Research

February 15, 2024

New HSR Rules Threaten M&A Activity Vital to Small Businesses

Executive Summary

- In June 2023, the Federal Trade Commission and the Department of Justice proposed new rules governing the Hart-Scott-Rodino premerger notification program expected to take effect in the latter half of 2024.

- The overhaul would increase the regulatory burden and cost of compliance on companies seeking to engage in mergers and acquisitions.

- The changes threaten to choke off merger activity essential to small businesses, despite most transactions posing no threat to competition.

Introduction

In June 2023, the Federal Trade Commission (FTC) and the U.S. Department of Justice (DOJ) proposed amendments to the rules governing the Hart-Scott-Rodino Antitrust Improvements Act (HSR). The HSR Act established the premerger notification program requiring companies that intend to undergo mergers and acquisitions of a certain size to notify the agencies prior to consummating the transactions.

The FTC estimated that an extra 107 hours per filing totaling $350 million in additional labor costs would be necessary to comply with the new rules. Previous American Action Forum work explained that the proposed changes to HSR promise to throw a wrench in the gears of a functioning merger market while doing little to help the agencies identify potentially anticompetitive mergers.

Analysis of data dating back to 2011 from the Hart-Scott-Rodino Annual Report jointly published by the FTC and DOJ revealed that nearly one-in-five deals involved a small business and posed little threat to competition. Strapping small businesses with additional regulatory costs threatens to throttle merger and acquisition activity vital to their funding and growth.

Hart-Scott-Rodino Review Process

The HSR Act requires firms involved in mergers and acquisitions above a certain value ($119.5 million in 2024) to notify the agencies prior to consummating the merger. Both the buying and selling firms submit an HSR Form, which includes information about the industry and their respective businesses. Upon submission, the merging firms must observe a mandatory waiting period of 30 days before closing the deal to allow the agencies to assess the transaction for anticompetitive harms. If either agency concludes that a more in-depth investigation is warranted, the transaction will go through a clearance process. The clearance process determines which agency will investigate.

The responsible agency will launch a preliminary review and take one of three possible courses of action. First, the agency could terminate the waiting period by granting early termination. Historically, if there is no evidence of competitive harm, the agency would grant early termination, allowing the firms to close the deal prior to the end of the mandatory waiting period. This process is currently under indefinite suspension. The agency also has the option of simply allowing the 30-day waiting period to expire, permitting the firms to consummate the merger. For mergers that raise sufficient competitive concerns, the agency has a third option – issuing a Request for Additional Information, known as a Second Request. The Second Request requires that both parties to the merger provide the agency with more information. The Second Request also extends the waiting period by an additional 30 days.

The secondary waiting period triggered by the Second Request has three potential outcomes. The agency can allow the merger to be consummated, the agency could negotiate a consent agreement that includes structural or behavioral remedies to help restore lost competition resulting from merger, or the agency can file for a preliminary injunction to stop the transaction pending trial.

M&A Is Important to Small Business

A well-functioning merger and acquisition landscape is a vital tool for markets to allocate resources efficiently. These transactions often help businesses expand into new geographic markets, leverage economies of scale, fuel innovation, and lower prices.

Small businesses are uniquely reliant on the merger and acquisition market. The possibility of merging with another firm or being acquired by a larger firm often dictates whether a small business can even get off the ground. The lynchpin in this relationship is often venture capital.

Before a startup becomes an acquisition target, many rely on venture capital to help get the business going. Before a venture capitalist makes an investment, however, a viable exit strategy is often considered. Being acquired is frequently a key strategy.

Findings from the 2020 Global Startup Outlook survey quantify this dynamic. The survey found that 36 percent of startups expect venture capital to be the next source of funding for their business. The same survey showed that nearly 60 percent of respondents view being acquired as a realistic long-term goal. Just 17 percent would prefer going public via an initial public offering, while just 14 percent planned to stay private.

Changes to HSR, and the overall more aggressive approach to merger enforcement generally from the FTC and DOJ, create a heightened level of uncertainty in the mergers and acquisitions market.

