Research

October 19, 2017

PRIMER: Prescription Drug Prices: Discounts, Fees, and Effects on Part D

Executive Summary

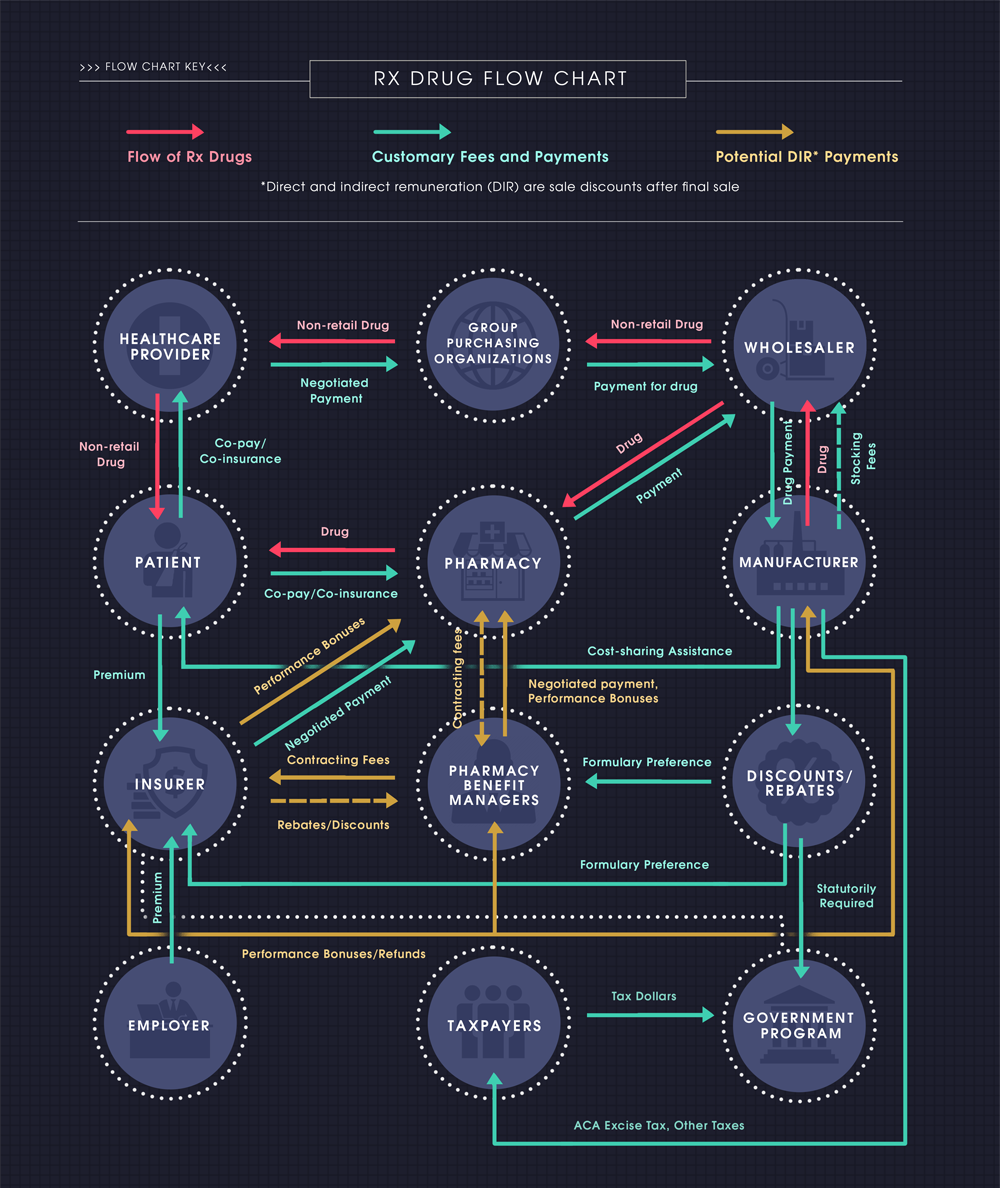

The path of a prescription drug from the manufacturer to the patient is a long and winding road with many stopping points along the way. The number of middlemen between the manufacturer and the ultimate consumer—the patient—complicates the pricing structure. Adding to the complexity is the extent of the rebates, discounts, and other forms of compensation that are provided between the various middlemen, particularly those provided after the final point of sale. These post-point-of-sale discounts are known in Medicare as direct and indirect remuneration (DIR).

