Research

September 20, 2016

Systemic Risk and Regulation: The Misguided Case of Insurance SIFIs

Scott E. Harrington

The Wharton School

University of Pennsylvania

September 20, 2016

Introduction

Questions concerning the nature, magnitude, scope, management, oversight, and supervision of systemic risk have dominated research and policy regarding financial service providers following the 2007-2009 crisis. The September 2008 collapse and federal government rescue of American International Group (AIG) in particular have had an enormous influence on regulatory policy. Section 113 of the 2010 Dodd-Frank Act established the Financial Stability Oversight Council (FSOC) with authority to designate systemically important nonbank financial institutions (nonbank SIFIs) for enhanced supervision by the Board of Governors of the Federal Reserve “[I]f the Council determines that material financial distress at the U.S. nonbank financial company, or the nature, scope, size, scale, concentration, interconnectedness, or mix of the activities of the nonbank financial company could pose a threat to the financial stability of the United States.”

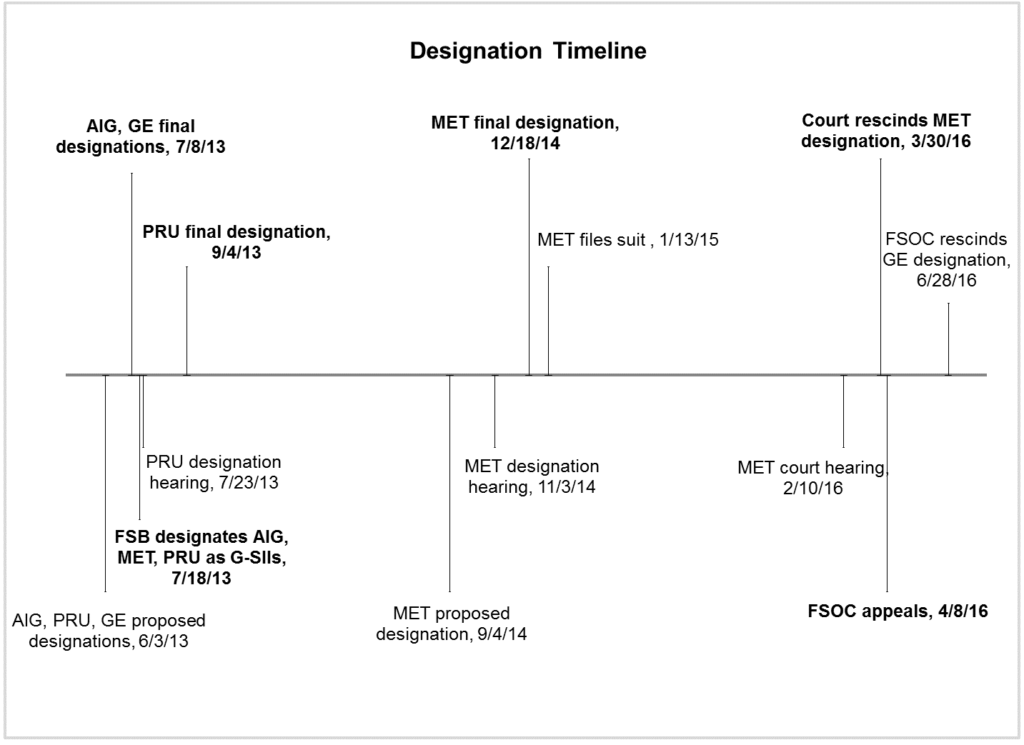

In July 2013, the FSOC designated AIG and GE Capital as systemically important nonbanks, and the G20’s Financial Stability Board (FSB) designated AIG, Prudential Financial (Prudential), and MetLife as globally systemically important insurers (G-SIIs).[1] With the FSOC’s designation of MetLife in December 2014, the three largest U.S. insurers were subject to enhanced regulation by the Federal Reserve under Section 113 (see Figures 1 and 2). MetLife’s subsequent legal challenge to its designation was upheld in U.S. district court in March 2016, rescinding its designation. The Court’s decision is under appeal by the FSOC. The FSOC rescinded GE Capital’s designation in June 2016 following substantial divestitures and changes in its operations, leaving only AIG and Prudential as currently subject to enhanced supervision under Section 113.

The Federal Reserve proposed rules this June for enhanced prudential standards under Section 113 for corporate governance and risk management, including liquidity stress testing and buffer requirements. It also issued an advance notice of proposed rulemaking for capital requirements for systematically important insurers and for 12 other insurers it supervises as depository institution holding companies.[2] The Financial Stability Board is developing enhanced prudential standards and capital requirements through the International Association of Insurance Supervisors (IAIS).[3] The FSB and IAIS do not have direct regulatory authority; the organizations rely on national governments and regulators to adopt their rules. In contrast to the approach taken for the insurance sector, the FSOC and Financial Stability Board have thus far eschewed designation of individual entities in the asset management sector as systemically important and subject to enhanced supervision. The FSB is instead moving towards an “activities-based” approach for asset management, which would focus on monitoring and supervision of activities with systemic risk potential, rather than individual entities, and the FSOC could do likewise.[4]

This paper provides an overview of research and debate over whether insurance poses systemic risk, with a focus on U.S. life insurance. It considers the FSOC designation process, its rationales for designating AIG, Prudential, and MetLife as systemically important under Section 113, and MetLife’s challenge. It highlights the adverse consequences of designating individual insurance entities for enhanced supervision, which favor an alternative activities-based approach to addressing potential systemic risk. The principal conclusions are: (1) there is no compelling evidence that any life insurer poses a threat to the financial stability of the United States, (2) the Section 113 and FSOC regime of designating individual insurance organizations as subject to enhanced supervision is flawed in concept and execution, and (3) it would be preferable to move towards an activities-based approach to systemic risk monitoring and supervision.

The paper first discusses systemic risk potential in insurance compared with banking, relevant historical evidence prior to the 2007-2009 crisis, the life insurance sector’s performance during the crisis, and post-crisis research. It then turns to the FSOC’s designation process under Section 113, the designations of AIG, Prudential, and MetLife, MetLife’s legal challenge, and the Court’s decision rescinding its designation. The final two sections highlight the fundamental flaws in designating a few large insurance firms as systemically important with enhanced supervision and why an activities-based approach to systemic risk represents a better path forward.

Insurance and Systemic Risk

The term “systemic risk” generally is used broadly to encompass the risk of significant destabilization of the financial system with spillovers on real economic activity. Systemic risk can arise from two main sources. First, large and “common” macroeconomic shocks can directly and adversely affect many financial institutions, with attendant spillovers on the real economy. Second, extensive interdependencies or “interconnectedness” among firms could lead to contagion, whereby negative shocks to some financial firms could adversely affect others less directly exposed, amplifying the shocks’ effects on real economic activity. Parsing the relative contribution of shocks’ direct effects from possible contagion when assessing any financial “crisis” is generally problematic. Common shocks to the economy, such as widespread reductions in housing prices, have the potential to directly harm large numbers of people and firms. Immediate evidence of the effects on a few firms may lead to reevaluation and information that other firms have also been directly affected (e.g., recognition of asset problems at one institution leads to recognition of similar problems at other institutions). If so, delayed recognition of the effects of a common shock might sometimes give the appearance of contagion.

Several potential channels could contribute to contagion. Shocks to some financial firms could make them unable to honor commitments to counterparties, weakening those counterparties’ ability to honor their commitments, with attendant repercussions on their counterparties. The revelation of financial problems at some institutions could create uncertainty about the effects on counterparties and whether other institutions face similar problems, so that parties become reluctant to trade until further information becomes available. Shocks that cause a subset of financial institutions to have to sell assets at temporarily depressed “fire sale” prices could further depress prices and market values of institutions that hold similar assets, especially in the presence of “runs” by customers seeking to withdraw assets from troubled firms.

Banks vs. Insurers

Research, analysis, and commentary since the financial crisis have emphasized fundamental differences in the business models and operations of banks and insurers, with a growing recognition that appropriate regulation should reflect those differences.[5] There would appear to be substantial agreement that property/casualty insurance does not pose systemic risk and that life insurers’ traditional, core activities do not pose significant systemic concerns.[6] There is disagreement, however, concerning the extent to which evolution in life insurers’ product offerings has increased vulnerability to shocks and the risk of potential spillovers.

Banks and life insurers are fundamentally different in several key respects. Banks rely heavily on short term, liquid sources of financing (deposits and related instruments) and invest heavily in illiquid loans with longer maturities than their liabilities. Because life insurers rely heavily on longer-term, less liquid sources of funds and invest heavily in relatively liquid, longer-term financial assets, the potential for systemic risk is an order of magnitude lower than for the banking sector. Shocks to life insurers do not threaten the economy’s payment system, as is true for commercial banks. Insurers also have far fewer interdependencies with other insurers and financial institutions than banks. Banking crises have far greater potential for rapid and widespread harm to economic activity and employment.

The life insurance sector has experienced decades-long growth in providing annuities and related retirement savings products. Life insurers have played an increasingly important role in providing products combining savings accumulation and protection against longevity risk through a variety of guarantees involving minimum death benefits and minimum withdrawals during retirement. These products are instrumental in helping to promote financial security through individual retirement accounts, defined contribution retirement plans, and direct channels, especially in view of the long-run financial challenges confronting Social Security.

Several key factors reduce the life insurance sector’s vulnerability to widespread and rapid withdrawals of funds by contract holders and attendant fire sales and spillovers. As history illustrates, including the financial crisis as discussed below, insurers generally have very low probabilities of financial distress. Strong market incentives generally exist for insurers to hold sufficient capital to make distress unlikely and to achieve high ratings from financial rating agencies, including incentives provided by risk sensitive demand of contract holders and the potential loss of firms’ intangible assets that financial distress would entail.

