Research

March 17, 2017

WMATA Financing Lacks Incentives for Performance

Summary

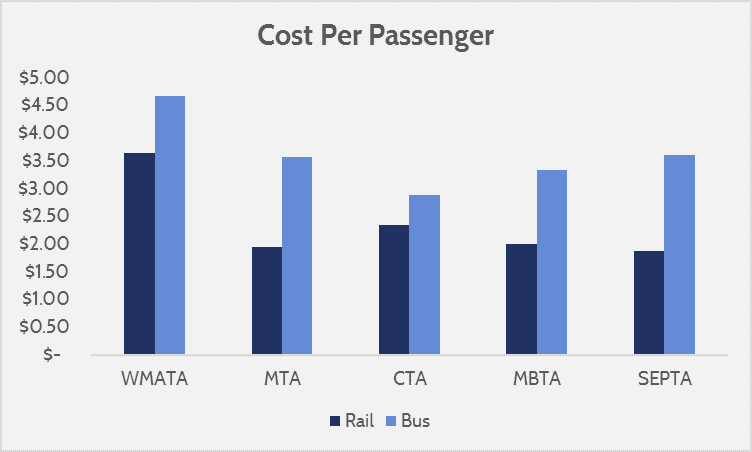

- WMATA is one of the most expensive transit systems in the country, costing an average of $3.64 per rail passenger and $4.68 per bus passenger. Relative to the population serviced, WMATA is better funded than its peers, raising about $618 per-capita.

- There are no aspects of the WMATA budget that are disproportionately more expensive, meaning no one aspect of the budget can be trimmed to right-size the budget.

- WMATA’s budgetary difficulties are systemic in nature, and a product of patchwork funding mechanisms that do not incentivize performance. This issue can only be resolved if the taxed districts establish uniform criteria for funding the system that incentivizes performance.

Introduction

The Washington Metropolitan Area Transportation Authority (WMATA) is in budget turmoil yet again. At $300 million overbudget, WMATA is now having to entertain a series of fare hikes, service cuts, and subsidy requests to put the balance sheet back in order. Transit systems receive considerable federal funding via the revenue raised by the federal gas tax (which is dedicated to infrastructure spending), therefore transit systems are not merely local issues. WMATA gets a large portion of its funds from the federal government, and has become essential to the functioning of the federal government (to the point that the Pentagon is a major transit hub of WMATA).

It is in the interest, not just of the region, but of all taxpayers that support WMATA through federal funds that the system is in good working order and is accountable for its performance. Several highly publicized incidents that jeopardized passenger safety (resulting in one death) have put WMATA in the spotlight. However, in seeking ways to improve the system, data and analysis are likely to offer the best insights. For WMATA to truly become a world class metro system, it must reform its funding structure and system costs to reach comparability with peer transit systems in America. To that end, the following data compares WMATA to the New York Metropolitan Transportation Authority (MTA), the Chicago Transportation Authority (CTA), the Massachusetts Bay Transportation Authority (MBTA), and the Southeastern Pennsylvania Transportation Authority (SEPTA).

Data Interpretation

To identify deficiencies that may be specific to WMATA, comparing the system to its peers is helpful. Below are a series of graphs comparing WMATA to other large U.S. transit systems. All data is taken from the National Transit Database, the last annual release of which was for 2015 data (SafeTrack impacts not included in data). The data only compares heavy rail (subway), and buses. Special access programs, commuter rails, rapid transit, and other non-comparable costs are not included, except in total system revenues.

WMATA is one of the most expensive transit systems in the U.S. for both rail and bus.

