 2018, provisions from a proposal authored by the Health Policy Consensus Group – an affiliation of health policy analysts offering recommendations and analysis on a variety of health policy issues – titled “Health Care Choices Proposal” were discussed by Republican economic and health advisers during the first Trump Administration as a potential reform of the Medicaid program. With the re-election of President Trump, similar proposals may again be on the table.

The American Action Forum’s Center for Health and Economy (H&E) analyzed part of this framework to estimate the budgetary, coverage, and premium implications of some of these proposed reforms to the Medicaid funding process – specifically, instituting either a per-capita cap on federal funding of states’ Medicaid programs or providing federal Medicaid funding through a fixed block grant calculated from the previously mentioned per-capita amounts. While the “Health Care Choices Proposal” assesses broader Affordable Care Act-related spending (for example, subsidies and the Medicaid expansion population) H&E specifically looked at the block grant/per-capita cap proposal (herein referred to as the Medicaid Reform Proposal (MRP)) with respect to Medicaid expenditures. Below are estimates for selected impacts of the MRP:

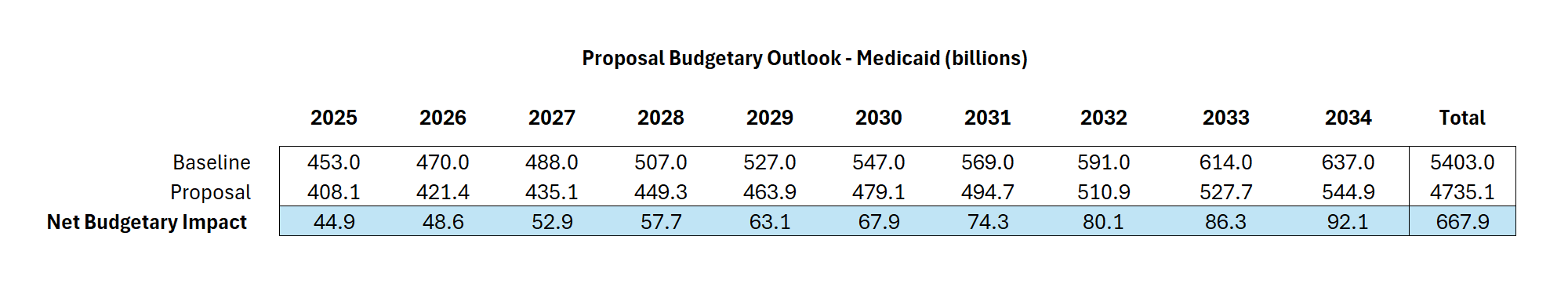

- Budget Impact: Compared to H&E’s 2024 baseline, H&E’s projection of the Medicaid noted block grant or per-capita cap provision would decrease federal spending by approximately $670 billion from 2025–2034, or $67 billion per year.

