Research

April 7, 2016

The Fiduciary Rule is Final – Now What?

Executive Summary

- The Department of Labor’s (“DOL”) final version of the fiduciary rule comes in at over 1,000 pages and is estimated to cost over $31.5 billion and require nearly 57,000 paperwork burden hours – even by DOL’s conservative estimates.

- The fiduciary rule is the most expensive rule, proposed or final, in 2016 so far.

- DOL made significant strides in explicitly defining who and what are covered under the rule and thus with whom and when a fiduciary duty is triggered. DOL also eased up on some of the disclosure requirements from the proposed rule that would have created substantial compliance costs.

- Although DOL attempted to make the BICE more workable by eliminating its qualifying asset class list and giving advisors leeway as to when they should execute the BICE, it still remains the most burdensome component of the rule and could drive many of the lowest income retirement savers out of the investment advice market.

Nearly a year since its re-proposal, the DOL fiduciary rule was released in its final version this morning and will be officially published in the Federal Register this Friday. After a year of hearings, comment letters, revisions, amendments, and proposed legislative blocks and alternatives, did DOL make any meaningful changes to its original proposal? Short answer: yes. But the rule likely will still result in higher costs to retirement savers and fewer choices (or no choice at all) for investment advice for those savers with modest retirement savings accounts.

At its heart, the final version of the fiduciary rule didn’t change: It still requires investment advisors to adhere to a fiduciary standard when dealing with clients, requires significant new disclosures and compliance burdens, and subjects advisors to litigation if a client feels that an investment was not in their best interest. However, DOL did make some progress in terms of clarifying who and what are qualifying relationships and recommendations under the rule, and it did streamline some of the more burdensome disclosures and compliance requirements.

Since the final rule clocks in at over 1,000 pages in length, it will take some time to sort out and fully comprehend the comparative effect that the rule will have with the changes made by DOL. In the meantime, it’s helpful to note a few of the major modifications made since the rule was first proposed.

Throughout the rule’s notice and comment period, analysts’ and commenters’ concerns about the rule can, in most cases, be broken out into three main areas: 1) Ambiguity over who and what exactly are covered by the rule, 2) Excessive new disclosure requirements and compliance costs, and 3) An unworkable best interest contract exemption (“BICE”).

Ambiguity over who and what are covered

The proposed rule failed to adequately distinguish exactly the types of advisor and saver interactions that would trigger a fiduciary relationship. Without knowing exactly with whom and when a fiduciary relationship is required, investment advisors and their firms would be forced to comply with more situations than necessary, thus subjecting all of their clients to increased costs as a result of more paperwork and hiring of additional compliance staff.

The final rule took some steps to specify exactly when the rule and its requirements would be triggered. Specifically, DOL made an effort to clarify that investment education, including information on the saver’s particular plan as well as general financial and investment education, would not be subject to the rule. DOL also made a point to exclude from the rule any general recommendations that a retirement saver should hire a particular advisor or firm and any advice about health, dental, or disability insurance. It also stipulated that any appraisal issues, including those involving employee stock ownership plans (ESOPs) were not included in this rule, but would be reserved for a future, separate rulemaking.

Excessive new disclosure requirements and compliance costs

The second, and presumably costliest, component of the proposed rule to raise concern were the several new disclosure requirements and their resulting burdens. Originally, DOL included in the proposed rule a requirement that advisors disclose 1-, 5-, and 10-year performance projections at the point of sale of any given investment product in order to be able to take advantage of the BICE (discussed below). Not only would such disclosures require an enormous amount of research and document production, but they would require advisors to attempt to predict the future behavior of financial markets and be subject to litigation if they were incorrect.

Further, the proposed rule would have required that advisors and their firms disclose on their website the way in which and the amount of compensation that advisors receive for their advice. Many commenters pointed to the fact that this would, in effect, reveal advisors’ personal income online, which is troublesome. But more problematic, at least from a cost perspective, the amount of time and effort put into reworking the websites to display such information, especially for firms with thousands of advisors, would be immense. And eventually would be passed on to consumers.

