Research

November 9, 2021

Details of the U.S.-EU Aluminum and Steel Tariff Rate Quota System

Executive Summary

- The United States reached an agreement to replace tariffs on European aluminum and steel with a tariff rate quota system (TRQ), which will eliminate tariffs on aluminum and steel imports from the European Union up to a certain amount per year; in return, the European Union will cancel retaliatory tariffs on $3 billion worth of imports from the United States.

- The U.S. agreement’s two main stated goals are to reduce carbon emissions from the production of aluminum and steel and to reduce costs for U.S. businesses and consumers.

- By using these tariffs to pursue its climate priorities, the Biden Administration is overstepping the authority vested to the executive branch by Congress to set trade policy.

- Although the U.S. agreement will reduce costs associated with the tariffs, the tariff rate quota system will encourage market manipulations that lead to higher costs and uncertainty for U.S. companies.

Introduction

On October 29, 2021, the United States announced it will replace the Section 232 tariffs it had imposed on aluminum and steel imports from the European Union (EU) with a new tariff rate quota system (TRQ). In return, the European Union cancelled retaliatory tariffs on $3 billion worth of imports from the United States. The TRQ will go into effect on January 1, 2022. The Section 232 tariffs on aluminum and steel imports from most other countries are still in effect and will not change unless those countries agree to a similar deal with the United States.

The Biden Administration states this agreement will create a framework starting in 2024 for the United States and EU to lower carbon emissions from the production of aluminum and steel. The idea is to increase the use and trade of each other’s aluminum and steel, and to lower demand for China’s aluminum and steel which emit more carbon.[1] Regardless of the carbon emissions outcomes from this agreement, these Section 232 tariffs are intended only to be used to protect national security interests. Much like the Trump Administration, the Biden Administration is overstepping its authority in trade policy because it is pursuing interests that have nothing to do with the original intent of the tariffs. The Biden Administration also states this agreement will lower costs for U.S. consumers and businesses. While TRQ will lower the amount U.S. companies pay due to the tariffs, the TRQ will lead to market manipulations that will conversely raise costs and create new uncertainties for U.S. businesses.

How the Tariff Rate Quota System Works

The TRQs on aluminum and steel will go into effect on January 1, 2022, and apply only to aluminum and steel from the EU. The Section 232 tariffs will still apply to aluminum and steel imports from most other countries.

Under the TRQ, there will be 54 categories for steel products and the annual import volume is set at 3.3 million metric tons (MMT), allocated by each EU state (the 3.3 MMT amount is based on 2015-2017 historical import figures). The TRQs on steel will be administered quarterly, and is a first-come, first-served system. Any amount of steel imported from the EU within the quota, will not be subject to the Section 232 25 percent tariffs. If the quota is reached, any subsequent imports will be subject to the 25 percent tariffs.

There will be two product categories for unwrought aluminum, and the annual import volume is set at 18 thousand metric tons (TMT). There will be 14 product categories for wrought aluminum and the limit is set at 366 TMT. The combined annual duty-free limit is 384 TMT (based on 2018-2019 historical import figures). The TRQs on aluminum will be administered semi-annually. The aluminum TRQ otherwise will operate like the steel TRQ. If the quota is reached, any subsequent imports of aluminum from the EU will be subject to the Section 232 10 percent tariffs on aluminum.

The exclusions process for both aluminum and steel products will be reinstated. Through this process, U.S. companies can petition for an exemption from Section 232 tariffs on a product-by-product basis. The excluded products will not be counted toward the quota. A detailed list of product exclusion can be found here.

Finally, there is a “melting and poured” requirement on steel imports. In the production of steel, steel is first produced into a liquid state in a furnace, and then poured into a shape where it then cools into a solid. For steel products to be eligible for the TRQ, the melting and pouring process must occur within the EU. This provision will mean steel that is melted and poured in China, and then transshipped through the EU to United States will still be subject to the tariffs.

Under this agreement, the tariffs on EU derivative aluminum and steel have been completely cancelled.

Overstepping Executive Authority on Trade Policy

Section 232 of the Trade Expansion Act of 1962 gives the president the authority to impose tariffs on imports that threaten national security. It is one of the laws Congress wrote to give the executive branch the authority to pursue trade policy, without having to wait on Congress. This is the statue former President Trump used to impose tariffs on nearly $21 billion worth of aluminum and steel imports (based on 2019 import figures). This was an abuse of Section 232 because the true intent of the tariffs was to increase the competitiveness of U.S. aluminum and steel manufacturers, not a national security issue. The primary objective the Biden Administration stated for the Section 232 TRQs is to lower carbon emissions from aluminum and steel production. This justification is as unrelated to national security as was the justification former President Trump used to originally impose the tariffs. The Biden Administration should not abuse Section 232 as a form of leverage to pursue interests that have nothing to do with the original intent of the statute.

Violating the Rules of the World Trade Organization

This agreement also violates World Trade Organization (WTO) rules. The most favored nation principle (MFN) of the WTO states if a member reduces export restrictions on one country, it must do so for every other member of the WTO. By changing the tariffs to a TRQ only for the EU and not for every other country subject to the tariffs, the Biden Administration is violating the MFN clause. Due to the disfunction of the WTO and the collective power of the United States and EU, other countries are unlikely to appeal to the WTO. The issue is the negative precedent this agreement sets. If two of the most prominent members of the WTO are unwilling to follows its rules, then its other members are less likely to as well.