Life insurers’ balance sheets divide assets and liabilities into two categories. “General account” assets and liabilities are for contracts, such as traditional life insurance, fixed annuities, and certain deposit-type contracts, which provide stipulated benefits backed by all general account assets. “Separate account” assets and liabilities are for contracts, such as variable life insurance, variable annuities, and pension products, which pass most investment risk directly to contract holders. Life insurers’ general account assets consist largely of investment in medium-to-long term fixed income securities, especially investment grade corporate bonds. Separate account assets consist primarily of investments in common stocks. Life insurers’ liabilities for both general and separate account liabilities consist of “policy reserves” representing obligations to policyholders and beneficiaries. General account liabilities are subject to relatively conservative regulatory accounting requirements, and generally accepted accounting principles (GAAP) liabilities include margins above best estimates. Separate account products and attendant assets and liabilities greatly reduce insurers’ exposure to common shocks to the value of underlying assets.

Insurers practice extensive risk management through product design, asset and product diversification, matching of asset and liability durations, and hedging programs.[7] Many life insurer liabilities are in significant part relatively illiquid because the underlying contracts are purchased for long term asset accumulation rather than for transaction or short term investment. Early withdrawals are often restricted and/or subject to market value and other adjustments and forfeiture of future benefit guarantees. They also have potential negative tax consequences. Insurers generally maintain substantial liquidity through large holdings of marketable securities and ongoing cash flows from product renewals. In the unlikely event of a severe liquidity shortage, insurers have the contractual and legal authority to delay certain withdrawals, and state regulators have authority to issues stays.

Some life insurer liabilities are risk sensitive and subject to withdrawal in the event an insurer appears headed for distress. But liquid liabilities are a two-edged sword. While they increase the threat of unanticipated withdrawals, they also provide incentives for insurers to hold capital and manage liquidity and other risks to make financial distress unlikely.

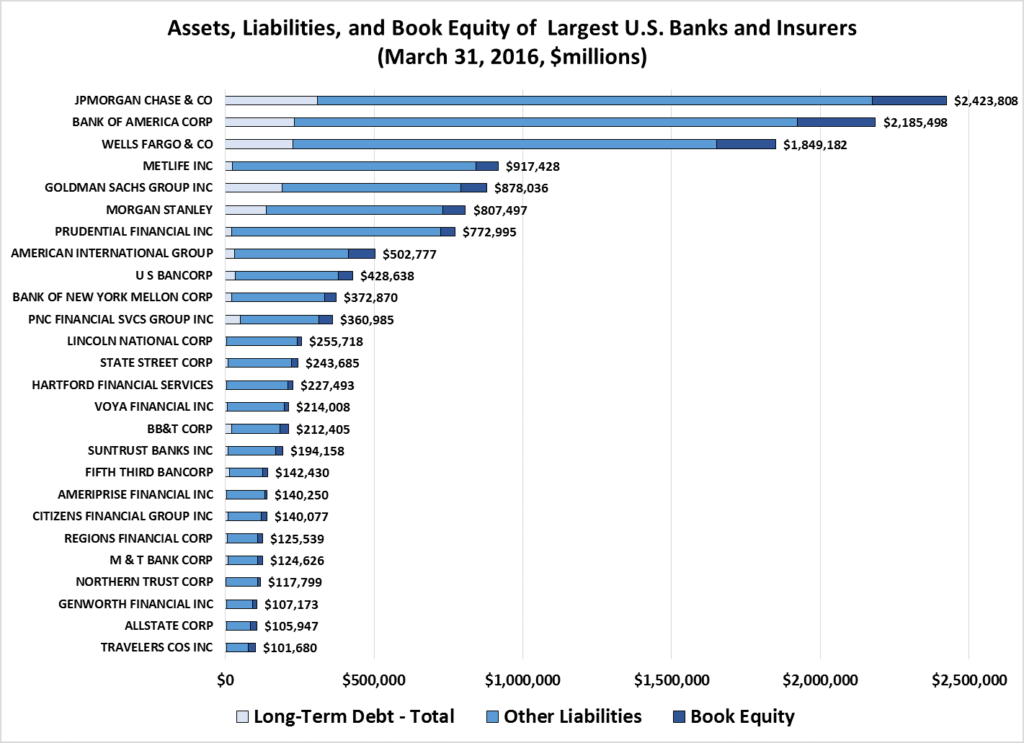

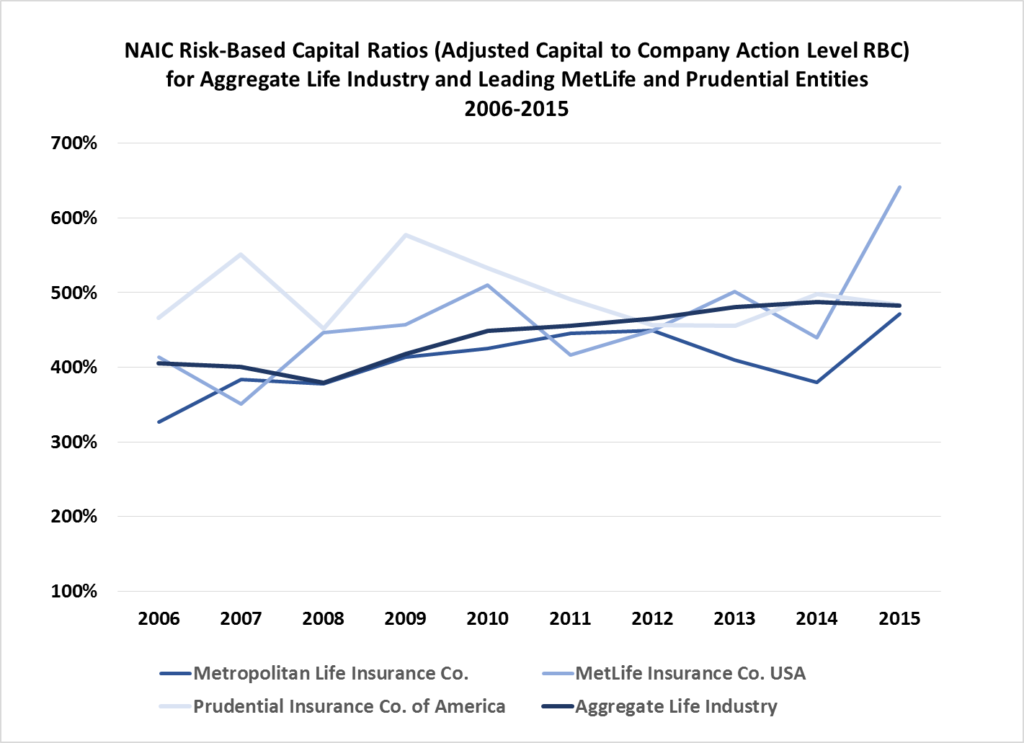

Historical differences in regulation across the banking and insurance sectors would appear to be broadly consistent with differences in systemic risk. Greater systemic risk favors stronger government guarantees of financial institutions’ obligations to protect consumers and deter runs and relatively stringent capital requirements to help internalize systemic risk and mitigate the moral hazard that accompanies strong government guarantees. Because insurance poses much less systemic risk than banking, there is less need for stringent regulatory capital requirements and relatively broad guarantees of insurers’ obligations. Insurance guarantees have been narrower in scope than in banking. Market discipline is reasonably strong, with insurers commonly holding much more capital than required by regulation in order to achieve high financial strength ratings from rating agencies (see Figure 3).

Consistent with a reasonably well-functioning market—and reasonably effective state solvency regulation—there have been very few insurer insolvencies of any size. In the case of life insurance, Baldwin-United, whose insurance subsidiaries wrote roughly $4 billion in annuities, failed in 1983, with a resolution plan that ultimately made most contract holders whole, in conjunction with $3.9 million in state guaranty association payments.[8] Six life insurers with significant exposure in high yield debt and/or commercial real estate and approximately $40 billion in assets failed in 1991 (before the subsequent development by state-based regulators of risk-based capital requirements).[9] The resolutions of these failures generally involved a variety of transfers or sales of policies to surviving insurers, guaranty association payments, and sometimes haircuts to certain policyholders. Executive Life produced net guaranty association assessments of $2.6 billion over 24 years. Executive Life of New York eventually resulted in $755 million in assessments during 2012-2014, more than 20 years after its takeover by New York regulators. Both companies had heavy exposures in high yield bonds, as did First Capital Life and Fidelity Bankers Life (subsidiaries of First Capital Holdings), which produced $5 million in assessments over the next two decades. The largest failed entity in terms of assets, Mutual Benefit Life ($13.5 billion of assets in 1990), resulted in $136 million in guaranty association payments during 1992-1999. Assessments for Monarch Life totaled $6 million. Both companies had extensive commercial mortgage and real estate exposure with limited geographic diversification.

Executive Life experienced $3 billion in cash withdrawals and surrenders in the year before its insolvency. Mutual Benefit Life experienced approximately $1 billion in surrenders during the weeks preceding its request for intervention by regulators. Increased surrenders were also reported for First Capital, Fidelity Bankers, and Monarch. But there was no evidence of contagion to other life insurers.[10] There was likewise no evidence of contagion from the insolvency in 1994 of Confederation Life, a Canadian company with approximately $14 billion (USD) of assets and U.S. subsidiaries doing business in Michigan and Georgia (producing $50 million in guaranty association assessments). Nor was there evidence of contagion from the failure of U.S. insurer General American Life Insurance Company in 1999, which had experienced significant withdrawals of funds for stable value products.[11] The early 1990s experience in life insurance (and some late 1980s failures of property/casualty insurers) led to significant enhancements in state solvency regulation, including the development by the National Association of Insurance Commissioners (NAIC) of risk-based capital requirements and an accreditation system for solvency regulation in individual states.

