Weekly Checkup

April 24, 2020

COVID-19 and the Fiscal Sustainability of Federal Health Care Programs

Over the course of the last month, Congress has enacted roughly $4 trillion in spending measures related to the public health and economic fallout of the coronavirus pandemic. And that’s only the start: Politicians are already positioning themselves for a likely fourth phase of emergency spending. Much of this money has been devoted to the health care response, and health care will remain a priority for future spending, particularly the costs for the uninsured and newly uninsured. But all of this new spending is deficit spending, which points to the underlying question facing all of the United States’ health care programs: How are we going to pay for them?

This week the Medicare Trustees released their annual report on the program’s fiscal outlook. Unsurprisingly, Medicare’s financial future is bleak. AAF has released this analysis of both the Medicare and Social Security Trustees’ reports, but here are the Medicare program highlights (or rather lowlights). Medicare’s Hospital Insurance Trust Fund is expected to be bankrupt in 2026. Medicare spent $396 billion more on medical services in 2019 than it collected in payroll taxes and monthly premiums. Cumulatively, since the creation of the Medicare program, outlays have exceeded revenues by $5.5 trillion, and Medicare’s cash shortfall accounts for 34 percent of the national debt. Much of that shortfall has come in recent years. During the Obama Administration, Medicare’s cash shortfall was $2.4 trillion, and by the end of this year the shortfall under the Trump Administration’s stewardship is projected to reach $1.5 trillion. Combined, Medicare and Medicaid are expected to cost $2 trillion annually by 2025. Further, those figures don’t account for anticipated increases in Medicaid enrollment and future increases in federal funding to states that may occur as a result of the current pandemic and economic collapse. Those numbers also haven’t touched on other federal health programs such as the Affordable Care Act’s insurance subsidies.

In the absence of structural reforms to the Medicare program, beneficiaries and taxpayers would face extraordinarily burdensome measures to fully fund the current benefits. It would require a 15 percent increase in the annual Medicare payroll tax to cover the Medicare Part A (hospital services) shortfall. To address the shortfall in Medicare Part B (physician services), the typical Medicare enrollee’s annual premium would need to increase by $4,431. And to address the shortfall in Medicare Part D (prescription drugs), the average senior would see their drug plan premium increase by 518 percent, or $2,062 annually. These steps are politically untenable, but they serve to highlight just how intractable a problem solving our looming entitlement crisis has proven to be. Nevertheless, in the absence of action, Medicare will collapse.

As the immediate crisis fades over the next 12 to 18 months, attention will inevitably turn to further expansion of federal health programs. Short-term emergency increases in federal spending on Medicaid, efforts to extend coverage for COVID-19 care, or proposals to cover COBRA premiums during the immediate aftermath, will shift to renewed calls for Medicare for All as well as efforts to extend the emergency provisions into more permanent expansions. And there will always be another crisis on the horizon to justify pushing off necessary reform to our entitlement programs. But if we continue down our present course, eventually the health care crisis will be the insolvency of the programs themselves.

In the midst of this pandemic and requisite emergency spending, it’s important not to lose sight of the long-term fiscal impact of federal health care programs. Now may not be the time to sweat the financials, but the bill for both these emergency actions and our long-term obligations will come due eventually. For Medicare, that reckoning will be sooner than many would like to acknowledge. If we refuse to address entitlement reform before it’s too late, the crisis will be one of our own making.