Tariff Rate Quotas and Added Costs

The other stated objective of this agreement is to reduce costs for U.S. businesses and consumers. Based off 2019 import figures, the United States imported about $20.5 billion worth of combined aluminum and steel products subject to the Section 232 tariffs. The United States paid about $3.8 billion in additional costs due to these tariffs. Had the tariffs not been applied to aluminum and steel from the EU, the United States would have lowered its additional cost burden to about $2.4 billion, a 36 percent reduction in total costs. This is equivalent to the amount the United States will pay in a TRQ that does not bind on EU aluminum and steel, i.e., United States demand for EU aluminum and steel is not enough to reach the quota, and therefore no tariffs will be paid.

Looking at 2017 thru 2019 figures, United States demand for EU aluminum and steel would have been enough to cause the respective quotas to bind, however. For example, in 2017, total U.S. demand for EU steel was 4.7 MMT, well over the current 3.3 MMT quota. Superimposing the quota fill dynamics onto 2019 import figures, the above 36 percent cost savings decreases to a 27 percent cost savings. U.S. firms will import aluminum and steel as much and as quickly as possible to realize these cost savings for themselves. They do not want to be responsible for the import which causes the quota to bind, because they will then have to pay the tariff. The TRQ will encourage hoarding and other market manipulations among U.S. importers and traders of aluminum and steel. Large U.S. firms with more purchasing power and more legal resources are in a better position to navigate this new landscape while smaller firms will be at a significant disadvantage. All these factors will lead to increased costs and uncertainty for both U.S. firms and consumers.

For more detailed calculations, data, and methodology, please see the appendix below.

Conclusion

Section 232 tariffs were imposed by the Trump Administration on suspect national security reasons, and created significant economic harm for both the United States and EU. It is encouraging that the United States and EU were able to reach a deal on the Section 232 tariffs. In this agreement however, the Biden Administration is continuing the Trump Administration’s reckless use of Section 232, only this time to pursue climate interests. This deal will also fail to lower costs for the U.S. economy associated with the tariffs and will instead introduce new costs and uncertainties for U.S. consumers and businesses. Moreover, the agreement violates WTO MFN rules, setting a negative precedent that jeopardizes the legitimacy of the organization.

Appendix

All import data was collected from the United States International Trade Commission Dataweb.

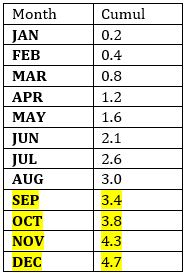

Steel Quota Fill

Since the steel quota is based on 2015 to 2017 import figures, we use 2017 import figures to estimate when the steel quota would be filled as this was the year with the most imports. Below is a table which contains the actual amount of steel imports from the EU in kilograms. It also contains the cumulative amount for the year up to date.

Table 1: U.S. Steel Imports from the EU in MMT: 2017

In September, the total volume of imports exceeded the set quota of 3.3 MMT. The amounts imported from September through December would therefore be subject to the 25 percent tariffs.

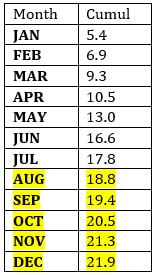

Unwrought Aluminum Quota Fill

Since the unwrought aluminum quota is based on 2018 to 2019 import figures, we use 2018 import figures to estimate when the steel quota would be filled as this was the year with the most imports. Below is a table which contains the monthly cumulative number of unwrought imports from the EU in TMT.

Table 2: U.S. Unwrought Aluminum Imports from the EU in TMT: 2018

In August, the amount of unwrought imported aluminum from the EU exceeded the 18 TMT quota. Any imports from August to December would have been subject to the 10 percent aluminum tariff.

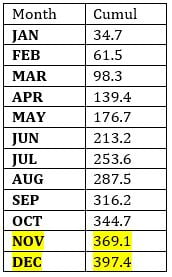

Wrought Aluminum Quota Fill

Since the unwrought aluminum quota is based on 2018 to 2019 import figures, we use 2019 import figures to estimate when the steel quota would be filled as this was the year with the most imports. Below is a table which contains the monthly cumulative number of unwrought imports from the EU in TMT.

Table 3: Wrought Aluminum Imports from the EU in TMT: 2019

In November, the amount of wrought imported aluminum from the EU exceeded the 366 TMT quota. Any imports from November to December would have been subject to the 10 percent tariffs.

Cost Savings and Difference with Quota Fill

First we use 2019 import figures and assume that no tariffs would be paid on EU aluminum and steel. This would reduce the total costs of the Section 232 aluminum and steel tariffs from $3.8 billion to $2.5 billion, a 36 percent decrease. Superimposing the above fill rates onto the 2019 figures i.e. for the highlighted months we use assume tariffs were paid, the reduction in total costs goes from $3.8 billion to $2.8 billion, a 27 percent decrease. A more detailed table of these calculations can be found here.

For reference, an excel file which covers the amount of steel imported from the EU for years 2015 through 2020 can be found here.

An excel file which covers the amount of aluminum imported from the EU for years 2015 through 2020 can be found here.

[1] https://static1.squarespace.com/static/5877e86f9de4bb8bce72105c/t/60c136b38eeef914f9cf4b95/1623275195911/How+Clean+is+the+U.S.+Steel+Industry.pdf