Research

April 8, 2020

Primer: The Inpatient Prospective Payment System and Diagnosis-Related Groups

Executive Summary

- The Inpatient Prospective Payment System is an acute care hospital reimbursement schematic that bundles Medicare Part A fee-for-service payments for a complete episode of care through a Diagnosis-Related Group.

- These payments are based on a series of calculations involving the geographic area of the hospital, proportion of low-income patients in the hospital population, new technologies used during treatment, and a determination of whether the case classifies as outlier, among others; these payment amounts are updated each year using historical cost data.

- This system was designed to control costs in Medicare Part A by preventing providers from running up costs by performing an effectively unlimited number of tests and procedures.

Introduction/Background

By itemizing charges for each individual service and procedure performed during an episode of care, Medicare fee-for-service (FFS) encourages greater utilization of provider services and, thus, higher healthcare costs. To facilitate phasing out FFS for hospitals, the Social Security Amendments of 1983 established the Prospective Payment System (PPS) for Medicare.[1] The goal of the PPS was to alter hospital behavior under the FFS structure by incentivizing more cost-efficient care management. This law consolidated charges for care received in a hospital, paid by Part A, into one lump sum through the Diagnosis-Related Group (DRG) classification system—a departure from the separate, itemized charges under FFS. Today, this system is referred to as the Inpatient Prospective Payment System (IPPS), and it is a method of consolidating payments made to acute care hospitals (ACH) through Medicare Part A.

This system establishes a way of consolidating diagnoses and procedures into what is known as a Medical-Severity Diagnosis-Related Group (MS-DRG), the fundamental unit for differentiating payments.[2] These MS-DRGs are based on billable codes from the International Classification of Diseases (ICD-10) and serve as the focal point for a wide variety of payment adjustments the Center for Medicaid and Medicare Services (CMS) can make. The adjustments include metrics such as patient length-of-stay (LOS), the proportion of low-income patients served by the hospital, and any new and costly technologies used during treatment. This primer lays out a detailed map for how Part A determines a final DRG payment, from the initial geographic and weighted adjustments to the various policy, hospital, and case-specific adjustments.

DRG Definition

Formally known as Medical-Severity Diagnosis-Related Groups (MS-DRGs) but referred to in this piece as simply DRGs, these groups serve as the core functional unit for determining provider reimbursement under the IPPS. Each of the official DRGs are classified by the principal diagnosis and up to 24 secondary diagnoses. They are further stratified by medical severity, receiving a classification of with or without a complication/comorbidity (CC) or Major Complication/Comorbidity (MCC), the presence of either increasing the payment rate. Additionally, up to 25 procedures performed during admission, the patient’s age, gender, and discharge status may affect the DRG assignment.[3]

How frequently are these DRGs used?

In 2015, payments under the IPPS accounted for 25 percent of Medicare spending, or 20 percent of overall acute care hospital revenues.[4] In 2018, the 10 highest-volume DRGs accounted for 30 percent of total Medicare patients, with number one being major joint replacement without an MCC and number 10 being nutritional and miscellaneous metabolic disorders without an MCC.[5]

ACH Payment Structure Overview

IPPS payments under Medicare are built on two separate, national base payment rates: the operating and capital base payment rates. The operating payment is based on the labor and supply costs for the total episode of care, while the capital payment covers costs such as depreciation, interest, rent, and property-related costs such as insurance and taxes.[6] Each base rate is updated annually using historical cost data on a variety of factors including patient and market conditions. As of 2018, the nationally determined operating base rate was $5,574 and the capital rate was $454. This comes down to the capital rate accounting for roughly 8 percent of total base payments, with the operating rate accounting for the other 92 percent.

From the base payments to the final payments, a series of adjustments and separate charges take place. Both operating and capital base payments are adjusted by a wage index, a DRG relative weight, and a cost-of-living adjustment (COLA) if applicable. Adjustments for Direct Graduate Medical Education (DGME) and organ acquisition costs for transplants are intentionally left off and paid separately. Additional payments and adjustments are made in isolation or applied to either payment rate across a wide variety of criteria.

