Research

April 10, 2017

The Consequences of the Fiduciary Rule for Consumers

Executive Summary

- The fiduciary rule is the most expensive regulatory action of 2016 and the second most expensive non-environmental rule since 2005.

- It has the potential to increase consumer costs by $46.6 billion, or $813 annually per account, in addition to the $1500 in duplicative fees for retirement savers that have already paid a fee on their commission-based accounts.

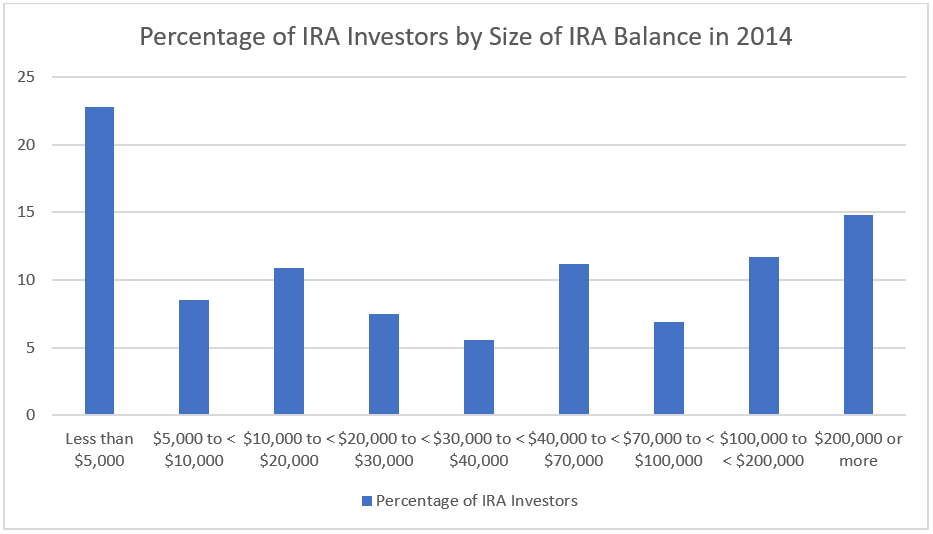

- Based on a minimum balance requirement of $30,000, the rule could force 28 million Americans out of managed retirement accounts completely. Even with a minimum account balance of $5,000, over 13 million would lose access to managed retirement accounts.

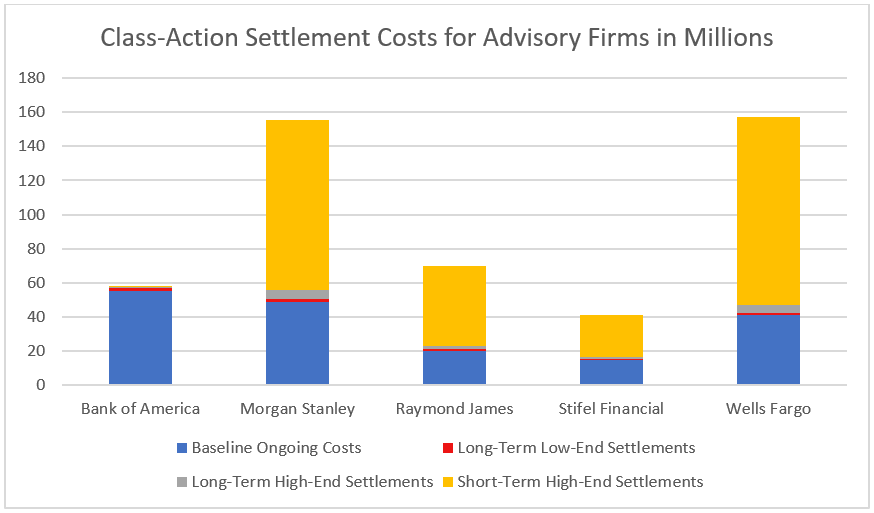

- Wealth management firms covered under the fiduciary rule will see annual litigation costs up to $150 million as a result of class-action lawsuits stemming from the Best Interest Contract Exemption, in addition to the cost of wasted resources and foregone opportunities due to the uncertainty of litigation.

