Testimony

December 10, 2020

Testimony on: Small Business in Crisis: The 2020 Paycheck Protection Program and Its Future

United States Senate Committee on Small Business and Entrepreneurship

*The views expressed here are my own and not those of the American Action Forum. I thank Thomas Wade for his insight and assistance.

Chairman Rubio, Ranking Member Cardin, and members of the Committee, thank you for the privilege of appearing today to share my views at this hearing titled “Small Business in Crisis: The 2020 Paycheck Protection Program and its Future.” I wish to make three main points:

- The $525 billion authorized by the Paycheck Protection Program (PPP) and disbursed by our nation’s banks is perhaps the single most effective policy tool deployed by Congress in response to the economic stresses posed by COVID-19;

- Any weaknesses exposed in the program are far outweighed by its successes, and were Congress to reinstate the PPP without any program changes this would likely be a significant benefit to the economy; and

- Potential PPP reforms include shifting focus to revenue replacement rather than payroll retention, simplified forgiveness, and structural improvements at the Small Business Administration (SBA) and Treasury.

The Status of the Paycheck Protection Program

Title IV of the Coronavirus Aid, Relief, and Economic Security (CARES) Act, signed into law on March 27, 2020, set aside $349 billion for the relief of small businesses, to be administered by the SSBA in the form of the P PPPP[1]. The SBA commenced the PPP on April 3, 2020, and closed the program on April 16, 2020, on the exhaustion of the $349 billion appropriated by Congress. Congress later provided an additional $310 billion for the PPP in H.R. 266, the Paycheck Protection Program and Health Care Enhancement Act.[2] This supplement brought the total funds available to the SBA and the PPP to $659 billion.

Per the original drafting of the CARES Act, the PPP program was due to expire at midnight on June 30 regardless of funds remaining. Just hours before the expiration of the program, Congress authorized an extension through August 8. This date passed without a second extension to the program, with the result that the SBA ceased taking applications to the program.

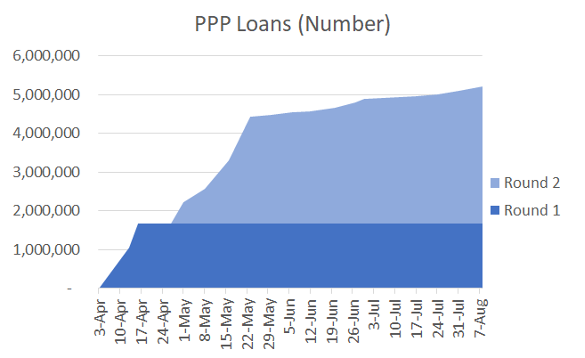

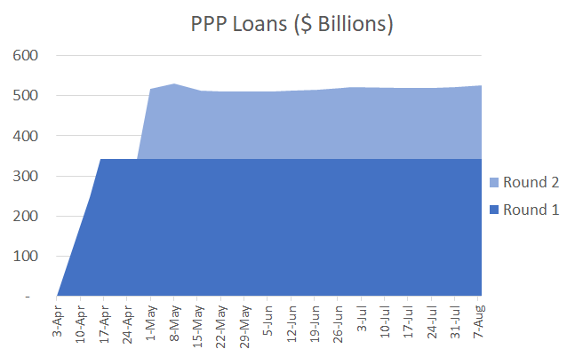

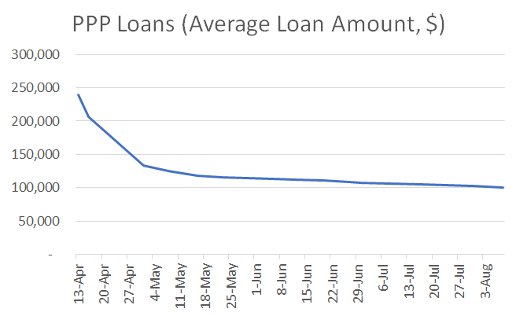

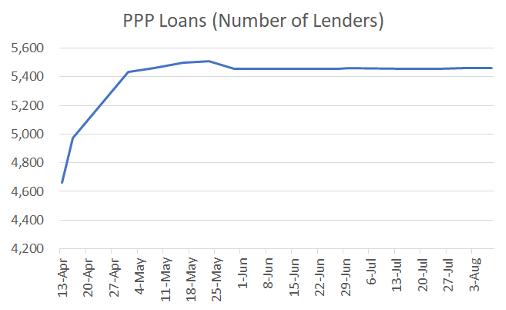

As a result, the PPP remains frozen in time as of August 8. As of that date, the SBA has disbursed $525 billion of the $659 billion so far appropriated by Congress to this program, with $134 billion, or 20 percent of PPP funds remaining available to the program.[3] Figures A through D (below) illustrate the total number and value of PPP loans disbursed to date in addition to the average value of a PPP loan and the total number of SBA-approved lenders across the entire life of the program. All data in Figures A through G come from the SBA website, as interpolated by the American Action Forum.[4]