Operating Payment Rate

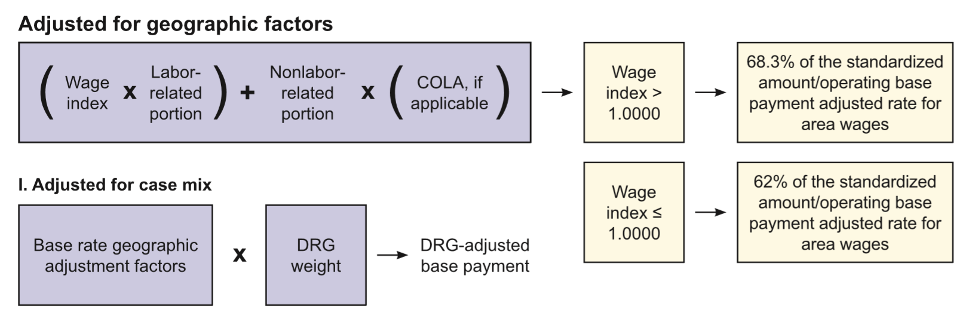

The operating payment rate undergoes a great degree of adjustment, more so than the capital rate. With the base operating payment rate as the starting point, the first step is adjustment based on geographic factors. This adjustment involves the application of a wage index and a COLA, if applicable. After geographic adjustment comes the case-mix adjustment, which consists of the DRG Relative Weights, yielding the adjusted base-payment rate. From there, payments are added and other slight adjustments are made based on participating programs, hospital characteristics, patient case characteristics and quality measures.

Operating Geographic Adjustment Factors

The adjustments for the operating base payment can be separated into labor and non-labor shares. The labor share of the operating base rates are adjusted by a wage index to account for the local labor market according to the Medicare Geographic Classification Review Board (MGCRB).[7] CMS calculates this each year by comparing the average hourly wage (AHW) for hospital workers in a given area to the national average. The pivotal number for the wage index calculation is 1.0, for which payments are determined based on whether the equation for the wage index puts out a value above or below it. The wage index value—established by CMS for the area that hospital resides in—is first multiplied by the labor-related portion or “labor share,” which estimates the portion of costs affected by local wage rates and fringe benefits5. If the wage index is calculated to be greater than 1.0, the estimate for the operating labor share is set at 68.3 percent of the total base payment. If the wage index is less than 1.0, the estimated operating labor share is 62 percent.

From there, the non-labor related portion of the payment is added in and multiplied by the Cost-of-Living Adjustment (COLA). The COLA is usually 1.0 unless the hospital resides in an area with a much higher cost of living, like the states of Hawaii or Alaska—in which case it is higher—and attempts to account for disproportionate costs of supplies and non-labor resources.

Operating DRG Relative Weight Adjustment

With the base operating rate adjusted by geographic factors, the next step is multiplying by the DRG Relative Weight, which is based on the DRG designation and structure outlined above. This yields the adjusted operating base payment rate that is subjected to the wider range of hospital and patient-specific additions and adjustments. The image below visually demonstrates the process leading from the initial operating base rate all the way to the adjusted operating base payment rate.

Figure 1: Operating Geographic and DRG Weight Adjustment Formula

Source: Centers for Medicare and Medicaid Services

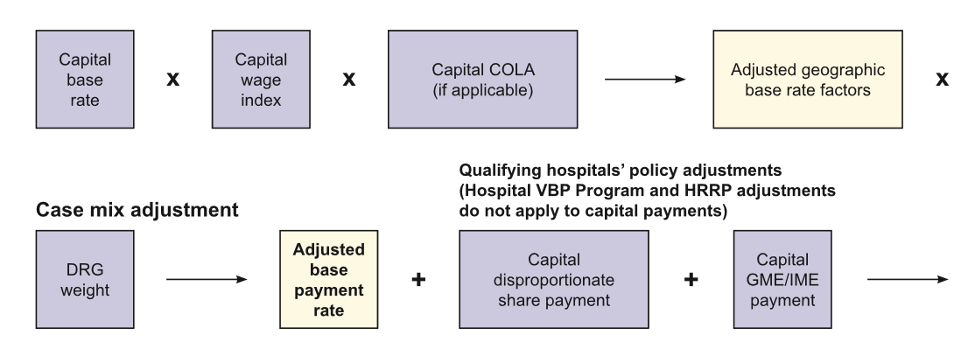

Capital Payment Rate

As mentioned above, the capital base rate is predicated on the costs of depreciation, interest, rent, and other property-related expenses. Determining the adjusted capital base rate largely falls in line with the adjusted operating base rate but in a more streamlined format. This discussion of the adjusted capital base rate will focus predominantly on the differences between adjusting for the capital rate versus the operating rate.

