Weekly Checkup

April 26, 2019

Medicare is Short on Money, and Time

Democrats announced this week that they will convene a hearing of the House Rules Committee on Medicare-for-all legislation, likely setting up a floor vote on the House version of BernieCare. It’s thus important that policymakers and the public understand exactly how the Medicare program is doing. Fortunately, the Medicare Trustees released their annual report on the program’s financial health this week, enabling us to do just that.

As Democrats pay lip service to expanding Medicare coverage to more (or even all) Americans, the Trustees report provides a word of caution. The American Action Forum has already detailed some of their key findings, but the primary takeaway is stark: Medicare’s hospital trust fund will be bankrupt in 2026. This timeline should come as a shock to exactly no one, but the program’s fiscal outlook is staggeringly bad. Medicare’s cash shortfall in 2018 was $363 billion: $40 billion from Part A, $244 billion from Part B, and $79 billion from Part D. Since Medicare’s enactment, the program has accumulated a total shortfall of $5.1 trillion. Only twice since 1965 has Medicare not run an annual shortfall. Over the Obama Administration’s 8 years managing the program alone, the shortfall totaled $2.4 trillion. Now the Trustees project that by the end of the Trump Administration’s third year, Medicare will have accumulated another $1.1 trillion in shortfalls.

How would one right the ship? In order to cover 2018’s deficit (which, by the way, for Part B and D was covered by general revenue, further constricting funds for discretionary programs) the Medicare payroll tax would need to increase by 15 percent, Part B premiums would need to be 261 percent higher, and Part D premiums would have to increase 502 percent. Those rate hikes might be a recipe for fiscal sustainability, but advocating for them is also a recipe for electoral defeat on a grand scale. Maybe that’s why President Trump, like many of his predecessors, has systematically avoided undertaking any real effort to reform the program to ensure its long-term, and increasingly short-term, survival.

Elected officials have been derelict in their duty when it comes to Medicare for decades, but Democrats are taking it one step further in recent months by pushing to increase the financial burden of this and other health programs on the federal coffers. For the most part, proposals being marketed as “Medicare for All” or “Medicare Buy-in” aren’t really expansions of the program, but every single proposal being discussed on the left would increase federal obligations for health care spending, further draining the general funds that have been propping up the Medicare program. Without serious reforms to Medicare, we won’t be facing Medicare for All, but rather Medicare for none.

Chart Review

Tara O’Neill Hayes, Deputy Director of Health Care Policy

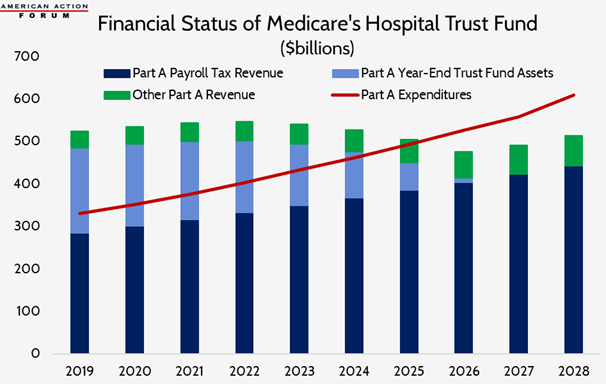

The claim that Medicare is “going bankrupt” technically refers just to Medicare Part A’s Hospital Insurance (HI) Trust Fund, which accounts for 40 percent of Medicare’s total expenditures. The graph below illustrates the financial situation of the HI Trust Fund, which is primarily funded by payroll taxes as well as a few other income streams. Its assets are quickly depleting: While there were $200 billion remaining at the end of 2018, the cash reserve will be down to just $10.6 billion at the end of 2025. With expenditures in 2026 expected to total $527 billion, the expected income of $466 billion would leave $50 billion in unpaid hospital bills. Unlike the rest of the Medicare program, Part A expenses may only be paid from money on hand; borrowing from the Treasury is not an option. To ensure hospital payments can continue to be made in 2026 through just 2028, Part A payroll tax revenues would need to increase by an average of 25 percent over the next 10 years.

Team Health Around Town

AEI Event: Medicare’s perilous fiscal future – The 2019 Trustees Report

Deputy Director of Health Care Policy Tara O’Neill Hayes discussed the fiscal future of Medicare at the American Enterprise Institute on April 23rd. You can watch her presentation on reforming Medicare Part D here, and you can watch the entire event here.

From Team Health

The Future of America’s Entitlements: What You Need to Know About the Medicare and Social Security Trustees Reports

Tara O’Neill Hayes and Director of Fiscal Policy Gordon Gray break down the key figures from the Social Security and Medicare Trustees reports issued this week.

Floridian Drug Reimportation — The Wrong Prescription

AAF President Douglas Holtz-Eakin details why Florida’s proposal to allow importation of drugs from Canada will not help either patients or drug prices.