Figure A

Figure B

Figure C

Figure D

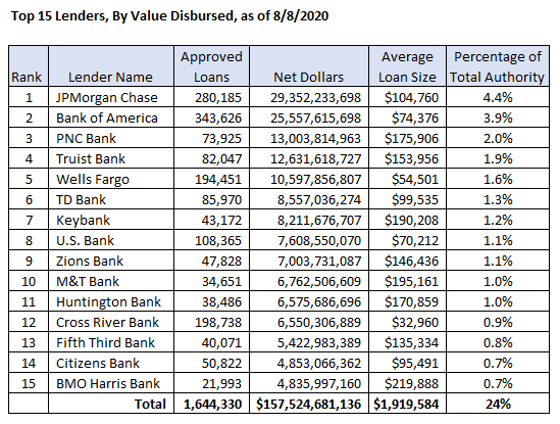

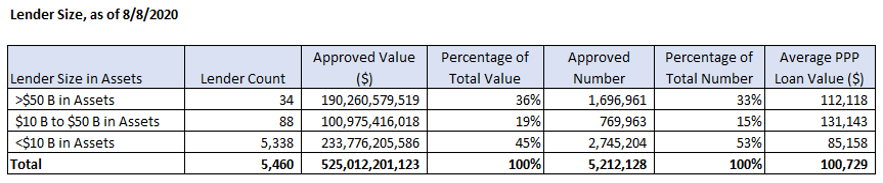

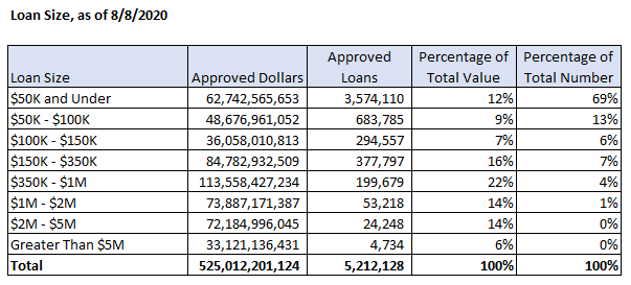

The SBA also made available data on the top 15 lenders by value disbursed, a breakdown of all lenders in the program by asset size, and a breakdown by loan size, as can be seen in Figures E through G below.

Figure E

Figure F

Figure G

Strengths of the Paycheck Protection Program

In June I noted in my writings that the PPP has been an enormous success; nothing has occurred since that time to change my opinion.[5] The data presented above are testament to what the SBA and Treasury have achieved in coordination with our nation’s banks – distributing $525 billion in financial assistance to small businesses in a time of crisis. In the first two weeks of April and the first two weeks of May, the PPP distributed a combined $513 billion, a testament to hard work at the SBA, which is used to handling fractions of this volume. The $525 billion distributed stands in stark relief to emergency aid to companies as provided by the Federal Reserve’s s13(3) emergency loan facilities, including the Main Street Lending Program, which to date has provided about $2 billion of the $600 billion it is authorized to back.[6] The total $669 billion authorized by Congress represents the single-largest component of the policy response to COVID-19 and alone is not far short of the estimated $840 billion cost of the 2009 Recovery Act.[7]

Injecting billions of dollars into a supply – and therefore liquidity – shock economic environment could be deemed a success in and of itself. The PPP went further, however, and recent research by Hubbard and Strain shows that the PPP “substantially increased the employment, financial health, and survival of small businesses.”[8]

Figure C shows that across the entire life of the PPP the average dollar size of each loan only decreased. This decline means that new loans were steadily smaller; the average loan size fell from $239,00 in the first week to $100,000 by the end of the program. The PPP is well beyond serving only “big” firms and reached increasingly smaller ventures. At the end of the program, loans under $50,000 represented 69 percent of total PPP loans, and 12 percent by value. Loans over $5 million represent less than 1 percent of total PPP loans, and only 6 percent by value. These proportions remained largely unchanged toward the end of the program.

Figure E demonstrates the vital role of our nation’s banks in providing the loans backed by the PPP and the SBA. While credit is of course due to JP Morgan Chase and the other financial titans that provided such a significant percentage of total PPP authority, the list of top 15 lenders demonstrates a considerable effort by smaller and regional banks, demonstrating that the program was created to engage the banking industry as a whole.

