Research

March 21, 2016

Primer: Medicare Advantage Employer-Group Waiver Plans

Introduction

Included in the Medicare Modernization Act of 2003 (MMA)—known primarily for its creation of the Medicare Part D Prescription Drug Program (Part D)—were lesser known provisions regarding employer-sponsored Medicare Advantage (MA) plans and employer-sponsored Part D plans. These plans presented employers with a new opportunity to provide health care benefits to their Medicare-eligible retirees. Like other MA or Part D plans, these plans offer, at minimum, the full range of Medicare Part A and B benefits and/or prescription drug benefits to plan beneficiaries. Employers may either contract directly with the Centers for Medicare and Medicaid Services (CMS), or, more commonly, with a Medicare Advantage Organization (MAO) to administer a health plan on the employer’s behalf.

These employer-sponsored plans have come to be known as employer group waiver plans (abbreviated as EGWPs and pronounced “egg whips”), due to the waiver authority provided for such plans. Unlike other MA and Part D plans offered by private insurers and available to any Medicare-eligible individual in a geographical service area, EGWPs are offered specifically to Medicare-eligible retirees of a particular employer. Thus the requirement that anyone be allowed to enroll in such a plan is waived. Requirements pertaining to the design of such plans were also waived in recognition of the fact that 1) these plans would likely need to provide national network coverage because an employer’s retirees may choose to retire anywhere (whereas most MA plans provide more geographically limited coverage) and 2) it may be beneficial for employers to design their plans in a way that more closely aligns with coverage offered to current employees, rather than the standard benefit design used for non-group Medicare beneficiaries. (Plan designs must have an actuarial value at least equal to that of the standard plan design.)

While not required, employers may pay for more than just the cost of administering such a plan, allowing retirees to benefit from reduced cost-sharing, greater benefits, and lower premiums. Employers may even choose to pay their retirees’ Part B premiums, which every Medicare enrollee must pay regardless of whether they enroll in MA or receive Part B benefits through traditional fee-for-service (FFS).

Background

With pensions and employer-sponsored retiree health care plans becoming a thing of the past while federally-funded entitlement programs are destined to break the budget, lawmakers have looked for new ways to encourage employers to continue financing some of the needs of retirees. The MMA included two provisions aimed at doing just that. Following passage, many employers chose to utilize the newly-created Retiree Drug Subsidy (RDS) to supplement their retirees’ health care coverage. The RDS provided employers with a tax-exempt subsidy equal to 28 percent of a retiree’s allowable prescription drug costs. However, several changes in the Affordable Care Act (ACA) have encouraged employers to transition to EGWP plans, including the elimination of the tax exclusion for RDS payments; the creation of the Coverage Gap Discount Program, in which drug manufacturers must provide a 50 percent rebate for brand-name drugs in the Part D coverage gap (which does not exist in the RDS, because the RDS is not itself a health care plan, and thus does not allow RDS recipients to benefit from this discount); and the closing of the coverage gap through gradual reductions in the catastrophic coverage threshold, which reduces the cost of such coverage to employers offering EGWP-Part D plans.

