Weekly Checkup

March 16, 2018

Expanding Age Bands to Lower Premiums

Since Congress pivoted last year from health care to tax reform, policymakers and wonks have debated how, or even whether, Congress should attempt stabilizing the individual health insurance marketplace. This debate is now entwined in the fiscal year 2018 government spending bill that must be passed by March 23. The White House has reportedly added to the mix a list of health insurance market policy changes the president wants as part of any stabilization packaged, including a change in the Affordable Care Act’s (ACA) age band restrictions.

One of the ACA’s key provisions was the community rating of premiums. In a nutshell, insurers can no longer adjust the premiums they charge to individuals based on various risk factors, such as their health status or gender. The ACA allowed premium variation in only two cases. The first was a surcharge for individuals who smoke tobacco products, and the second was a three-to-one premium variation based on age. This means that while insurers can’t charge healthy people less than they charge sicker people, they can charge older people more than they charge younger people—but not more than three times as much. In the pre-ACA individual market where no such limitation existed, the average premium variation between the oldest and youngest enrollees was a ratio of roughly five to one.

AAF’s Jonathan Keisling explains the age band issue in greater detail here, but to cut to the chase, the age bands function as a proxy for rating based on health status. Older enrollees are more likely to have higher health expenses. But limiting what an insurer can charge them relative to younger—likely healthier—enrollees to a three-to-one ratio results in higher premiums for younger individuals. This, in turn, makes health insurance less attractive to the so called “young invincibles.” And if they decline to buy insurance because of the high costs (resulting in part from the age bands), the overall risk pool becomes less healthy, and premiums climb even higher.

A host of the ACA’s design features have resulted in higher health insurance premiums, but the three-to-one restriction has had a particularly significant impact. Conservative health wonks have long advocated for President Trump’s proposal to increase the ratio to five to one. This change could put downward pressure on overall average premiums by increasing enrollment and improving the health of the risk pool.

Chart Review

Tara O’Neill Hayes, Deputy Director of Health Care Policy

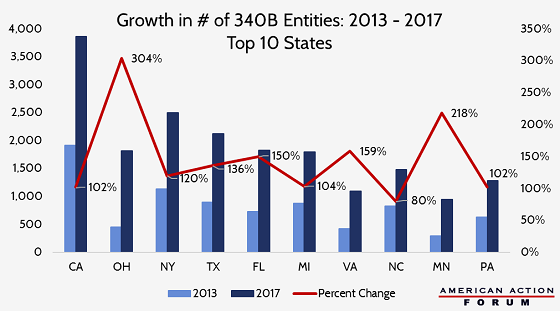

Yesterday, the Senate HELP Committee held a hearing on the need for greater oversight of 340B prescription drug discount program. The 340B program requires drug manufacturers to provide discounts for all of their covered outpatient drugs purchased by an eligible health care facility for any “qualified patient.” After the first 13 years of the 340B program, only 583 hospital organizations participated. Repeated expansions in eligibility as well as the ability of hospitals to adopt “child sites” (outpatient facilities to which the program’s discounts can be extended) have resulted in the number of qualifying entities to surpass more than 42,000 as of November 2017. The chart below shows the 10states which have seen the greatest increase in the number of 340B entities over the past four years. Evidence shows the program has led to health care providers consolidating, resulting in fewer choices for patients, increased costs for health care services—particularly cancer treatments—and decreased prescribing of cheaper generic drugs at 340B sites.

– Chart from Market Distortions Caused by the 340B Prescription Drug Program

New York Times: Why Is U.S. Health Care So Expensive? Some of the Reasons You’ve Heard Turn Out to Be Myths

Axios: Exclusive: Alexander’s ACA market stabilization proposal