Introduction

As we approach the originally-scheduled effective date of the Department of Labor’s (DOL) now delayed fiduciary rule, interested parties should not lose sight of why this rule has faced so much push back for the past several years. The American Action Forum (AAF) has previously written that the fiduciary rule will not only reduce investors’ access to investment advice and investors’ choice in investment products, but that it will also cost investors upwards of $1500 in duplicative fees. As more and more financial companies announce their plans to either leave the retirement advice market completely or draw down their advisory business, it is important to drill down to what this rule and its unintended consequences will really mean for consumers, especially low and middle income consumers who benefit most from retirement advice.

When the fiduciary rule was originally finalized in 2016, it was (and still is) the most expensive regulation that year, with $31.5 billion in total costs and $2 billion in annual burdens. Although the rule has not yet become effective, AAF research has found that three major companies have left part of the brokerage business, and six more are drawing down their business or switching to a fee-based arrangement. From these companies alone, reported compliance costs have already topped $100 million, affecting 92,000 investment advisors, $190 billion in assets, and at least 2.3 million consumers.

Advocates for DOL’s fiduciary rule argue that it is necessary to prevent bad actors from acting in their own best interest instead of that of their clients. They argue that without it, consumers will be cheated out of a portion of their retirement savings by being conned into investments that don’t work for them. On its face, a fiduciary standard is widely supported throughout the industry. The problem with DOL’s fiduciary rule is not the requirement to act in a client’s best interest, but the dissuasion of commission-based accounts and the imposition of the Best Interest Contract (BIC) Exemption, which opens up financial advisors to the risk of a litigious clientele.

Despite its length and complexity, the fiduciary rule can be broken down into two paths of compliance for advisors: 1) Moving to a primarily fee-based model or 2) Entering into the BIC with clients. The consequences resulting from each of these options are explored in detail below.

1. Moving to a primarily fee-based model

Created by the Employee Retirement Income Security Act of 1974 (ERISA), individual retirement accounts (IRAs) have become an integral part of Americans’ retirement saving strategies. Based on data from the Internal Revenue Service (IRS), by the end of 2014, 57.3 million Americans own at least one IRA all totaling nearly $7.3 trillion in assets.

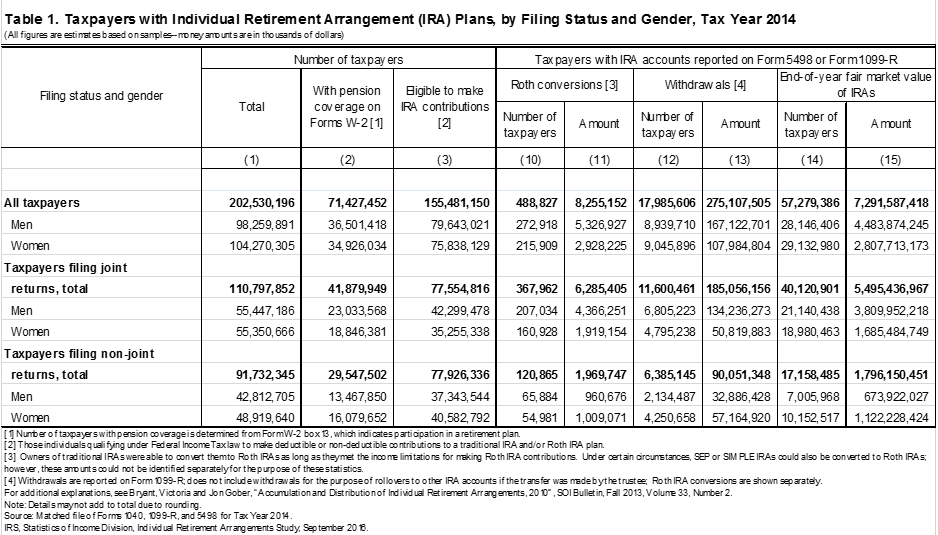

In 2011, a survey of 25.3 million IRA accounts found that a large majority of IRA investors opted for a commission-based instead of a fee-based arrangement, and that those investors with lower IRA account balances preferred a commission-based arrangement at even higher levels than those with higher account balances as seen in the chart below.

