Week in Regulation

January 5, 2026

Holiday Special: Two “Weeks” in One

Between the extended Christmas break announced by President Trump and the typical New Year’s Day holiday, the past two weeks included only six official work days for federal agencies. Despite the truncated period marking the end of 2025 and beginning of 2026, agencies issued regulations at a steady clip. There were 21 rulemakings that contained some kind of quantifiable impact. Of these, four actions – all deregulatory, no less – had roughly $1 billion or more in economic effects. Across all rulemakings, federal agencies published roughly $4.9 billion in total cost savings but added 4.3 million paperwork burden hours.

REGULATORY TOPLINES

- Proposed Rules This Week: 35

- Final Rules This Week: 70

- 2025 Total Pages: 61,448

- 2025 Final Rule Costs: -$129.7 billion

- 2025 Proposed Rule Costs: -$849.2 billion

- 2026 Final Rule Costs: -$2.4 billion

- 2026 Proposed Rule Costs: $392.4 million

NOTABLE REGULATORY ACTIONS

As mentioned above, the most notable items of the past two weeks came in a series of fairly significant deregulatory actions. These include (in descending order of total estimated cost savings):

- A Department of Health & Human Services (HHS) proposed rule seeking to streamline various regulatory provisions “regarding Health information technology standards, implementation specifications, and certification criteria and certification programs for health information technology, and information blocking” ($1.8 billion in total savings);

- A Department of Treasury final rule “amending the Anti-Money Laundering/Countering the Financing of Terrorism (AML/CFT) Program and Suspicious Activity Report (SAR) Filing Requirements for Registered Investment Advisers and Exempt Reporting Advisers (IA AML Rule) to delay the effective date by two years” ($1.5 billion in total savings);

- An Environmental Protection Agency (EPA) final rule extending “certain deadlines within the final rule titled “Standards of Performance for New, Reconstructed, and Modified Sources and Emissions Guidelines for Existing Sources: Oil and Natural Gas Sector Climate Review” ($1.4 billion in total savings); and

- Another EPA final rule certifying the rescission of a Biden-era rule under the Congressional Review Act (CRA) ($936 million in total savings[1]).

While this calendar-turning period was broadly deregulatory in nature, there were some substantial burden-adding rulemakings as well. A proposed rule jointly issued by HHS, the Internal Revenue Service (IRS), and the Department of Labor on “Transparency in Coverage” would bring an annual average of approximately 3.6 million hours-worth of new paperwork requirements. There was also another proposed rule from IRS seeking to:

Add new regulations to the Income Tax Regulations (26 CFR part 1) under sections 163 and 6050AA of the Internal Revenue Code (Code), as amended and enacted, respectively, by section 70203(a) and (c)(1) of Public Law 119-21, 139 Stat. 72, 176-179 (July 4, 2025), commonly known as the One, Big, Beautiful Bill Act (OBBBA), related to the allowance of a Federal income tax deduction under section 163(a) and (h)(4) for qualified passenger vehicle loan interest.

The agency estimates that the additional reporting requirements for these revisions will amount to 1.5 million hours of paperwork annually.

TRACKING TRUMP 2.0

Shortly before the holiday period, reports broke that the Trump Administration – via Office of Management and Budget (OMB) Director Russ Vought – has now claimed 646 deregulatory actions against only five regulatory actions (a 129:1 ratio) with total savings of $211 billion under the auspices of Executive Order (EO) 14192. Details on how Director Vought arrived at these totals are scant beyond these initial reports. For instance, an accompanying blurb attributes $25.4 billion in savings to the announcement from last July that the Transportation Security Administration would no longer require passengers to remove shoes ahead of airport security screening. It is not clear how OMB arrived at this total and there does not seem to be any other readily available supporting documentation.

By way of comparison, during the first term of the Trump Administration, OMB produced a series of reports (see appendix) each fiscal year detailing its deregulatory efforts. Later this week, the American Action Forum (AAF) will produce our overall review of 2025 regulatory policy that will include our accounting of EO 14192 activity according to rulemakings included in the RegRodeo database. Additionally, especially as CRA developments continue to wane, this portion of the Week in Regulation will focus more on providing an ongoing accounting of EO 14192 items to compare to whatever further documentation the administration provides to bolster its claims.