Insurers and the Financial Crisis

Many banks, investment banks, thrifts, hedge funds, mortgage originators, and subprime borrowers took on substantial risk in anticipation of continued housing price appreciation during the lead up to the financial crisis. Implicit or explicit guarantees of debt issued by Fannie Mae and Freddie Mac lowered financing costs and contributed to the housing bubble in general and rapid expansion of subprime lending in particular. Deposit insurance and implicit guarantees of banks’ obligations likewise encouraged risky lending, especially as Congress pressed them, Fannie Mae, and Freddie Mac to expand lending to low-income borrowers. Some banks located their leveraged investments in opaque, off-balance sheet vehicles. Investment banks helped spread the risk of housing price declines and mortgage defaults broadly through securitization. Subprime mortgage originators were often new entrants with little reputational capital at jeopardy and only modest participation in the risk of underlying mortgages. In conjunction with widespread speculation, the Federal Reserve kept short-term interest rates at historically low levels, fueling demand for credit and housing, and encouraging relaxation in historical underwriting standards. Regulators uniformly failed to anticipate the coming crisis.

AIG. The financial collapse and U.S. government bailout of AIG International Group immediately following the bankruptcy of Lehman Brothers in September 2008 was a singular event. The initial $85 billion assistance package was repeatedly modified, with total federal commitments growing to $182 billion.[12] During 2008, approximately $21 billion of assistance was provided to support AIG’s domestic ($17 billion) and foreign ($4 billion) life insurance subsidiaries, largely in relation to securities lending. The remaining assistance largely went to bank and investment bank counterparties to AIG’s credit default swap and securities lending transactions.

Securities lending associated with AIG’s life insurance subsidiaries clearly contributed to significant collateral calls and liquidity issues.[13] AIG’s unusual securities lending program involved lending government and corporate bonds and other securities and investing much of cash collateral in risky, mortgage-backed securities.[14] State regulators and AIG had commenced steps to reduce AIG’s exposure from securities lending in 2007. Federal intervention was precipitated by a liquidity crisis resulting largely from the sale of credit default swaps and related non-insurance activities through AIG’s financial products group, which produced substantial collateral calls following rating downgrades of the underlying instruments. AIG’s credit default swap activities were not conducted by regulated insurance subsidiaries. Treasury and Federal Reserve officials initially justified the bailout as necessary to protect AIG’s banking and securities counterparties and prevent collapse of the financial system. They later argued that the bailout helped protect AIG’s policyholders and prevent runs on AIG’s insurance subsidiaries. It’s still uncertain whether any of AIG’s insurance subsidiaries would have become insolvent if the government had not intervened.

Because it owned a savings and loan subsidiary, AIG was subject to consolidated regulation by the ill-fated U.S. Office of Thrift Supervision (OTS), which was eliminated by the Dodd-Frank Act. Many of AIG’s major counterparties were regulated by U.S. and foreign banking regulators. It is therefore hard to escape the conclusion that the financial crisis was aggravated by fundamental failures in banking regulation, which permitted high leverage, aggressive investment strategies, and complex off-balance sheet vehicles, often financed by commercial paper.

Beyond AIG. In addition to the pathological case of AIG, mortgage and financial guaranty insurers experienced significant losses, highly publicized downgrades by financial rating agencies, and ultimately a few failures. Insurance law and regulation mandate a monoline structure for such insurers and require substantial contingency reserves. This regulatory framework apparently helped prevent their problems from spilling over to other lines of insurance. All things considered, the insurance sectors otherwise withstood the crisis tolerably well. General property/casualty insurers and most life insurers avoided severe challenges. Several large life insurers experienced a degree of financial strain and rating downgrades in conjunction with long-term investments in mortgage-backed securities, other fixed income securities, and common equities to fund asset accumulation products, including contracts with minimum return guarantees. Several insurers sought and received regulatory permission in some states to modify financial reporting to improve their reported capital. The NAIC modified financial reporting rules to permit insurers to include more deferred assets on their balance sheets and developed new risk-based capital requirements for mortgage backed securities to reduce potentially punitive effects of the earlier requirements.[15] But, very importantly, there is no evidence of contagion.

AIG received a total of $69.8 billion in special funding from the Troubled Asset Recovery Program (TARP), but TARP support for insurers was otherwise minimal. Six insurers applied for and were authorized to receive funds through TARP’s $205 billion Capital Purchase Program. Allstate, Ameriprise Financial, Principal Financial, and Prudential Financial were approved but declined to receive funds. Hartford Financial was the 13th largest of 707 recipients, receiving $3.4 billion (1.7 percent of the $205 billion total). Lincoln Financial, the 27th largest recipient, received $950 million (0.4 percent of the total). MetLife did not seek TARP funding. Genworth Financial applied for funding but was denied. In contrast, Bank of America, Citigroup, JP Morgan, and Wells Fargo each received $25 billion; Goldman Sachs and Morgan Stanley each received $10 billion.

In order to promote and provide liquidity, the Federal Reserve’s Commercial Paper Funding Facility, in effect from October 2008 through April 2010, purchased a total of $738 billion in U.S. entity commercial paper from 82 financial and nonfinancial corporations at favorable rates. AIG issued and rolled over commercial paper totaling $60.2 billion (8.2 percent of the total). This was second only to HBS ($74.5 billion, 10.1 percent). After AIG, the four largest insurer participants were Prudential Financial ($2.5 billion, 0.3 percent), MetLife ($1.6 billion, 0.2 percent), Hartford Financial ($725 million, 0.1 percent), and Lincoln National ($472 million, 0.06 percent).

Because of its ownership of a bank at the time and status as a bank holding company, MetLife was eligible to participate in the Federal Reserve’s Term Auction Facility, which provided short term funding to depository institutions from December 2008 through early April 2010. After encouragement from regulators who desired healthy financial institutions to participate in the program to bolster overall market liquidity, MetLife’s former bank subsidiary received loans totaling $17.6 billion, which was 0.5 percent of the $3.8 trillion in total funding provided. This total was for four 84-day loans and fifteen 28-day loans. The 84-day loans totaled $1.375 billion, with a maximum amount outstanding at any time of $875 million. The 28-day loan amounts averaged $1.2 billion, with a maximum amount of $2.8 billion in July 2009. The funding stayed within the bank subsidiary and were not used to fund other operations. MetLife’s total borrowing under the program ranked 58th among 417 participants. Bank of America’s loans under the program totaled $212 billion. Twenty-three banks borrowed $50 billion or more; 11 borrowed $100 billion or more.

MetLife also issued a total of $397 million in unsecured short-term debt during March 2009-June 2012 that was guaranteed by the Federal Deposit Insurance Corporation under its Debt Guaranty Program (part of its Temporary Liquidity Guarantee Program), which provided low cost funding[16] This amount was 0.1 percent of the $618 billion in loans guaranteed under the program. MetLife ranked 36th among the 122 issuers. GE Capital, Citigroup, and Bank of America each issued over $100 billion under the program. Ten banks issued $10 billion or more.[17] MetLife’s participation in this program and the Commercial Paper Funding Facility was not needed to fund operations, as it had substantial access to the private capital markets during 2008-2009, raising $9.3 billion.[18]

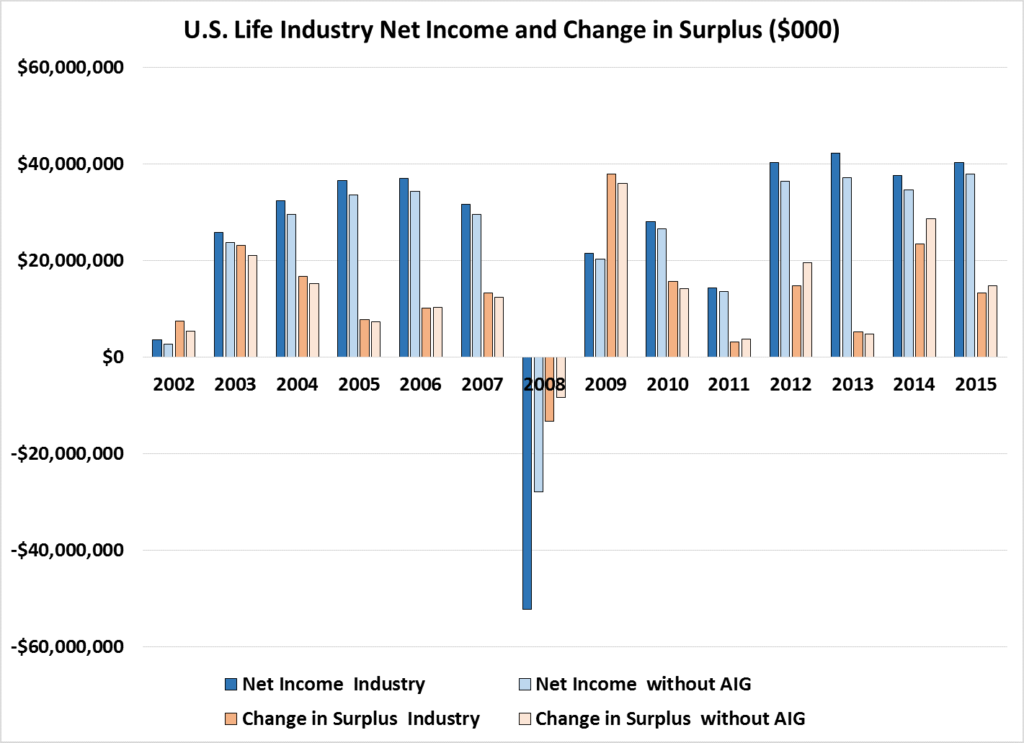

Figure 4 shows the U.S. life industry’s reported annual net income and annual change in reported surplus (admitted assets less liabilities) from insurers’ regulatory financial statements (calculated according to “statutory accounting principles”). It also shows approximate values excluding AIG.[19] The industry reported large losses and reductions in surplus in 2008, with close to half of the amounts due to AIG. The negative income and reduction in surplus were in significant part due to realized capital losses from sales of securities and required markdowns of impaired assets. Insurers also reported significant unrealized capital losses in 2008, even though regulatory accounting does not require recognition of the declines in values for some securities.[20] The industry returned to the black in 2009, with large increases in surplus, including from some changes in financial reporting requirements, substantial capital contributions from parents, and issues of equity and related securities by parents.[21]