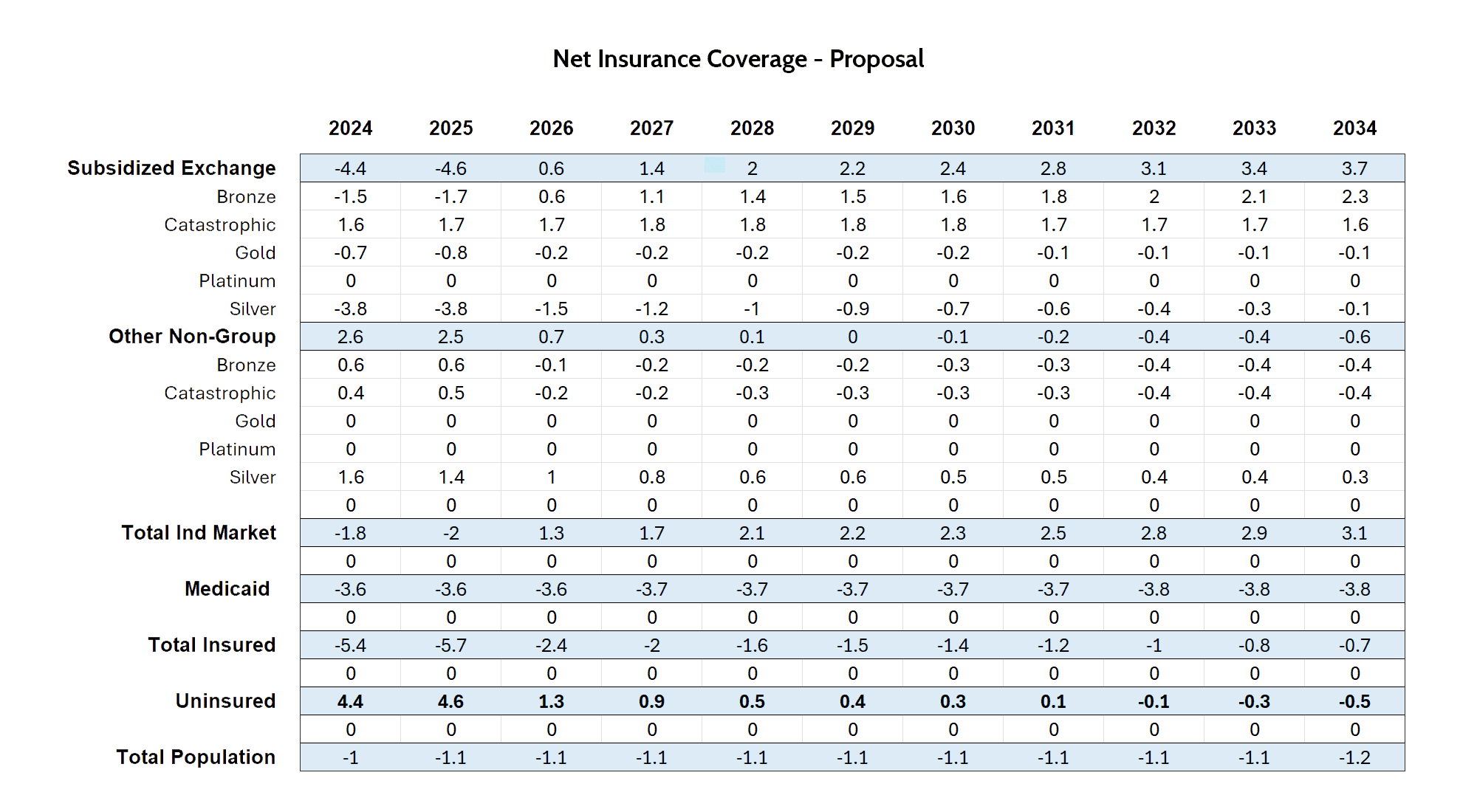

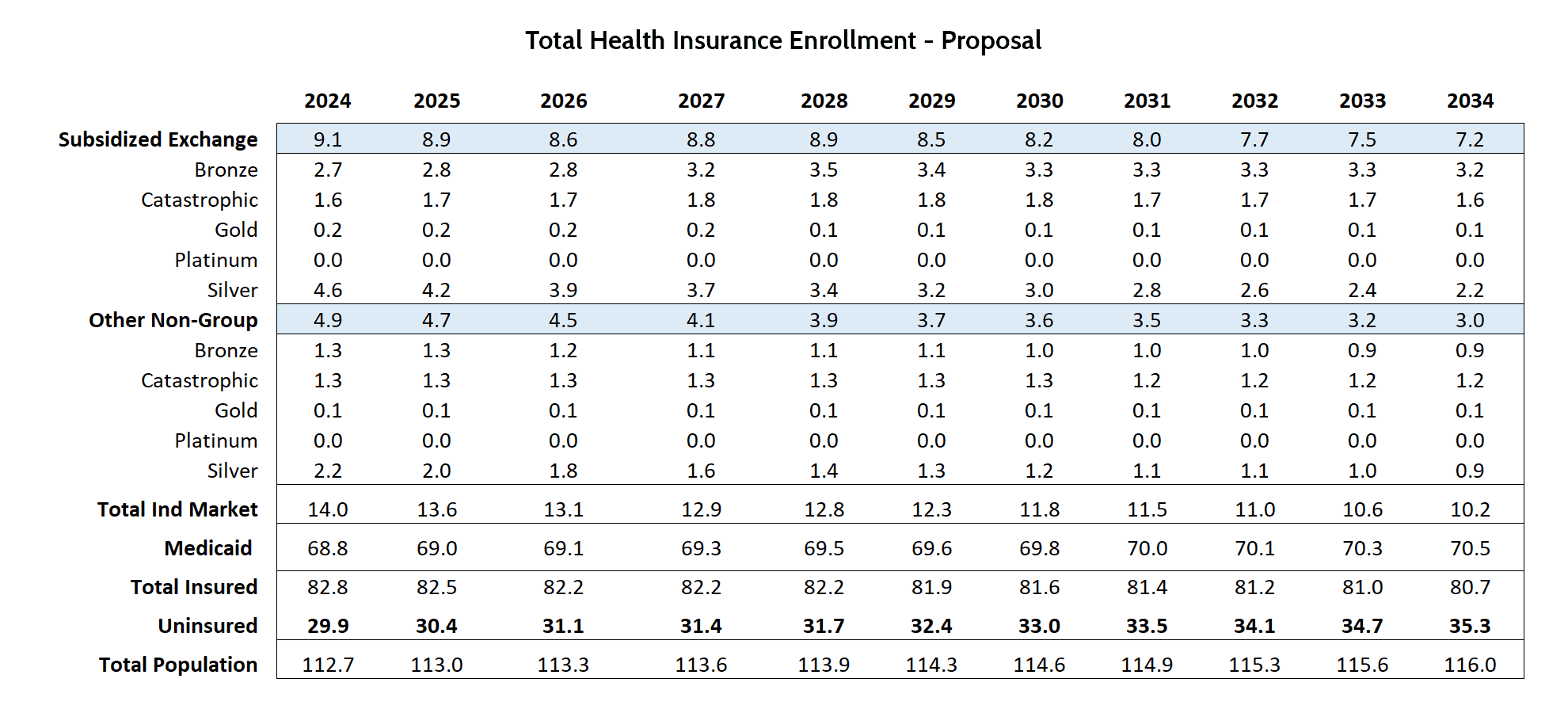

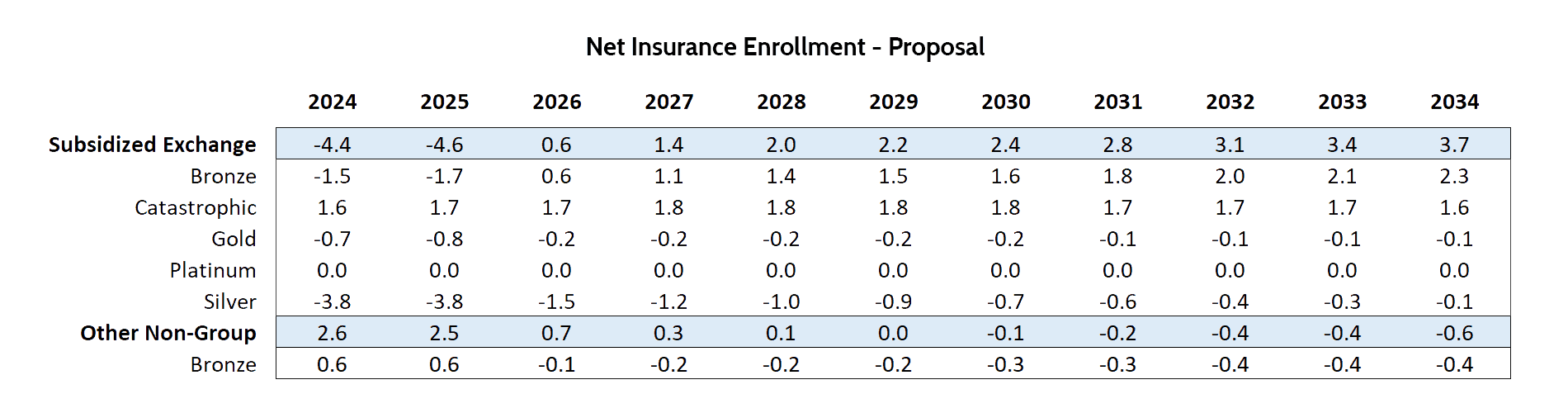

- Coverage Impact: Under H&E’s considered reforms, Medicaid enrollment would decrease by 3.8 million by 2034. Enrollment in Bronze and Catastrophic plans on the subsidized exchange would potentially increase by 2.3 million and 1.6 million, respectively. Minimal changes in enrollment were observed for Silver, Gold, and Platinum plans.

- Premium Impact: Annual premiums for Bronze and Catastrophic plans in both single coverage and family coverage would decrease moderately under these reforms as compared to current baseline estimates. Annual premiums for single coverage and family coverage for Silver, Gold, and Platinum plans would increase substantially.