The contracts and price negotiations that take place between the various members of the supply chain and the payment system—manufacturers, wholesalers, pharmacies, pharmacy benefit managers (PBMs– see sidebar), and insurers—all add to price distortions in the market. Determining the size of the benefit of those negotiations and to whom they accumulate can be difficult.

As policymakers seek to make health care more affordable, they should carefully consider the various potential impacts of any changes to the rules pertaining to the treatment of DIR. In particular, policymakers should consider the tradeoffs between passing such payments through at the point of sale to reduce patient cost-sharing—and the extent to which this is possible, since DIR by definition is not known at the point of sale—versus using such payments to provide across-the-board premium reductions.

Introduction

In health care, as with most other markets in a capitalist economy, the cost of a good and the price paid by the consumer are not the same. Unlike other markets, though, this equation is much more complex and convoluted for most health care goods and services because of the number of middlemen between the initial provider or manufacturer and the ultimate consumer—the patient. The market for prescription drugs is no exception, particularly because of the extent of the cost adjustments that often take place after a drug has been provided to the patient.

The various forms of retroactive payments, discounts, and rebates made to insurers, pharmacies, and pharmacy benefit managers (PBMs) after the point of sale are referred to as direct and indirect remuneration (DIR) and alter the final cost of a drug for the payer or the price paid to the pharmacy. DIR is typically provided through discounts and rebates which reduce the cost of the drug, but may occasionally increase costs; on net, though, DIR reduces overall prescription drug spending.

Technically, in federal statute, DIR specifically refers only to payments affecting Medicare Part D plan sponsors, but these types of post-point-of-sale payments occur throughout the industry impacting patients, insurers, PBMs, pharmacies, and manufacturers serving individuals with all types of health insurance or no insurance at all. The extent to which such discounts benefit or negatively impact the various parties involved is difficult to assess. This paper primarily focuses on DIR in Medicare Part D and its effect on the program and beneficiaries, but many of the effects are similarly felt by privately insured individuals.

Types of DIR

Over the years, many different types of prescription drug payment adjustments have come to be referred to as DIR. For example, people use DIR to refer to manufacturer rebates, pharmacy discounts, and myriad fees which may increase costs, such as network access fees, administrative fees, and service fees. However, most of these price adjustments are inappropriately described as such.

Some manufacturer rebates and discounts are required by law (such as those mandated by the Medicaid Drug Rebate Program and by the Affordable Care Act (ACA) to close the coverage gap in Medicare Part D); others are voluntarily negotiated by drug manufacturers in exchange for preferred placement on an insurer’s or PBM’s formulary, which increases the likelihood patients will take that drug over a competitor’s. Most of these types of discounts and rebates are known beforehand and do not constitute DIR, but not all. Performance bonuses or refunds may also be exchanged between insurers and drug manufactures participating in a value-based contract depending on the outcomes achieved by the patient, which of course, must occur after the point of sale. These types of value-based payment adjustments, typically provided by the drug manufacturer, constitute new forms of DIR payments, and reflect the Centers for Medicare and Medicaid Service’s (CMS) goal of moving toward a more value-based reimbursement structure throughout the health care system.

PBMs often charge pharmacies various types of fees that are less directly tied to specific prescription drugs, but rather are for services provided by the PBM. These can include fees charged for the opportunity to be a preferred network provider (sometimes referred to as “pay-to-play” fees); for claims submission assistance; for assistance with use of health information technology (HIT); and for other administrative services. However, most of these fees are known beforehand, and as such, are not allowed to be considered DIR, as discussed below. Rather, CMS considers these “bona fide service fees,” and only amounts exceeding fair market value for these services may be considered DIR.[i]

Other transactions between pharmacies and PBMs, often referred to as “true-up” payments, may also be classified as DIR. Similar to the value-based payments that occur between drug manufacturers and insurers, these payments may either increase or decrease reimbursement rates depending on a pharmacy’s performance on a given outcome measure, often reconciled after the close of a plan year. For instance, pharmacies may receive payment increases for meeting specific generic disbursement rates, review and reconciliation of potential negative drug interactions, or medication adherence targets.