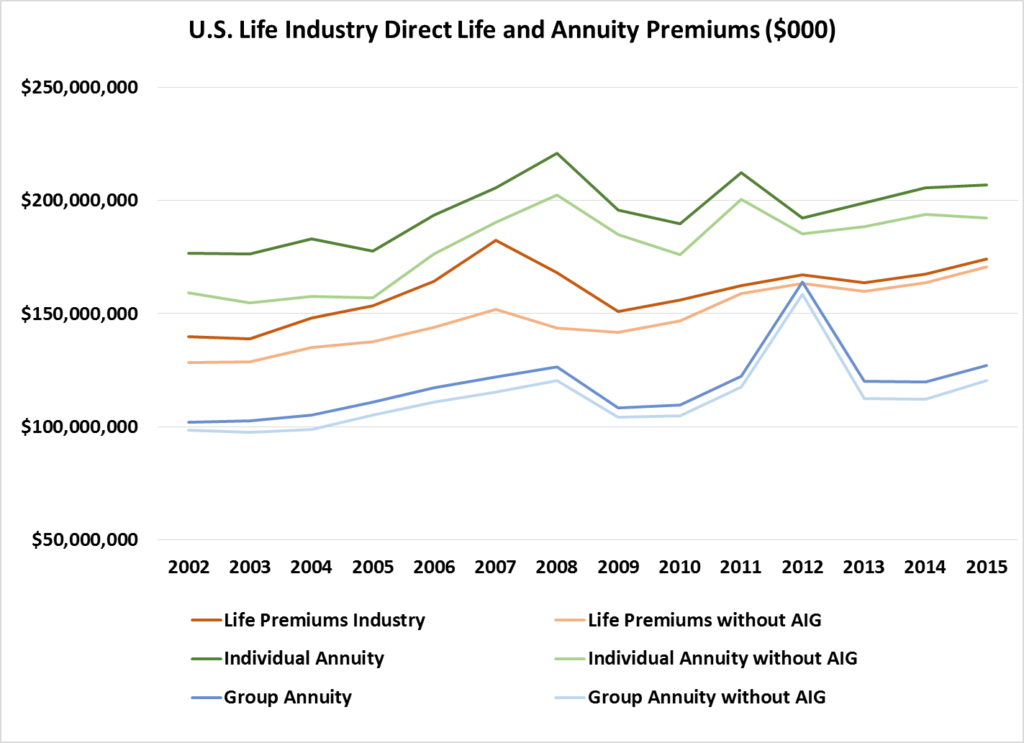

Figure 5 reports U.S. life industry life insurance and annuity premiums during 2002-2015. The values are for “direct” business, i.e., they do not reflect reinsurance transactions among insurers. Total life and annuity premiums increased in 2008 before declining significantly in 2009, although remaining above 2005 levels.[22] The 2009 decline was sharper for AIG than the rest of the industry. Life insurance premiums exclusive of AIG were relatively stable during the crisis and grew slowly over the entire period.

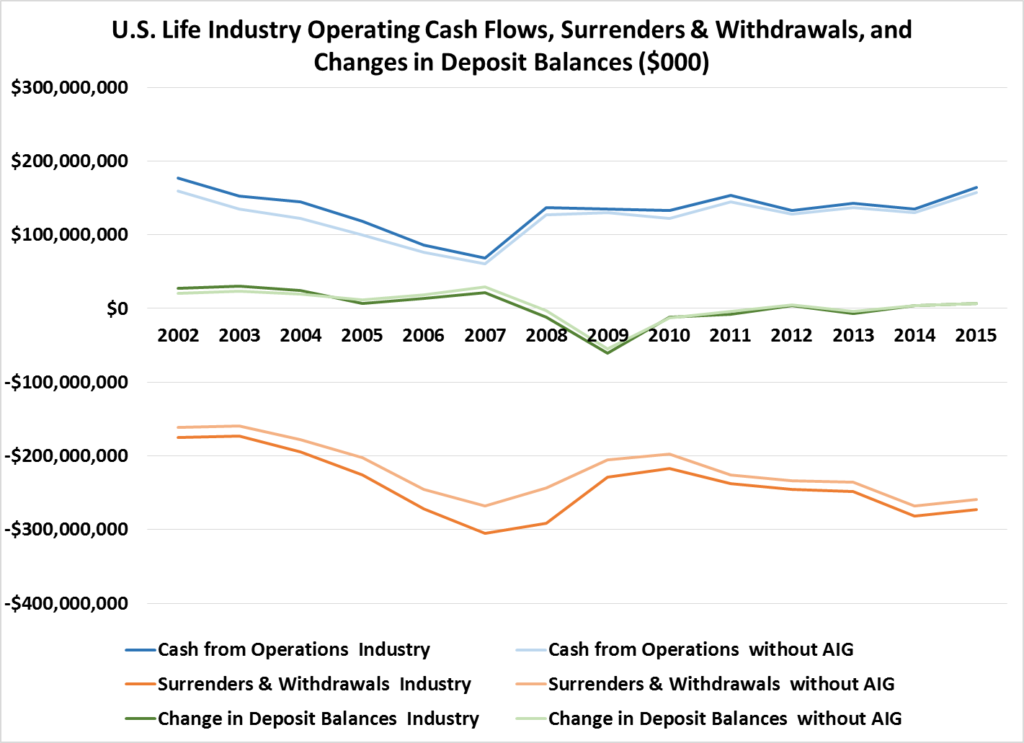

Figure 6 shows life insurers’ operating cash flows, contract surrenders and withdrawals, and changes in deposit product balances for the same period.[23] Surrenders and withdrawals increased through 2007 and then in 2008 through 2010. The reduction in surrenders and withdrawals was at least partially attributable to reduction in contract holders account balances during the crisis below the minimum amounts guaranteed by insurers, which reduced incentives for withdrawals. Deposit balances shrunk in 2008 and 2009 and stabilized in 2010. Operating cash flows, which reflect premiums, benefits, surrenders and withdrawals, changes in deposit balances, and operating expenses declined through 2007 but actually increased sharply in 2008 in conjunction with reduced surrenders and withdrawals that substantially exceeded the reduction in premiums that year.

State insurance regulators responded to the crisis in a variety of ways. As noted earlier, they made several changes to financial reporting requirements to reduce stress on reported capital.[24] Some states permitted insurers to increase the amount of tax deferred assets that could be counted as “admitted” assets. The NAIC revised accounting rules in 2009 to permit the increases for all insurers. The NAIC changed the methodology used to determine risk-based capital charges for non-agency residential mortgage-backed securities in 2009 and for non-agency commercial mortgage-backed securities in 2010. The revised charges reflected estimated expected recovery rates on securities rather than financial ratings. In 2010 the NAIC adopted accounting rules effective in 2013 to increase disclosure and transparency of securities lending transactions. Beginning in 2008, the NAIC launched a Solvency Modernization Initiative to improve monitoring and communication among regulators regarding insurance groups. It modified its model Holding Company Act in 2010 to expand regulators authority to obtain information and evaluate any entity within an insurance holding company system. It also developed and is implementing requirements for insurers to prepare annually a detailed “own risk and solvency assessment.”

Post-Crisis Research

Published and unpublished academic studies have considered various aspects of insurer “micro” behavior within the broad context of the financial crisis and potential systemic risk concerns. One study argues that life insurers cut prices significantly below projected costs during late 2008 to early 2009 in order to generate accounting profits and improve regulatory reported capital when the cost of obtaining external capital was high.[25] The extent to which the estimated price reductions simply reflect the failure to adjust rates immediately upward in response to potentially temporary reductions in U.S. Treasury yields is an open question. There is evidence during the early 2000s that insurers categorized as financially constrained by the researchers were more likely than other insurers to sell speculative graded bonds that were downgraded with attendant temporary downward pressure on prices of those bonds.[26] Another study suggests that some “financially constrained” insurers may have sold downgraded residential mortgage-backed securities at “fire sale” prices.[27]

Other evidence suggests that insurers may have “reached for yield” in their bond investments prior to the crisis, especially those with lower capital compared with required regulatory capital, and that changes in regulatory capital requirements for non-agency mortgage-backed securities following the crisis may have increased some insurers’ risk taking.[28] Expectations that other investors would withdraw funds may influenced some investors in certain funding agreement backed notes issued by insurers to withdraw their funds during 2007, but without any evidence that the withdrawals led insurers to sell assets.[29]

Other analysis has been critical of crisis-induced changes in insurance regulatory capital rules, emphasized that some insurers obtained government support, and, in what might be regarded as turning virtue into vice, taken a pejorative view of holding company parents’ contributions to insurance subsidiaries’ capital surrounding the crisis.[30] Other work suggests that life insurer parent capital contributions to weaker subsidiaries was an important risk sharing mechanism.[31] Finally, considerable attention has been paid to life insurers’ use of captive reinsurance arrangements to manage capital and whether the arrangements could result in excessive risk taking.[32]

As is true for all empirical research, questions necessarily arise concerning such studies’ “internal” validity—whether the results are somehow biased—and “external” validity—whether the results have implications beyond the particular data and context. Several of the analyses only find statistically significant effects for subsamples of firms that meet particular criteria (e.g., that are classified by the authors as financially constrained). A number are puzzling in that they motivate the analysis based on purported binding regulatory capital requirements, without mentioning that a large majority of insurers hold far more capital than required (see Figure 3), or the importance of firms’ incentives to be safe and maintain high financial ratings.