Capital Geographic Adjustment Factors

Unlike the adjusted operating base payment rate, the capital rate is not separated into a labor and non-labor portion. Instead, the equation calls for the capital base rate to be multiplied by the same wage index (called the capital wage index below). What is interesting, however, is this wage index is raised to a fractional power, diminishing the variation of the index between market areas. From there, it is multiplied by the capital COLA (if applicable), which yields the capital base rate adjusted for geographic factors.

Capital DRG-Relative Weight Adjustment

The exact same DRG relative weights are used for both the operating and capital rate adjustments. As with calculating the adjusted operating base payment rate, the capital rate (adjusted for geographic factors) is multiplied by the DRG weight to give the final adjusted capital base payment rate that is then subjected to similar policy adjustments as the operating rate. Figure 2 lays out the calculation in a visual format.

Figure 2: Capital Geographic and DRG Weight Adjustment Formula

Source: Centers for Medicare and Medicaid Services

Policy Adjustments

With the adjusted operational and capital base payment rates determined, a large range of additional payments and adjustments are made before the payments are finalized. These additional payments and adjustments are largely based on policy and demographic information at the individual hospital systems and surrounding area, along with the characteristics of the hospital system and the hospitalized patient under consideration. Of note, the policy adjustments for disproportionate share hospitals8 and medical education apply to both payment rates while others apply to only the operational rate. There are no adjustments made for just the capital rate.

Graduate Medical Education

Many hospitals are classified as teaching hospitals due to the training of residents in allopathic, osteopathic, dental, or podiatric specialty programs. The Direct Graduate Medical Education (DGME) payment is made separately from the IPPS and accounts for the direct costs of training these residents. This value is based on the hospital’s costs per resident, the total number of residents trained at that facility, and the proportion of Medicare inpatient days compared to total inpatient days, referred to as the “Medicare patient load”.[8] DGME payments are capped for hospitals with resident numbers greater than 140 percent of the national average.

In addition to DGME, there is a parallel Indirect Medical Education (IME) adjustment that attempts to account for higher indirect costs of patient care related to resident training. This is calculated by CMS using the resident-to-bed ratio for a particular hospital. In 2018, the IME adjustment was roughly 5.5 percent of the total adjusted base payment rate for every 10 percent increase in the resident-to-bed ratio.[9]

Disproportionate Share Hospital Payments (DSHs)

Medicare Disproportionate Share Hospitals (DSHs) are those that treat a higher proportion of low-income patients and are eligible for increased operating and capital payments.

Two separate equations dictate the final DSH operating payment amount. First, hospitals receive 25 percent of the normal total DSH payment under traditional DSH payment statute. To determine whether a hospital qualifies for this operating DSH payment, the hospital’s proportion of its Medicare inpatients days is summed with its proportion of its total Medicaid inpatient days. If this total proportion is greater than 15 percent, the hospital qualifies for DSH operating payments. The add-on rate is capped at 12 percent for most hospitals with fewer than 100 beds.

The remaining 75 percent of the original DSH payment moves into an uncompensated care payment pool. Hospitals do not necessarily receive this entire payment, but rather a proportion of it. The payment is initially reduced by multiplying the remaining 75 percent by 1 minus the annual percent decrease in the national insurance rate.[10] From here, each qualifying hospital receives their portion of the uncompensated care payment by comparing their uncompensated care costs against all other DSH-eligible hospitals, using the result from this calculation as the final DSH payment adjustment factor.

Capital DSH payment amounts have a much simpler path, but they are not partitioned into an uncompensated care portion. Furthermore, capital DSH payments only apply to urban hospitals with more than 100 beds and that serve a disproportionately low-income patient population.

Technology Add-on Payments

Some patient cases require the use of high-cost or novel therapies not usually required for a particular DRG designation, triggering evaluation for a new technology add-on payment (NTAP). An example of such a technology is Chimeric Antigen Receptor T-Cell (CAR-T) therapy, which is used as an intermediate line therapy for conditions such as relapsed large B-cell lymphoma in adults. Additionally, clinical trials are being performed to adapt CAR-T to treat multiple myeloma, a form of cancer that primarily affects people at 65+ years of age.[11] CMS evaluates new technologies for NTAP eligibility based on newness, cost and clinical improvement. If CMS determines the technology is eligible for an NTAP, each case where the technology is utilized will be reimbursed by the NTAP amount. Of note, NTAPs are temporary and are mostly only available for three years following approval of the technology by the FDA.