Some contracts require additional rebates from drug manufacturers if price increases exceed an agreed-upon price inflation threshold. A complete list and description of the various types of DIR that CMS requires to be reported can be found here.

Medicare and DIR

Because the federal government pays for a large share of Medicare beneficiaries’ prescription drug costs, CMS requires Part D plan sponsors to report their drug costs, which should reflect their negotiated prices inclusive of all rebates, discounts, and other price concessions. This information is provided through two reports: prescription drug event reports (PDEs) and DIR reports. A PDE must be filed every time a beneficiary fills a prescription. These reports contain substantial amounts of information regarding payment at the point of sale, such as the amount paid to the pharmacy for the drug by the plan sponsor, the beneficiary, and any third-party payments on behalf of the beneficiary.[ii] DIR reports, which must be filed annually, are intended to capture payment information which may be missing from the PDE reports, such as rebates paid, discounts offered, and other price concessions made after the point of sale and which cannot be “reasonably determined” in advance.

The statutory language requires plan sponsors to provide enrollees access to negotiated prices which “shall take into account negotiated price concessions, such as discounts, direct or indirect subsidies, rebates, and direct or indirect remunerations, for covered Part D drugs, and include any dispensing fees.”[iii] CMS, through its regulatory authority, defines “negotiated prices” as “prices for covered Part D drugs that (1) The Part D sponsor (or other intermediary contracting organization) and the network dispensing pharmacy or other network dispensing provider have negotiated as the amount such network entity will receive, in total, for a particular drug; (2) Are reduced by those discounts, direct or indirect subsidies, rebates, other price concessions, and DIR that the Part D sponsor has elected to pass through to Part D enrollees at the point of sale; and (3) Include any dispensing fees.”[iv]

It became clear over the years that not all plan sponsors were handling and reporting DIR in the same manner, and that the prices patients were paying at the pharmacy counter were often not reflective of the entirety of the discounts and rebates that had been provided for a drug. A case can be made that the phrases “take into account” and “elected to pass through” do not impose a strict-enough burden to ensure that the full amount of any and all price concessions are passed through at the point of sale. Further, because DIR is not known at the point of sale, it may be impossible to do so. Instead, insurers use the DIR they receive to hold down premium rates. Finally, not all of the rebates and discounts are provided to the plan sponsor—an amount not publicly disclosed is retained by PBMs in exchange for the discounts they negotiate with insurers, pharmacies, and manufacturers, affecting the price of a drug on both sides of the equation. Whether DIR payments should be passed through at the point-of-sale has become the primary point of contention regarding DIR, but it is not clear there is much more that can be done on this front.

In 2014, CMS attempted to address the inconsistent reporting across plan sponsors by finalizing a rule to clarify how insurers should report costs and DIR; this consistency is important in allowing beneficiaries to accurately compare plans and prices. In this rule, CMS made clear its intent for all discounts to be reported and passed-through at the point-of-sale. The agency agreed, however, to provide a narrow exception for pharmacy price concessions which are contingent upon some other factor and cannot be “reasonably determined” at the point of sale from inclusion in reported negotiated prices; these price concessions must instead be included in a sponsor’s annual DIR report.[v] The changes took effect beginning with the 2016 plan year and final DIR reports for last year were due July 31, 2017; data from the reports, which will show the impact of these changes, are not yet available.[vi]

Impact of DIR on Medicare and Part D Beneficiaries

DIR impacts Medicare and Part D beneficiaries in various ways, and the extent of the benefit received by taxpayers and enrollees from such price concessions is hard to determine. This is primarily because of the multiple mechanisms that are ultimately used to pay for the cost of drugs through Part D, as well as the numerous players in the supply chain, such as the PBMs.