The AAF CRA tracker provides a full survey of activity under the law thus far into this term. As of today, members of the 119th Congress have introduced CRA resolutions of disapproval addressing 70 rulemakings across the Biden and Trump Administrations that collectively involve $138 billion in estimated compliance costs. Of these, 22 have been passed into law[2], repealing a series of Biden Administration rules that had a combined $3 billion in associated compliance costs. The Trump Administration estimates that the repeal of this rule yields an additional $936 million in savings. While the main window of CRA action has largely passed, there are still outstanding resolutions that could move legislatively. AAF will continue to monitor and update such developments as appropriate.

TOTAL BURDENS

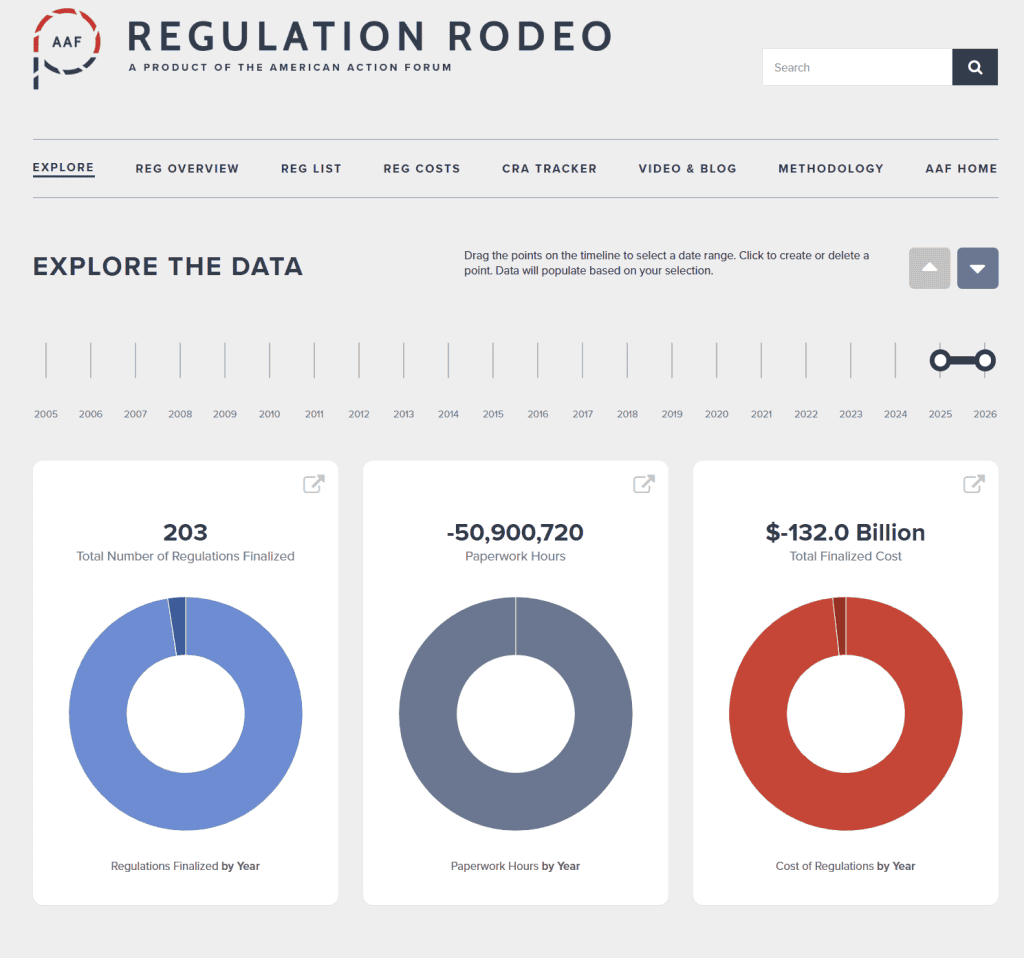

For 2025 and the one day so far of 2026, the federal government has published $980.9 billion in total regulatory net cost savings (with $132 billion in cost savings from finalized rules) and 70.8 million hours of net annual paperwork cuts (with 50.9 million hours coming from final rules).