An article from CNBC illustrates the consequences of this new merger enforcement regime, noting that venture capitalists (VCs) “fear…that if companies no longer have enough viable exit paths, institutional investors that back VCs…will shift money elsewhere. In turn, VCs will have fewer funds to dole out to entrepreneurs, who may see less reason to take the risk of starting a new company.”

Increasing the regulatory burden via the proposed rules governing HSR threatens to disrupt the relationship among venture capital, merger activity, and entrepreneurs while stifling innovation and business formation.

Hart-Scott-Rodino Annual Report

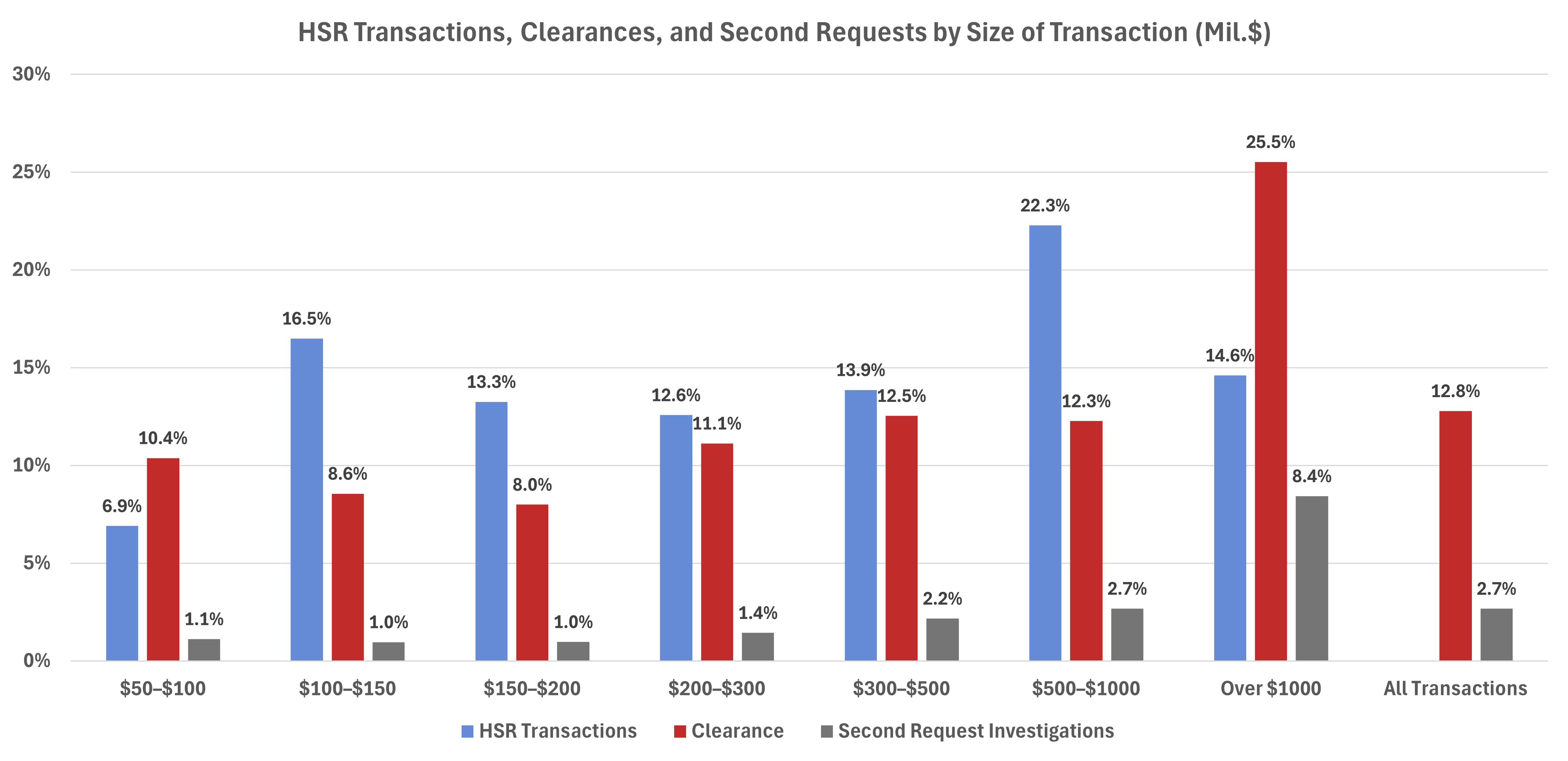

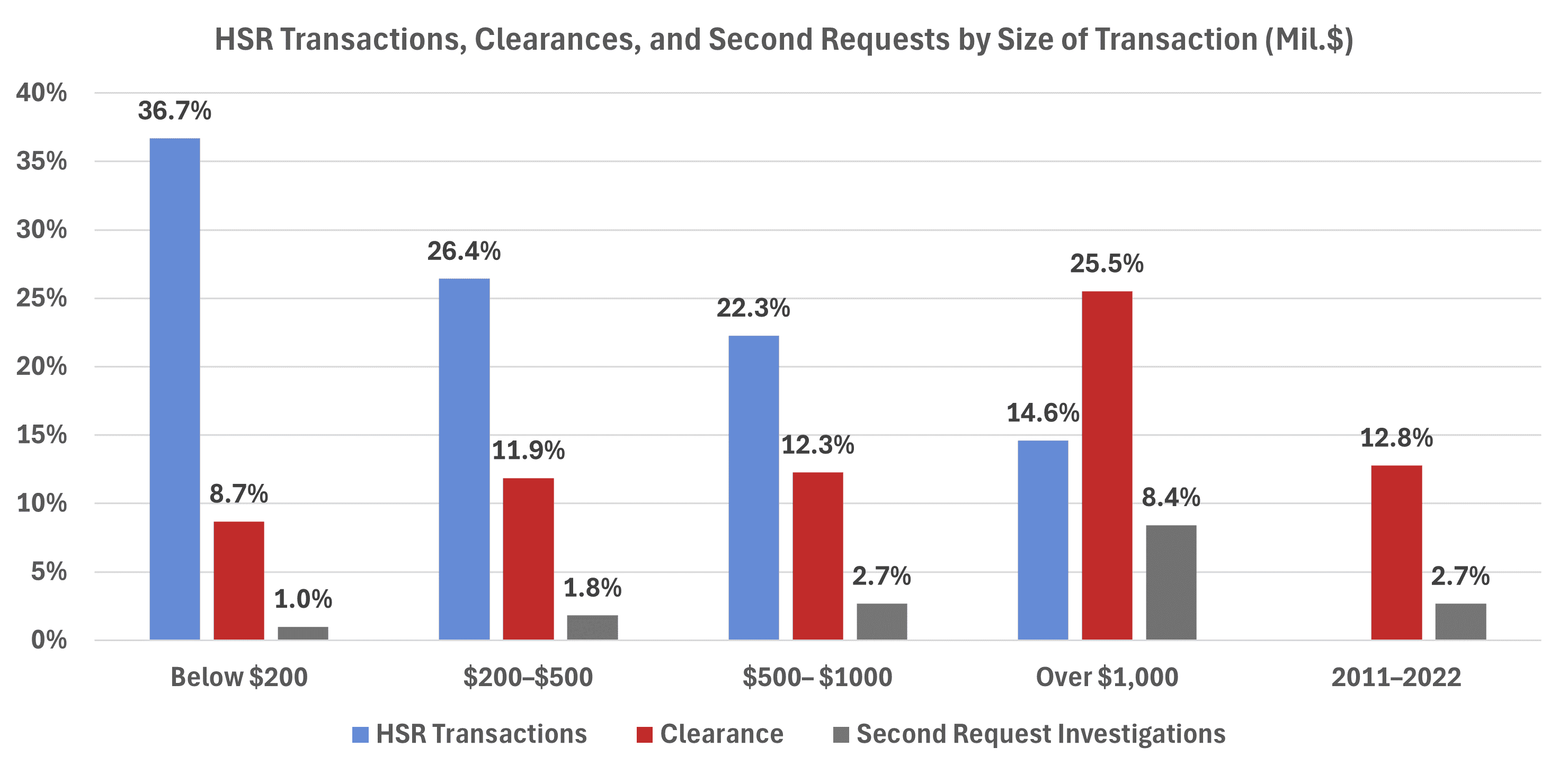

The Hart-Scott-Rodino Annual Report provides aggregated data detailing merger and acquisition activity. The report includes information on the number of HSR transactions, a count of transactions subject to the clearance process and Second Requests, and more. The data are categorized by size of the transaction, value of assets and sales, and by industry. Figure 1 summarizes these data based on the size of the transactions.

Figure 1

Analysis of the data showed that there were 23,316 HSR transactions between fiscal years 2011–2022. Aggregating certain categories of the size of the transaction to estimate mergers and acquisitions involving small businesses showed that 37 percent of the transactions (8,555) were valued below $200 million. Details from the report suggested that these small transactions were unlikely to pose a threat to competition. Less than 9 percent of these transactions were cleared to an agency and 1 percent involved a Second Request compared to the overall shares of 12.8 percent and 2.7 percent, respectively.

