Research

April 6, 2017

Coal Declines Explained Mostly by Markets

Summary

- Coal use for electricity has been declining since 2007, well before regulations restricting coal had been envisioned. However, major regulations since 2014 likely explain more recent steep coal declines.

- Market conditions, such as falling natural gas and renewable energy prices, better explain the trend of coal declines over a ten-year period.

- The shift away from coal due to cheaper competing energy sources, not from regulation, yields economic benefits.

Introduction

As regulation pertinent to coal and other fossil fuels in electricity production is being curtailed, there is renewed warrant for examination of the explanatory factors in shifting electricity markets. Coal continues to slide, and in 2015 was barely edged out by natural gas for the number one source of electricity in the country, signaling the end of coal’s dominance. Market forces in the form of low natural gas prices, as well as regulations on coal, are frequently cited as the dominant reasons for this. In crafting policy, though, consideration must be given to the strength of these variables, and what the economic costs and benefits of such policies are.

The Current State of Electricity Markets

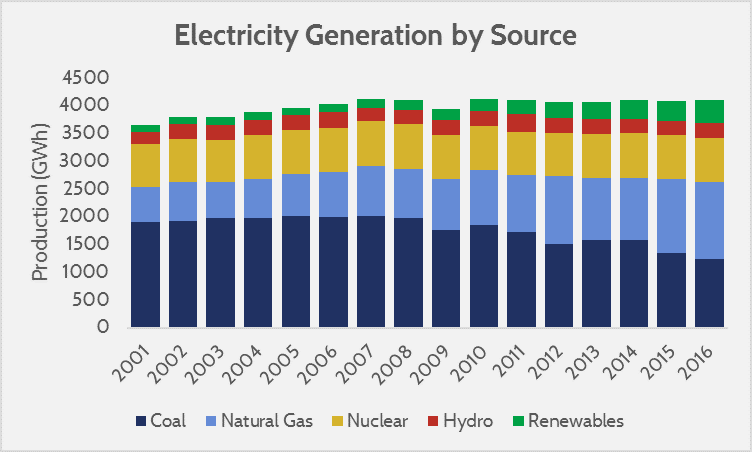

Up until around 2006, electricity market trends were steady. Total demand was growing each year, but the composition of electricity sources was relatively constant. Coal provided around half of all electricity, with other major sources being natural gas and nuclear power. Those three sources alone accounted for nearly 90 percent of all electricity generation. More recently, the trends are different. Total electricity demand growth has remained somewhat stagnant, likely as a result of efficiency regulations, weak growth, and more of the economy being powered by less energy-intensive industries. Coal has slipped to produce around 30 percent of electricity, natural gas produces around 33 percent, and non-hydro renewable energy is around 10 percent. Nuclear and hydroelectricity have remained constant, and the clear winners under the new markets are natural gas and renewables.

Source: EIA Electricity Data

Source: EIA Electricity Data

Notice that the trend of natural gas consumption increasing began around 2006, and coal use peaked in 2007. Also, the use of nuclear and hydropower have remained relatively stagnant throughout the entire 16-year period. With total generation mostly flat, the natural conclusion is that coal-powered electricity has been displaced by renewables and natural gas, but to what extent? Since 2007, increased natural gas generation has replaced around 62 percent of lost coal generation, and renewable energy around 32 percent. Hydroelectricity contributes a small amount, and only around 3 percent of the coal displacement is not accounted for from the biggest electricity sources. In total, from 2007 – 2016, around 3.6 thousand terawatt hours less generation came from coal than what would have been expected under previous trends.

Since 2007, increased natural gas generation has replaced around 62 percent of lost coal generation, and renewable energy around 32 percent. Hydroelectricity contributes a small amount, and only around 3 percent of the coal displacement is not accounted for from the biggest electricity sources. In total, from 2007 – 2016, around 3.6 thousand terawatt hours less generation came from coal than what would have been expected under previous trends.