Introduction

With the new Trump Administration, there have been discussions among the president’s economic advisers and congressional Republicans to revisit proposed Medicaid reforms originally discussed during Trump’s first term in office. During previous health care policy debates, a frequently discussed Medicaid reform proposal recommended by the Health Policy Consensus Group’s “Health Care Choices Proposal” involved switching from the current system of state Medicaid reimbursement to a block grant/per-capita cap allotment system. While the “Health Care Choices Proposal” assesses broader Affordable Care Act-related spending – for example, individual market subsidies or spending on Medicaid expansion – the American Action Forum’s Center for Health and Economy’s (H&E) block grant/per-capita cap proposal (herein referred to as the Medicaid Reform Proposal (MRP)) considers only reforms to Medicaid expenditures.

The MRP discussed above concerns two policy proposals:

- The impact of placing a cap on states’ Medicaid funding on a per-enrollee basis.

- The effects of a block grant capping the total amount the federal government reimburses state Medicaid programs.

This report estimates the impact of both a block grant method of funding disbursement to states and a per-capita funding method. All impacts projected in this report are relative to the 2024 H&E baseline estimations and are associated with some degree of uncertainty. For consistency purposes, the MRP is estimated to begin in 2025, but projections utilize the most current data.

Under the current program design, the federal government reimburses states for a portion of each state’s Medicaid spending, with no upper limit or cap on the amount of federal funding a state can receive.

The per-capita allotment proposal would create per-enrollee limits on federal government payments to states’ Medicaid funds, indexed to the CPI-U. Any state with spending higher than its targeted aggregate amount would receive corresponding reductions to federal funding in the following fiscal year.

States would alternatively have the option to receive a Medicaid block grant, a fixed amount of federal funding instead of a per-capita allotment. The formula for the block grant amount would be based on the targeted per-enrollee amount from the per-capita cap provision. The block grant amount would increase according to the CPI-U, with unspent funds available for the next fiscal year.

Analysis

The analysis uses a microsimulation model which employs micro-data available through the Medical Expenditure Panel Survey to analyze the effects of health policies on the health insurance plan choices of the under-65 population and to interpret broader effects. This report utilizes a microsimulation comparing these outcomes with the 2024 H&E baseline estimates.

While previous proposed plans may differ in certain provisions, the analysis considers the general implementation of a block grant or per-capita cap beginning in 2025.