Beneficiary Cost Sharing

DIR has the potential to have the most significant impact on beneficiaries through their cost-sharing responsibilities. Beneficiary cost sharing is based on the list price at the point of sale, which often differs from the ultimate net price once all post-point-of-sale discounts, rebates, and other forms of DIR are taken into account. Consequently, whether the full amount of DIR is passed through at the point of sale can have a significant impact on the amount the beneficiary must pay at the pharmacy counter. This is particularly likely if their prescription drug benefit utilizes coinsurance (calculated as a percentage of the drug’s cost), rather than co-payments (fixed-dollar amounts, regardless of the price at the point of sale), as has become more common in recent years. In 2016, the median coinsurance rate for preferred brand-name drugs was 20 percent, and roughly half of beneficiaries face coinsurance rates of 33 percent for specialty drugs.[vii] If no DIR is passed through at the point of sale, then the beneficiary does not benefit from any of these negotiated price reductions in regard to their cost-sharing responsibility. Similarly, because Medicare pays the cost-sharing amounts for which low-income beneficiaries are otherwise responsible, taxpayers also do not benefit from DIR in this regard. In 2015, there were 12 million enrollees benefitting from the Part D program’s low-income subsidy (LIS).[viii] However, because DIR—by definition—is intended to capture only those payment adjustments which cannot be “reasonably determined” at the point of sale, making any such discounts available at the point of sale is difficult. CMS has attempted to make it easier to do so by permitting Part D plan sponsors to estimate expected rebate amounts and pass those expected savings through at the point of sale, and then reconcile any differences in the DIR report. It is also important to note that insured individuals typically benefit from significant negotiated discounts that are not considered DIR (the types of discounts and rebates which were previously mentioned), that are passed through at the point of sale and reflected in the list price.

Premiums

Medicare pays 74.5 percent of the overall premium cost for Part D plans, significantly subsidizing the premiums that beneficiaries would otherwise pay. Because final payments to plans must be reconciled at the end of the year to reflect actual costs to plan sponsors, inclusive of DIR, insurers pass these discounts along in the form of lower premiums rather than at the point of sale. In fact, premiums in 2018 will decline by 3.5 percent, the first premium decrease for Part D plans in five years.[ix] A report from Milliman, an actuarial consulting firm, estimates that Part D premiums are 21.5 percent lower because of DIR.[x] Using DIR funds in this way certainly benefits the Medicare program and beneficiaries; although, in a less direct manner. Because every beneficiary must pay the premium, all beneficiaries benefit from DIR when the funds are used in this way. However, because not all beneficiaries use the same number of prescriptions or take medicines that have equal costs, some beneficiaries would see a much greater benefit if DIR was used to lower their cost-sharing, rather than their premiums. A uniform across-the-board premium reduction does not allow benefits to accrue to individuals in the most well-targeted manner.

Reinsurance

Medicare also provides reinsurance to Part D plans, covering 80 percent of drug costs once expenditures for a given beneficiary have surpassed the out-of-pocket threshold— $8,071 in 2017.[xi] Again, because DIR does not reduce beneficiaries’ cost-sharing, the higher cost at the point of sale results in many beneficiaries reaching the out-of-pocket (OOP) threshold more quickly and increasing the program’s reinsurance expenditures. In 2014, 3.4 million Part D enrollees reached the catastrophic coverage phase. As the number of high-cost enrollees has increased, so has the amount of spending above the OOP threshold, rising at an annual rate of 26 percent between 2010 and 2014.[xii] On a per-enrollee basis, Medicare’s reinsurance subsidy grew at an annual rate of 17 percent between 2010-2015.[xiii] Changes in the ACA—allowing discounts provided by manufacturers for brand-name drugs to count towards an enrollee’s OOP spending calculation—have contributed to this increase, and with the increased prevalence of manufacturer discounts, this problem is likely to worsen.

Plan Liability

Relative to the government, plans are the winners with respect to savings gained through DIR. In addition to the direct payments plans receive through DIR, plan liability is significantly reduced as beneficiaries move more quickly to catastrophic coverage, as discussed above. Part D plan sponsors pay only 15 percent of a beneficiary’s costs in the catastrophic phase, compared with the 80 percent paid by Medicare. As shown in the chart below, DIR reduces plan liability significantly more than it reduces Medicare liability. In fact, plan liability has declined each year since 2010 while plan premiums have risen each year, though premiums are expected to decline slightly in 2018 for the first time in five years.[xiv]