Reason for the Changes in Electricity Production

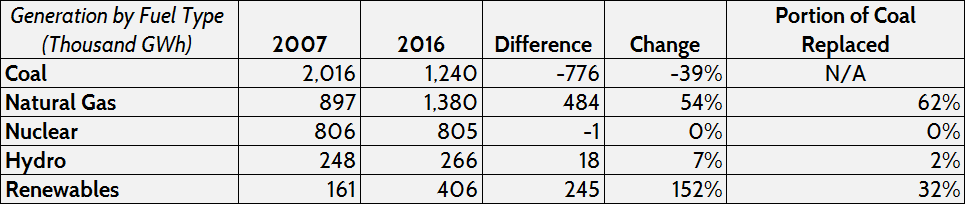

Coal’s decline is primarily due to falling natural gas prices relative to rising coal prices. The graph below shows the change in price (2007 being indexed as 100 percent) for coal, wind, solar, and natural gas.

Source: Averaged levelized costs from the Transparent Cost Database.

Source: Averaged levelized costs from the Transparent Cost Database.

The prices above are unsubsidized levelized costs for wind (onshore) and solar, and fuel costs for natural gas and coal. Immediately noticeable is that solar and natural gas have fallen significantly since 2007, but coal and wind prices have risen. The average wind price could be somewhat misleading, though, because national averages are not at all representative of the regional market dynamics (e.g. high wind potential drives down levelized costs, but wind power potential is heavily concentrated in several regions in the U.S. while virtually nonexistent in others).

Natural gas’ rise to prominence relative to coal can be explained by its falling price and rising production. Hydraulic fracturing (fracking) has led to dramatic increases in natural gas production. Coal, on the other hand, has experienced stagnant or declining production during the same period.

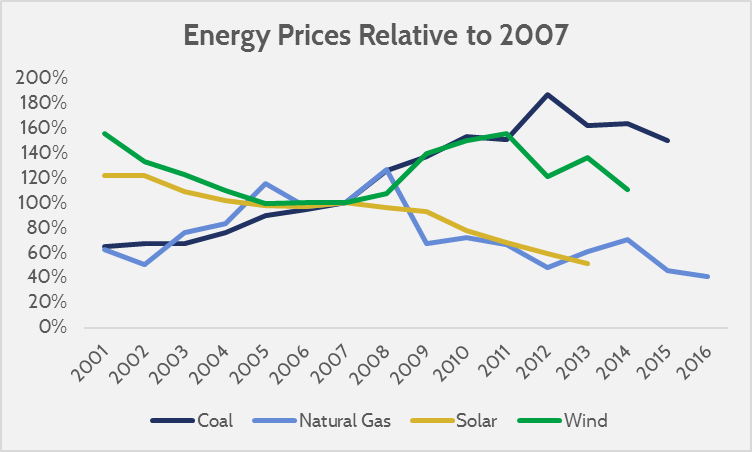

Source: FRED Mining Production Data.

Source: FRED Mining Production Data.

The above graph shows changes in production of both coal and natural gas, and labels when coal-relevant regulations (the Coal Ash Rule, the Mercury and Air Toxics Standards, the Clean Power Plan, and the moratorium on federal coal leases) were proposed and finalized. Notice that coal production fell during the recession, and did not recover to its pre-recession levels. It maintained a relatively constant rate, even when major regulations were introduced. It was not until the Coal Ash Rule and Clean Power Plan were finalized in late 2014 and 2015 that production sharply fell. Regulations may be responsible for more recent troubles in the coal industry, but the trend of coal’s decline goes back to 2007. Coal’s loss in electricity markets is likely better explained by the high production and low price of natural gas, with regulations only being able to explain more recent declines. For a more complete picture, consider renewable energy.

Sources: Transparent Cost Database and EIA Data.

Sources: Transparent Cost Database and EIA Data.

Although solar power is growing very quickly, the 2013 data still shows it as considerably more expensive than wind. Wind power, despite its relatively level costs, grew quickly and significantly. Wind’s popularity can likely be explained by a combination of subsidies, market anticipation of long-term coal regulations (a power plant’s typical lifespan is 20-years or more), and localities with low levelized costs due to high wind potential.

The most likely explanations for coal’s decline in electricity generation are highly competitive natural gas, renewable energy subsidies, falling solar costs, and an anticipation of carbon constraints within the lifetime of new power plants. Significant changes in regulations on coal are a relatively recent phenomenon given that coal’s decline began ten years ago (around the same time that natural gas production began to rise), and are only a partial explanation for market trends.