Budget Impact

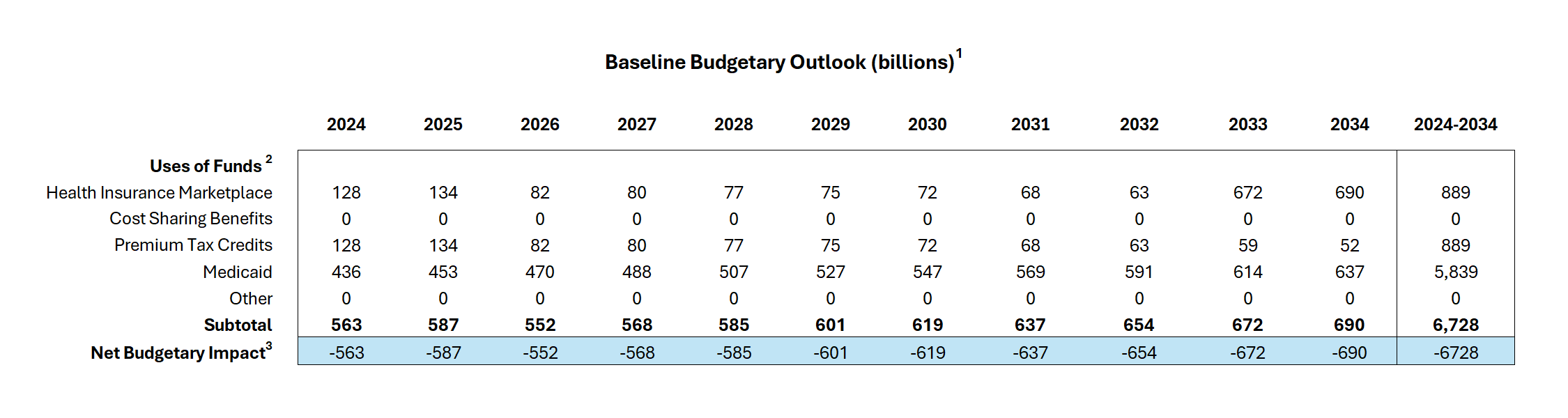

The MRP demonstrates savings of $670 billion to the federal budget compared to baseline estimates. By summing the annual differences between current policy (baseline) and MRP estimates, an average net saving of $67 billion is predicted for each fiscal year. The tables below demonstrate the net savings for each fiscal year comparing the H&E baseline to the MRP budget from 2024 to 2035. Table 1 demonstrates the 2024 baseline budgetary estimates, including federal spending in the individual market as well as Medicaid. Table 2 highlights the budgetary outlook of the MRP, with the final table demonstrating net budgetary savings specifically from Medicaid.

Table 1. Baseline Budgetary Outlook (billions)

Table 2. MRP Budgetary Outlook (billions)

Table 3. MRP Budgetary Outlook – Medicaid (billions)