Trends in DIR

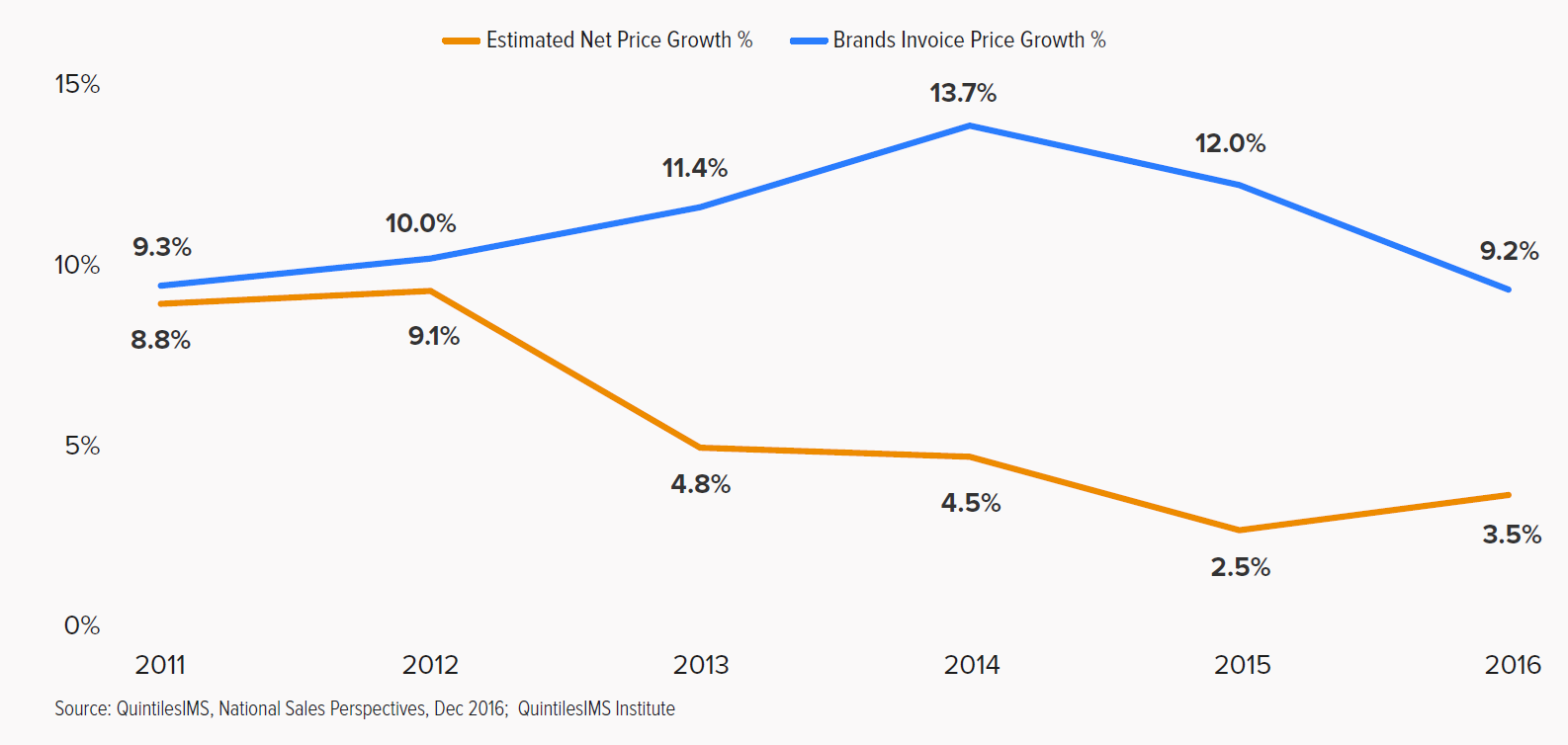

As the prescription drug market has evolved, and insurers and PBMs have played an increasingly substantial role in helping patients pay for prescription drugs, the number and size of post-point of sale payment adjustments have also increased. Over the last several years, growth in invoice (or list) prices has grown faster than net prices, as shown in the chart below from a recent report from QuintilesIMS.[xv] This means rebates and discounts are increasing alongside invoice prices, shielding insured consumers from a growing portion of the cost, at least once they’ve met their deductible. Uninsured patients, however, are not likely to see the same benefit. In 2016, discounts, rebates, and other price concessions averaged 28 percent for brand name drugs.[xvi]

Similarly in Medicare, growth in DIR is outpacing growth in Part D costs, both in total and on a per-member, per-month basis. Part D drug costs per beneficiary grew 5 percent between 2010-2015, while DIR per beneficiary grew 14 percent per year during the same period.[xvii] This should help bring down total program costs, but because DIR payments are not uniformly and proportionately distributed across the payers (plans, patients, and Medicare), payers do not share equally in the savings, as discussed above. Increased rebates and discounts may seem beneficial on the surface, but what they actually represent are increased price distortions and reactions to continuously climbing invoice prices for drugs.