DOL made perhaps its strongest revision between proposed and final rules with these sections. It did away with the 1-, 5-, and 10-year performance projection requirement in its entirety. It also clarified that website disclosures of individual advisor compensation are not required and modified the remainder of the disclosure rules to require more general statements of conflict, any fees or service charges, a model contract, and the firm’s compensation policies. The web disclosure rules could be streamlined some more, but removing the individual advisor compensation disclosure requirement was a good start.

With regard to general compliance concerns, DOL included in the final rule a grandfathering provision to for any existing advisor and saver relationships and any asset purchases that were executed before the rule’s applicability date. However, even with existing relationships, any services agreed to after the applicability date fall under all of the rule’s provisions. DOL also pushed out the applicability date from 8 months after its release to a full 12 months after its release, or April 2017. It also stipulates a “phased in” implementation which gives firms until January 2018 to come into full compliance so long as they are in compliance with the “broader definition of fiduciary” within 12 months of the final rule’s release.

An unworkable BICE

Overwhelmingly, the most common concern about the proposed fiduciary rule was that the BICE, as proposed, was wholly unworkable and, among other problems, would result in a substantial loss of commission-based retirement savings accounts. Such a loss would either force savers to switch to a fee-based account or would cut them out of the market entirely because the amount of savings in their account would not be sufficient to be profitable to an advisor in a fee-based system.

Under the proposed rule, advisors could have been required to execute detailed contracts with their clients before the clients even decided whether or not to invest with that particular advisor and could have been required to execute similar contracts multiple times throughout the advisor and saver relationship. Additionally, the proposed rule contained a very specific list of only certain assets that qualified for the BICE, harming the retirement savers’ investment choices even further.

In the final rule, DOL eliminated the list of qualifying assets, which allows advisors now to use the BICE on just about any investment product. It also modified the logistical requirements so that advisors may execute the BIC at the same time they fill out all their other paperwork to open their investment account. For advisors with existing clients, the final rule allows them to send the BIC as an update to their current terms via email or letter. It also allows for some leeway with the point in the relationship that the BIC is signed, however if the BIC is signed after advice is given, the advice given must have complied with the rule and the terms of the BIC.

The modifications outlined above were a step in the right direction, but the fiduciary rule is still going to cost a lot of folks a lot of money and may even cost some retirement savers access to their advisor entirely. In addition to the individual costs attributed to the intricacies of the rule, there are monumental paperwork burden hours and costs imposed by the rule. DOL argues that this rule will save investors upwards of $17 billion. That number has been debunked, but even if it were accurate, it pales in comparison to the $31.5 billion that the rule will cost – in its first decade alone – as detailed below:

Cost Breakdown

- Total Costs: $5.7 Billion (over 10 years)

- Total Paperwork: 65,631 hours

Final Rule:

- Total Costs: $31.5 Billion (over 10 years)

- Total Paperwork: 56,833 hours

Total Change: $25.8 billion in increased costs, 8,798 fewer paperwork burden hours

Regulatory Analysis

Days after releasing one of its most expensive rules ever, DOL outdoes itself again and releases this new measure. According to the agency’s own Regulatory Impact Analysis (RIA), this rule could cost upwards of $31.5 billion over its first decade. That easily makes the most expensive rule – proposed or final – in 2016 thus far. Despite DOL’s claims that it has added certain exemptions and cost-cutting measures to the proposed version, even the final rule’s lower-end cost estimates are roughly double that of the proposed version. These costs include:

“…the cost to [Broker Dealers] BDs, Registered Investment Advisers, insurers, and other ERISA plan service providers for compliance reviews, comprehensive compliance and supervisory system changes, policies and procedures and training programs updates, insurance increases, disclosure preparation and distribution to comply with exemptions, and some costs of changes in other business practices.”

Including this rule’s total costs puts the overall regulatory tally for 2016 at approximately $60 billion. DOL now accounts for roughly two-thirds of that with $40.5 billion on its ledger. In the most recent years, the regulatory cost leader competition has been between either the Environmental Protection Agency or the Department of Energy. DOL is certainly making a strong push to shake up that annual race.