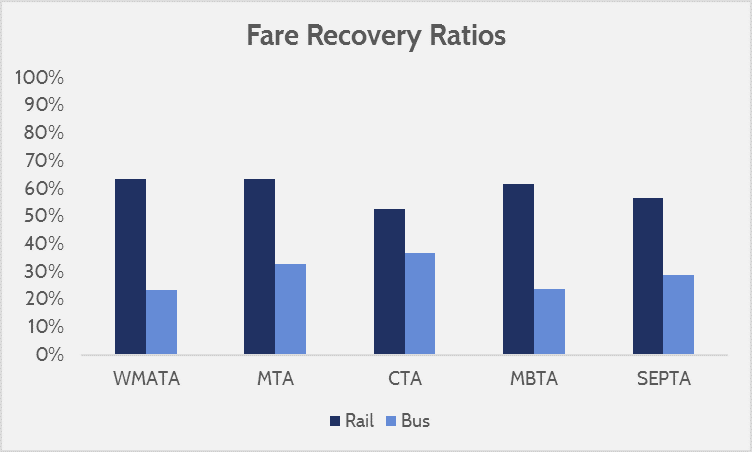

Although WMATA fares are high, they do not recover or subsidize a significantly greater share of the operating costs than other systems.

Per capita of service area, WMATA receives more revenue (generated, subsidies, etc.) than other transit systems.

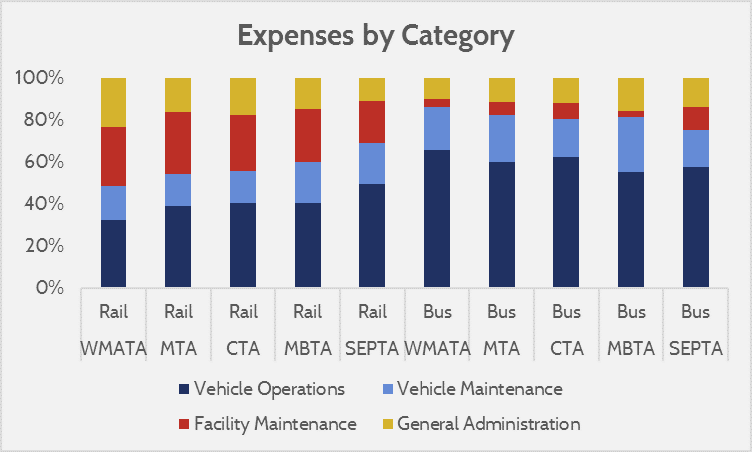

Employee compensation is included in category costs (e.g. a bus driver’s salary is included in vehicle operations costs). The distribution of expenditures is not very different than other systems.

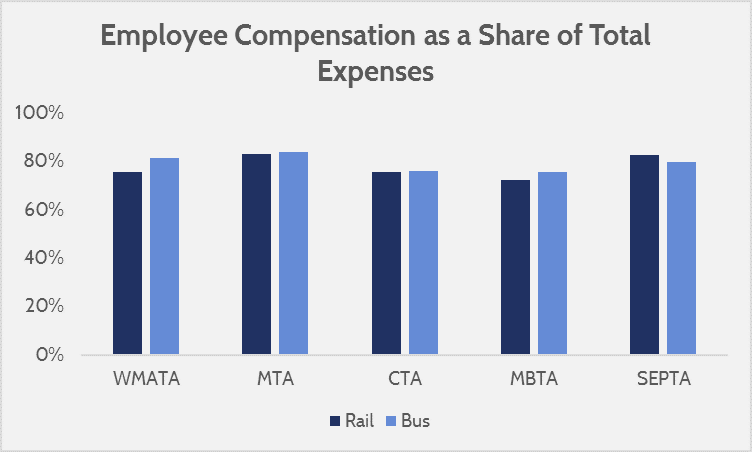

WMATA does not spend any greater share of its revenues on employee compensation than other major transit systems. While there is much focus on employee salaries (natural given the subsidies WMATA receives), the total expenses for employee compensation proportional to the budget are around what is expected for the system.