Source Oliver Wyman Study, 2011

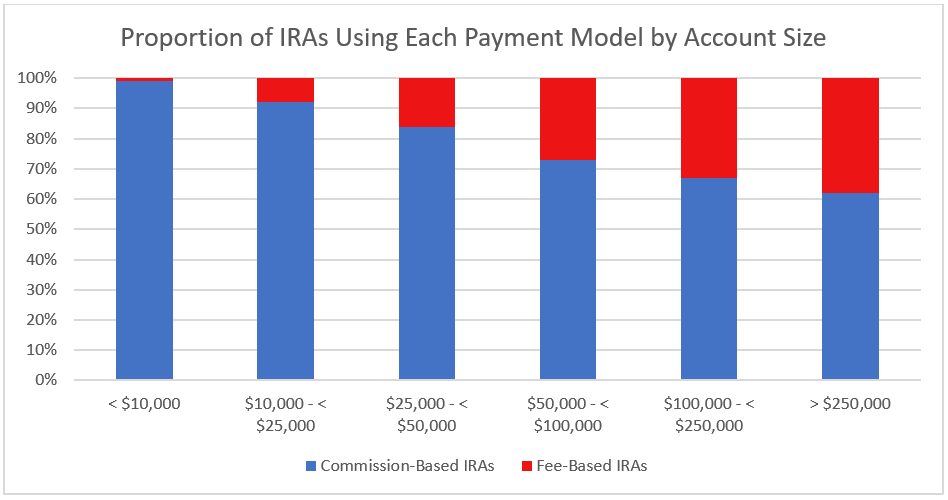

In a 2014 study, the Investment Company Institute (ICI) found that nearly 23 percent of the 57.3 million Americans with IRAs have balances less than $5,000, over 42 percent have less than $20,000, and almost 74 percent have less than $100,000.

Source: ICI’s IRA Investor Database

All of this data is important to the fiduciary rule’s effects on consumers because the fiduciary rule will force many investment advisors to move away from a commission-based model to a fee-based model in order to avoid any possibility of an apparent conflict of interest. In fact, some firms have already announced that they are doing away with their commission-based IRAs entirely. This presents two major problems for consumers. First, fee-based accounts are much more expensive for investors. As Morningstar explains, fee-based accounts yield upwards of 50 percent more revenue for firms than commission-based accounts because “[f]ee-based accounts are already under a fiduciary standard of care that is defined by the Securities Exchange Commission (SEC). This SEC fiduciary standard requires increased monitoring, legal liability, and typically is accompanied with a higher service level than commission-based accounts, so clients are charged more.” By way of background, the reason DOL is involved in a developing a fiduciary standard is because of its oversight of ERISA and the retirement plans under it, which are the only ones covered by this rule.

One study found that advisors earn .54 percent on commission-based accounts versus 1.18 percent on fee-based accounts. With nearly $7.3 trillion of assets in IRAs, that’s a difference between consumers paying a total of $39.4 billion or $86 billion in fees each year, an average of $813 per IRA account holder – an unaffordable amount for many.

The second major problem is that because fee-based accounts mean increased monitoring, liability, and servicing, advisors will be forced to require higher minimum account balances in order to remain financially viable. For example, Edward Jones will require investors to have $100,000 in retirement assets to open a fee-based IRA, whereas other firms will require minimum balances of $20,000 or $30,000. Looking back at the third chart above, even with a minimum account balance requirement of $20,000 that leaves over 42 percent of IRA investors will be forced out of managed retirement accounts, and almost half if that minimum is increased to $30,000. Even with a minimum balance of just $5000, over 13 million accounts will fail to qualify for managed advice.