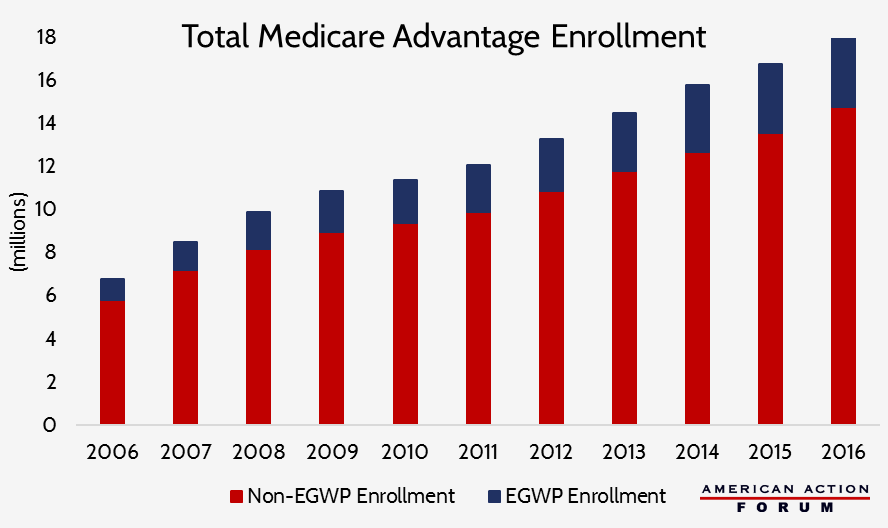

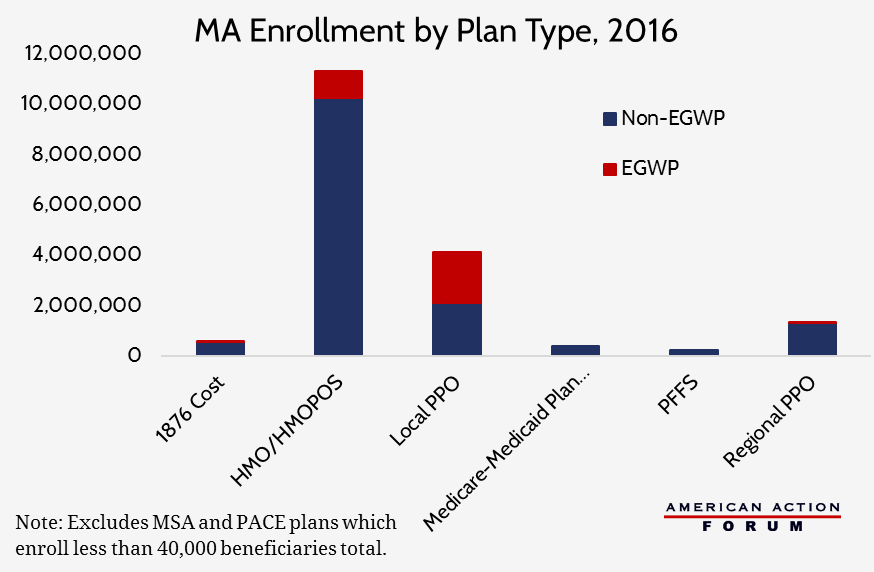

In 2013, approximately 6 million individuals were enrolled in Part D EGWPS; 2.3 million of these individuals had benefited from the RDS the year before. The growth of Part D EGWPs was naturally followed by the growth of MA-EGWPs. There are currently approximately 3.3 million individuals enrolled in MA-EGWPs, an increase of more than 226 percent since 2006. Individuals enrolled in EGWPs now account for more than 18 percent of all MA enrollees. Rising health care costs, combined with the continuously worsening burden of administering health insurance, have made it increasingly beneficial for employers to transfer retirees to EGWPs from more traditional retiree health benefit plans.

The Current Bidding Process and Payment Structure for EGWPs

Under the current rules, EGWPs must submit bids to CMS for the expected cost of coverage of a single enrollee, similar to the bidding process of non-EGWP MA and Part D plans, and are paid by CMS in the same manner as non-EGWP plans in MA but not Part D.

In MA, payments to plans are dependent upon the plan’s bid and the benchmark for the coverage area, though there are differences in the impact of the bid for regional MA plans compared with local MA plans. For both local and regional MA plans, plan issuers are paid based on their bid, relative to the benchmark. The most a plan will be paid by CMS is the benchmark (plus a potential bonus and rebate, based on the plan’s quality ratings). If a bid is below the benchmark, the base plan payment is equal to the bid. If a bid is above the benchmark, the payment will equal the benchmark and any beneficiary enrolling in that plan must pay the remainder (for enrollees of EGWP plans, this difference may be paid by the employer on the beneficiary’s behalf). There is a difference though between local and regional plans in how the benchmark is calculated. While the benchmark for local plans is based solely on a statutorily-prescribed formula pertaining to the average expenditure of traditional FFS beneficiaries in the county, the benchmark for regional plans is also adjusted by a weighted average of the plan bids for that region. Therefore, other plans’ payments are effected by EGWP bids in regional MA markets, but not local markets.

Historically, EGWP bids have been referred to as “placeholder bids” because they do not necessarily represent the plan design that will ultimately be offered to beneficiaries. Employers and the insurer who will be offering the plan on their behalf must negotiate the terms of the plan with each other before the bid is submitted to CMS, but CMS ultimately has authority to accept or reject the plan, just like it does with non-group plans. Thus, the plan design is often renegotiated with the employer after CMS has accepted the bid, sometimes adjusting the level of the benefits and/or how much the employer will contribute on the retiree’s behalf depending on how much CMS will pay the plan.