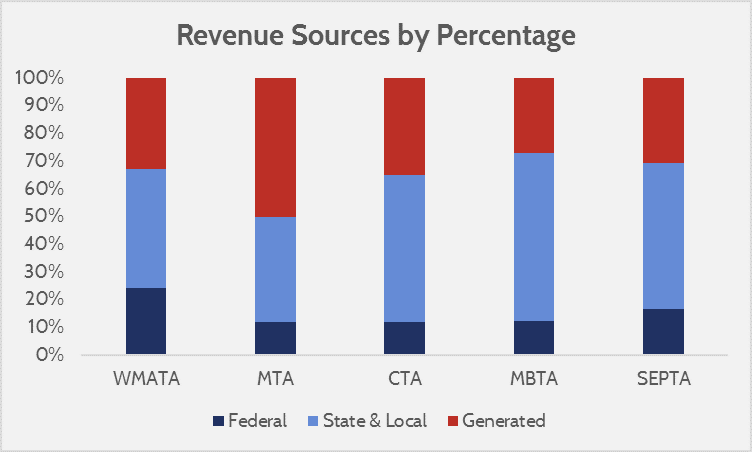

Lastly, there is the share of revenues by source. Immediately noticeable is that WMATA stands apart from its peers in the large role federal funds play in its funding, and less reliance on system-generated revenue. It is worth noting, though, that federal funding from year-to-year for transit systems can fluctuate greatly, and in 2015 federal funds were higher than in the 2016, 2017, or 2018 budgets.

The data tells a story; WMATA has higher operating costs than its peers, but does not have any seemingly unusual expenditures that drive those high costs. Compensation, vehicle operations, fare recovery, etc. are all comparable to other major transit systems that somehow manage to do more with less. There is no silver bullet explanation, or one program eating into the WMATA budget so much that is causing the organization’s poor budgetary discipline. There must be another reason for this, and most likely it has to do with funding incentives.

WMATA Funding

WMATA is unique in how it receives funding compared to most other transit systems. A typical transit system functions by getting around half or more of its revenue from fares, and then the other half is subsidized. Defendants of subsidizing public transit point out that the economic activity generated by access to public transit spurs taxable revenues that offset the system’s subsidies. As such, transit system subsidies usually come in the form of sales taxes or property taxes—revenues that rise when use of the system (which increases the burden on its budget) also rises. This comes in a mixture of local and state taxes. Federal subsidies may be sought through grants (paid for by federal gas taxes) to invest in capital costs (like new trains). Typically, a well-functioning and cost-effective system is important for justifying subsidies from the local regions and state, since the system is competing with other programs for those subsidies.

WMATA, though, is atypical. Although WMATA still collects state and local subsidies, the system spans three states (treating the District of Columbia as a state for budgetary purposes). Maryland also subsidizes a metro system in Baltimore. To acquire subsidies each year, WMATA proposes its budget, and requests funds from the local districts and states. For Maryland, the localities calculate what their share of the WMATA budget should be, and so long as WMATA is compliant with the Tri-State Oversight Committee, seem to have no formidable difficulties in approving the funds (which are then disbursed through the Maryland Department of Transportation). The money comes from a combination of federal funding for infrastructure, and revenues from highway use.

The District of Columbia (DC) pays its share of the WMATA budget out of pocket, a small portion of which comes from “dedicated” revenue streams (parking sales taxes mainly). Bear in mind that DC receives about a quarter of its revenue from federal funds (defended by the fact that the federal government is reliant on DC being functional and not disrupted by crime, weather, etc.). Essentially, the federal government subsidizes WMATA twice—once directly, and once by subsidizing DC which then uses part of its budget to subsidize WMATA.

Virginia determines how much funding WMATA gets through the “Northern Virginia Transportation Commission” (NVTC). The NVTC raises money from 2 percent tax on gasoline, and decides how much each locality is responsible for paying to WMATA and other transit organizations. Northern Virginia (NOVA) has multiple transit systems in addition to WMATA, and not all of NOVA is serviced by WMATA. Because some of the commissioners for NVTC represent non-WMATA serviced districts, areas that do not benefit from WMATA funding still have a say in how the pool of funds that WMATA draws from is disbursed. Furthermore, the NVTC gets reimbursed partially by the state of Virginia, but on a two-year delay. If the NVTC increases its funding for WMATA, it might not be reimbursed by the state for two years—if at all.

To add additional strain, all the funding sources for WMATA differentiate between capital expenses and general expenses, so money is not fungible across purposes for WMATA. Consequently, WMATA gets little benefit from utilizing its assets efficiently. Furthermore, NVTC is projecting a 65 percent capital funding shortfall.

