Research

June 15, 2017

The Tax Treatment of Carried Interest

Introduction

The previous administration and Candidate Trump, as well as other policymakers have proposed to increase the taxation of “carried interest.” Carried interest is an integral feature of the financial arrangements of partnerships, a management structure broadly utilized in the United States and especially prominent in finance, insurance, and commercial real estate. This structure provides the general partners with a share of profits that is more than proportional to their capital contribution only if those general partners are successful in achieving the investment goals of the partnership. The business model permits entrepreneurs to match their expertise with a financial partner, assume risks, and align the parties’ economic interests so that entrepreneurial risk taking is viable.[1]

This paper examines the impact of changing the tax treatment of carried interest. It begins by reviewing the current tax treatment and previously proposed changes to carried interest tax policy.[2] Next, we turn to the extent and scale of partnership operations, and the range of impacts that higher taxes might deliver and follow this with analysis of the likely channels by which raising taxes on carried interest would affect the United States. The final section is a summary.

To anticipate the conclusions, increasing taxes on carried interest would constitute a potentially large tax increase on partnerships – especially in finance, insurance, and real estate – both in dollar terms and relative to the income generation of the affected partners. The specter of these tax implications will spawn reactions ranging from legal restructuring to crowding out valuable real economic transactions that are not sufficiently profitable to carry the additional burden. Perhaps most damaging, the higher taxes on carried interest will re-allocate managerial talent, as the entrepreneurially-inclined are deterred by these higher taxes and seek their outlets elsewhere in the economy.

The Tax Proposal

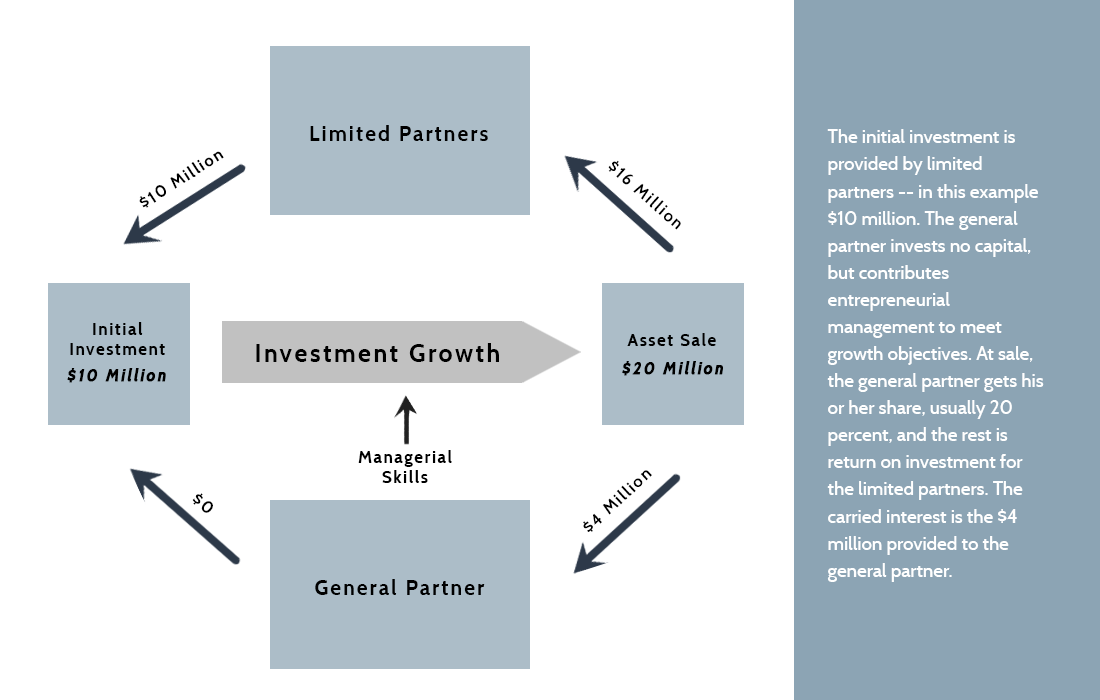

Many business ventures are organized as limited partnerships. Investors such as pension funds, endowments, foundations, individuals, and others contribute capital and become limited partners (LP) in the partnerships. One or more general partners (GP) provide entrepreneurial management of the partnership and are paid a management fee that is typically one to two percent of the overall partnership’s capital.