Other research has focused on “macro” systemic risk issues and the measurement of systemic risk for different sectors and firms. One line of research has focused on the assessment of interconnections among financial institutions by analyzing correlations in security returns for different sectors.[33] With respect to quantitative measures of systemic risk potential for individual firms, one measure, known as SRISK, has received particular attention because it generally has ranked several large insurers (most notably MetLife and Prudential) among the top five to ten U.S. financial institutions with the highest estimated risk.[34] The SRISK measure thus runs contrary to the notion that large insurers do not pose significant systemic risk concerns.

SRISK equals an estimate of the shortfall of a firm’s market value of equity relative to an assumed prudent value during a sustained downturn in stock prices (e.g., a 40 percent market decline over six months). The measure purportedly reflects the firm’s potential contribution to a system wide shortage of capital and the amount of capital that the firm would need to raise following a severe market downturn and attendant shortage of overall capital. The calculation of SRISK for a firm depends on a few key inputs: (1) the market value of the firm’s equity; (2) a leverage measure (the book value of liabilities plus the market value of equity, divided by the market value of equity); (3) the predicted percentage reduction in the firm’s market value of equity conditional on a severe market downturn (which is very highly correlated and in some versions directly related to an estimated “beta” for the firm’s stock); (4) an assumed prudent capital ratio of the market value of equity to assets (typically 8 percent, with assets defined as book liabilities plus the market value of equity).

Regardless of its theoretical underpinnings and seeming precision, SRISK is fundamentally flawed as a policy-relevant measure of systemic risk for insurers. The underlying notion that an insurer’s need to raise capital during a period of market distress would be closely tied to the market value of its equity is mistaken.[35] The measure’s assumed prudent ratio of the market value of equity to assets does not consider the nature and liquidity of the firm’s assets and liabilities, its diversification and risk management, or a multitude of other factors considered by management, analysts, rating agencies, and regulators when assessing a firm’s risk, appropriate capitalization, and potential need to raise capital. Large financial institutions also are inherently prone to have high values of SRISK as the measure is highly correlated with the book values of firms’ liabilities, making it to a significant extent a proxy for firm size.

FSOC Designation of Insurance SIFIs

The Dodd-Frank Act charges the FSOC with (1) identifying risks to financial stability from “the material financial distress of large, interconnected bank holding companies or nonbank financial companies, or that could arise outside the financial services marketplace”; (2) promoting market discipline “by eliminating expectations on the part of shareholders, creditors, and counterparties that the Government will shield them from losses in the event of failure”; and (3) responding to “emerging threats to the stability of the U.S. financial system.” The FSOC has 10 voting members from member agencies (including, among others, the Federal Reserve Chair, Treasury Secretary, Securities & Exchange Commission Chair, Federal Deposit Insurance Corporation Chair, Comptroller of the Currency Director, and a presidential appointee with expertise in insurance) and five non‐voting members, including the Office of Financial Research Director, the Federal Insurance Office Director, a state insurance commissioner, a state banking commissioner, and a state securities commissioner.[36]

In what might aptly be called the AIG provision, Section 113 of the Dodd‐Frank Act provides the FSOC with the authority by a two thirds vote to designate a nonbank financial company, including an insurance company, as systemically important (by imposing a threat to the financial stability of the United States) and subject to enhanced regulation and supervision by the Federal Reserve. The Federal Reserve is required to establish, with input from the FSOC, enhanced risk‐based capital requirements, leverage rules, resolution standards, and other requirements for systemically important nonbank financial companies.

Section 113 specifically authorizes the FSOC to subject a nonbank financial company to supervision by the Federal Reserve if the FSOC “determines that (i) material financial distress at the nonbank financial company could pose a threat to the financial stability of the United States (the ‘‘First Determination Standard’’), or (ii) the nature, scope, size, scale, concentration, interconnectedness, or mix of the activities of the nonbank financial company could pose a threat to the financial stability of the United States (the ‘‘Second Determination Standard’’).” Section 113 specifies factors the FSOC must consider, including its leverage; off‐balance sheet exposure; importance as a source of credit and liquidity for households, businesses, state and local governments, and low‐income communities; the nature, scope, size, and interconnectedness of its activities; the amounts and nature of its assets and liabilities; the degree to which it is already regulated by one or more primary regulators; and “any other risk‐related factors that the Council deems appropriate.”

The Designation Process and Designation of AIG, Prudential, and MetLife

The FSOC final rule and interpretative guidance issued in April 2012 for designating nonbank financial companies as systemically important incorporated the statutory requirements into six broad risk categories for determining systemic importance: size, lack of substitutes for the firm’s services and products, interconnectedness with other financial firms, leverage, liquidity risk and maturity mismatch, and existing regulatory scrutiny.[37] According to the interpretative guidance, the size, lack of substitutes, and interconnectedness criteria “seek to assess the potential for spillovers from the firm’s distress to the broader financial system.” The leverage, liquidity / maturity mismatch, and existing regulatory scrutiny criteria “seek to assess how vulnerable a company is to financial distress.” The interpretive guidance also described three channels that the FSOC regarded “as most likely to facilitate the transmission of negative effects . . . of material financial or activities to other financial firms and markets”: (1) exposure of creditors, counterparties, investors, or other market participants to a nonbank financial company; (2) disruptions caused by the liquidation of a nonbank financial company’s assets; and (3) the inability or unwillingness of a nonbank financial company to provide a critical function or service with no ready substitutes. The FSOC also indicated that its evaluation of entities under the First Determination Standard would be done “in the context of a period of overall stress in the financial services industry and in a weak macroeconomic environment.”

The FSOC rules established a three-stage process for determination of whether a nonbank financial company poses a threat to the financial stability of the United States. Stage 1 employs publicly available information and information from member regulatory agencies to identify nonbank financial companies for more detailed evaluation in Stage 2. A company is evaluated further in Stage 2 if global consolidated assets are $50 billion or greater and it meets at least one of five additional quantitative thresholds. Stage 2 entails a review and prioritization of Stage 2 entities based on analysis of each company using information available to the FSOC through existing public and regulatory agencies and information obtained from the company voluntarily. Based on this analysis, the FSOC notifies companies it believes merit further evaluation in Stage 3, including analysis of additional information collected directly from the company. Following Stage 3 analysis, a “Proposed Determination” of a company as systemically significant requires a two‐thirds vote of the FSOC, followed by a hearing if the company requests, and a final vote.

In January 2013, the FSOC voted to advance AIG, GE Capital, and Prudential Financial from Stage 2 to 3. It voted for a proposed determination of these entities in June 2013 (see Figure 1), with 2 dissenting votes and dissent by the nonvoting state insurance representative. In July 2013, AIG and GE Capital Prudential were designated, Prudential was granted a hearing, and MetLife was advanced from Stage 2 to Stage 3. Following a hearing, Prudential was designated in September. Events were also proceeding globally during July 2013. The IAIS released an initial methodology for determining G-SIIs that could be subject to enhance supervision and higher capital standards. The FSB, with representatives from the U.S. Department of Treasury, the Federal Reserve Board, and the Securities & Exchange Commission, immediately designated nine G-SIIs, including AIG, MetLife, and Prudential.

The FSOC voted for a proposed determination of MetLife in September 2014. Following a November hearing, the company was designated in December with a 9-1 vote. MetLife filed its lawsuit challenging the designation in January 2015. The District Court rescinded its designation in March 2016, and the government filed for appeal the next week.

FSOC Rationales and Dissents

The FSOC designated AIG, Prudential, and MetLife based exclusively on the First Determination Standard (whether material financial distress of the organization could pose a threat to U.S. financial stability). The FSOC released a public basis for each designation stating its conclusions with respect to the exposure, asset liquidation, and critical function or service channels.[38] The December 2014 public basis for MetLife contains more detail than the earlier bases for AIG and Prudential. A redacted version of the FSOC’s detailed basis for the designation of MetLife became available later.[39]

While there is greater specificity for MetLife and a few of the other details differ among the entities, the FSOC’s basic rationale for designation is the same for each organization: material financial distress could lead to runs by contract holders, counterparties, and investors, which could result in fire sales of assets and attendant contagion.[40] When addressing the lack of any historical basis for this scenario, the FSOC’s detailed designation of MetLife stressed the lack of any precedent for what might happen with the failure of an organization with its scale and scope, stating, for example:

The absence of a past incident of undisputed insurance industry contagion that posed a threat to U.S. financial stability is not evidence that such contagion would not occur in the unprecedented event of the failure of MetLife—a company that is highly interconnected with the financial system, with significant counterparty exposures counterparties (sic), and with extensive capital markets activities.[41]

The FSOC’s consideration of the extent to which the companies were already regulated highlighted the lack of direct group supervision by state regulators. It also stressed the complexity of resolving the institutions if necessary.

In his dissent to the Prudential designation, voting member with insurance expertise Roy Woodall stated:

The underlying analysis utilizes scenarios that are antithetical to a fundamental and seasoned understanding of the business of insurance, the insurance regulatory environment, and the state insurance company resolution and guaranty fund systems. As presented, therefore, the analysis makes it impossible for me to concur because the grounds for the Final Determination are simply not reasonable or defensible, and provide no basis for me to concur.

Mr. Woodall also argued that Prudential’s individual counterparty exposures were small and broadly spread, that the run and asset liquidation scenario did not reflect any evidence or precedent, that it ignored important differences among policyholders and contract holders, and that it mischaracterized the role and potential importance of regulatory stays on withdrawals and of guaranty associations. He also argued that the Second Determination Standard (nature and scope of activities) should have been considered.

The Prudential dissent by voting member Ed DeMarco, Acting Director of the Federal Housing Finance Agency, stated that the exposure of Prudential’s individual counterparties was small, that exposure to runs was limited and could be halted by stays, and that insufficient attention had been paid to Prudential’s hedging to reduce risk. He also expressed concern with the impact of the designation on competition. Non-voting member insurance commissioner John Huff’s dissent emphasized policyholder disincentives to withdraw funds and the potential role of company and regulatory stays in impeding runs.