Figure 2

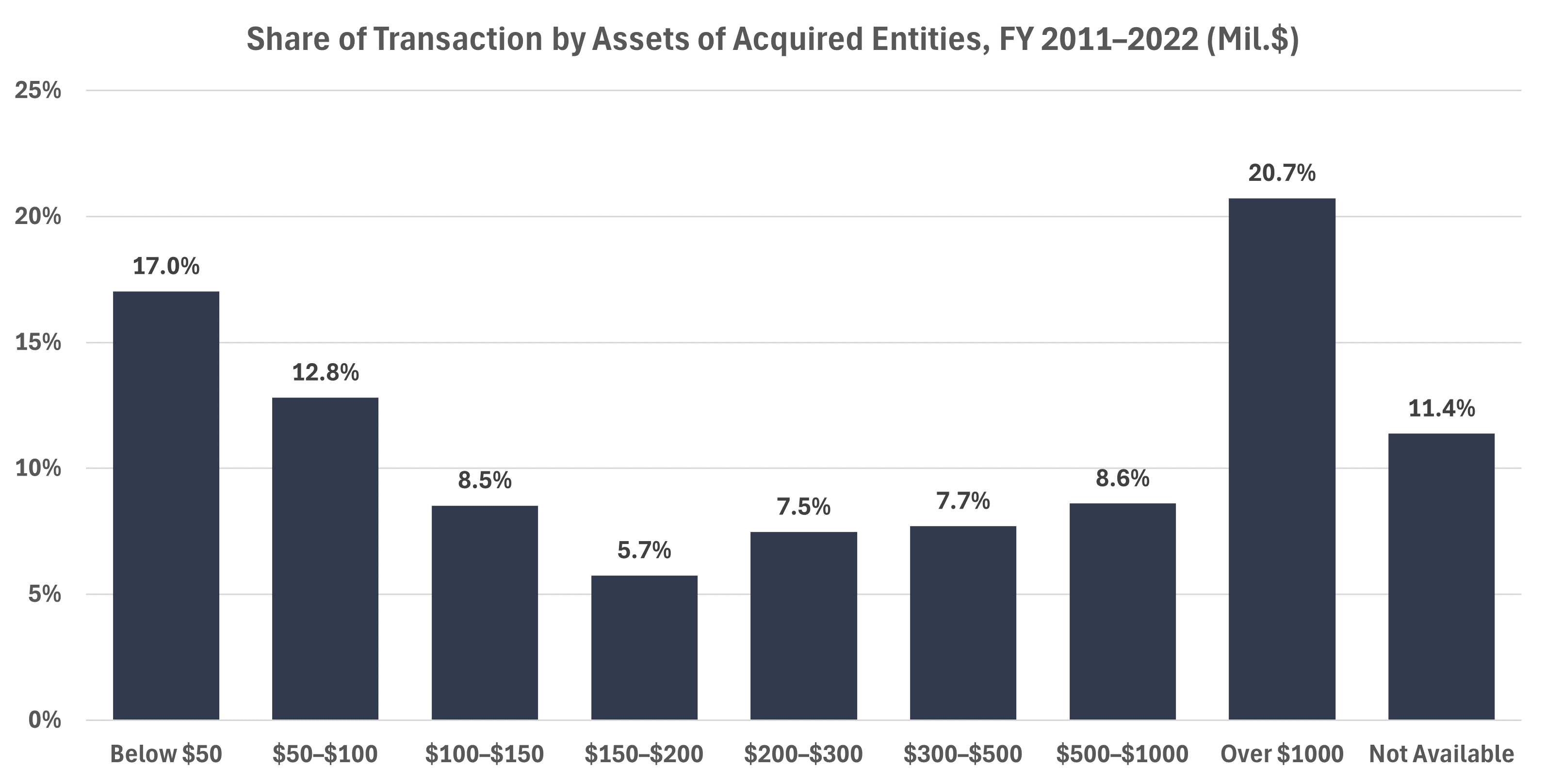

Additional analysis showed that small businesses were among the most targeted acquisitions. Between fiscal years 2011–2022, 17 percent of acquired firms had assets valued below $50 million. That share was one-in-five in FY 2022. Only 0.9 percent of these transactions involved a Second Request. It is also likely that many of the transactions in the $50–$100 million and $100-$150 million ranges involved small businesses. Figure 3 depicts the breakdown.

