Week in Regulation

March 29, 2021

Congressional Review Act Finally Steals the Spotlight

In the pages of the Federal Register, last week was a rather placid one. There were only eight rulemakings with some measurable economic impact, and none had a significant impact. The real drama of the week came in the Congressional Record as members of Congress introduced a handful of measures seeking to repeal Trump-era rules. Across all rulemakings, agencies published $14.9 million in total net costs but cut 9,963 hours of annual paperwork.

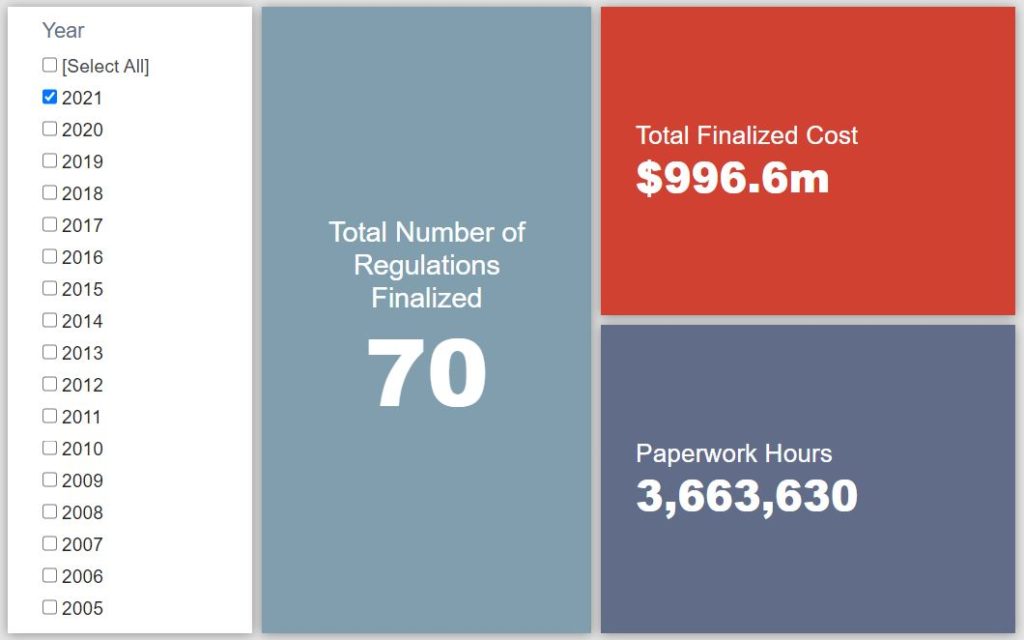

REGULATORY TOPLINES

- Proposed Rules: 68

- Final Rules: 61

- 2021 Total Pages: 16,254

- 2021 Final Rule Costs: $996.6 million

- 2021 Proposed Rule Costs: -$8.3 billion

NOTABLE REGULATORY ACTIONS

As noted above, this week did not have much in terms of rulemaking activity. Perhaps the only interesting actions were two proposals from the Environmental Protection Agency (EPA) and Nuclear Regulatory Commission (NRC), respectively, that actually estimated cost reductions for affected entities. EPA’s proposed rule on “Pesticide Product Performance Data Requirements for Products Claiming Efficacy Against Certain Invertebrate Pests” would consolidate labeling requirements for certain pesticides, saving producers approximately $7 million over 10 years. The NRC proposal regarding the “American Society of Mechanical Engineers 2019-2020 Code Editions” would align certain regulatory provisions with “voluntary consensus standards.” The commission expects that this will provide greater regulatory clarity and thereby yield $6.3 million in “averted costs” for industry actors relative to a no-action baseline.

TRACKING THE ADMINISTRATIONS

As we have already seen from executive orders and memos, the Biden Administration will surely provide plenty of contrasts with the Trump Administration on the regulatory front. And while there is a general expectation that the new administration will seek to broadly restore Obama-esque regulatory actions, there will also be areas where it charts its own course. Since the American Action Forum’s RegRodeo data extend back to 2005, it is possible to provide weekly updates on how the top-level trends of President Biden’s regulatory record track with those of his two most recent predecessors. The following table provides the cumulative totals of final rules containing some quantified economic impact from each administration through this point in their respective terms.