Mr. Woodall also dissented from the MetLife designation, stating that he did “not believe the analysis’ conclusions are supported by substantial evidence in the record, or by logical inferences from the record.” He criticized the analysis for relying on “implausible, contrived scenarios” and for “failures to appreciate fundamental aspects of insurance and annuity products” and state regulation. He again criticized the failure to consider the Second Determination Standard (noting that while some of MetLife’s activities could conceivably pose a threat under certain circumstances, this had not been evaluated) and for failing to provide a roadmap for how the firm could exit SIFI status. He also highlighted connections between the FSOC and Financial Stability Board designations of AIG, Prudential, and MetLife, and that failure of the FSOC to designate MetLife “would appear to amount to a failure of the U.S. to meet international commitments already made within the G-20.”[42] Dissenting non-voting member insurance commissioner Adam Hamm expressed concern with the MetLife designation’s treatment of state regulation and the exposure and asset liquidation channels.

MetLife Challenge, Decision, and Appeal

MetLife’s lawsuit challenged its designation on numerous grounds, including whether the organization met the criterion for potential regulation under Section 113 as a U.S. nonbank financial company, and whether the designation process violated due process and separation of powers. It challenged the FSOC for failure to undertake a review under the Second Determination Standard, for failure to assess MetLife’s vulnerability to financial distress as implied by its final rule and interpretative guidance, for arbitrary and capricious reliance on irrational behavior by policyholders and MetLife in its run / fire sale rationale, and for failure to consider the consequences of designation to MetLife, which would ultimately harm consumers. The lawsuit stressed evidence provided to the FSOC—which the FSOC disputed or dismissed in its detailed designation—in particular, evidence that the FSOC’s counterparties’ exposure analysis failed to consider collateral and other offsets that substantially reduced exposures, studies (not publicly available) by the consulting firm Oliver Wyman indicating no evidence of contagion from prior insurance insolvencies and that MetLife had sufficient liquidity to withstand all potential surrenders and withdrawals without requiring asset sales with systemic effects, and a survey indicating that policyholders were unlikely to surrender policies in the event of insurer financial distress.[43]

D.C. District Court Judge Rosemary Collyer’s March 30 decision rescinded MetLife’s designation on two grounds: (1) the designation was fatally flawed by the FSOC’s failure to consider MetLife’s vulnerability to financial distress as implied by its guidance, including that the “agency had reversed itself without acknowledgement or explanation,” and (2) the FSOC’s failure to consider any costs of designation to MetLife was “arbitrary and capricious.” The ruling specifically faulted the FSOC for failure to establish a basis that material financial distress would materially impair MetLife’s counterparties, including the FSOC’s gross exposure analysis without considering offsets, and that it failed to adhere to any standard for assessing MetLife’s threat to financial stability, noting that “every possible effect of MetLife’s imminent insolvency was summarily deemed grave enough to damage the economy.”

The FSOC’s appeal argues that the Court “read into the guidance an obligation to assess the likelihood that MetLife would experience distress and a requirement to identify with precision the impact that distress would have on the broader financial system during a hypothetical future crisis.” It likewise argues that the Court erred in holding that the FSOC was required to consider the cost of designation to MetLife. Numerous amici curiae have been submitted in support of the government, in district court or the appeal, including former Senator Chris Dodd and Representative Barney Frank, and former Federal Reserve Chairs Ben Bernanke and Paul Volcker, with several filed on behalf of MetLife. Messrs. Bernanke and Volcker assert that “there can be no question” that MetLife’s “stress could affect the financial stability of markets more generally.”[44] They also assert that the FSOC need not evaluate the likelihood of financial distress, “precisely quantify” the effects of material financial distress, or conduct a cost/benefit analysis given the potential adverse effects of a crisis on the economy.

The Section 113 Regime is Flawed in Concept and Implementation

The controversy over designation of insurance SIFIs highlights the fundamental tensions involved in selecting a limited number of large companies in a sector for regulation under a separate and distinct regime. The inclusion of Section 113 in the Dodd-Frank Act in the aftermath of the crisis may have been entirely predictable. Financial distress at large banking organizations and the AIG debacle represented the pinnacle of the crisis. Because of its noninsurance activities, AIG in particular fed the narrative that consolidated and enhanced supervision and capital requirements for large nonbank financial institutions were needed to prevent any recurrence. The AIG designation was a fait accompli once Section 113 was enacted. It was then highly unlikely that only one nonbank insurance organization would be designated, and the parallel process under which the FSB designated AIG, MetLife, and Prudential as G-SIIs made it exceedingly unlikely that the FSOC would stop with AIG. The diverse and predominantly state regulated U.S. life insurance sector had little clout with the FSOC regime.

Strong arguments against designating individual nonbank institutions were unavailing in the post-crisis political environment.[45] But the Court’s MetLife decision, the rescission of the GE Capital designation, the infant status of the development of enhanced supervision and capital standards for insurance SIFIs, and the international and possible domestic movement towards an activities-based approach to monitoring and managing systemic risk in the asset management sector suggest the possibility of a significant change in course.

Legal issues in the MetLife / FSOC case aside, and given the information available to me, I regard the FSOC’s rationales for designating these entities as speculative and inconsistent with the operation, regulation, and history of the sector. The overriding scenario—shocks and distress followed by runs and fire sales—is fundamentally bank centric. The FSOC’s support comes across as a laundry list of worst case conjectures. In addition, the process for designating Prudential and MetLife was opaque and provided no guidance for how the companies could avoid designation or have its designation rescinded.[46]

Efficient economic regulation considers the nature and scope of market failures and the likelihood that regulation will be able to cost-effectively mitigate those failures, as well as the particular regulatory tools that are likely to be most cost effective.[47] Legal issues aside, it makes no economic sense to assume material financial distress when assessing an entity’s potential threat to financial stability without considering its probability of distress. The potential benefits of enhanced regulatory supervision of nonbank financial institutions need to be considered in relation to the potential costs, even if those benefits and costs cannot be readily quantified. The potential benefits from enhanced supervision include a lower probability that the regulated entity would experience distress and reduced direct and indirect harm if material distress were to occur. As the probability of distress without enhanced regulation gets smaller, the expected benefits from regulation decline commensurately, making it less likely that they will exceed the expected costs.

If the potential direct and indirect costs of material financial distress at a company are high, the expected benefits of regulation could be sizable even if the probability of distress is low. However, if it is argued that the system wide consequences of material financial distress at a specific institution are so high that there is no need to consider the probability of material distress, it is incumbent on those making the argument to establish a compelling case that the consequences could indeed be extremely serious. The FSOC has not done so for its insurer designations.

This discussion does not imply that “precise” quantification of probabilities, potential consequences, and expected benefits are feasible or required. But economic justification for additional regulation requires at least some consideration of probabilities and analysis and evidence that goes beyond speculative, “the sky is falling” scenarios.

The focus on identifying individual nonbank financial entities for enhanced supervision also represents another example of government policy fighting the last war. The basic narrative is that the financial crisis involved a common shock (subprime housing and mortgages), producing financial strain at many institutions, which was substantially amplified with broader systemic consequences by the failure of a few large entities. The attendant economic rationale for Section 113 is that enhanced supervision of big nonbank entities by the Federal Reserve will reduce their likelihood of severe financial distress and systemic consequences if they were to experience material distress. But uncertainty remains about the relative magnitude of the amplification of the crisis from the large failures that occurred versus the direct effects of the shock. Moreover, the potential effectiveness of the Section 113’s strategy—enhanced supervision of a nonbank financial institution by the Federal Reserve—is uncertain, and it only indirectly addresses potentially broad vulnerability to common shocks.

The FSOC basis’ treatment of state insurance regulation is perfunctory. It largely ignores the historical solvency record, pays little attention to the history of improvements in solvency regulation, and dismisses states’ ability to issue stays on policyholder withdrawals because doing so “could” undermine financial stability during an unspecified crisis. The treatment reflects the notion that the lack of a true consolidated regulator at the state level trumps any argument for the effectiveness of state regulation, including changes in response to the crisis. A good theoretical argument can be made that state regulatory policy may fail to consider potential cross-border systemic consequences of material financial distress.[48] But if the case were made that existing state regulation has material shortcomings in practice on this dimension, it would not imply that Section 113’s solution of singling out a couple of large entities for enhanced supervision at the federal level is the appropriate policy response.

Legal issues aside, appropriate economic regulation requires consideration of potential costs in addition to potential benefits. This again does not require that accurate quantification is necessary or feasible. But it cannot be argued with a straight face that costs are irrelevant from an economic perspective. If it is instead asserted that the potential systemic harm from material distress of a financial institution is so great that any costs must be regarded as negligible and safely ignored, the assertion should be based on correspondingly strong evidence and analysis of the magnitude of potential harm.

The potential costs of designating a few insurance entities as systemically important and subject to (as yet substantially undetermined) enhanced supervision standards are well known and worth repeating, even though dismissed by many as irrelevant. Such regulation imposes direct costs and risk on the designated institutions. The magnitude of the costs is uncertain, especially given that the specific rules and capital requirements have largely yet to be determined, but it cannot be presumed negligible.[49] Section 113’s two-tiered system will alter competitive dynamics in the life insurance sector. MetLife and Prudential compete with numerous other life insurers, a number of which are large entities, in a highly competitive market for products and services. Other things being equal, the increased costs of enhanced supervision will reduce their ability to compete effectively, plausibly shifting some amount of business and risk to entities not subject to the additional level of regulation, and destabilizing rather than stabilizing the market. Large banks who compete with each other are all under the same regulatory umbrella(s). This is not the case with Section 113 designations of insurers.