In a typical partnership, the GP also contributes capital alongside the investors’ capital. This ranges from 1-10 percent in most cases. The GP also receives an interest in the overall profits above the share allocable to his capital contribution. This interest is commonly referred to as a “promote,” “profits interest,” or “carried interest.” Typically, the carried interest is 20 percent of the profits and is generated from appreciation in the value of the partnership’s property. In the case of real estate, for example, this means that after a period of between five to 10 years, the GP receives a payoff linked to the degree to which the entrepreneurial input has resulted in higher asset prices.

Figure 1: Example Partnership Structure

The carried interest provides powerful incentives to align the interests of the GP and the LPs. While the GP also receives a management fee that covers administrative overhead, operating costs, and managers’ salaries, that fee is fixed and does not provide incentives to improve the performance of the real assets.

The management fees are taxed as ordinary income. The carried interest, however, is taxed at the time of sale. The tax character of the income is consistent with that distributed by the partnership. The sale of the partnership’s real assets produces a long-term capital gain taxable at the capital gain rates (maximum 23.8 percent).

Changes to the taxation of carried interest were proposed and passed by the House of Representatives in 201o, but were not adopted into law. Successive budgets under the Obama administration have proposed taxing carried interest as ordinary income, rather than as a long-term capital gain (if the partnership income so qualifies). Congressional Democrats have recently reintroduced a similar proposal. As a candidate, now President Trump, also proposed taxing carried interest as ordinary income. Under current law, long-term capital gains are taxed at a rate of 23.8 percent – 20 percent capital gains rate as of January 2011 plus a 3.8 percent Medicare tax on investment income enacted as part of the Affordable Care Act. The top marginal income tax rate is 43.4 percent – 39.6 percent, plus the 3.8 percent Medicare surtax if applicable. Taxing carried interest as ordinary income would thus increase the tax rate from 23.8 percent to 43.4 percent, an 82 percent increase.

Principles of Taxation and Carried Interest

Proponents of this change argue that the tax treatment that the current tax treatment is “unfair” because it accords a particular form of GP compensation preferential tax treatment. They argue that the GP is providing services to the partnership and services are taxable as ordinary income.

How does this assertion compare to standard principles of tax policy? From an equity perspective, a greater unfairness inherent in the proposal is that it would cause similar taxpayers to be taxed differently. If enacted, investments in real assets would face different effective tax rates depending upon whether they are undertaken by an individual, C Corporation, or via the limited partnership structure.

Next, carried interest is not the same as other compensation. The carried interest is a potential share of partnership profits and not considered compensation for services by the partners –management and other annual fees constitute such compensation. These not insubstantial fees are taxed at ordinary income rates. They are based on the entire amount of partnership capital under management and paid annually by the partnership. The management fee is typically 2 percent of capital under management but can also include other fees like acquisition, development and leasing fees. If a partnership under-performs, they are the only income the general partner receives. Simply stating that the carried interest is compensation for services ignores the economic relationship of the partners in the partnership.

The tax change is potentially unfair from a third perspective as current proposals are not exclusively changes in the prospective treatment of carried interest. That is, they do not rule out retroactive tax increases on investments undertaken assuming that carried interests would be characterized as capital gains for tax purposes.

From an efficiency perspective, treating carried interest as ordinary income would not improve the U.S. tax code. First, differential taxation of capital income across sectors and business forms introduces inefficiencies in the allocation of national wealth.

Second, the proposed treatment is inconsistent with both income tax principles and consumption tax principles. Consider the latter. There is now a wide consensus that fiscal policy in the United States must promote the most sustainable pace of long-term economic growth. As part of this, it is essential to keep taxes on the return to saving, investment, and entrepreneurial innovation as low as possible. Pro-growth tax reforms that focus on taxing consumption typically permit a full deduction from the tax base for all capital contributions to investments as the appropriate offset for taxing the future cash flow returns at a full rate. The proposed tax change on carried interest imposes the latter taxation, without the corresponding deduction and is, thus, inconsistent with a consumption tax base.

Similarly, it is inconsistent with a Haig-Simons income tax in which the appropriate base is the potential to consume during the tax year – i.e., the actual consumption plus any net saving. Under an income tax, the GP should be taxed on the basis of the expected increase in consumption in the year in which the project is begun.

In sum, from the perspective of tax policy, it is neither a genuine move toward more fairness in the current tax system nor a movement of the current system toward a more desirable overall tax code.

