Research

December 3, 2018

The Energy Loan Guarantee Program is Worth Reforming

Executive Summary

- The Loan Programs Office (LPO) was created under the Energy Policy Act of 2005 to create a source of capital for early stage energy technologies that may struggle to attract loans. The program was designed to pay for itself by having applicants pay for their expected subsidy.

- After its creation, the Obama Administration expanded LPO by funding the expected subsidy costs of LPO loan guarantees via federal appropriations. As some high profile projects such as Solyndra failed, the economic stimulus rationale for the program was proven to be faulty, and some have called to end LPO altogether.

- The program still offers value in accelerating the deployment of innovative energy technologies, and it is worth reforming. A comprehensive pro-innovation energy policy should pare back existing late-stage renewable energy subsidies and use that revenue to turn LPO into a more transparent and competitive program that could better attract applicants. Absent reform, LPO would remain a revenue-neutral or revenue-positive loan guarantee program with few applicants.

Introduction

The Loan Programs Office (LPO) is an obscure federal agency within the Department of Energy (DOE), but many people have heard of one of its biggest failures: Solyndra. Solyndra was a solar panel manufacturer that was meant to be the exemplar for the Obama Administration’s 2009 economic stimulus package. “We can see the positive impacts right here at Solyndra…Before the Recovery Act, we could build just 5 percent of the world’s solar panels. In the next few years, we’re going to double our share to more than 10 percent,” said President Obama in May of 2010. Not long after President Obama said this, Solyndra went bankrupt.

Solyndra epitomized much that was wrong with President Obama’s “green jobs” strategy for growth: Companies that are supported by taxpayer funds to satisfy a policy objective are not as efficient as companies that succeed in the market without support. Ever since Solyndra, conservatives have frequently called for the elimination of LPO. To be sure, the office has significant flaws and is open to abuse. But Solyndra has been a distraction from a deeper truth about LPO: There is an appropriate role for the government to play in supporting energy and environmental innovation.

Reforming LPO to play this role—and not to be some sort of economic stimulus program—would require several discrete reforms as well as broader reforms to other federal energy policies. Such reforms would not prevent another Solyndra, exactly—the government would still support risky ventures that could fail, as supporting ventures too risky for the private sector is the point—but they would focus the program around a specific mission while increasing the possibility of successfully supporting breakthrough technologies at a lower risk to taxpayers.

What is the Loan Programs Office?

The DOE’s LPO began under Title 17 of the Energy Policy Act of 2005 (EPAct), which created a governmental program to offer loan guarantees with the express objective of reducing pollution, and specifically greenhouse gas (GHG) emissions. The program predominantly supports cutting-edge innovations in electricity production: Under Title 17 regulations, only new technologies with fewer than three commercial implementations are eligible for a loan guarantee.

The rationale behind LPO was that the private sector has little economic incentive to pursue clean energy innovation on its own, creating a market failure as there is no market incentive to address the externalities of pollution. Several factors underscore this reality. Electricity production is extremely capital intensive—it costs a lot up-front to build a generation facility—which creates considerable exposure in a capital lender’s portfolio. Furthermore, determining whether a new technology will work as intended requires significant engineering expertise, so the due diligence required for an innovative electricity generating technology is much greater than that for other technologies. Simply, because electricity is a commodity, a private sector lender is afforded little-to-no advantage for supporting an innovative electricity generating technology over a commercially proven incumbent technology, and Title 17 loan guarantees are intended to relieve the private sector of some of the costs (particularly due diligence) and risks associated with them.

The LPO initially issued loan guarantees with little government money, instead recouping the risk and costs through various fees. Conventionally, a loan guarantee is effectively a subsidy because it moves the risk of the loan from the private sector to the taxpayers, allowing for more favorable rates. In the case of LPO’s Title 17 loans, however, the loan guarantee applicant pays for this subsidy through a fee equal to the “credit subsidy cost (CSC),” or estimated total cost to the federal government (called a credit subsidy fee). Fees of $100,000 to $350,000 are also paid for the due-diligence that LPO performs, in addition to a $50,000 application fee. In other words, a loan applicant must pay $150,000 to $400,000 worth of fees even before the CSC is calculated, and then the applicant must continue to pay for due diligence throughout the life of the loan. And these fees are on top of the interest that the applicant is already paying to the lender.

LPO was created to provide loan guarantees at virtually no cost to taxpayers. Not surprisingly, since Title 17 loans did not offer any subsidy, and the private sector had no incentive to pursue innovation that may not offer much reward for many years, the program struggled to attract applicants.

