Weekly Checkup

July 12, 2017

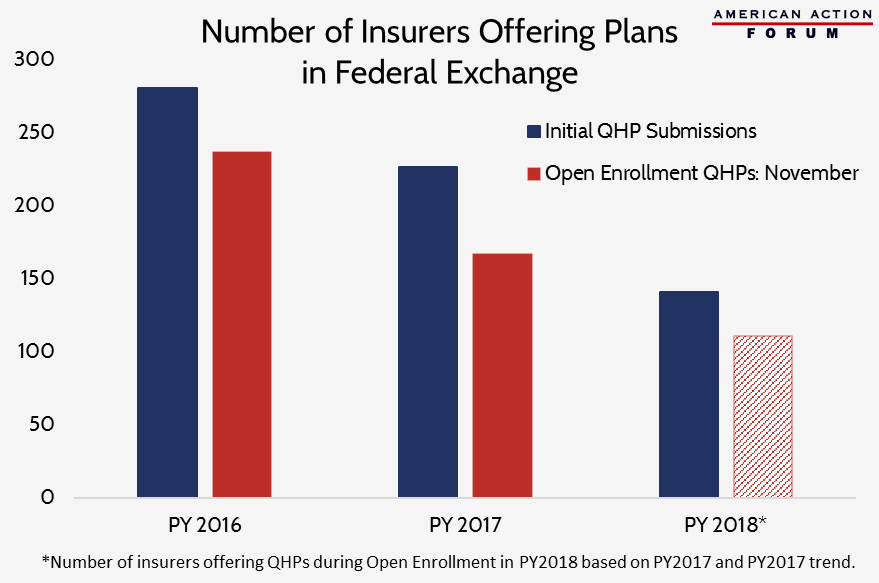

ACA Exchange Insurer Participation Continues to Decline

Each Spring, insurers wishing to participate in the Affordable Care Act’s (ACA) Federal exchange the following year must submit initial rate filings about the insurance plans they intend to offer to the Centers for Medicare and Medicaid Services (CMS). These rate filings include details about the plan’s benefit design, expected premium rate, and coverage area. CMS must review and approve insurers’ plans prior to the start of Open Enrollment; if initial submissions are not approved, insurers are given an opportunity to revise and resubmit their plans. For plan year 2016, 281 insurers initially submitted filings; 84 percent ultimately offered plans. For 2017, initial filings fell to 227, and 167 insurers (73.5 percent) ultimately offered plans. CMS released data on Monday showing that initial filings for next year fell 50 percent from 2016 to 141. If 79 percent of insurers who submitted an initial request offer a plan during Open Enrollment in November (the average rate from the past two years), there would be only 111 issuers still participating in the ACA’s Federal exchange in 2018. The continued reduction in market participation is a result of the failures of the ACA. Consumers are increasingly left with fewer choices, and less competition leads to higher prices. Congress must act to reverse this trend and ensure individuals have affordable health insurance choices next year.