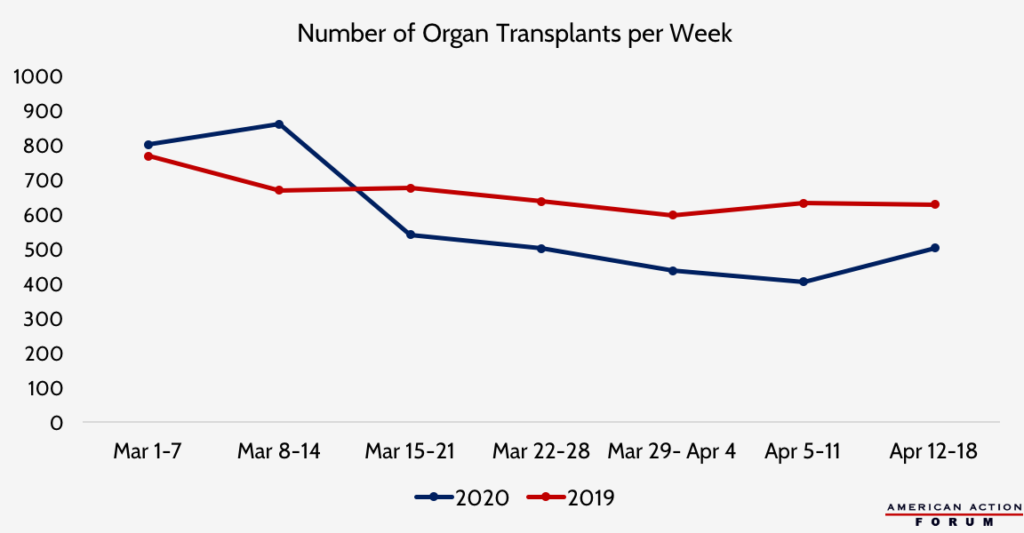

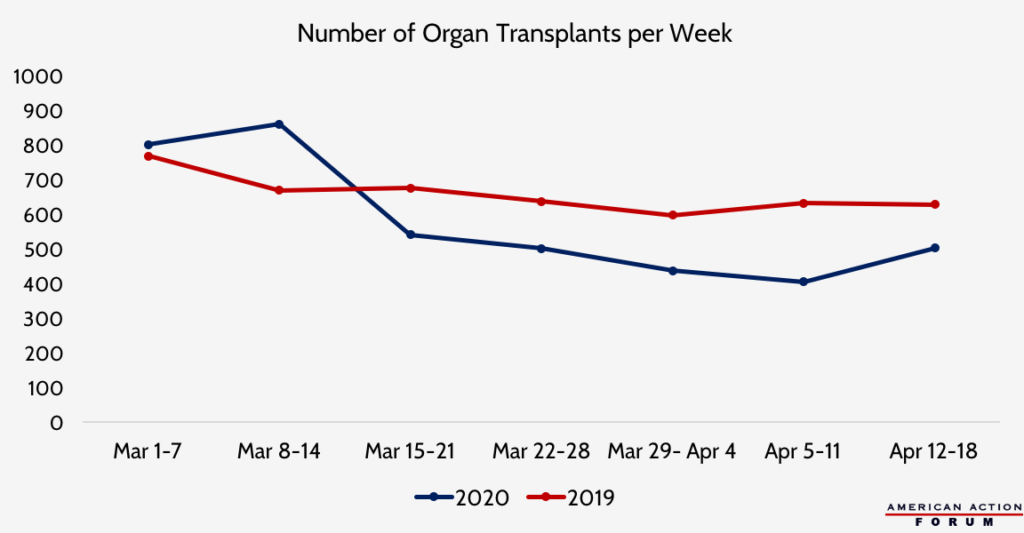

Chart Review: The Impact of COVID-19 on Organ Transplants

Margaret Barnhorst, Health Care Policy Intern

Data source: UNOS Donation and Transplantation Database

From Team Health

Additional Health Care Funding in the Paycheck Protection Program Increase Act – Health Care Policy Director Christopher Holt

The latest COVID-19 response bill includes $100 billion in health-related spending, although it does not include language that changes controversial aspects of earlier bills.

The Bridge to a Vaccine: Antiviral and Antibody Therapies for COVID-19 – Health Care Data Analyst Andrew Strohman

Antiviral and antibody treatments could help COVID-19 patients recover, providing society greater security until a vaccine arrives.

The Future of America’s Entitlements: What You Need to Know About the Medicare and Social Security Trustees Reports

Several AAF experts highlight the key figures from the recently released Trustees Reports for the United States’ largest entitlement programs.

Worth a Look

Kaiser Health News: Coronavirus Fuels Explosive Growth In Telehealth ― And Concern About Fraud

New York Times: Vaccine Rates Drop Dangerously as Parents Avoid Doctor’s Visits