In 2013 the Retail Distribution Review initiative (RDR) was implemented in the United Kingdom. It’s not an exact match of DOL’s fiduciary rule, in that it explicitly forbids commission-based accounts, but it is a close comparison. Since the RDR was implemented, several studies have been conducted looking at its effects on investment advisors and their clients. Without getting bogged down in the details because it is an imperfect comparison, it would be remiss ignore them completely.

The UK’s Financial Conduct Authority (FCA) conducted a review in 2016 of the changes in the retirement advice market as a result of the RDR. One of the more telling findings is that “over the last two years, the proportion of firms who ask for a minimum portfolio of more than £100,000 has more than doubled, from around 13 percent in 2013 to 32 percent in 2015. The FCA’s recent survey of advisors also supports this, suggesting that 45 percent of firms very rarely advise customers on retirement income options if those customers have small funds (i.e. less than £30,000) to invest.”

Another review of the RDR’s impact on the UK’s financial advice market conducted by the Cass Business School at the City University London found that the enhanced requirements on advisors will drive advisors out of the investment advice market completely. “Advisor numbers fell from 40,000 at the end of 2011 to 31,000 by the start of 2013: we find that the remaining financial advisors are unduly optimistic about their own business prospects in the RDR world.” Further, they found “that the average advisor expects to garner around £1,500 from each of roughly 150 clients to sustain the £220,000 of gross revenue that they tell us they require to function as a business. With fees averaging approximately 1 percent of assets under advisory this means that the average client will need to have around £150,000 in investible assets on average.”

In sum, the fiduciary rule will force many IRA investors into fee-based accounts which, at a minimum, will noticeably increase the amount they pay their advisor each year, and, at a maximum, will cut them out of the investment advice market completely. Considering that the IRAs with the lowest account balances will be hit the hardest, it’s a reasonable conclusion that the fiduciary rule will end up hurting those low to middle income retirement savers that it was intended to protect the hardest.

2. Entering into the BIC with clients

The second option presented to investment advisors by the fiduciary rule is to enter into the BIC with their clients. Like the rule itself, on its face, the BIC sounds good – a best interest contract between advisor and advisee. But in reality the BIC will open the door to litigation, especially to class action lawsuits. Specifically, the BIC exemption purports to “allow entities such as registered investment advisors, broker-dealers, banks and insurance companies…and their employees, agents and representatives…that are ERISA or Code fiduciaries by reason of the provision of investment advice, to receive compensation that may otherwise give rise to prohibited transactions as a result of their advice to plan participants and beneficiaries, IRA owners and certain plan fiduciaries…”

In other words, the BIC exemption allows advisors to provide investment advice which on its face may seem conflicted so long as they enter into a contract with their client stating that it is in fact in their best interest, and, if it’s not, their client can sue them for breach of contract. And while it does allow for the inclusion of mandatory arbitration clauses, the BICs cannot waive the client’s ability to file or participate in a class action lawsuit.

In 2016 alone, nearly 4000 FINRA arbitration cases were filed by consumers alleging some wrongdoing by their broker-dealers, yet only 158 cases were decided in favor of the consumer, which means many broker-dealers spent significant time and money defending themselves, perhaps unnecessarily. One could expect BIC litigation to fall along the same lines, but with the added threat of class action lawsuits and, at times, their resulting settlements.