The designation of a few insurers for enhanced supervision under Section 113 also raises issues of regulatory scale and scope—in addition to the question of whether the needed funding could be more efficiently spent under an alternative approach. While some scale and scope economies from Federal Reserve regulation of designees is feasible given Federal Reserve oversight of a dozen insurance organizations that own a bank or savings and loan, the fact remains that implementing Section 113 will require substantial resources to regulate very few organizations, including the development of specific and new risk based capital requirements. The Federal Reserve’s recognition that insurance has fundamentally distinct features that require tailored regulation has been a very positive development. But the question arises as to whether coming up with elaborate supervisory rules and capital requirements for a handful of organizations makes any economic sense.

Finally, the emphasis of regulation following the crisis thus far has been on beefing up capital requirements and supervision of large financial institutions. That emphasis need not persist indefinitely. Over the longer run, the impression that insurance SIFIs regulated by the Federal Reserve are too big to fail could significantly undermine competition and market discipline, with the attendant benefits to designated insurance SIFIs ultimately outweighing any increased costs of enhanced supervision and stricter capital requirements.

A Better Path

The alternative and better approach to developing enhanced supervision to mitigate systemic risk is to eschew designation of specific institutions as systemically risky and instead focus on the underlying activities in different sectors that could give rise to systemic risk. If substantial evidence and analysis suggest that a particular activity or behavior (e.g., liquidity management) is creating systemic risk without adequate market or regulatory constraints, the activities-based approach would involve the development of new rules or standards governing the activities throughout a sector or across sectors. It would facilitate targeting of attention on underlying risk with systemic potential. It would address all entities participating in a particular activity. It would consider systemic issues without regard to potential distress at a single institution, thus reflecting the potential accumulation of risk across entities. If an activities-based approach had been in effect during the mid-2000s, it’s possible that the financial crisis would have been substantially mitigated or even prevented.

Analysis and discussion of potential systemic risk in asset management (mutual funds, collective investment vehicles, hedge funds, exchange traded funds, etc.) has considered the same underlying story as for insurance—the threat that some shock could lead to liquidity problems, runs, and asset liquidations with systemic consequences.[50] The FSB has moved towards an activities-based approach as opposed to a SIFI approach for asset management, and the FSOC could be doing so as well.[51] The political dynamic for the asset management sector differs from insurance both globally and domestically. The largest asset managers are concentrated in the United States and subject to substantial regulation by the Securities & Exchange Commission, with a strong lobbying effort to thus far deter designation of asset manager SIFIs subject to enhanced supervision.

Although the domestic and international insurance SIFI trains have left the station, the U.S. train is currently down to two cars, and there is a long way to go in terms of developing and implementing insurance specific standards for enhanced supervision under Section 113. There is no compelling evidence that any life insurer poses a threat to the financial stability of the United States, and the Section 113 regime is flawed in concept and execution. A better approach would be to return to the station and change destinations. If the United States were to shift towards an activities-based approach for insurers, it might have positive spillover effects globally.

References

Acharya, Viral V., and Matthew Richardson. 2014. “Is the Insurance Industry Systemically Risky?” In Modernizing Insurance Regulation, edited by J. H. Biggs and M. Richardson, 151–80. Hoboken, New Jersey: Wiley.

Acharya, Viral V., Robert Engle, and Matthew Richardson. 2012. “Capital Shortfall: A New Approach to Ranking and Regulating Systemic Risks.” American Economic Review 102(3. 59–64.

Adrian, Tobias and Markus K. Brunnermeier. 2016. “CoVaR.” American Economic Review 106: 1705-1741.

Barnes, M. L., J. Bohn, and C. L. Martin. 2016. “A Post-Mortem of the Life Insurance Industry’s Bid for Capital during the Financial Crisis.” Federal Reserve Bank of Boston Current Policy Perspectives, 15-8, March.

Becker, B. and M. Opp. 2013. “Regulatory Reform and Risk-Taking: Replacing Ratings.” NBER Working Paper.

Becker, Bo, and Victoria Ivashina. 2015. “Reaching for Yield in the Bond Market.” Journal of Finance 70: 1863–901.

Benoit, S., Colletaz, G., Hurlin, C., and Perignon, C. 2013. “A Theoretical and Empirical Comparison of Systemic Risk Measures.” HEC Paris Research Paper No. Fin-2014-1030, February….

Benoit, S., Colletaz, G., Hurlin, C., and Perignon, C. 2015. “Where the Risks Lie: A Survey on Systemic Risk.” Review of Finance, in press.

Bernanke, Ben and Paul Volcker. 2016. “Brief Amicus Curiae of Ben S. Bernanke and Paul A. Volcker in Support of Defendant-Appellant.” MetLife, Inc. vs. Financial Stability Oversight Council.

Berry-Stölzle, T. R., G. P. Nini, and S. Wende. 2014. “External Financing in the Life Insurance Industry: Evidence from the Financial Crisis.” Journal of Risk and Insurance, 81(3. 529-562.

Billio, M., M. Getmansky, A. W. Lo, and L. Pelizzon. 2012. “Econometric Measures of Connectedness and Systemic Risk in the Finance and Insurance Sectors.” Journal of Financial Economics 104:535–559.

Bipartisan Policy Center. 2015. “Global Insurance Regulatory Issues: Implications for U.S. Policy and Regulation.” November.

Brenneman, Elise, David Du, and Cynthia Martin. 2014. “Variable Annuities—Recent Trends and the Use of Captives.” Federal Reserve Bank of Boston, October 7.

Breyer, Stephen. 1984. Regulation and its Reform. Cambridge, Mass.: Harvard University Press.

Brownlees, Christian T., and Robert F. Engle. 2015. “SRISK: A Conditional Capital Shortfall Measure of Systemic Risk.” Universitat Pompeu Fabra and New York University.

Chen, H., Cummins, J.D., Viswanathan, K.S. and Weiss, M.A. 2013. “Systemic Risk and the Inter-Connectedness between Banks and Insurers: An Econometric Analysis.” Journal of Risk and Insurance, 81:623-652.

Congressional Oversight Panel. 2010. The AIG Rescue, Its Impact on Markets, and the Government’s Exit Strategy, June 10.

Cummins, J. David and Mary A. Weiss. 2014a. “Systemic Risk and Regulation of the U.S. Insurance Industry.” In Modernizing Insurance Regulation, edited by J. H. Biggs and M. Richardson, 151–80. Hoboken, New Jersey: Wiley.

Cummins, J. David, and Mary A. Weiss. 2014b. “Systemic Risk and the U.S. Insurance Sector.” Journal of Risk and Insurance 81: 489–527.

Eling, Martin and David Pankoke. 2014. “Systemic Risk in the Insurance Sector: Review and Directions for Further Research.” Working Paper, University of St. Gallen. November.

Ellul, A., C. Jotikasthira, C., C. Lundblad and Y. Wang. 2015. “Is Historical Cost Accounting a Panacea? Market Stress, Incentive Distortions and Gains Trading.” Journal of Finance 70: 2489-2538.

Ellul, A., C. Jotikasthira, C. Lundblad. 2011. “Regulatory Pressure and Fire Sales in the Corporate Bond Market.” Journal of Financial Economics 101: 596-620.

Federal Insurance Office. 2015. “Annual Report on the Insurance Industry.” September.

Federal Reserve Board. 2016a. “Capital Requirements for Supervised Institutions Significantly Engaged in Insurance Activities.” 12 CFR Ch. II, June 14.

Federal Reserve Board. 2016b. “Enhanced Prudential Standards for Systemically Important Insurance Companies.” 12 CFR Part 252, June 14.

Fenn, George W. and Rebel A. Cole. 1994. “Announcements of Asset-Quality Problems and Contagion Effects in the Life Insurance Industry.” Journal of Financial Economics 35: 181-198.

Financial Stability Board. 2016. “Consultative Document–Proposed Policy Recommendations to Address Structural Vulnerabilities from Asset Management Activities.” June 22.

Financial Stability Oversight Council. 2012. “Authority to Require Supervision and Regulation of Certain Nonbank Financial Companies.” 12 CFR Part 1310, April 11.

Financial Stability Oversight Council. 2016. “Update on Review of Asset Management Products and Activities.” April.

Foley-Fisher, Nathan C., Borghan Narajabad, and Stephane H. Verani. 2015. “Self-Fulfilling Runs: Evidence from the U.S. Life Insurance Industry.” Finance and Economics Discussion Series 2015-032, Board of Governors of the Federal Reserve System, Washington.

General Accountability Office. 2013. “Insurance Markets—Impacts of and Regulatory Response to the 2007-2009 Financial Crisis.” GAO-13-583, September.

Geneva Association. 2010. “Systemic Risk in Insurance: An Analysis of Insurance and Financial Stability.” Special Report of the Geneva Association Systemic Risk Working Group, March. Geneva: The International Association for the Study of Insurance Economics.

Harrington, Scott E. 1992. “Policyholder Runs, Life Insurance Company Failures, and Insurance Solvency Regulation.” Regulation: Cato Review of Business and Government, Spring: 27-37.

Harrington, Scott E. 2004. “Capital Adequacy in Insurance and Reinsurance.” in Scott, H., ed., Capital Adequacy Beyond Basel: Banking, Securities, and Insurance, Oxford University Press.

Harrington, Scott E. 2009. “The Financial Crisis, Systemic Risk, and the Future of Insurance Regulation.” Journal of Risk and Insurance 76:785–819.

Scott E. Harrington. 2014a. “Regulation and Supervision of Insurance SIFIs.” In J.H. Biggs and M. Richardson, eds., Modernizing Insurance Regulation. Hoboken: N.J.: Wiley.

Harrington, Scott E. 2014b. “The Use of Captive Reinsurance in Life Insurance.” American Council of Life Insurers.

Harrington, Scott E. 2015. “The Economics and Regulation of Captive Reinsurance in Life Insurance.” Journal of Insurance Regulation 34(10): 1-37.

Hartley, D., Paulson, A.L., R.J. Rosen. 2016. “Measuring Interest Rate Risk in the Life Insurance Sector: The U.S. and the U.K.” The Economics, Regulation, and Systemic Risk of Insurance Markets, Oxford: Oxford University Press, forthcoming.