Coverage Impact

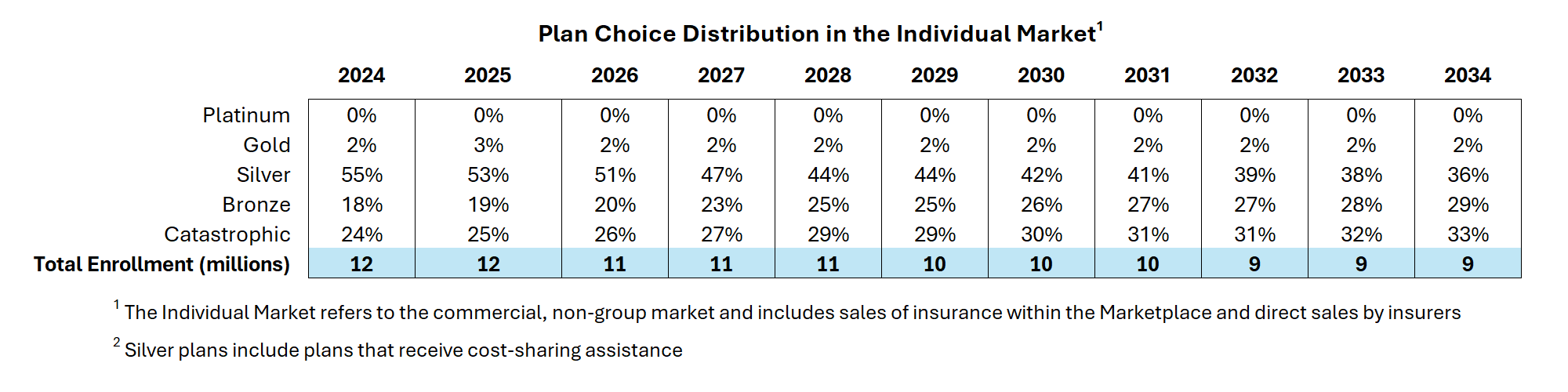

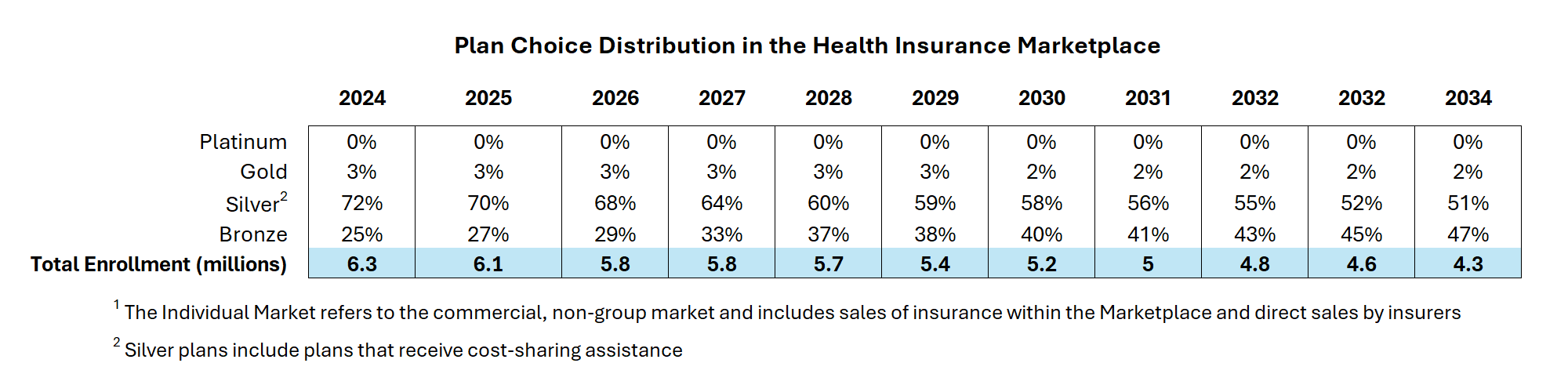

Participation in various health coverage programs will fluctuate based on the MRP. Implementation of the MRP would lead to a predicted decrease in Medicaid enrollment by 3.8 million over a 10-year period. Individual market coverage is projected to increase by 3.1 million individuals over a 10-year period. The MRP predicts an uptick of 2.3 million individuals enrolled in Bronze plans and 1.6 million individuals enrolled in Catastrophic plans. Bronze, Silver, and Catastrophic plans are projected to account for the vast majority of Subsidized Exchange plans. Table 4 demonstrates the net changes between MRP enrollment and the 2024 baseline enrollment estimates, with Table 5 providing the full enrollment outlook underneath the MRP. Table 6 provides the net differences in subsidized exchange enrollment between the 2024 baseline estimates and the MRP enrollment projections. The final two tables, Tables 7 and 8, demonstrate the plan choice distribution in the individual market and the health insurance marketplace.

Table 4. Net Insurance Coverage – MRP (millions)

Table 5. Total Health Insurance Enrollment – MRP (millions)

Table 6. Net MRP Insurance Enrollment (millions)