![]()

With the only final rule of last week being a fairly negligible airworthiness directive, there was minimal movement in terms of week-over-week trends. Similar to the week prior, the trends in regulatory activity across the past three administrations remain remarkably stable. The only real divergence was a 14 rule outburst (as compared to one apiece for Biden and Trump) during a similar period in the Obama Administration. Despite that uptick in volume, those rules’ combined impact was relatively modest at only $23 million in estimated costs.

THIS WEEK’S REGULATORY PICTURE

This week, the Congressional Review Act (CRA) comes out of hibernation.

CRA enthusiasts were perhaps a little disappointed heading into this week that no resolutions of disapproval had yet been introduced in the 117th Congress. For the uninitiated, the CRA allows Congress to disapprove of regulations, essentially repealing them. It is seldom used, however, because there are only certain circumstances when it is viable. Those conditions are currently met in that Democrats have unified control of the House, Senate, and presidency and the previous president was of a different party. Thus, Democrats can now take advantage of the provision of the CRA that allows for the Senate to pass a resolution with just 50 votes at the start of a new Congress. More information on the unique dynamics of the CRA is available here.

Prior to 2017, the CRA – passed in 1996 – had only been successfully used once. In 2017, that changed, as congressional Republicans and President Trump used the law to overturn 16 Obama Administration regulations. That success, and Democrats’ vehement opposition to many Trump-era regulatory (and deregulatory) actions, led many to speculate that the CRA would be used to overturn several of those rules.

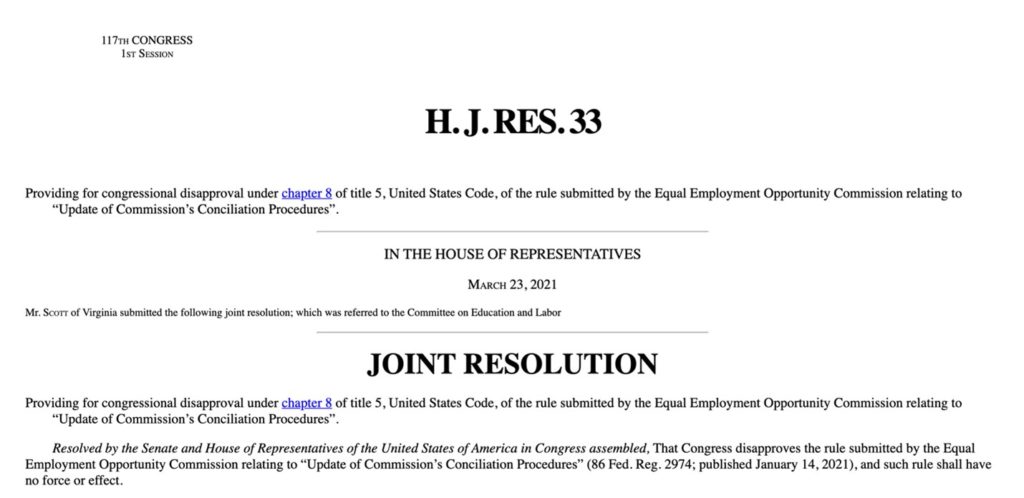

Alas, that speculation failed to materialize – until this week. On March 23, a resolution disapproving of an Equal Employment Opportunity Commission (EEOC) rule regarding conciliation procedures was introduced. On March 25, Democrats introduced three more resolutions to disapprove of an EPA methane rule, an Office of the Comptroller of the Currency rule defining “true lender,” and a Securities and Exchange Commission rule on procedural requirements and resubmission thresholds.

Media reports indicate that Senate Majority Leader Chuck Schumer expects the Senate to pass the resolutions involving the EEOC rule and the methane rule, though passage of any of the resolutions will likely rely on Democrats’ ability to keep all of their party members on board. Whether more resolutions follow remains to be seen. The clock is ticking, though, as the window for introducing resolutions subject to the Senate’s 50-vote threshold is expected to expire on April 4.

TOTAL BURDENS

Since January 1, the federal government has published $7.3 billion in total net cost savings (with $996.6 million in new costs from finalized rules) and 7.3 million hours of net annual paperwork burden reductions (with 3.7 million hours in increases from final rules).