This all changed, however, during the Great Recession.

The Mission Drift of LPO During the Recession

Shortly after President Obama took office, his administration and Congress sought to fund government programs to stimulate the economy, which was in the midst of a recession. As part of the American Recovery and Reinvestment Act (ARRA), LPO received a hefty appropriation to cover the CSC of some applicants (these ARRA supported loan guarantees became known as section 1705 loans, which are different from the unsubsidized section 1703 loans where the CSC is not paid for by government), which turned the program into a substantial subsidy for innovation. This injection of money effectively added a prong to LPO’s mission, turning it into an economic program as much as an environmental or innovation one. LPO’s objectives dovetailed nicely with the Obama Administration’s stated goal of creating “green jobs” as a panacea for both the recession and the environment. But this mission drift of the LPO revealed some big problems and created some others.

One big problem was that the promise of economy-boosting “green jobs” never materialized. For example, the solar-panel manufacturer Solana received a subsidized Title 17 loan guarantee for an amount of $1.45 billion, but only expected to support 90 permanent jobs.

Another, potentially bigger problem was the influence of the administration’s policy priorities on what was originally an innovation-focused program. Documents released in 2011 showed that the Obama Administration was seeking information on specific projects to tout on the campaign trail. Vice President Joe Biden heralded Solyndra as “so important” to powering the world of tomorrow—yet soon after Solyndra went bankrupt and defaulted on its government-guaranteed loans. The hopes for funded projects did not match economic reality—and taxpayers ended up footing the bill.

The ARRA might have heightened the pressure for using LPO as an economic stimulus tool, but the potential for LPO to be repurposed for other policy issues was already present. The Secretary of Energy has an unduly large amount of authority in the acceptance or rejection of applicants (by statute). As a result, risky-but-popular projects—such as Solyndra—might be accepted, or potentially innovative technologies that do not align with the administration’s priorities (or fear that they do not) could decline to apply.

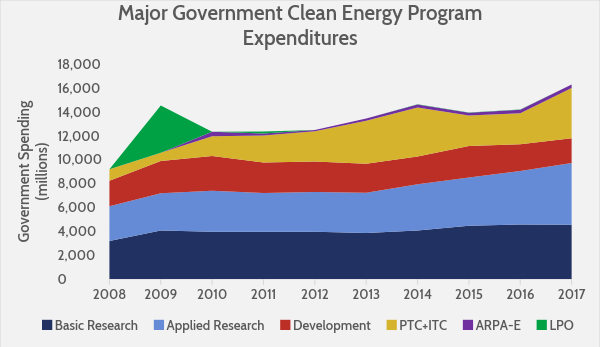

To put in context LPO’s place in government energy policy, below are the biggest consumers of government spending on what can be described as “clean energy” or “innovation” objectives. Included is basic and applied research conducted by the DOE, as well as development and the Advanced Research Projects Agency-Energy (better known as ARPA-E), the Production Tax Credit (PTC) and Innovation Tax Credit (ITC), and budget authority for Title 17 loan guarantees (minus collected fees).

Source: DOE Budget Requests, FY2009-FY2019.

What the chart above shows is that LPO was a huge (and ultimately not very successful) part of the government’s innovation strategy as part of the ARRA, but since then has played very little role while the costs of the PTC and ITC continue to rise.

Why did LPO struggle to attract applicants or fill a gap in private sector financing? Put simply, with government money it created an artificial government preference for specific technologies, yet without any government money it is not attractive to many potential applicants. While LPO was originally intended to pursue innovative technologies as an environmental program, the government repurposed LPO to take tax money and fund the administration’s sanctioned projects as an economic stimulus that would only support a small number of jobs. The result was that LPO accomplished neither of its goals: It did not stimulate the economy, and it did not meet expectation as a major driver of innovation.

Since the ARRA’s budget authority for covering CSCs has mostly ran out, the number of new Title 17 applicants for LPO has plummeted, and the Trump Administration has requested the elimination of LPO in its budget requests. But such a move ignores the potential benefits that a refocused LPO could have.

Restoring LPO as a Pro-Innovation Environmental Program

Earlier this year, Chairwoman of the Senate Energy and Resources Committee Lisa Murkowski said, “I don’t want Title 17 programs eliminated. I want them reformed.” The senator’s statement reflected a view that is starting to take hold—that LPO still has value to offer in seeding innovation. The same market dynamics that instigated LPO initially are even more pronounced today, as electricity demand has stagnated. Further, the political rationale for reducing GHG emissions remains strong.