Weaknesses of the Paycheck Protection Program

Program Structure

The PPP was created as a forgivable loan program where loans effectively acted as grants. The SBA delegated significant authority to banks to allow borrowers to borrow up to 2.5 times their average monthly payroll costs, capped at $10 million.[9] This fairly unique structure capitalized on existing relationships between small businesses and their lenders and the capital available within the banking system to disburse large amounts of funds very quickly. In this the PPP succeeded. Initial criticisms of the program’s structure focused on the unusual necessity for the involvement of the banking industry and the incentives that would be required. The PPP was also criticized for the initial $349 billion being too low, a problem that was corrected.

It is tempting to see the remaining $134 billion unused by the PPP as a failing or a weakness, and indeed some commentators attempted to pin the blame on confusing program terms or a lack of clarity on forgiveness (see below). This assertion is refuted somewhat by the staggering news from the U.S. Census Bureau that nearly three-quarters of all small businesses in the United States received a PPP loan.[10] One of the most common criticisms of the PPP is that the program limited aid to a single application, and thus that the program was clearly geared toward a much shorter lockdown period. While this made sense at the time (particularly when the program was only authorized for $349 billion), nine months into a pandemic it is likely that businesses will require a second loan or source of support. This simple change would likely exhaust remaining PPP funds in short order.

If Congress has an appetite for more significant restructuring, the most effective reform could be to change the PPP’s focus from payroll to revenue. While a useful goal, payroll is not the most reflective metric of the costs and challenges small businesses face. A revenue-replacement program would capture the universe of expenses facing small businesses and would be easier to certify. Such a program would likely be expensive, however, with Strain and Hubbard estimating that replacing 80 percent of revenue for 12 weeks for eligible service-sector businesses would cost $1.2 trillion[11].

Allegations of Fraud and Inappropriate Recipients

In the first two weeks of April, publicly traded companies received $365 million in PPP loans, leading to considerable condemnatory media coverage.[12] Some of these recipients, including Shake Shack and the L.A. Lakers, subsequently chose to return the proceeds. It is worth noting that none of these firms had acted inappropriately, and any funds they might have received would have aided them in retaining payroll, the entire point to this program. Nonetheless, the SBA responded to these criticisms by indicating that any business with access to capital markets would be unlikely to make a good-faith certification that it was in need of aid, and Treasury Secretary Mnuchin committed to a review of every loan provided in excess of $2 million. Figure C above demonstrates that PPP loans only decreased in size, targeting increasingly smaller businesses.

In addition to singling out individual recipients of aid, the PPP has been criticized for not targeting industries most impacted by COVID-19, states most impacted by COVID-19, or minority groups disproportionately impacted by COVID-19.[13] The PPP as drafted was not designed to discriminate on any of these factors. That the program still had funds available when the PPP expired indicates that “less deserving” recipients did not prevent “more deserving” recipients from obtaining aid, however those terms are defined. Some potential recipients of aid may have been prevented from obtaining a PPP loan by virtue of a lack of relationships with banks and lenders, however.

The SBA inspector general’s office reported that it found “tens of thousands” of PPP loans disbursed for borrowers in amounts that exceeded what the borrower could claim.[14] In order to expedite the disbursement of aid to small businesses, the CARES Act removed usual bank requirements to validate and verify loan recipients (with the exception of anti-money laundering and financing of terrorism checks). Fraud in any government program is possible, doubly so when some of the safety rails are removed. That “tens of thousands” of cases of PPP fraud is, at maximum, two percent of all PPP loans provided should be considered a success. Again, if the program is functioning exactly as intended, it is difficult to brand this rate of fraud a failure – although if the PPP is reinstated, Treasury and the SBA can and should do more to reinforce the decision to hold harmless banks involved in borrower fraud lest banks stop offering PPP loans.

Administration

The unprecedented size of the relief and speed at which aid needed to be deployed to save jobs would be a challenge for even the largest agency. But the SBA is tiny by the standards of other cabinet agencies. It had less than 4,000 full-time equivalent employees in fiscal year (FY) 2019; in comparison, the Department of Commerce had about 52,000 for the same year, according to its FY 2020 budget request.[15] [16]

The SBA’s capacity presented a major potential implementation challenge. Across its lending platforms, SBA approved $28.2 billion in loans in FY 2019 – 8 percent of what it is being asked to distribute in short order[17]. In order to overcome these challenges, the process will have to be streamlined to an extraordinary degree. In addition, the agency’s budget request for 2020 was $820 million, of which less than half would support direct-lending assistance.[18] $349 billion effectively equals roughly one thousand times the usual annual guaranty amount, delivered in only two months.