In cases where therapies such as CAR-T are required, CMS will make an additional NTAP payment. Currently, Medicare pays a cost factor of 65 percent of the estimated patient case costs beyond the normal, full DRG payment, and maxing out an NTAP at 65 percent of the costs of the technology with a max of 75 percent for particular antimicrobials.[12] Put another way, if a the full DRG payment for a hypothetical case is $50,000 dollars and new, necessary cell therapy treatment triggered an NTAP with the new technology costing $20,000 to implement, Medicare will pay the full $50,000 plus up to $13,000 for the treatment.

Outlier Payments

There is significant variation in the seriousness of an ill patient even within a particular DRG, and many need an even greater degree of care than normal. To account for this, CMS may make outlier payments for these high-cost individuals.

Outlier cases are determined by comparing a patient’s actual cost of care to a fixed-loss threshold, which is the sum of that hospital’s DRG payment, any IME, DSH, or new technology payments, and a nationally set fixed loss amount, which was equal to $26,601 in 2018.[13] If it qualifies as an outlier case, CMS will pay for 80 percent of costs above this fixed loss threshold and 90 percent of costs for burn victims.

Rural/Small Hospital Adjustments

Some payment adjustments attempt to account for the fact that a number of hospitals are geographically isolated and have small or disproportionate patient populations. The hospitals that are eligible for these payments are overwhelmingly rural, although certain urban locations may also qualify.

Sole Community Hospitals (SCHs) (Occurs in both operating and capital under disproportionate share payments)

Hospitals located at least 35 miles from the next nearest hospital are classified as Sole Community Hospitals (SCHs) and are eligible for higher IPPS payments. The operating portion of the payment is based on the higher of the hospital-specific payment rate—using a baseline year (the previous year) and comparing it to today to adjust for changes to the hospital’s case mix—or the federal rate. The capital portion of the rate is based only on the capital base rate.

Medicare Dependent Hospitals (MDHs) (Occurs in both operating and capital under disproportionate share payments)

This program is reserved for small, rural hospitals that have Medicare patients comprising at least 60 percent of their admission or inpatient days. For hospitals that qualify, they will receive and MDH payment equal to 75 percent of the difference between the current payment amounts and an annually updated baseline cost.

Rural Referral Center (RRC) Program Adjustments

The RRC program attempts to alter payments to qualifying high-volume rural hospitals to provide additional financial support. There are many criteria that must be met to qualify as an RRC,[14] but these include being in a designated rural area, having greater than 275 usable beds, and having 60 percent of its Medicare patients coming from more than 25 miles away. Rather than direct monetary benefits, hospitals receive a list of benefits such as exemption from the 12 percent cap on DSH payments described above and exemption from certainly AHW requirements.

Low-Volume Hospital Payments

Low-volume hospitals are classified by two criteria: if they are more than 15 miles from the next closest hospital, and if they discharge fewer than 3,800 patients per fiscal year. For those that qualify, their payments are adjusted according to which of two groups they fall into. For hospitals with fewer than 500 total discharges in the fiscal year, the total payment is increased by 25 percent. For hospitals with total discharges between 500 and 3,800, their payment is increased by a percentage according to the formula: (95/330) – (# of total discharges/13,200).

Hospital Value-Based Purchasing (VBP) Adjustment

The Hospital VBP program provides upward or downward payment adjustments based on a hospital’s performance on a variety of metrics. As of 2019, these metrics included measures for clinical outcomes, safety, patient experience, and efforts to reduce hospital/patient costs. The adjustments are equal to 2 percent of the national average for base operating payment rates.

Negative Payment Rate Adjustments

When particular metrics are met, CMS may trigger a number of negative payment rate adjustments. These adjustments serve as “punishment” for not meeting certain standards of care or if the patient had to be transferred to another facility.