LPO must return to its original mission of supporting environmental innovation. As an environmental program, LPO and its Title 17 program hold considerable potential (if reformed), but it cannot be part of any so-called “green jobs” or other economic growth strategy. Government redistribution does not spur economic growth, and LPO is no exception to this rule: A government-directed environmental program will not directly boost the economy. Yet this fact does not mean that there is not a role for LPO, as the government has goals besides strengthening the economy. Politicians seek GHG reductions, and, as outlined above, existing technology in the market is unlikely to deliver them. There is therefore a role for a program that can provide capital to innovative technologies. LPO could be that invaluable environmental program.

The reasoning behind pursuing innovation as an environmental policy is premised on the projection that a future technology will be able to achieve better environmental outcomes at a lower cost than the technology available today. LPO could help to make such technology a reality. Other government programs show that government does have a valuable role to play in seeding innovation. The National Labs, for example, have supported the development of such valuable technologies as lasers and directional drilling (which has facilitated the shale revolution in the natural gas industry). Reframing LPO as an environmental innovation program, and reforming it with that mission in mind, could make the program into a valuable success.

Key Reforms

Three major changes need to be made to LPO to focus it squarely on its primary mission of being an innovation program.

First, the potential for mission drift of LPO need to be minimized. It is antithetical to the goals of the Title 17 program to have a loan-guarantee program that is contingent upon the approval of the administration in power. Proper innovation policy should absolutely be as technology-neutral as possible, since any government preference could potentially prohibit or delay the commercialization of a technology that could be economically competitive.

Approval or disapproval of loan guarantees should therefore not be under the authority of the Secretary of Energy, but rather up to a commission or nonpartisan entity within DOE. Transitory policy issues should not affect LPO oversight and loan guarantee approval or disapproval, and decisions of approval or disapproval should be made purely on the technological potential of a project, its potential GHG reductions, and the ability to repay. There certainly is no way to insulate LPO completely from the oversight of political appointees, but these steps would help to insulate it from an administration using it as an electioneering tool.

Second, there needs to be more transparency in what an applicant can expect as a CSC fee. The CSC is a reflection of both technological and financial risk, and thus the ability of an applicant to repay. A low-risk loan guarantee will have a low CSC, and a high-risk one a higher CSC. Given the relatively low rate of default among Title 17 projects, one would expect the CSCs to be quite low, yet the Government Accountability Office notes that the expected appropriations under the ARRA to cover the CSCs (that is, section 1705 loan guarantees)were approximately 11.4 percent of the total loan guarantee volumes—indicating a fairly high subsidy cost. And such high subsidy costs have continued: The estimated CSC for Vogtle, a major nuclear power plant supported by LPO loan guarantees, was $1.6 billion, or about 20 percent of the loan guarantee amount (the CSC has since been zeroed out, as the project is in a regulated market with guaranteed cost recovery).

Considering that fees even before the credit subsidy fee can reach up to $400,000, (not even counting the legal fees incurred in navigating the process) it seems unreasonable to expect that a company with an innovative technology would expend resources pursuing a loan that they know will be expensive and might not even be affordable. If applicants have a range of what CSC they can expect to pay if their project is accepted, it might increase the pool of applicants. LPO could set a maximum CSC that would be accepted, which would have the dual purpose of rejecting projects that would struggle to repay and let loan guarantee applicants know the maximum they could expect to pay in fees before they apply.

Third, the program needs to be more competitive, which requires spending money. Recall that the program is currently designed to cost taxpayers nothing—but the result has been a program that struggles to attract applicants. To wit: The current remaining LPO loan guarantee authority (i.e. guarantees it is authorized to make, not money it is spending) is approximately $40 billion, and the total volume of all Title 17 issued loan guarantees was approximately $21 billion. (LPO authority can also be used for Advanced Technology Vehicle Manufacturing loans, which are not discussed in this piece).

LPO would function better if it were a prize-based system. In other words, the terms of the loan guarantees should be very attractive but only a few projects should then be supported. Such a structure would constrain the overall costs of the program by taking only the projects most likely to be truly innovative and commercially disruptive. LPO could implement such a reform to be more competitive by setting targets that are tied to specific awards. As an example, if a project were expected to achieve a certain threshold for emissions reductions via its “Life Cycle Assessment” of GHG impacts, it could have the credit subsidy fees waived (up to a certain value). Industry participants with specific needs could also offer to cover the credit subsidy fees of projects that promise to fulfill the requirements of contract (such as a power marketing agreement or manufacturing delivery), which may be an easier lift than providing capital directly. For example, the new renewable portfolio standards in California encourages electricity providers in that state to fund the commercialization of technology that can comply with new regulations.