The SBA and Treasury’s administrative challenges were not simply limited to personnel, and the PPP called attention to ageing government and agency IT systems, seen by Strain and Hubbard as the key factor preventing the U.S. government from having lent directly to small businesses themselves[19].

Forgiveness, Verification, and Validation

In subsequent months, media attention and the force of criticism of the PPP has shifted to the final piece of the PPP term sheet: forgiveness. Initial SBA and Treasury information was extremely thin on the ground regarding the eventual forgiveness of PPP loans, the last part of the process and the step that turns PPP loans effectively into grants.

Subsequent FAQ releases have done some but not enough to explicate the process of forgiveness and leave lenders lost as to the process.[20] Confusion around the terms of the PPP was not (and is not) limited to the banks involved in the program, with some studies noting that 3 in 4 PPP borrowers were confused by loan terms.[21]

As noted above, as drafted, the CARES Act did not provide sufficient guidance on how the information flowing from borrower to lender to SBA should be verified and validated. A strict interpretation of the Act implied that significant portions of the usual underwriting process should be taken on good faith, with what little testing that the Act requires (for instance, that a business seeking relief be in operation on February 15, 2020) placed the burden of verification on lenders. This, combined with confusion about the forgiveness regime, may have made many lenders reluctant to participate in the program.[22]

Conclusions

The PPP was the single-largest source of support for the economy for the month of April. In that same month the economy shed 20 million jobs. It is painful to imagine how much worse this may have been without the prompt intervention of the SBA, although one MIT paper estimates that as of the first week of June the PPP had saved 2.3 million jobs.[23] It speaks volumes, to my mind, that one of the most pressing criticisms of the PPP was that it only allowed for businesses to receive one loan. How significant can all other criticisms of the PPP be if its biggest flaw is preventing businesses from accessing it again?

It does not seem a stretch to say both that the PPP has done much good and that, given the length of COVID-19 lockdowns, it may be time to reinstate and refund the program. If Congress does so without making any program changes this would still likely be an enormous success. If the appetite for change exists, I would strongly recommend that Congress consider a revenue rather than payroll-retention structure and allow for multiple applications as the pandemic continues. In addition, Treasury and the SBA must make the terms and forgiveness of PPP loans as clear as possible while improving program oversight and resources at both agencies.

Thank you, and I look forward to your questions.

[1] https://www.banking.senate.gov/newsroom/press/cares-act-title-iv-summary

[2] https://www.congress.gov/bill/116th-congress/house-bill/266

[3] https://www.americanactionforum.org/research/tracker-paycheck-protection-program-loans/

[4] https://www.americanactionforum.org/research/tracker-paycheck-protection-program-loans/

[5] https://www.americanactionforum.org/daily-dish/fixing-the-ppp/

[6] https://www.americanactionforum.org/insight/assessing-financial-support-for-businesses-during-the-pandemic-the-state-of-play/

[7] https://www.stlouisfed.org/on-the-economy/2017/may/which-bigger-2009-recovery-act-fdr-new-deal

[8] http://ftp.iza.org/dp13808.pdf

[9] https://www.americanactionforum.org/insight/financial-services-provisions-in-the-coronavirus-aid-relief-and-economic-security-cares-act-final-version/

[10] https://portal.census.gov/pulse/data/

[11] http://ftp.iza.org/dp13808.pdf

[12] https://apnews.com/article/6c5942eec36cc43b25ad5df5afebcfbd

[13] https://www.pgpf.org/blog/2020/08/did-the-paycheck-protection-program-work-the-way-it-was-supposed-to

[14] https://www.sba.gov/about-sba/oversight-advocacy/office-inspector-general

[15] https://www.sba.gov/sites/default/files/2019-12/SBA_FY_2019_AFR-508.pdf

[16] https://www.commerce.gov/sites/default/files/2019-03/FY_2020_DOC_BiB-032019.pdf

[17] https://www.sba.gov/sites/default/files/2019-12/SBA_FY_2019_AFR-508.pdf

[18] https://www.sba.gov/sites/default/files/2019-04/SBA%20FY%202020%20Congressional%20Justification_final%20508%20%204%2023%202019.pdf

[19] http://ftp.iza.org/dp13808.pdf

[20] https://www.nytimes.com/2020/10/09/business/small-business-ppp-loans-forgiveness.html

[21] https://www.bankingdive.com/news/borrowers-paycheck-protection-program-confusion-loan-terms/578577/

[22] https://prospect.org/coronavirus/unsanitized-why-banks-dont-want-to-help-small-businesses/

[23] http://economics.mit.edu/files/20094