Weekly Checkup

June 24, 2022

Saccharine Insulin Deals and Voluntary Price Controls

Tuesday marked the first day of summer, but the frequent return of the undead Build Back Better Act (BBBA) and its disembodied parts prove that on Capitol Hill, it’s always Spooky Season. This week’s installment of Frankenstein’s undead monster features some newly introduced insulin pricing legislation from Senators Jeanne Shaheen (D-NH) and Susan Collins (R-ME), the Improving Needed Safeguards for Users of Lifesaving Insulin Now (INSULIN) Act. Much like Frankenstein’s monster, insulin pricing is often misunderstood.

Recall that Build Back Better’s insulin pricing initiative would have required insurance plans to cover at least one drug for each type of insulin and would cap patient out-of-pocket costs at $35 or 25 percent of the negotiated price –whichever was lower – on top of subjecting insulin prices to “negotiation” (read: price control) by the federal government. The INSULIN Act would cap out-of-pocket costs at the same levels as the BBBA for both the privately insured and Medicare Part D beneficiaries for “certified” insulin (more on that in a moment). The INSULIN Act would also prevent cost control measures such as prior authorization or step therapy from being applied to insulin coverage except in certain instances. Additionally, the bill would bar insurance plans and pharmacy benefit managers from getting price concessions on “certified” insulin.

It’s the “certified” insulin part that differentiates this legislation from the BBBA. The INSULIN Act would create a process whereby a pharmaceutical manufacturer can apply for “certification” for its insulin products. This certification would require that manufacturers implement a ceiling price “not … greater than the weighted average of the Medicare Part D negotiated prices for such insulin, net of all manufacturer rebates, received by plans in 2021.”Manufacturers seeking certification would also not be allowed to raise insulin prices faster than inflation (which seems like a great idea until inflation surpasses 8 percent). It must be stressed that this certification process is entirely voluntary.

What do manufacturers get out of voluntarily cutting their prices? They get their product’s name on a list of “certified” insulins that the government will publish, and that’s all. One might wonder what would compel drug manufacturers to voluntarily drop their prices just because Uncle Sam asked nicely, and one would need to keep wondering for quite a while. It’s difficult to believe any companies would jump through hoops and take significant financial hits just to be considered “certified.” It’s possible that some drug companies will participate in order to undercut their competitors on pricing in hopes of attracting enough customers to offset any decrease in profits. Pharmaceutical manufacturers aren’t known for being politically foolish, and it’s unlikely they will gamble on this prisoner’s dilemma in order to pick up a few extra customers. Instead, the government should focus on the things that have been proven to drive down insulin costs: generic and biosimilar competition. The likelihood of this legislation passing in a midterm year is slim, but the likelihood it will do anything to significantly lower insulin prices is even slimmer.

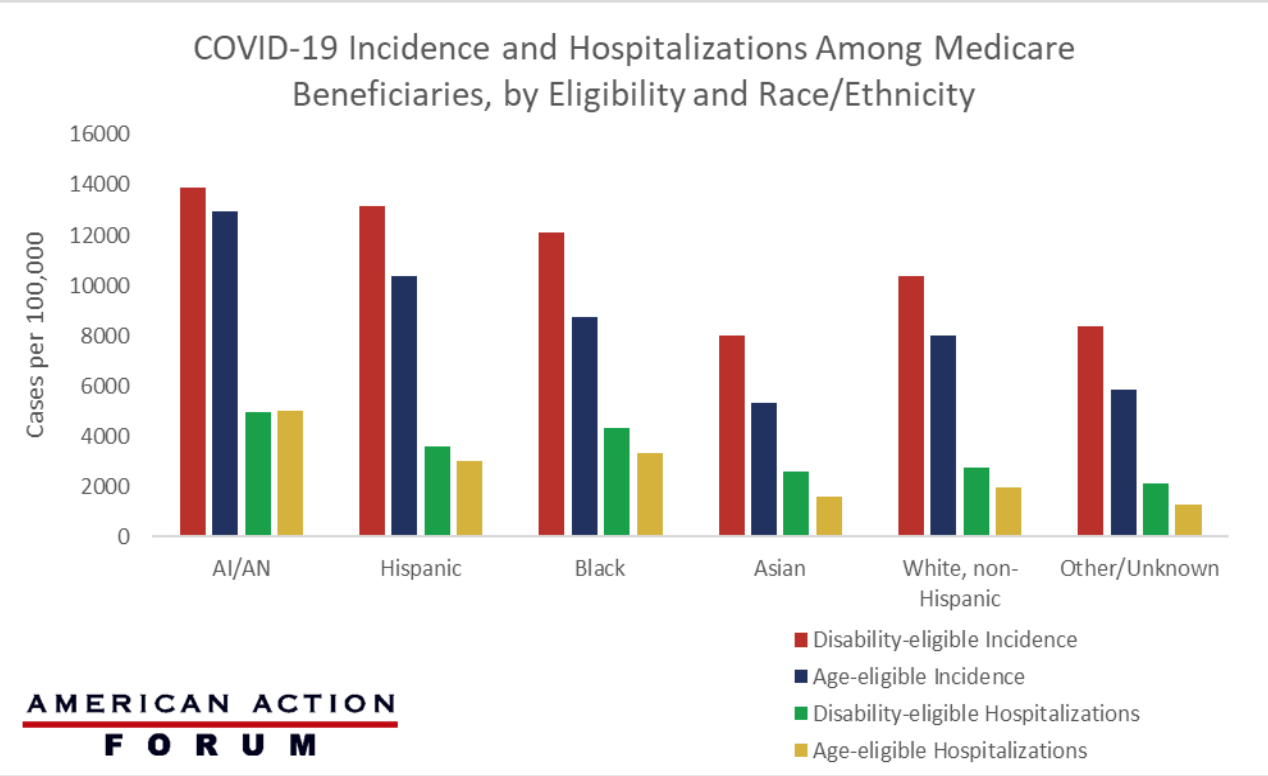

Chart Review: COVID-19 Incidence and Hospitalizations Among Medicare Beneficiaries

Evan Turkowsky, Health Care Policy Intern

On June 17, the Centers for Disease Control and Prevention (CDC) released its report on COVID-19-associated hospitalizations and cases among Medicare beneficiaries according to their eligibility and race/ethnicity. The study consisted of approximately 69 million Medicare beneficiaries, 78 percent of whom were age-eligible and 22 percent of whom were disability-eligible. American Indian/Alaskan Natives (AI/AN) make up approximately 1 percent of all Medicare beneficiaries, but experienced the highest rates of COVID-19 incidence and COVID-19-associated hospitalizations in both disability-eligible (13,891 cases per 100,000 and 4,962 hospitalizations per 100,000, respectively) and age-eligible groups (12,924 cases per 100,000 and 5,024 hospitalizations per 100,000, respectively), as shown in the chart below. Within all other racial and ethnic groups, hospitalization and incidence rates among disability-eligible beneficiaries were significantly higher than those among age-eligible beneficiaries.

Data Source: The CDC: Morbidity and Mortality Weekly Report