Weekly Checkup

November 15, 2019

Is a Medicare Buy-In Plan Viable?

This week, AAF’s Center for Health and Economy (H&E) released modeling on the cost and coverage impacts of a Medicare buy-in plan—specifically H.R. 1346, “The Medicare Buy-in and Health Care Stabilization Act of 2019.” As discussed in last week’s Checkup, the popularity of Medicare for All (M4A) is declining as its details get parsed in the Democratic presidential primary. Simultaneously, other proposals for expanding coverage—albeit ones that have not been as closely examined—have become much more popular. According to the Kaiser Family Foundation, 77 percent of Americans have a favorable opinion of extending a Medicare buy-in option to Americans aged 50 to 64.

But what would the reality of Medicare buy-in look like? According to our modeling, the reality wouldn’t live up to the hype.

H.R. 1346, like most Medicare buy-in proposals, is more of a public option/Medicare hybrid, and the bill does far more than just create a new insurance option. H.R. 1346 makes a number of changes to the Affordable Care Act (ACA) in addition to creating a “Medicare” plan that Americans age 50 to 64 can purchase. The major ACA changes include establishing a reinsurance program to protect insurers selling plans in the ACA marketplace against especially high-cost patients, and restarting and increasing cost sharing reduction (CSR) payments to marketplace insurers.

The buy-in plan itself would be sold in the individual market; the enrollees would be charged a premium set at the average annual per capita cost for benefits and administrative expenses under Medicare Parts A, B, and D. Additionally, if an individual purchasing the buy-in plan is eligible for premium tax credits or CSR payments through the ACA exchanges, those benefits can be applied to the buy-in plan.

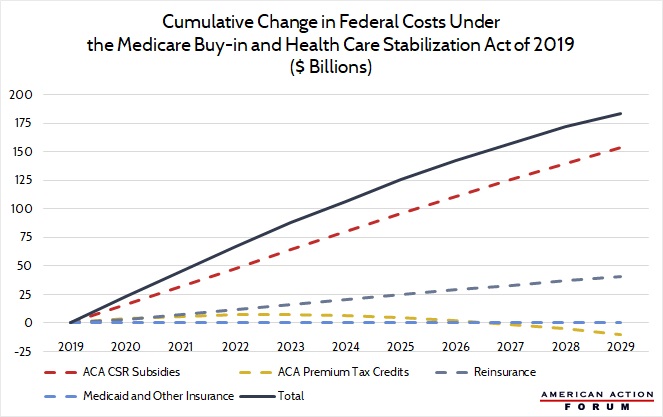

Altogether, H&E finds that the number of people insured under the package of policies in H.R. 1346 would increase by about 1 million initially, relative to H&E’s baseline, but that increase would drop to less than 500,000 by 2029. Just under 300,000 people would purchase the Medicare buy-in plan in the first year, and the number of buy-in enrollees would decrease over time to less than 200,000 by 2029. Overall, H.R. 1346 would increase federal spending by $184 billion over 10 years. Of note, H&E found that H.R. 1346 would lead to a decrease in premiums paid for catastrophic, Bronze, Silver, and Platinum marketplace plans of between 4 and 12 percent. That drop in premiums, however, is most directly the result of the reinsurance program, and not the Medicare buy-in plan. Additionally, premiums for the Medicare buy-in plan are expected to grow faster then marketplace plans of a similar actuarial value.

What do all of these figures mean? This Medicare buy-in proposal would spend $186 billion over 10 years to reduce the uninsured population ultimately by less than 500,000, or 0.2 percent, with the introduction of the Medicare buy-in contributing little. To put it another way, H&E projects that under current law about 29 million Americans will be uninsured at some point in 2020, but under H.R. 1346, after spending $186 billion, the country will still have roughly 33 million Americans uninsured for at least part of 2029.

Medicare buy-in is an increasingly attractive policy option for politicians. After all, it doesn’t take away private insurance, any impacts to the individual market would likely be positive, and it can be framed as a choice. But what H&E’s modeling has found is that Medicare buy-in would spend a lot of money to do very little. Medicare buy-in is fools gold: It won’t do much to address the uninsured, but it will increase federal spending.

Chart Review

Jonathan Keisling, Health Care Policy Analyst

Many of the Medicare buy-in bills written in the last year and a half include far more than the introduction of a public option offered through the Affordable Care Act’s (ACA) exchanges. Consider H.R. 1346, “The Medicare Buy-in and Health Care Stabilization Act of 2019”: This bill allows individuals aged 50 to 64 to buy into Medicare using ACA premium tax credits and cost-sharing reduction subsidies (if they qualify), while also providing new funding for reinsurance. The AAF Center for Health and Economy’s plan-choice model found that H.R. 1346’s funding for reinsurance and increased cost-sharing reduction subsidies make up the bulk of its projected $184 billion of increased spending. Despite this increase in spending, net enrollment is only projected to increase by 500,000 by the year 2029, reducing the uninsured rate by 0.2 percent.

From Team Health

H.R. 1346 – The Medicare Buy-in and Health Care Stabilization Act of 2019

AAF’s Center for Health and Economy modeled the impact of implementing a recent Medicare buy-in proposal.

The AAF Exchange: Medicare for All

Christopher Holt examines the forces driving the ascendance of Medicare for All and assesses the policy idea’s assumptions and potential impact.

Worth a Look

Wall Street Journal: China’s Drug Market Is Opening Up

Washington Post: Deadly superbugs pose greater threat than previously estimated