Holtz-Eakin, Douglas. 2014. “The Investor Cost of Designating Investment Funds as Systemically Important Financial Institutions.” American Action Forum, May 15.

Holtz-Eakin, Douglas. 2015. “FSOC Accountability: Nonbank Designations.” Testimony before the United States Senate Committee on Banking, Housing, and Urban Affairs, March 25.

International Monetary Fund. 2016. “The Insurance Sector – Trends and Systemic Risk Implications.” Global Financial Stability Report, Ch. 3, April.

Koijen, R. S. J., and M. Yogo. 2015. “The Cost of Financial Frictions for Life Insurers.” American Economic Review, 105: 445-475.

Koijen, R. S. J., and M. Yogo. 2016a. “Risks of Life Insurers: Recent Trends and Transmission Mechanisms.” The Economics, Regulation, and Systemic Risk of Insurance Markets, Oxford: Oxford University Press, forthcoming.

Koijen, R. S. J., and M. Yogo. 2016b. “Shadow Insurance.” Econometrica, forthcoming.

McDonald, Robert and Anna Paulson. 2015. “AIG in Hindsight.” Journal of Economic Perspectives 29: 82-106.

Merrill, C.B., T.D. Nadauld, and P.E. Strahan. 2014. “Final Demand for Structured Finance Securities.” Working Paper, August.

Merrill, C. B., T. D. Nadauld, R. M. Stulz, and S. M. Sherlund. 2014. “Were there Fire Sales in the RMBS Market?” Fisher College of Business Working Paper Series, May.

NAIC. 2012. “The U.S. Insurance Industry’s Exposure to the Federal Home Loan Banking System.” Capital Markets Special Report, Center for Insurance Policy and Research.

Niehaus, Greg. 2014. “Managing Capital and Insolvency Risk via Internal Capital Markets Transactions: The Case of Life Insurers.” Working Paper, February.

NOLHGA. 2015. Nationwide Assessment Activity by Insolvency. October 14.

Office of Financial Research. 2013. “Asset Management and Financial Stability.” September.

Oliver Wyman. 2013. “The Consumer Impact of Higher Capital Requirements and Insurance Products.” April.

Paulson, Anna, Richard Rosen, Kyal Berends, and Robert McMenamin. 2014. “Understanding the Relationship Between Life Insurers and Federal Home Loan Banks.” Chicago Fed Letter, January.

Paulson, Anna, Thanases Plestis, Richard Rosen, Robert McMenamin, and Zain Mohey-Dean. 2014. “Assessing the Vulnerability of the U.S. Life Insurance Industry.” In Modernizing Insurance Regulation, edited by J. H. Biggs and M. Richardson. Hoboken, New Jersey: Wiley.

Peirce, Hester. 2014. “Securities Lending and the Untold Story in the Collapse of AIG.” Working Paper 14-12, Mercatus Center at George Mason University, Fairfax, Virginia.

Prudential Financial. 2013. “Discussion with Federal Reserve Regarding Separate Accounts with Guarantees.” Meeting Between Federal Reserve Board Staff and Representatives of Prudential Financial, Inc., May 8.

Schwarcz, Daniel, and Steven L. Schwarcz. 2014. “Regulating Systemic Risk in Insurance.” University of Chicago Law Review 81: 1570–640.

Scott, Hal, Kristin Ricci, and Aaron Sarfatti. 2016. “SRISK as a Measure of Systemic Risk for Insurers: Oversimplifed and Inapt.”

Thimann, Christian. 2014. “How Insurers Differ from Banks: A Primer on Systemic Regulation.” SRC Special Paper No. 3, London School of Economics and Political Science. July.

Wallison, Peter J. 2014. “What the FSOC Prudential Decision Tells Us About SIFI Designation.” American Enterprise Institute, March.

Figure 1

Figure 2

Figure 3

Source: NAIC and SNL Financial. Regulators require a company to submit a plan, subject to approval, for increasing capital if adjusted capital falls below Company Action Level RBC. Further reductions in adjusted capital lead to increased regulatory intervention and takeover.

Source: NAIC and SNL Financial. Regulators require a company to submit a plan, subject to approval, for increasing capital if adjusted capital falls below Company Action Level RBC. Further reductions in adjusted capital lead to increased regulatory intervention and takeover.

Figure 4

Figure 5

Figure 6

[1] The Financial Stability Board was formed in 2009 to promote financial stability and coordination among national regulators and various international bodies. The Federal Reserve Board, U.S. Treasury, and Securities & Exchange Commission represent the United States. See Bipartisan Policy Center (2015) for further background.

[2] Federal Reserve Board (2016a, 2016b).

[3] The IAIS, a member organization of the Financial Stability Board with over 200 members from 140 countries, is also developing capital standards for “Internationally Active Insurance Groups,” which will eventually become the basis for stricter requirements for G-SIIs.

[4] Financial Stability Board (2016) and FSOC (2016).

[5] An enormous amount of academic research has considered potential systemic risk and its measurement. Benoit, et al. (2016) provides and introduction and review. Eling and Pankoke (2014) review 30 academic studies and 13 industry/practitioner studies on systemic risk in insurance as of November 2014.

[6] See, for example, Geneva Association (2010), Cummins and Weiss (2014b), Thimann (2014), and International Monetary Fund (2016) for background. Also see Harrington (2004).

[7] See, for example, Prudential Financial (2013). In addition, the combination of life insurance and annuity products to some extent provides a natural hedge of longevity risk. While increases in longevity increase the economic values of liabilities for insurers’ income and withdrawal guarantees under many annuity products, they reduce the value of liabilities for future claims under contracts providing premature death protection.

[8] Data on assessments obtained from NOLHGA (2015) and equal amounts collected less any refunds.

[9] Harrington (1992) provides details and analysis. Approximately 150 life/health insurers failed during 1986-91, many of which focused on health insurance and most of which were very small.

[10] There is evidence of stock price declines for firms with similar asset portfolios at the time of announced asset write downs at Executive Life and Travelers in January and October 1990, respectively (Fenn and Cole, 1994).

[11] Metropolitan Life (now MetLife) purchased the company for $1.2 billion.

[12] This summary draws from Harrington (2009), which provides and early and detailed discussion of AIG’s problems and government bailout. Congressional Oversight Panel (2010) provides a comprehensive review. McDonald and Paulson (2015) reiterate the basic facts, summarize the performance of certain funding vehicles used in the federal intervention, and suggest that AIG may have had solvency concerns in addition to liquidity.

[13] See Harrington (2009) and Peirce (2014).

[14] This contrasts with lending government bonds and reinvesting collateral in other government bonds with minimal risk.

[15] See GAO (2013). Further discussion is provided below.

[16] The second component of the Temporary Liquidity Guarantee Program was the Transaction Account Guarantee Program, which guaranteed in full all domestic transaction and related deposits at participating banks (eliminating the $250,000 maximum deposit insurance amount) through December 2010.

[17] Along with many banks, MetLife and a number of other insurers involved in mortgage finance routinely obtain funding (“advances”) as Federal Home Loan Bank members. MetLife’s outstanding FHLB balances increased significantly to approximately $15 billion in 2008 and have remained fairly stable since. See Paulson, et al. (2014) and NAIC (2012) for further discussion of insurer FHLB relationships.

[18] MetLife raised $3.3 billion in equity and $1.8 billion in debt and hybrid securities during 2008 and $1 billion in equity and $3.2 billion in debt and hybrid securities during 2009.

[19] Author’s calculations using data for affiliated insurance groups and unaffiliated insurers from SNL Financial. This data source reports aggregate results for affiliated groups using current holding company / affiliate structures. It does not report “as was” results for group structures in effect at the time the data were reported. MetLife purchased ALICO and its insurance affiliates from AIG in 2010 (the deal closed in November). The data source excludes the experience of those subsidiaries from the reported results for AIG in all years. I obtained adjusted totals for AIG by adding the results for ALICO’s U.S. life subsidiaries to the AIG results for 2002-2010 and then deducted the adjusted AIG values from those for the total industry. Life insurance premium shown in Figure 5 include premiums for ordinary and group coverage.

[20] GAO (2013) provides additional details, reporting that life insurers had $64 billion in unrealized capital losses in 2008, with $30 billion for AIG alone. The Federal Insurance Office, established as part of Dodd-Frank, provides a summary of insurers’ financial results annually (e.g., Federal Insurance Office, 2015).

[21] In an analysis of external equity issues by life insurers during 1997-2010, Berry-Stolzle, Nini, and Wende (2014) find that insurers had no greater difficulty raising external capital during 2007-2009 than other periods.

[22] The increase in annuity and total premiums in 2012 was due in significant part to some very large pension risk transfer products sold by Prudential.

[23] The data in Figure 6 are only available “net” of reinsurance.

[24] GAO (2013) provides detailed discussion.

[25] Koijen and Yogo (2015).

[26] Ellul, Jotikashthira, and Lundblad (2011). Ellul, et al. (2015) presents evidence that some insurers engaged in selective trading of bonds to improve their reported capital positions during 2004-2010.

[27] Merrill, et al. (2014).

[28] Becker and Ivashina (2015) and Becker and Opp (2013). Also see Merrill, Nadauld, and Strahan (2014).

[29] Foley-Fisher, Narajabad, and Verani (2015). Paulson, et al. (2014) analyzed potential withdraws in the life insurance sector under entirely implausible “extreme” stress scenarios.

[30] Barnes, Bohn, and Martin (2016).

[31] Niehaus (2014).

[32] See Koijen and Yogo (2016a, b) for life insurance and Brenneman, Du, and Martin (2014) for variable annuities. Koijen and Yogo (2016a) also discuss variable annuity and securities lending risks. I have considered the use of captive reinsurance in life insurance and state regulatory developments in detail and with a much different perspective in Harrington (2014b, 2015).