Figure 3

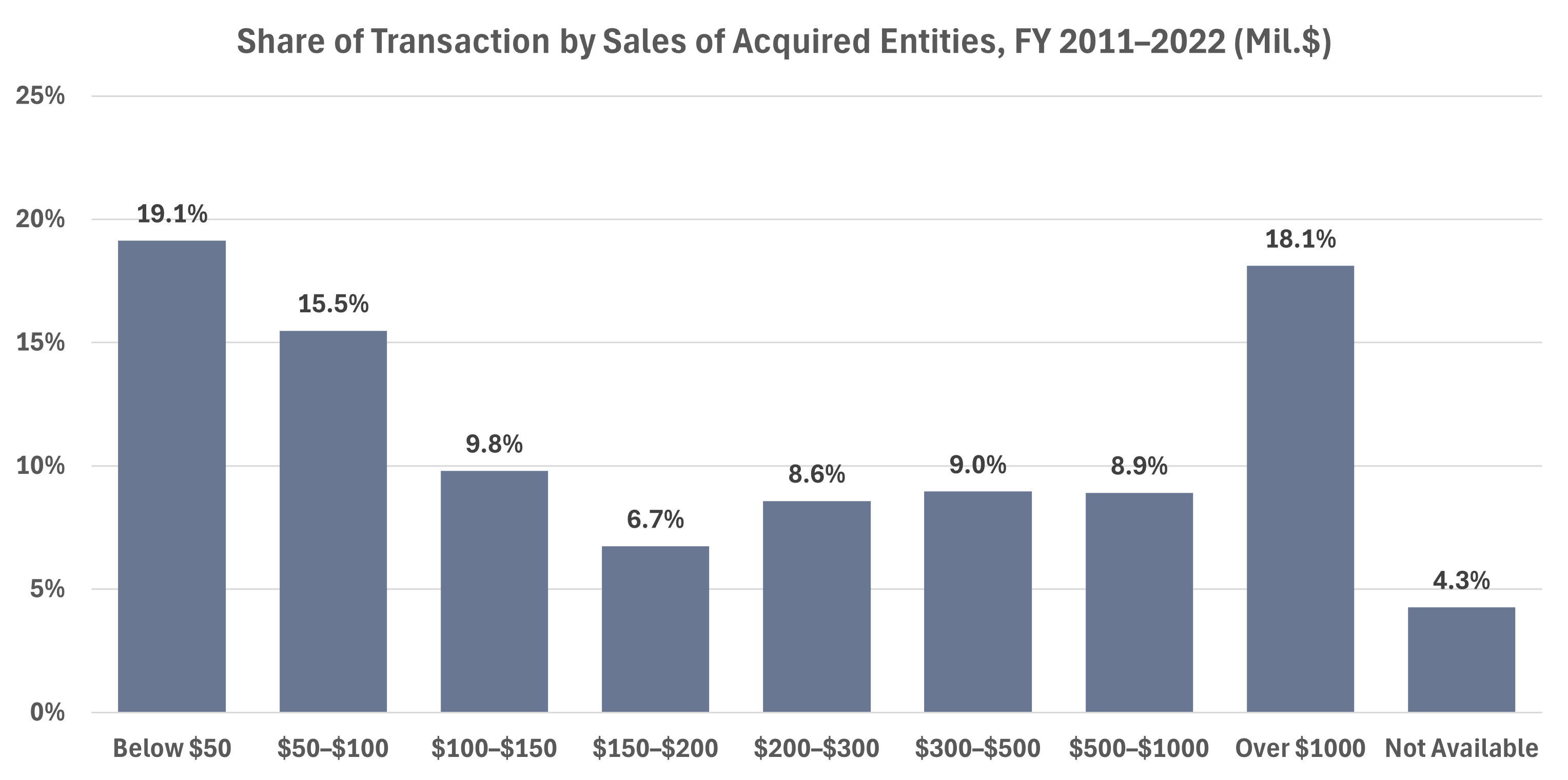

Similarly, 19.1 percent (4,461 transactions) involved an acquired firm with less than $50 million in sales. Figure 4 provides the detailed breakdown over the period of 2011–2022.

Figure 4

Small firms were not just being acquired; they were also acquiring other firms. Thirteen percent of HSR transactions involved an acquiring person with assets below $50 million. The report showed that just over 3 percent of these transactions were cleared to an agency and 0.4 percent were subject to a Second Request. Only transactions involving assets of the acquiring person greater than $1 billion had a larger share of transactions. Relatedly, 9.6 percent of deals involved an acquiring person with sales below $50 million.

The data found in these reports suggested the agencies did not consider transactions involving small businesses to be a threat to competition.

Regulatory Flexibility Act

The Regulatory Flexibility Act of 1980 requires federal agencies to consider the effects of rules and regulations on small businesses, and if possible, develop alternative compliance structures while achieving the original objective of the rule to reduce the burden.

Congress understood that “the failure to recognize differences in the scale and resources of regulated entities has in numerous instances adversely affected competition in the marketplace, discouraged innovation and restricted improvements in productivity.” Furthermore, Congress maintained that “unnecessary regulations create entry barriers in many industries and discourage potential entrepreneurs….”

The FTC projected that 107 additional hours will be spent on each HSR form, a quadrupling of the time required. Furthermore, the agency estimated an additional $350 million in labor costs will be necessary to comply. This estimate ignores infrastructure investments businesses must make to document the information needed to complete the new HSR form.

The FTC addressed the Regulatory Flexibility Act’s requirements in its proposed changes to HSR. The agency “certified” that “the regulatory action will not have a significant economic impact on a substantial number of small entities.” The agency rationalized this decision stating that “because of the size of the transactions necessary to invoke an HSR Filing, the premerger notification rules rarely, if ever, affect small entities.” Yet as the data showed, there is a significant number of small businesses involved in the HSR process. The FTC mistook the size of the transaction with the size of the business being acquired.

It is possible that the FTC did not comply with the requirements of the Regulatory Flexibility Act and may need to address these concerns before moving ahead with a final rule’s implementation.

Conclusion

The overhaul to HSR would, by the FTC’s own estimate, quadruple the regulatory burden and cost of compliance on companies seeking to engage in mergers and acquisitions. The changes threaten to choke off merger activity essential to small businesses despite most transactions posing no threat to competition.