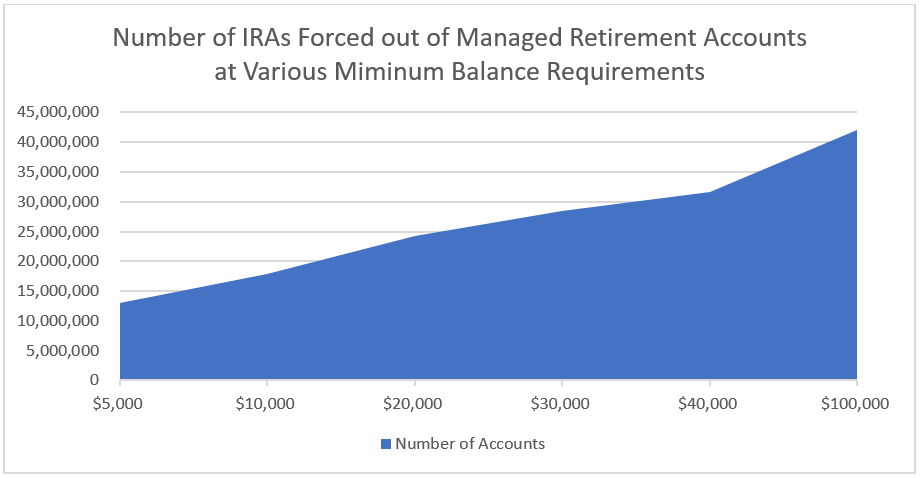

One study estimated the costs of class action lawsuits under the BIC using historical restitution data from wealth management firms, claims on implied errors and omissions insurance policies, DOL monetary estimates, and previous settlements on retirement plan class actions. It found that the long-term costs for class action lawsuits is between $70 million and $150 million each year – in addition to DOL’s estimate of $1.5 billion in ongoing costs. The study goes on to say that the near-term class action settlements could exceed the long-term estimates by a multiple “as firms try to figure out how to determine, demonstrate, and document best interest.” Some strategic litigation could force targeted investment advisors into some extremely costly settlements – not as a result of their malpractice, but as a result of gray area in the law of the fiduciary rule and the BIC. The same study estimates that near-term class action settlements could decrease the operating margins on commission-based IRAs by 24 to 36 percent.

Strangely, proponents of the fiduciary rule seem to view the litigation risk as a positive product of the rule. Barbara Roper of the Consumer Federation of America has been on record saying, “That enforceable [Best Interest] Contract provides a hook for litigation.” And AARP has said that the provision which bars the ability to waive class action liability is “one among several steps” that DOL is taking to “curb companies’ efforts to shield themselves…through the fine print.”

In an effort to curb potential litigation costs, investment advisors may purchase liability insurance. DOL’s cost estimates pin the increase in premiums at approximately 10 percent, or $300 per year, but independent studies estimate that number to be much higher. In an Oxford Economics study, researchers found that the potential cost of litigation stemming from the fiduciary rule was the greatest concern to investment advisors, largely because it is the area of the greatest unknown. Due to that uncertainly, the study does not give an exact estimate of the increase in the cost of insurance, but it does say, “importantly, from an economic perspective, the full cost of all this may be far larger than the ultimate amount spent on litigation – although that could end up being quite large as well. The cost of the uncertainty caused by the proposed rule could be far greater, as firms waste resources and forgo opportunities because of the risk of litigation…DOL assumes that Error and Omission insurance costs for some representatives will increase by 10 percent. This appears to be a wild underestimation of the potential costs of litigation, and the uncertainty it fosters as a result of the proposed rule.”

Morningstar estimates that, in the short-term, class action settlements could double the costs of the fiduciary rule for firms.

Source: Morningstar

Conclusion

At the end of the day, the fact remains that the fiduciary rule is the most expensive regulatory action of 2016 and the second most expensive non-environmental rule since 2005. Even DOL’s own conservative compliance cost estimates are astronomical.

Based on the above data, the fiduciary rule has the potential to increase consumer costs by $46.6 billion, or $816 annually per account, in addition to the $1500 in duplicative fees for retirement savers that have already paid a fee on their commission-based accounts that move the same investments into a fee-based account. Worse, based on a minimum balance requirement of $30,000, the fiduciary rule could force 28 million Americans out of managed retirement accounts completely. Add that to $150 million in annual litigation costs and operating margins reduced by 24 to 36 percent, which will ultimately either be passed on to consumers or force firms out of the market, decreasing the supply of advice, and the fiduciary rule will end up doing a lot more harm than good. DOL’s fiduciary rule is well-intended, but the costs it imposes, especially to low- and middle-income consumers, are too high to justify implementing the rule as it is currently written.