A major problem lies in the fact that because WMATA receives money from so many different districts, a political dynamic comes into play where each district’s desire to minimize local cost burdens compels them to pressure other districts to increase their share. Regardless of how well, or poorly, WMATA performs each year, they are virtually guaranteed to receive money from state and local subsidies just because of the natural inclination of liable parties to seek fairness. Consequently, this means that the total revenue from state and local funds is also far more unpredictable. Since each district will not want to shoulder an unfair burden, whenever one wishes to cut or raise WMATA funding, it influences the others.

Federal funding is awarded through grants, which are either competitive or formulaic. Given WMATA’s role in the functioning of the federal government, as well as the system’s size, federal grants are an attractive income source that can offer better budget certainty than state and local subsidies. For WMATA, seeking funding from state and local sources is uncertain and chaotic, whereas federal grants have much more transparent criteria. Ease of access to Federal Transit Authority (FTA) personnel for answering questions or guiding WMATA through the grantmaking process may also offer WMATA an advantage over other U.S. transit systems when competing for funds.

Overall, because WMATA lacks predictable funding, and because requirements to attain funding are not consistent, transparent, or responsive across states, WMATA lacks incentives to efficiently manage its resources. Some level of funding for WMATA is guaranteed in any given year, and the best way to maximize funding is to spend as much money as possible (which then justifies bigger budget requests). Because federal funding is more transparent than other sources, WMATA gravitates towards shoring up budget shortfalls from federal funds rather than state and local funds. This is exacerbated by the fact that some federal grants are awarded based on the estimated cost of the funded project, and in the case of 5309 grants (a type that WMATA receives) the supported project must exceed $300 million in estimated costs. Pursuing federal funds over state and local funds also diminishes the desire to provide cost-effective performance, since local satisfaction is not a criterion for receiving federal funds.

Furthermore, the method by which states—particularly Virginia—raise revenue for subsidizing WMATA are not optimal. Levying taxes on gasoline or parking means that the people who subsidize WMATA are not the ones that directly benefit from it. Attempts to raise revenue by hiking such taxes would incentivize further use of WMATA (inflating cost burdens), while further discouraging use of cars (eroding the base for the taxes used to subsidize WMATA). Whatever taxes WMATA is funded by should be ones that are expected to have rising revenues as system use increases, such as property or sales taxes in the serviced areas.

Recommendations

To improve WMATA’s budget sustainability, there are two big steps that could be taken. The first is to either raise fares on buses, or scale back their deployment. Compared to rail, buses have very poor fare recovery rates, have very high operations costs, and are considerably more expensive (and thus more subsidized) per passenger than would be expected of WMATA. Although media attention has largely focused on deficiencies with WMATA rail operations given a number of incidents (track fires, a derailment, a death from smoke inhalation, etc.), it is actually far more cost-efficient than WMATA’s buses.

The second recommendation is that Virginia, DC, and Maryland should move to establish a regional commission that will create unified funding criteria for WMATA and recommend dedicated funding sources. The commission should provide clear metrics for efficiency that WMATA will comply with. With dedicated funding sources that are reliant on the performance of the system, WMATA would have more incentives to perform well in the districts responsible for the subsidies.

Smaller approaches, such as removing overtime pay from pension calculations, improving logistics, and establishing a State Safety Oversight Program to be compliant with FTA funding requirements would help as well. However, none of these individually, or together, can resolve the systemic problems with WMATA funding which fail to incentivize performance.

Absent such approaches, a move towards privatization of the system could yield substantial benefits as well. While there are few cases of privatized metropolitan transit systems, Hong Kong offers a shining example. The immaculately punctual (99.9 percent on time), and cheap (average fare cost of less than $1) metro system was evaluated in a McKinsey report last year. The metro system in Hong Kong operates without subsidies, and nets a profit of over $1 billion annually. The comparison is somewhat apples to oranges because the Hong Kong metro benefits from having a densely-populated area to service (fewer infrastructure needs, but higher revenues from ridership), especially compared to Washington. However, the private sector would likely capitalize on opportunities for efficiency that WMATA’s current funding model does not benefit from.