Impacts of Changing the Tax Treatment of Carried Interest

A straightforward approach to analyzing the impact of changing the tax treatment of carried interest begins noting that partnerships are a pervasive part of the economic landscape. Table 1 displays selected characteristics of partnerships using data for 2014 drawn from the Internal Revenue Service’s Statistics of Income data series. The data indicates that there were roughly 3.61 million partnerships comprising over 27.7 million partners. These enterprises managed over $26.13 trillion dollars in assets and generated net income of roughly $837.4 billion. Clearly, substantially increasing the taxes on such a broad-based business structure will have potentially dramatic impacts on the economy.

Counted by number, partnerships are most prominent in real estate (50.3 percent), finance and insurance (9.3 percent) and retail trade (4.7 percent). Viewed from the perspective of total assets, the finance sector (56.4 percent) appears larger than real estate (21.6 percent).

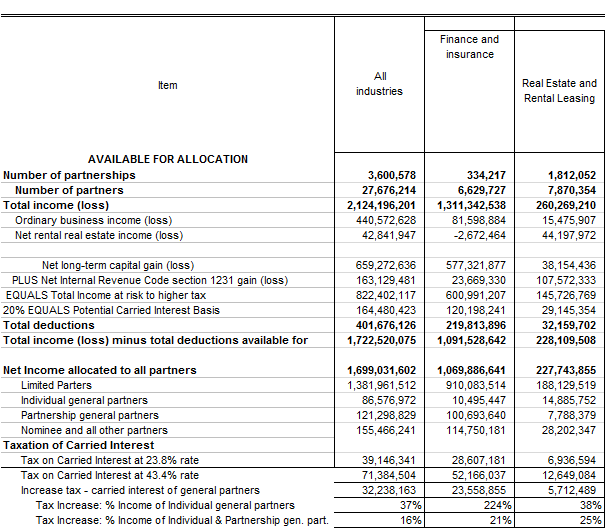

Table 2 draws on the information in Table 1 and focuses attention on the potential magnitudes involved in changing the tax treatment of carried interests, with particular emphasis on the finance, insurance and real estate industries.[3] Specifically, consider the first column that shows the economy-wide partnerships. It indicates that of the $2.1 trillion in net income generated by partnerships, roughly $822 billion is has the character that would potentially lead it to be classified as carried interest (the sum of “Net long-term capital gain” and “Net section 1231 gain”). To get a rough sense of magnitudes, we assume that 20 percent of this income flow is the share of general partners yields an estimate of the income that might be subject to reclassification for tax purposes – $164 billion.

As shown in the bottom panel of the table, these data suggest that changing the tax treatment from a 23.8 percent tax rate to 43.4 percent increased total taxes from this source from $39 billion to $71 billion – a tax increase of $32 billion.[4]

The remaining columns indicate that a similar accounting exercise suggests that the finance industry faces a potential rise of about $24 billion, while the real estate sector would face a $6 billion increase, or nearly as large as the finance industry.[5] Regardless of the original intentions of advocates for the change, the overall potential increased taxation of carried interest will likely have substantial economic impacts.

Table 2 offers an alternative metric of the size of the tax increase. Ideally, one would like to know what fraction of an individual general partner’s income would be subject to greater tax, and just how much higher (in absolute or percentage terms) the partner’s taxes would be. Unfortunately, general partners incomes could come from a variety of sources – multiple partnerships, wage and salary income from another job, portfolio investment income, spouses earnings, etc. – and data that are organized by partnership will not be able to shed light on this impact.

However, Table 2 does show the flow of income from partnerships to partners. Thus, for the real estate industry, approximately $14.9 billion flowed to individual general partners. Assuming that there is a single individual general partner for each of the 1.8 million partnerships, this corresponds to about $8,278 per GP. If there were two such general partners on average it would be only $4,139.

Table 1. Characteristics of Partnerships, Tax Year 2014 (Dollar values in thousands)

Table 2.Static Implications of Changing the Taxation of Carried Interests, Tax Year 2014 (In thousands of US dollars)

An alternative metric is to examine the increased taxes as a fraction of the underlying partners’ incomes. As shown at the bottom of Table 2, overall the tax increase is 37 percent of the individual general partners’ income and 16 percent of combined income of individual and partnership general partners. The average tax rates are even more striking in finance and insurance, where the static implications are that over 224 percent of individual general partners’ incomes would be required to match the taxes. For real estate, the rates range from 38 percent to 25 percent.

