Weekly Checkup

October 28, 2022

The RSC Has a Plan

There’s a running joke in the health care world that the phrase “conservative health policy” is an oxymoron. While this author disagrees with that judgment – check out the American Action Forum’s wide body of work on health care policy here – there’s a kernel of truth to it. Conservative policy makers have struggled to formulate a united, coherent vision for American health care in the same way the left has with single-payer health care. While recent health care “proposals” from the right have been lackluster in detail and imagination, the Republican Study Committee’s (RSC) newly released plan for reforming Medicare, the notorious third rail of American politics, deserves discussion in the broader policy sphere.

The policy in the RSC’s plan appears to flow from a single principle: Medicare must become sustainable without major tax increases. To that end, the RSC plan promotes several significant reforms. First, and possibly most controversially, it would bump the eligibility age for Medicare from 65 to 67. Citing increased life expectancy and a decreased worker-to-beneficiary ratio, the RSC’s proposal would align Medicare’s eligibility age with the current Social Security eligibility age and then index it to life expectancy.

The next major point of the RSC’s plan is to create a unified, federally administered plan (referred to as the “Fed Plan”) that would provide all the Medicare benefits in Parts A, B, and D. Seniors could still access stand-alone Part D plans. The Fed Plan would then be listed on regional exchanges alongside Medicare Advantage (MA) plans and stand-alone Part D plans. The federal government would provide premium support subsidies for beneficiaries, scaled to income and wealth, for both the Fed Plan and MA plans, but benchmarked to the cost of the Fed Plan to discourage MA plans from raising prices to receive more subsidies. Another big part of this section is merging Medicare’s trust funds into a singular fund that would pay premium support subsidies.

The RSC also proposed to reform Medigap significantly, essentially requiring a uniform coinsurance rate of 10 percent between the first $750 spent and the $7,500 catastrophic cap. Additionally, the RSC plan would apply the narrow site-neutral payment policy first enacted in 2015 to all providers in the Medicare program, reducing the incentives for hospitals to acquire physician practices. Further policies include eliminating Medicare’s reimbursement to hospitals for “bad debt” that results from Medicare beneficiaries not paying their required out-of-pocket costs, eliminating incentive payments to hospitals in the Medicare Shared Savings Program, and reforming graduate medical education (GME) financing that would change GME funding from mandatory to discretionary spending to require more oversight. Hospitals won’t be big on this plan. Insurers won’t be, either: The RSC plan would not only require insurers’ MA plans compete with the Fed Plan, it would also eliminate quality score bonuses for MA plans and allow seniors who choose to keep private health insurance over Part A to keep their Social Security benefits. This would ensure at least some elderly, generally more expensive patients remain on private insurance rolls.

The RSC plan needs and deserves more analysis and attention from conservatives. The RSC has proposed a serious plan to address the problem of Medicare financing without politically (and, in the RSC’s case, ideologically) unpalatable tax hikes. The left is certainly taking it seriously. The conservative policy world should do the same.

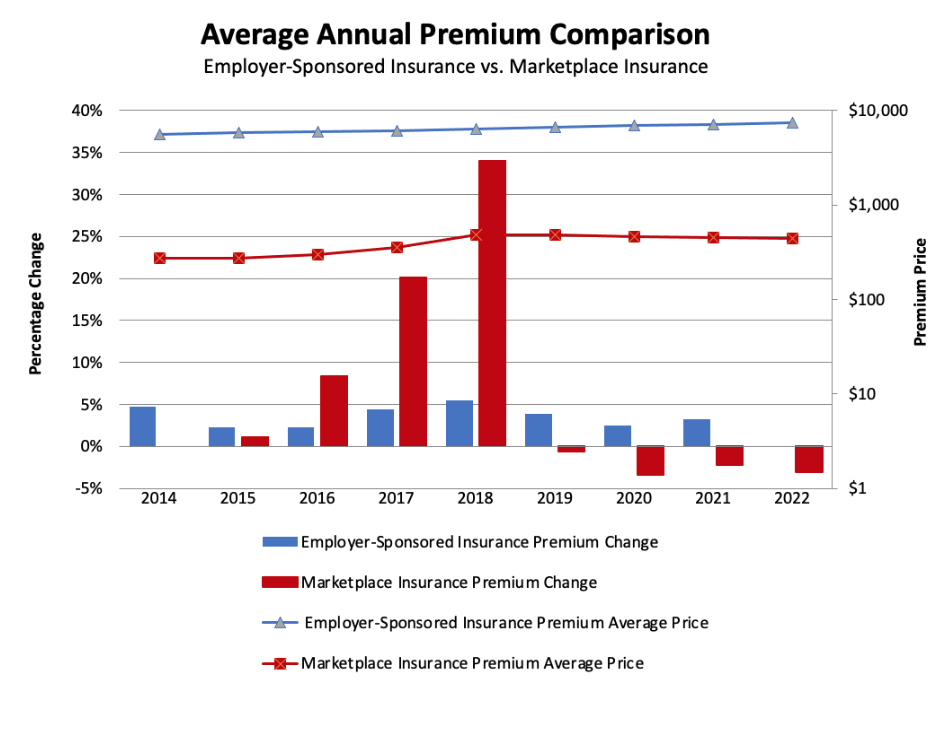

Chart Review: Comparing Employer-Sponsored Insurance and the Affordable Care Act Marketplace

Danielle Bartolotta, Health Care Policy Intern

Supporters of the Affordable Care Act (ACA) have touted gains in ACA plan participation over the past several years, but to some degree these gains have come at the expense of employer-sponsored plan participation. Employer-sponsoredinsurance (ESI) plans collectively cover over 155 million non-elderly individuals. The ACA’s Health Insurance Marketplace, meanwhile, has recently seen rapid growth with nearly 17 million individuals purchasing coverage through this option in 2022, up from 14.9 million last year. As the chart below indicates, the past decade has brought more notable changes in Marketplace premiums than in ESI premiums. In the Marketplace, the early years following implementation saw a substantial increase in premium price changes with an 8 percent, 20 percent, and 30 percent increase in 2016, 2017, and 2018, respectively. ESI premiums have not experienced such extreme changes, with yearly increases hovering between 2–5 percent. From 2018–2019, Marketplace premiums stabilized and have since dropped, in part due to generous federal subsidies. Because ESI premiums were not offset by federal subsidies, they were likely more directly influenced by the rising cost of health care. Policymakers should consider how the significant subsidization of Marketplace premiums may have made these plans artificially but unsustainably attractive, causing people to shift away from ESI.

Data Sources: KFF Analyses of Marketplace Benchmark Premiums and Annual Single Premiums for Employer SponsoredHealth Insurance

*Data for 2022 Employer Sponsored Health Insurance Unavailable