In Part D, the bidding process and payment structure is somewhat of a mix of the two models used for MA plans. All plans submit bids based on their projected cost of providing the “standard benefit” to a typical enrollee, and CMS calculates the average bid, but does not include the EGWP bids. The bids are essentially the plans’ premium, and CMS pays plans 74.5 percent of that average bid; enrollees must pay the remainder; again, for EGWPs, this may be paid by the employer on behalf of the beneficiary.

The inclusion or exclusion of the EGWP bid in the calculation of the benchmark (MA) or the average bid (Part D) is important because CMS has found that EGWP bids tend to be higher on average than non-EGWP bids. The inclusion of higher bids will necessarily increase the average. Therefore, regional EGWPs theoretically increase payments for all regional MA plans, but do not have an impact on payments for local MA plans or Part D plans since their bids are excluded from the calculation. However, because only 1 percent of Regional PPO plans are EGWPs, the impact is minimal.

Most Recent Proposal to Change the Bidding Process

In the Advance Rate Notice for MA and Part D plans for the 2017 payment year, CMS has proposed to waive the bidding process for EGWPs entirely and use a new formula for calculating the payment for such plans. EGWPs will now be paid based on the county benchmark and average bid of non-EGWP plans to be offered in that area.

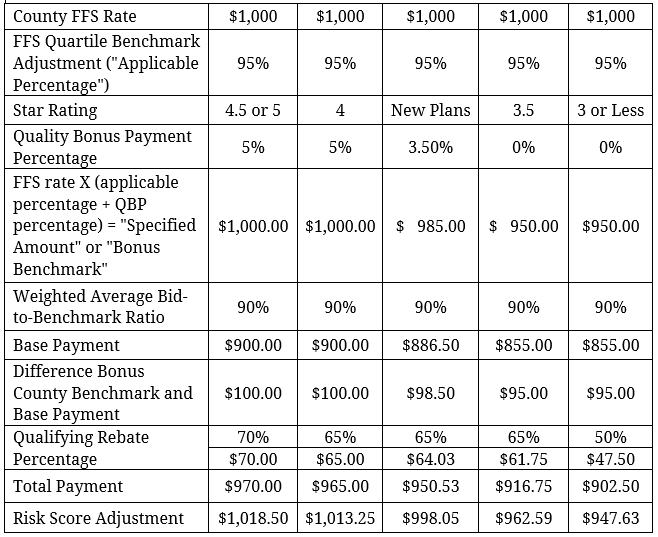

As with other plans, CMS will use the “applicable percentage” to adjust the FFS county rate based on where the county falls in the quartile rankings (based on the county’s average FFS cost per beneficiary) to set the benchmark. CMS will also determine the bonus benchmark amounts for each county based on the applicable bonus percentages (5 percent, 3.5 percent, or 0) for which a plan may qualify (“quality bonus payment percentage”). Then, CMS will calculate a weighted average bid-to-benchmark ratio for each quartile of counties, weighted by plan enrollment under each ISAR adjusted county bid and the standardized benchmark for each county. Next, the base payment will be determined using this weighted average and the county benchmark rate (including any bonus percentage an EGWP qualifies for based on their Star Rating). The rebate for each EGWP will then be calculated on a county level based on the difference between the EGWP’s base payment and its qualifying bonus benchmark for each county, multiplied by the rebate percentage each EGWP qualifies for given its Star Rating.[1] The rebate amount will be added to the base payment for the total payment, which will ultimately be adjusted based on the individual enrollees’ risk scores. This new methodology will result in each EGWP plan with the same Star Rating receiving the same payment amount for all enrollees in a given county, save for any adjustment made for the enrollees’ risk scores.

Under this new payment method, CMS would waive the requirement that rebate dollars be allocated to a specific purpose for EGWPs, but would also no longer allow EGWPs to buy down Part B premiums for their enrollees from this payment.

Example payment* for an EGWP beneficiary with a risk score of 1.05 in a local plan in the highest quartile of FFS expenditure counties given a county rate of $1,000 and a weighted average bid-to-benchmark ratio of 90 percent, for each Star Rating:

*Does not include all adjustments, such as the IME phase-out amount or the Coding Intensity Adjustment.

[1]Rebates for regional plans will be calculated slightly differently. For regional plans, the weighted average bid-to-benchmark ratio for each quartile and the corresponding bonus benchmark for each Star Rating would still be calculated on county level to determine the base payment. But that base payment would then be compared to the regional benchmark in order to calculate the amount of the rebate, so that EGWPs would receive a different base payment amount for each county, but a uniform rebate amount for every county in the region.*Does not include all adjustments, such as the IME phase-out amount or the Coding Intensity Adjustment.