It is important to emphasize that these computations are not a “revenue estimate” because they assume no change in the underlying behavior. Given the magnitudes involved, the absence of reaction is implausible unless the law precludes the ability to adjust to the new tax environment. We turn now to the ability and nature of such responses.

The “Retroactive” Components of Higher Carried Interest Taxation.

Because these estimates are built off historical data and assume that there is no change in partnership behavior, they serve as a rough guide to the impact of a change in the tax treatment of carried interests if those impacts are confined to existing partnerships. If, for example, the higher tax was imposed retroactively and exclusively on existing partnerships, the partnership contractual arrangements would be fixed and GPs would be forced to absorb these increased taxes without an avenue to minimize their impacts.

Importantly, the past proposals did not rule out retroactive taxation of existing partnerships. Thus, in the absence of change in the legislation, the impact of increasing taxes on carried interests will include at least in part these considerations.

The “Prospective” Component of Higher Carried Interest Taxation.

Going forward, however, there will be efforts to restructure partnerships in response to the new, higher level of taxation. Significant additional time and capital will be spent by finance, insurance, and real estate LPs and GPs in order to re-structure their investment vehicles so that the overall impact of the new tax on carried interests can be minimized or avoided altogether.

By definition, these new legal arrangements will be inferior to the original.[6] Thus, this outlay and use of time will not improve economic performance overall, and will not contribute to the objectives of investment managers’, their institutional investors (such as pension funds) and their individual clients. Indeed, if at all possible, the GPs will have the incentive to pass these higher costs to the institutional investors and individual clients, thereby reducing their received rate of return.

A related avenue of adjustment would be to replace the incentive-based carried-interests structure between GPs and their investors with non-contingent, fixed compensation arrangements. Because of the absence of performance incentives, these types of compensation contracts will not elicit superior investment performance, with a declining return to investment as a result. Moreover, depending upon the nature of these arrangements, they may raise little revenue as the taxed compensation to the GPs will be deductible to individual and corporate investors.[7]

However, it is unlikely that legal adjustments alone will be sufficient to avoid the entire tax. If so, the real economic activity will be affected. Intuitively, placing a greater tax burden on carried interests will raise the overall tax burden on the investment. Unless the project is sufficiently profitable, it will not be possible to pay the annual operating expenses, cover depreciation of the property, meet the contractual obligations for debt-financings, pay taxes, and offer a competitive return to the equity partners in the investment.

In such circumstances, the projects that don’t make the cut will be dropped – projects that likely will be in the more marginal locations or burdened with greater risk. In modern, competitive global financial markets, even small changes in margins move trillions of dollars of financial capital; the taxed partnerships would be at a clear financial disadvantage and would lose capital to other investment opportunities.

This impact – the shifting of capital from one sector of the economy to another in response to a discriminatorily higher tax – has been extensively analyzed in the context of the corporation income tax, beginning with Harberger (1966). The analogy is quite clear: the corporation income tax is a tax on the return to capital that is received through a particular business form – the chapter C corporation. Raising taxes on carried interest is a tax on the return to capital that is received through a particular business form – the partnership. The legal setting is different, but the economics are the same.

One dimension to the “cost” of the discriminatory taxation of carried interests is that capital is shifted to less productive uses; damaging overall economic performance. The intuition is straightforward. For simplicity, imagine that there is no tax (or equal tax treatment) across all uses of capital, and all returns are equalized at a pre-tax return of 20 percent. Now, suppose that one sector (partnerships) faces a unique and higher tax – to make the example simple – of 50 percent. Immediately, the post-tax return falls to 10 percent in this sector, inferior to opportunities of 20 percent elsewhere and capital flows to those opportunities.

The process will continue until post-tax rates of return equalize and eliminate incentives for capital shift. In this example, when pre-tax returns in the taxed sector are 30 percent and those in the less-taxed sector are 15 percent, the post-tax return will be 15 percent in both. The tax, however, generates a clear cost to the economy: capital is twice as productive (30 versus 15 percent) in the taxed sector as elsewhere. By driving capital from more productive to less productive activities, the tax reduces overall productivity of capital and shrinks the economy.

The Loss of Entrepreneurial Talent.

