Weekly Checkup

June 17, 2022

Probe of PBM Practices

The cost of prescription drugs has long been one of the most widely discussed and debated health care policy topics, though policymakers have historically differed on how to address the issue. Over the past several years, however, pharmacy benefit managers (PBMs) have received increasing attention in the debate and—given their central role in the pharmaceutical supply chain—have become an increasingly common target for proposed bipartisan reforms.

PBMs act on behalf of health insurers to manage prescription drug use and spending by negotiating rebates with drug manufacturers, creating insurance plan formularies, and reimbursing pharmacies for prescriptions. But PBMs have been criticized for lacking transparency and absorbing the savings they generate. While a previous federal report found that the majority of PBM savings are passed on to health plan sponsors, PBMs are, in fact, incentivized to place drugs with higher list prices on their insurer’s formulary as the PBMs get to keep a percentage of the rebates they negotiate. In order to study such potentially anti-competitive business practices, the Federal Trade Commission (FTC) last week launched an inquiry to explore how the vertical integration of PBMs with insurers, mail order and specialty pharmacies, and health care providers may affect access to and affordability of prescription drugs.

The FTC’s interest in studying PBM practices has been gaining traction since February of this year, when the FTC first proposed an inquiry to explore how PBM practices may disadvantage independent or specialty pharmacies. The motion ultimately failed in a 2-2 vote, however, over concerns that the inquiry did not address the influence of PBM practices on drug costs for consumers. Following that vote, the agency opened a request for public comment on the issue, which returned over 24,000 responses by the May 24 deadline. The substantial public interest and the appointment of a fifth FTC commissioner in May, as well as the expansion of the new inquiry to examine the influence of PBM practices on both pharmacies and consumers, helped the updated inquiry pass last week by a unanimous 5-0 vote.

The new study was issued under Section 6(b) of the FTC Act that allows the agency to conduct a study “without a specific law enforcement purpose”; thus, the study itself does not find PBMs guilty of any wrongdoing. As part of the inquiry, however, the FTC will scrutinize several opaque PBM practices it believes may be anti-competitive including fees and claw-backs charged to unaffiliated pharmacies, spread pricing, strategies used to drive consumers to PBM-owned pharmacies, audits of independent pharmacies, and the use of specialty drug lists, among others.

The inquiry covers the six largest PBMs—CVS Caremark, Express Scripts, Inc., OptumRx, Inc., Humana, Inc., Prime Therapeutics LLS, and MedImpact Healthcare Systems, Inc.—which, in 2020, handled more than 95 percent of all U.S. prescription claims. The three largest of these—CVS Caremark, Express Scripts, Inc., and OptumRx, Inc.— handled nearly 80 percent of claims. Within 90 days from the date they receive the order, each PBM will be required to provide the FTC with detailed information regarding company policies and procedures about pharmacy network participation, prescription drug lists and formulary placement, and rebate calculations, with several of the personnel requests asking for data dating back to January 1, 2017.

Taking a step back, the pharmaceutical supply chain and payment system, and more specifically, the contracts and price negotiations that take place in order to bring a drug from the manufacturer to the patient, are part of a long and often convoluted process with many middlemen, including manufacturers, wholesalers, insurers, PBMs, and pharmacies, who all add price distortions to the market. Ideally, the inquiry may provide some much-needed transparency into the PBMs’ drug pricing practices. Policymakers should keep in mind, however, that while PBM practices are important they are only one slice of the drug-pricing pie.

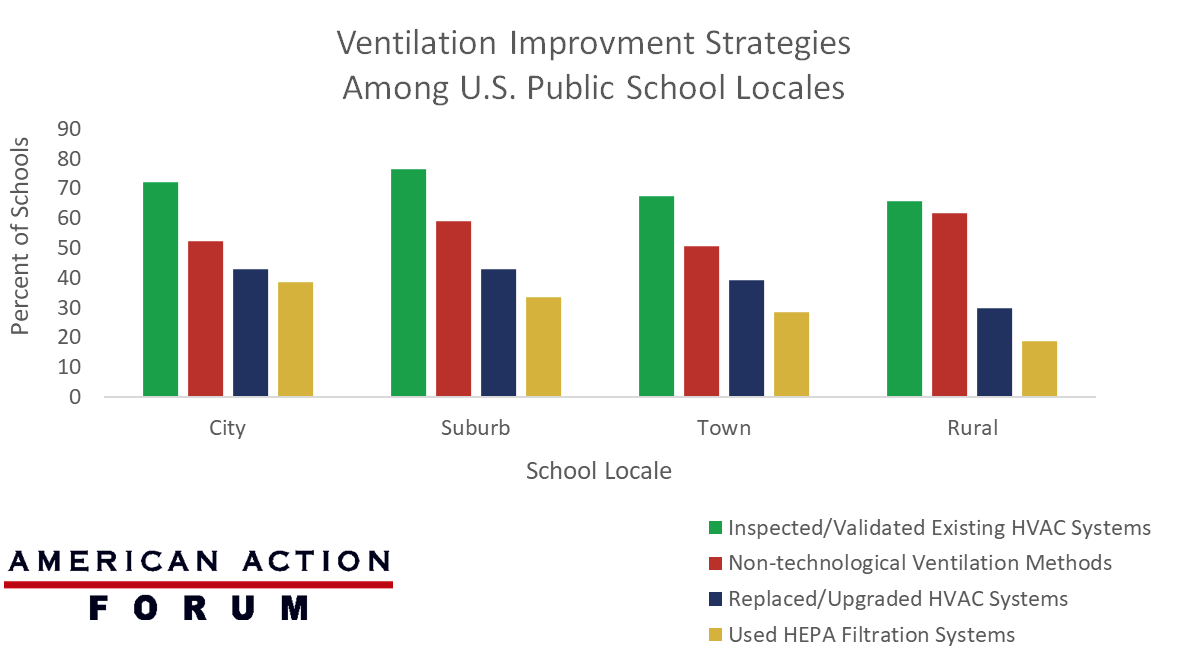

Chart Review: Covid-19 Relief Spending on U.S. Public School Ventilation Systems

Evan Turkowsky, Health Care Policy Intern

Of the $122 billion the American Rescue Plan allocated to public schools, $5 billion was earmarked for the improvement of heating, ventilation, and air conditioning (HVAC) systems. On June 10, the Centers for Disease Control and Prevention released its report on how public schools in different locales (city, suburb, town, and rural areas) chose to improve their ventilation strategies. It found that most public schools have made no major investments in this area since funding was made available. Over 70 percent of all public schools in the study chose to inspect and/or validate their existing HVAC systems, but less than 40 percent chose to replace or upgrade them, and the numbers varied by locale. For example, nearly 43 percent of city schools replaced or upgraded their HVAC system, compared to less than 30 percent of rural schools, as shown in the chart below. The most common reported strategies across all schools included non-technological methods (73.6 percent) that are less costly, such as using fans or moving class activities outside, which were most common among rural schools (61.7 percent) compared to schools in all other locales.

Date Source: The CDC Morbidity and Mortality Weekly Report