Weekly Checkup

September 21, 2016

Deductibles Matter, Too

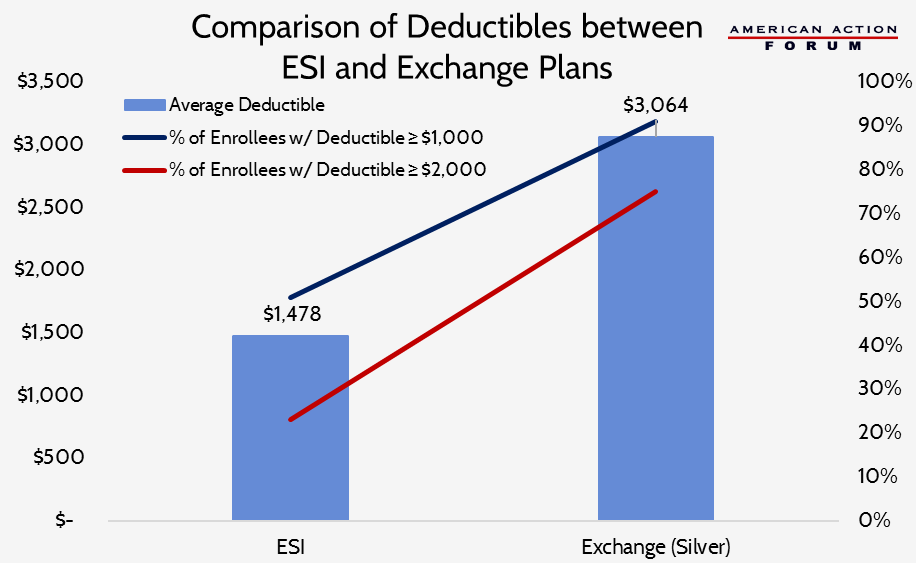

As open enrollment season approaches, much attention has been given to premium rate increases among Exchange plans, as well as insurers leaving the Exchange market and co-ops collapsing. However, consumers should be paying attention to much more than just premiums. While premium payments ensure you have health insurance coverage, they rarely ensure you can actually access care when you are sick. Two fundamental factors affecting access to care include the size and depth of provider networks and consumer cost-sharing responsibilities, such as deductibles and co-payments/co-insurance. Recent reports have shown there are stark differences in these factors between Exchange plans and employer-sponsored insurance (ESI) plans. Only two percent of “Silver”-level Exchange plans (which enroll 70 percent of Exchange customers) have no deductible; 17 percent of individuals covered by ESI plans have no deductible. The average deductible for a Silver-level Exchange plan in 2016 is $3,064 for plans with a combined medical and prescription drug deductible; for plans with separate deductibles, the sum of the average deductibles for each component is $3,478. The average deductible for ESI plans is $1,478. Among ESI policyholders, only 51 percent have a deductible over $1,000; 23 percent have a deductible over $2,000. Among Exchange enrollees, those percentages are 91 and 75, respectively. Further, many ESI covered individuals benefit from employer contributions to their health savings accounts (HSAs); 9 percent receive enough to cover the full cost of their deductible and 34 percent receive enough to bring the enrollee’s share of the deductible to less than $1,000.