Economic Benefits of Natural Gas and Renewable Energy

While coal has delivered significant benefits due to its low-cost, dispatchability (ability to be turned off and on at will), and reliability, it also has disadvantages. Pollution from coal plants is higher than other sources of electricity, and despite its relatively low costs it is still expensive relative to natural gas. The displacement of coal by cheaper electricity sources yields economic benefits.

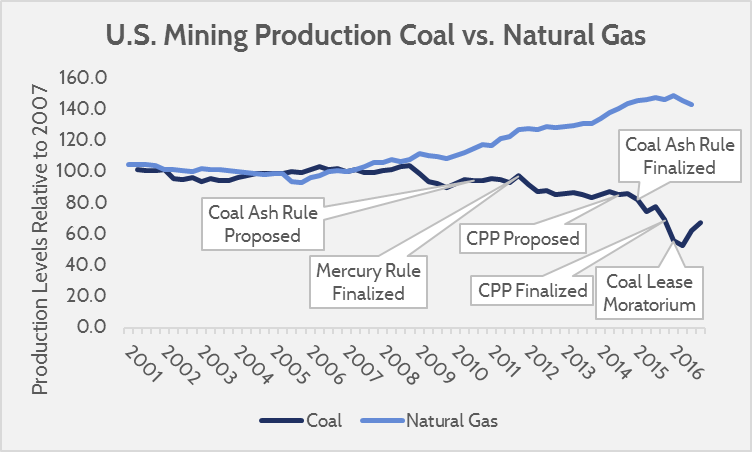

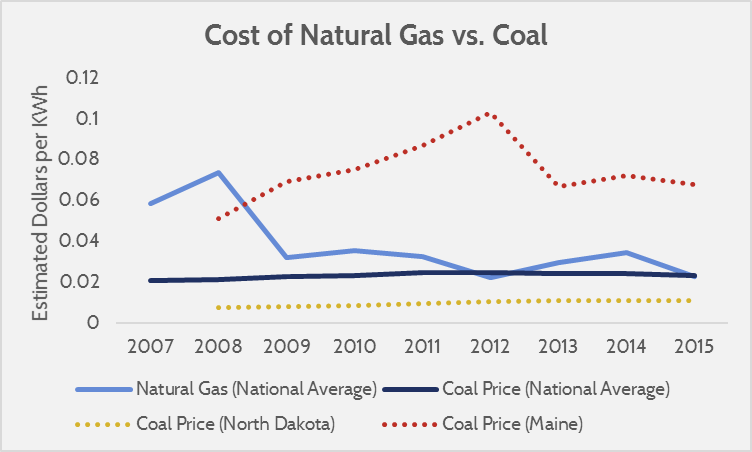

Falling natural gas prices and solar prices have certainly resulted in economic benefits from reduced fuel costs, but quantifying these benefits is difficult. The benefits are likely realized regionally, reliant on several factors such as pipeline infrastructure, technical potential for capacity, and localized coal prices. The graph below shows the national average natural gas price relative to the national average coal price, as well as exceptionally high and low state coal prices.

Source: AAF estimates, based on EIA prices and heat transfer rates for electricity generation.

Source: AAF estimates, based on EIA prices and heat transfer rates for electricity generation.

Since 2009, natural gas prices were comparable to coal, and maintained that comparability thanks to increasing natural gas production and improving efficiency of natural gas power plants. Although this analysis does not quantify the benefits, regions where switching energy sources away from coal was cheaper certainly created economic benefits by freeing capital from energy costs to more productive uses. Economic benefits from renewable energy may have been somewhat less, since the subsidies are paid for by taxing already productive sectors of the economy (profit, payrolls, etc.).

Conclusion

The coal industry’s decline is explained by four factors: cheap natural gas (thanks to better production methods), improving efficiency of natural gas power plants, increased deployment of renewable energy (partially due to subsidies and partially due to falling unsubsidized costs), and to a lesser extent regulations on coal production and electricity use. Regulations, despite being commonly discussed, are a major explanatory factor only for recent years. Market conditions better explain the trend of coal declines before the finalization of regulations.

Policies such as lifting the coal moratorium or ending the CPP are likely to deliver regional economic benefits to areas where coal is still the most competitive source of electricity. However, such policies will not reverse national trends that have contributed to coal’s declines. Any policy that attempts to intervene in favor of coal markets beyond lifting restrictions or reforming subsidies would be ill advised, as they would distort markets and forego potential economic benefits from falling natural gas and renewable energy prices.