Table 7. Plan Choice Distribution in the Individual Market

Table 8. Plan Choice Distribution in the Health Insurance Marketplace

Premium Impact

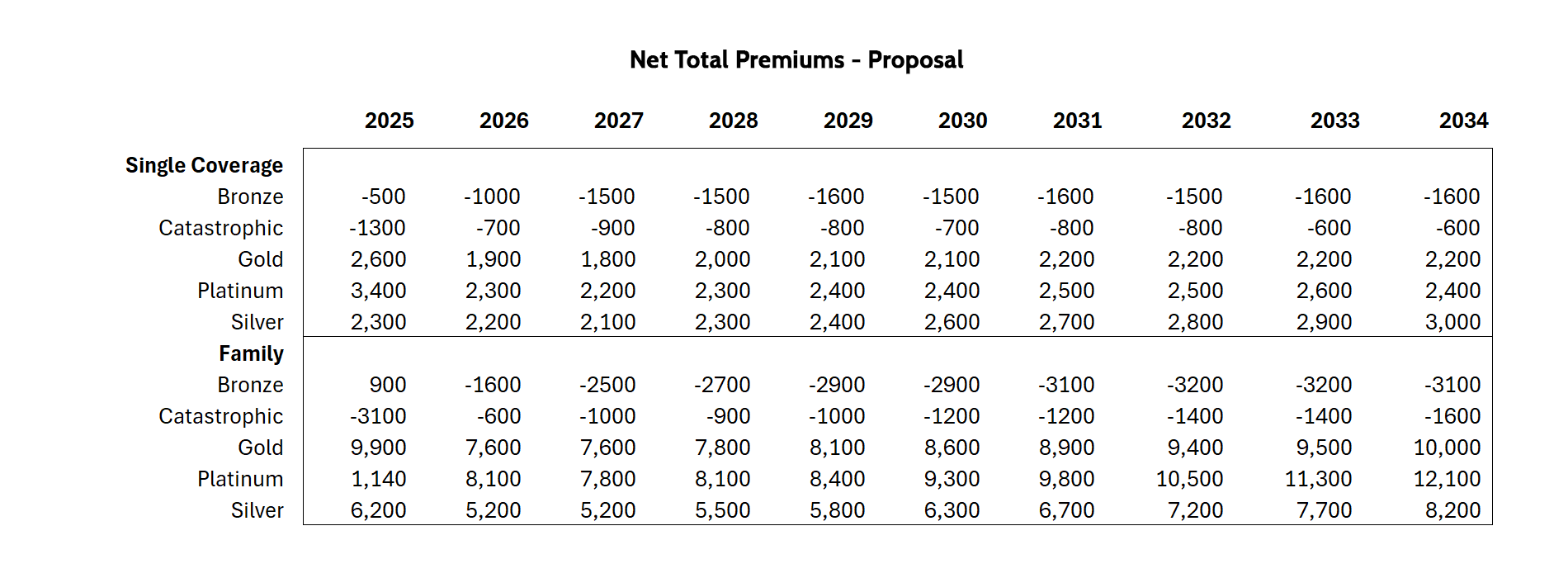

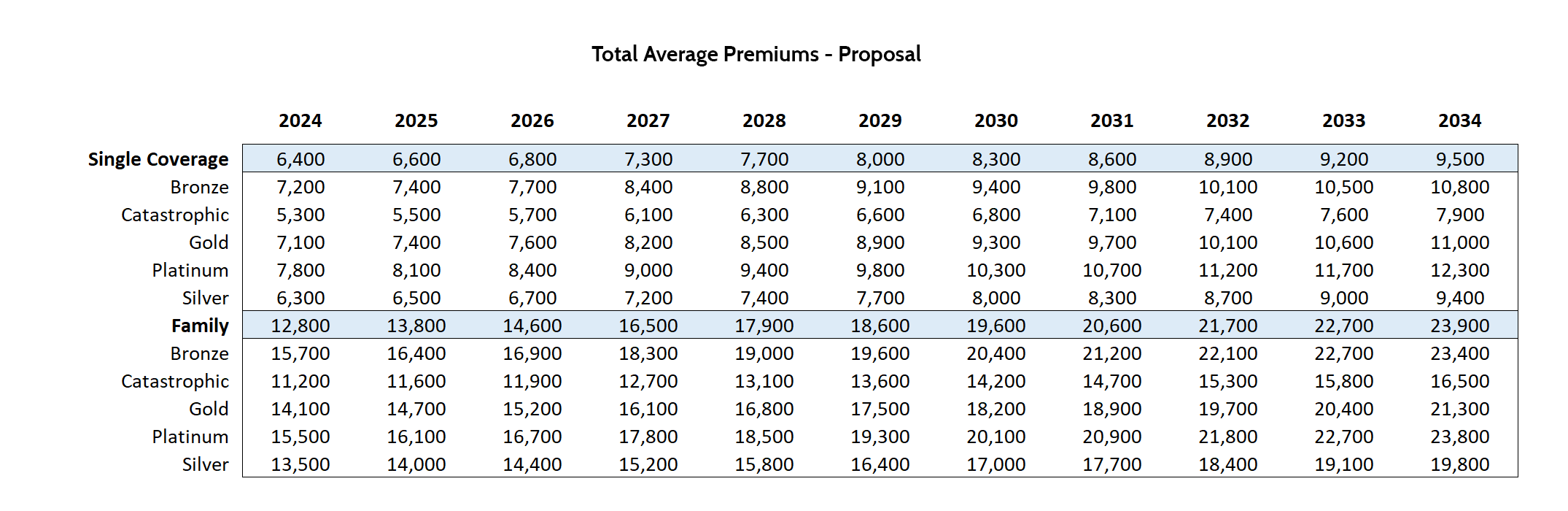

Under the MRP, annual premiums are projected to fluctuate over the 10-year window. Annual premiums for Bronze and Catastrophic plans in both single coverage and family coverage are predicted to decrease moderately – 14 percent and 5 percent, respectively, for single coverage; 12 percent and 9 percent for family coverage. Annual premiums for single coverage and family coverage for Silver, Gold, and Platinum are expected to increase – 24 percent, 17 percent, and 16 percent, respectively, for single coverage, 29 percent, 32 percent, and 34 percent, respectively, for family coverage by 2034. These changes are reflected in the tables below. Table 9 provides the net difference premiums between the 2024 baseline estimates and Table 10 demonstrates total average premium estimations from the MRP.

Table 9. Annual Net Total Premiums – MRP (USD)

Table 10. Annual Total Average Premiums – MRP (USD)

Conclusion

Based on analysis of the MRP, the observed 10-year window shows a statistically significant impact on the federal budget through decreased Medicaid enrollment and increased individual market enrollment. This change in individual market enrollment impacts premiums in the market, with some plans’ premiums decreasing for consumers and increasing premiums for other plans.