Transparency Has Unintended Consequences

The lack of public price transparency makes it difficult to know where all the money is going, who is benefiting from these price discounts, and who is impacted by the fees. Because no one besides CMS really knows the amount each party is being paid or reimbursed for each specific drug, it is hard to know the true cost of the drug and what patients should be paying at the pharmacy. As such, many policymakers and activists have called for enhanced price transparency. However, the market thrives on negotiations which require contractual confidentiality. If companies are forced to publicly reveal their negotiated discounts and reimbursement rates, the system will break down—revealing all prices will push rates to a common, across-the-board price, and the “best price” will ultimately become the highest price. CBO previously examined the impact that forced disclosure of drug rebates would have on the Medicare program and found that in addition to increasing costs, disclosure could also “facilitate tacit collusion” among manufacturers of drugs with very few competitors.[xviii]

Conclusion

As policymakers look for solutions to the problem of health care affordability, direct and indirect remuneration must continue to be part of the conversation. Policymakers should seek additional data to more fully understand the extent of the payments and how they should be used to provide the greatest benefit to patients and taxpayers—particularly the tradeoffs between passing such payments through at the point of sale to reduce cost sharing (and the feasibility of doing so) versus using such payments to provide across-the-board premium reductions.

[i] https://www.healthlawpolicymatters.com/wp-content/uploads/sites/8/2017/06/Final-2016-DIR-Reporting-Reqs-Memo-06-23-2017.pdf

[ii] https://www.cms.gov/Medicare/Prescription-Drug-Coverage/PrescriptionDrugCovGenIn/downloads/PDEDataElements.pdf

[iii] https://www.congress.gov/bill/108th-congress/house-bill/1/text

[iv] https://www.federalregister.gov/documents/2014/05/23/2014-11734/medicare-program-contract-year-2015-policy-and-technical-changes-to-the-medicare-advantage-and-the

[v] https://www.federalregister.gov/documents/2014/05/23/2014-11734/medicare-program-contract-year-2015-policy-and-technical-changes-to-the-medicare-advantage-and-the

[vi] https://www.healthlawpolicymatters.com/wp-content/uploads/sites/8/2017/06/Final-2016-DIR-Reporting-Reqs-Memo-06-23-2017.pdf

[vii] http://www.kff.org/report-section/medicare-part-d-in-2016-and-trends-over-time-section-3-part-d-benefit-design-and-cost-sharing/

[viii] https://www.cms.gov/Newsroom/MediaReleaseDatabase/Fact-sheets/2017-Fact-Sheet-items/2017-01-19-2.html

[ix] https://www.cms.gov/Newsroom/MediaReleaseDatabase/Press-releases/2017-Press-releases-items/2017-08-02-3.html

[x] https://www.pcmanet.org/wp-content/uploads/2017/07/Value-of-PDP-DIR_20170706.pdf

[xi] http://www.medpac.gov/docs/default-source/payment-basics/medpac_payment_basics_16_partd_final.pdf?sfvrsn=0

[xii] http://www.medpac.gov/docs/default-source/reports/mar17_medpac_ch14.pdf?sfvrsn=0

[xiii] https://www.cms.gov/Newsroom/MediaReleaseDatabase/Fact-sheets/2017-Fact-Sheet-items/2017-01-19-2.html

[xiv] https://www.cms.gov/Newsroom/MediaReleaseDatabase/Fact-sheets/2017-Fact-Sheet-items/2017-01-19-2.html

[xv] http://www.imshealth.com/en/thought-leadership/quintilesims-institute/reports/medicines-use-and-spending-in-the-us-review-of-2016-outlook-to-2021

[xvi] http://www.imshealth.com/en/thought-leadership/quintilesims-institute/reports/medicines-use-and-spending-in-the-us-review-of-2016-outlook-to-2021

[xvii] https://www.cms.gov/Newsroom/MediaReleaseDatabase/Fact-sheets/2017-Fact-Sheet-items/2017-01-19-2.html

[xviii] https://www.cbo.gov/sites/default/files/110th-congress-2007-2008/reports/03-12-drug%20rebates.pdf