Readmissions Penalty

When a patient is readmitted within 30 days for the condition they initially presented to hospital with, this event may trigger a readmission penalty. There are currently six conditions that may trigger a readmission penalty, such as acute myocardial infarction (heart attack), heart failure, a total hip or knee replacement, and pneumonia. The cutoff for triggering the penalty is based on the hospital’s 3-year risk-adjusted readmission rate for the conditions. As of 2018, the penalty is capped at 3 percent of that hospital’s annually determined base DRG payment (excluding any policy adjustments). Of note, the readmission penalty does not have to stem from readmission to the same facility, but may be triggered from readmission to any IPPS-accepting acute care hospital.

Hospital-Acquired Condition (HAC) Reduction Adjustment

As of 2014, when the HAC Reduction Program was implemented, hospitals are ranked on their rate of hospital-acquired conditions. These include but are not limited to: surgically-acquired infections, injuries from a preventable fall, and catheter-associated urinary tract infections. Those hospitals in the top 25 percent for HACs receive a 1 percent reduction in all inpatient payments.

Patient Transfer Adjustments

Occasionally patients must be transferred to other facilities due to a variety of needs. When this happens to a Medicare patient at an IPPS-covered acute care hospital, it may trigger a payment reduction. This reduction comes in the form of a per diem rate for the transferring facility rather than the full DRG payment. The way this works out, in general, is that the hospital receives twice the per diem rate for the first day of admission and then the per diem rate for all subsequent days up to, but not exceeding, the full DRG payment. This reduction occurs for a long list of reasons, but the main criteria are two-fold. First, the patient’s length-of-stay (LOS) is at least 1 day less than the geometric mean LOS for that DRG at that hospital. Second, they are then transferred to either another hospital covered by IPPS or to certain post-acute settings including psychiatric, long-term care, or skilled nursing facilities.

Bad Debts

Nonpayment for coinsurance or deductibles for Medicare beneficiaries are partially covered under bad debts reimbursement. After the hospital demonstrates it made “reasonable” efforts to collect these payments, CMS will reimburse for 65 percent of the total amount.

Conclusion

Determining Medicare payments under the IPPS is among the more complex rate-determining schematics in health care. This complexity, however, is by design in order to tailor payments—as closely as possible—to the individual’s situation. Hospitals in rural areas or with low-income patient populations benefit particularly well from increased reimbursement for Medicare patients, helping to buttress them against lost profit while ensuring access to health care for elderly and indigent people.

[1] https://www.congress.gov/bill/116th-congress/house-bill/6074?q=%7B%22search%22%3A%5B%22coronavirus%22%5D%7D&r=1&s=6

[2] https://www.cms.gov/Medicare/Medicare-Fee-for-Service-Payment/AcuteInpatientPPS

[3] https://www.cms.gov/Outreach-and-Education/Medicare-Learning-Network-MLN/MLNProducts/downloads/AcutePaymtSysfctsht.pdf

[4] http://medpac.gov/docs/default-source/payment-basics/medpac_payment_basics_17_hospital_final65a311adfa9c665e80adff00009edf9c.pdf

[5] https://www.ahd.com/ip_ipps08.html

[6] http://medpac.gov/docs/default-source/payment-basics/medpac_payment_basics_17_hospital_final65a311adfa9c665e80adff00009edf9c.pdf

[7] https://www.cms.gov/Regulations-and-Guidance/Review-Boards/MGCRB

[8] https://www.cms.gov/Outreach-and-Education/Medicare-Learning-Network-MLN/MLNProducts/downloads/AcutePaymtSysfctsht.pdf

[9] http://medpac.gov/docs/default-source/payment-basics/medpac_payment_basics_17_hospital_final65a311adfa9c665e80adff00009edf9c.pdf

[10] http://medpac.gov/docs/default-source/payment-basics/medpac_payment_basics_17_hospital_final65a311adfa9c665e80adff00009edf9c.pdf

[11] https://www.cancer.gov/news-events/cancer-currents-blog/2017/car-t-cell-multiple-myeloma

[12] https://www.cms.gov/newsroom/fact-sheets/fiscal-year-fy-2020-medicare-hospital-inpatient-prospective-payment-system-ipps-and-long-term-acute-0

[13] http://medpac.gov/docs/default-source/payment-basics/medpac_payment_basics_17_hospital_final65a311adfa9c665e80adff00009edf9c.pdf

[14] https://www.ecfr.gov/cgi-bin/text-idx?SID=133edc1b2d24b2d18d4e21ea10e5a806&mc=true&node=se42.2.412_196