Yet such competitiveness means companies are competing for something in particular: government funds. The current structure is expensive for those applying and doesn’t offer enough benefits. Spending money means that the government is more likely to support innovations in clean energy production.

Reforming LPO Should Coincide with Other Energy Policy Reforms

The above reforms to LPO, though, would mean little absent broader reforms to how both the federal government and state and local governments approach innovation and energy policy. Companies that receive LPO loan guarantees often can double-dip in other programs, discouraging any incentive to contain costs. For example, Vogtle has received $8 billion of loan guarantees via LPO, but the state where the plant is being deployed, Georgia, is a cost-of-service market—meaning Vogtle can charge for power whatever it cost them to produce it. Because Vogtle’s cost-recovery is guaranteed by captive ratepayers, and the risk associated with their debt is subsidized by LPO, the cost of the project does not matter to Vogtle’s owners. The dynamics are similar when considering wind and solar projects—which make up most of LPO’s Title 17 portfolio—as they are supported beyond their loan guarantees with the ITC and PTC after commercialization.

The ability of projects to “double-dip” for government support creates a poor incentive structure. The ITC and PTC (to take two problematic policies) create market-distorting incentives for particular technologies (solar and wind), which in turn affects the credit worthiness of particular loan-guarantee applicants. Such a distortion compromises the neutrality of the loan guarantee program.

Looking more broadly, any reforms of LPO should be done in light of the federal budget. As mentioned above, a vibrant Title 17 loan guarantee program will likely require federal funding to cover at least a portion of the CSC, but in the current deficit environment, an increased appropriation for energy innovation is difficult to accept. Reforming LPO, then, should be done in a revenue-neutral manner that pays for appropriations to LPO by cutting other energy subsidies.

Future tax credits for wind and solar via the Production Tax Credit (PTC) and Investment Tax Credit (ITC) are projected to cost more than $60 billion over the next 10 years. Curtailing these would mostly be untenable, as much of the provisions are baked in and promised to existing projects that secured financing based on the subsidies. The Joint Committee on Taxation, however, estimated when scoring the Tax Cuts and Jobs Act that ending the inflation provision of the PTC for future wind turbines would save $12.3 billion. It should also be noted that subsidies for the oil and gas industry remain, such as the “excess of percentage over cost depletion” credit which is estimated to cost $6.4 billion over the next 10 years.

The significance of these cost estimates is that serious reforms to how the federal government treats energy and innovation policy could identify subsidies worthy of curtailing, and those revenues could fund reforms to LPO to turn it into a more attractive and competitive offering. Recall that GAO estimated that the CSC required for loan guarantees (in other words, the subsidy required), was around 11.4 percent. That means funding LPO reforms via ending the excess of percentage over cost depletion would allow for a loan guarantee authority of $56 billion. Clearly, serious policy reforms that aim for a more technology-neutral and pro-innovation treatment of energy sources have opportunities for revenue-neutral reform that could hold taxpayers harmless.

Conclusion

LPO’s Title 17 loan program can, and should, play a greater role in the government’s energy innovation policies, which even without LPO represent $16.3 billion of spending in 2017. But the program’s struggles in the past show the program is desperately in need of reform. The program needs to be redesigned to remove the unduly large amount of authority that political appointees have over accepting or rejecting applicants. There also needs to be a better value proposition for applicants; without any real incentive to direct their capital towards innovation in energy, investors will likely seek better returns elsewhere. Finally, the program needs a competitive process for approving applicants, which will increase the likelihood that companies with approved loan-guarantees will have higher economic value.

Merely reforming LPO, though, is not enough to fundamentally improve the U.S. government’s energy innovation policies. The government’s innovation policies interact in unhelpful ways, and it would be important to reform other energy and environmental policies at the same time as revamping LPO. Making existing tax incentives more neutral would also have the effect of making LPO more neutral, and would also provide more than enough revenue to the government to fund an LPO.

LPO should be reformed to focus it purely on supporting innovations in clean energy production. To be sure, the result could be, in a sense, more Solyndras—funding innovation is risky, and some projects could fail. But the result could also be breakthrough technologies that transform how we produce power.