How does the overall cost estimate spike from $5.7 billion to $31.5 billion? The agency’s cost estimates mostly come from data submitted by the Securities Industry and Financial Markets Association (SIFMA) and the Financial Services Institute (FSI). Interestingly, in the proposed version’s analysis, DOL uses these organizations’ data with the caveat that, “the data appear to significantly overstate the cost of compliance.” However, outside input has apparently caused the agency rethink that stance. As it notes:

“The Department’s ability to interpret the SIFMA and FSI reports also benefited from other stakeholders’ comments on the reports. By using these cost estimates to inform the methodology to estimate the costs associated with the final rule and exemptions, the Department took a particularly conservative approach.”

Although DOL still has many caveats regarding its use of this data – many coming from other commenters’ concerns – it is apparently comfortable with using the data as the “benchmarks” of its now “conservative” cost estimates.

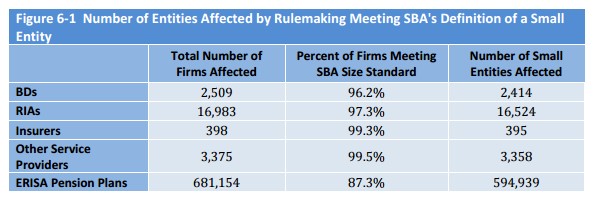

The overall, top-line figure is quite staggering, but it is also important to note the micro-level impact a rule like this will likely have on financial advisers. According to the agency’s Regulatory Flexibility Act (RFA) analysis, this rule “will have a significant economic impact on a substantial number of small entities.” In other words, small business must bear incredible costs and the vast majority of affected firms are small businesses (see below).

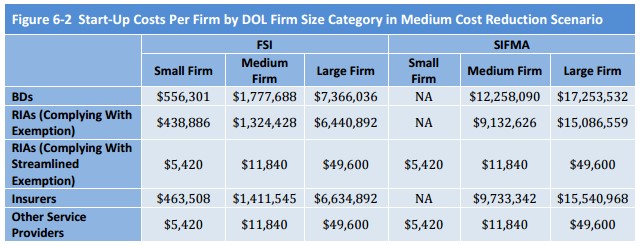

That categorization is based on a size-based metric for the Small Business Administration’s (SBA) “small entity” designation. DOL then includes a per-entity cost analysis based on its cost-benefit estimates that uses a different designation: “For purposes of the FRFA all firms in Chapter 5 that are considered small and medium sized firms have revenues under $38.5 million annually and therefore meet the SBA’s definition of a small entity.” Nevertheless, examining that data (see below) can help put perspective on the per-entity impact of this rule.

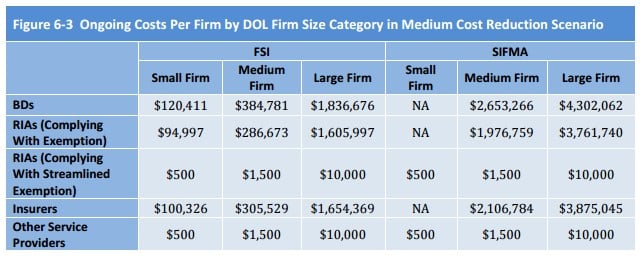

Some advisor categories will face minimal per-entity burdens due to some of the exemptions DOL has included. In addition, as can be seen above, the two datasets DOL used to arrive at its cost estimate are quite different. However, if one takes them as valid, reasonable estimates, there are interesting implications involved.

For perspective, the annual mean wage of “Financial Analysts and Advisors” is $99,730. This means that, for the advisor categories most affected (BDs, RIAs (non-streamline), and Insurers), this rule’s impact is effectively the cost of hiring the following numbers of such an employee equivalent to the start-up expenses and at least one year of “ongoing costs:”

| Category | FSI Small | FSI Medium | FSI Large | SIFMA Medium | SIFMA Large |

| BDs | 7 | 22 | 92 | 150 | 216 |

| RIAs (Complying W/ Exemption) | 5 | 16 | 81 | 111 | 189 |

| Insurers | 6 | 17 | 83 | 119 | 195 |

Conclusion

This rule is clearly one of the most burdensome rules in recent years, and likely one of the most expensive DOL regulation ever. It breaks that record that was only set by the silica rule a few days ago. Despite some apparent exemptions and carve-outs, DOL still sees these costs increasing dramatically over the proposed version due to a fuller understanding of the data available. These costs will have significant implications for financial firms and consumer in the future.