The Harberger analysis focuses exclusively on the shifting of capital. More recent research by Gravelle and Kotlikoff (1989), however, suggests that this approach badly understates the detrimental impacts of higher taxes because it has too narrow a focus. Specifically, Gravelle and Kotlikoff reconsider the computations and incorporate the fact that canceling investment projects alone are not the only fallout of raising taxes. Rather, when taxes are raised they also drive away the key element of economic success – entrepreneurial talent.

More specifically, taxed (partnerships) and untaxed (real estate investment trusts, etc.) business forms are competing for the same entrepreneurial management talent and producing the same ultimate product (investment services). Common sense suggests that the imposition of the additional tax on carried interests will diminish not only the ability to attract capital, but also the same quality of managerial talent to make the capital productive in partnerships. The prospect of lower after-tax pay will lead prospective investment managers to examine other employment options in the market. Inevitably, the lower quality management will diminish performance. Gravelle and Kotlikoff compare the efficiency cost apparent from the standard Harberger analysis with an efficiency cost that captures the loss of entrepreneurial talent. Over a wide range of assumptions about the nature of production and competition, the costs are at least 10 times as great and as much as 25 times higher.

These results suggest that the economic costs of crowding out partnerships projects plus the lower performance that comes from diminished entrepreneurial zeal will impair the economy as a whole. These economic costs represent foregone income in the economy – a loss for everyone.

Summary and Conclusion

There appears to be little merit to changing the tax treatment of carried interests. As indicated in an analysis by Michael Knoll (2007), taxing the carried interest will raise modest amounts of revenue.[8] In return, the tax would likely inflict large damage on the commercial real estate sector, diminish its entrepreneurial talent pool, and lead to lower construction and wages in the real estate sector.

References

Bulan, Laarni, Christopher Mayer, and C. Tsuriel Somerville, “Irreversible Investment, Real Options, and Competition: Evidence from Real Estate Development,” Brandeis University, 2004. (Good)

Gravelle, Jane and Laurence Kotlikoff, “The Incidence and Efficiency Costs of Corporate Taxation When Corporate and Noncorporate Firms Produce the Same Good,” Journal of Political Economy, 1989. (Good)

Harberger, Arnold, “The Incidence of the Corporation Income Tax,” Journal of Political Economy, 1962. (Good)

Harberger, Arnold, “Efficiency Effects of Taxes on Income from Capital,” in Effects of the Corporation Income Tax, M. Krzyzaniak (ed.), Wayne State University Press, 1966. (Could not find a direct link to it online to check, but when it is referenced in other papers, it is referenced in the same context. Good)

Hassett, Kevin and Aparna Mathur, “Taxes and Wages,” American Enterprise Institute, Working Paper #128, 2006. (Good)

Knoll, Michael S. “The Taxation of Private Equity Carried Interests: Estimating the Revenue Effects of Taxing Profit Interests as Ordinary Income,” unpublished, University of Pennsylvania, 2007. (Good)

[1] This paper updates, Holtz-Eakin, Smith, and Stoody, “The Tax Treatment of Carried Interest,” June 10, 2010; Dante Bucci provided excellent research assistance

[2] This examines carried interest proposals compared to current law, notwithstanding efforts at comprehensive tax reform in the Congress

[3] The data in Table 2 are restricted to those returns that permit the allocation of income to partners, a crucial consideration as the tax treatment of carried interests is focused on general partners.

[4] Fully phased in 2011 law in 2013, made the tax rate 39.6 percent.

[5] Might need a new footnote because the reasons might have changed as to why there was a lower increase in revenue

[6] If they were better, they would have been adopted in the absence of the new tax.

[7] Not all investors are taxable; e.g., pension funds so there will not be a perfect offset. At the same time, the overall dollar value of compensation will have to exceed the existing carried interest to compensate GPs for their higher level of taxation. Knoll (2007) makes this argument.

[8] His analysis is probably an overestimate. Knoll computes the cash value of an option contract that mimics carried interest for general partners, and calculates the additional taxes that would be collected by taxing this cash grant as ordinary income. In his analysis, this represents the additional payments that limited partners would be required to offer in order to retain sufficient inducement to attract general partnership talent. Another perspective on this analysis, however, is to note that he employs a conventional formula for valuation that assumes independent freedom to exercise the option and deep, liquid markets for the underlying asset. In the context of some investments, these likely overstate the reality and thus the value of the option.