Research

April 16, 2018

Tax Day 2018: Compliance Costs Approach $200 Billion

Regardless of how much Americans end up paying Uncle Sam on Tax Day, all feel the cost of simply filing their taxes. The total costs of complying with tax requirements have increased significantly, this study finds, with the cumulative monetized cost to file the tax paperwork approaching $200 billion – a 14 percent increase over last year. And the number of tax forms only continues to grow.

According to data from the Office of Information and Regulatory Affairs, the estimated time burden to complete the IRS forms, when rounded, remains unchanged from 2017 at 8.1 billion hours. This figure breaks down to 25 hours per American and 53 hours per taxpayer. According to the Internal Revenue Service (IRS), the monetary cost of completing this paperwork is $85.6 billion. Considering the IRS only estimates costs on 61 percent of burden hours, however, the true figure is likely much higher.

To calculate the total cost burden of IRS paperwork, including these missing hours, this study applies the most recent average hourly wage of a compliance officer to the unaccounted-for hours to arrive at a final sum: $194.3 billion, a 14 percent increase over Tax Day 2017. This projected cost is the highest since the American Action Forum (AAF) began its annual review in 2014, with the exception of the anomaly of 2016.

It is important to note that this cost does not reflect costs associated with the Tax Cuts and Jobs Act (TCJA). Associated compliance costs will be reflected in future data, but they are not captured by the IRS data considered here.

METHODOLOGY

AAF researched every active IRS Office of Management and Budget Control Number (collections of information or recordkeeping requirements) on reginfo.gov, the government website that houses all federal paperwork information (as of April 3, 2018, for the purposes of this study). That search found 704 unique information collection requests, all of which contained IRS estimates of expected responses and burden hours. The IRS estimates the costs for just 14 of these requests, however. To project costs for the remaining, AAF applied the Bureau of Labor Statistics estimated average hourly wage for compliance officers ($34.39). The methodology is consistent with AAF’s previous Tax Day research.

RESULTS

While costs, average hours per paperwork submission, and number of forms increased, the total number of hours required to deal with all active tax forms remained unchanged. Once again, just two of the information collection requests – individual and business tax returns – represented the majority (at 61 percent) of the burden hours.

- Forms: 1,186

- Hours: 8.1 billion

- Average Hours Per Paperwork Submission: 11.8

- Total Projected Cost: $194.3 billion

How did costs, average hours, and the number of forms all increase if the number of hours remains unchanged? The primary reason is that the paperwork estimates for the U.S. Individual Income Tax Return were revised in October 2017. While this revision increased the number of expected respondents by 2.2 million, it trimmed the burden by about 800 million hours. The IRS’s estimate of the total costs for this year fell by nearly $2 billion. New and newly revised paperwork made up for this difference (and then some) in terms of projected cost, but not in time spent.

Eleven collections require at least 100 hours per response. These collections are:

Five collections have an average hourly cost above $50. The five collections are:

| Collection Request | Cost/Hour |

| Notice of Medical Necessity Criteria under the MHPAEA | $1,006.35 |

| Annual Return/Report of Employee Benefit Plan | $405.46 |

| Suspension of Benefits Under the MPRA | $189.14 |

| IFR for Grandfathered Health Plans under the PPACA | $165.23 |

| Application for Certificate of Subordination of Federal Tax Lien | $52.00 |

One collection request appears on both lists: Suspension of Benefits Under the Multiemployer Pension Reform Act of 2014. At nearly $190 per hour, and 500 hours per response, the total estimated cost of this collection request is $94,570 per response. The form is required when a multiemployer defined benefit pension plan in “critical and declining status” seeks to suspend benefits, subject to application and approval by the Treasury Department. The IRS estimates there are 28 of these requests filed per year.

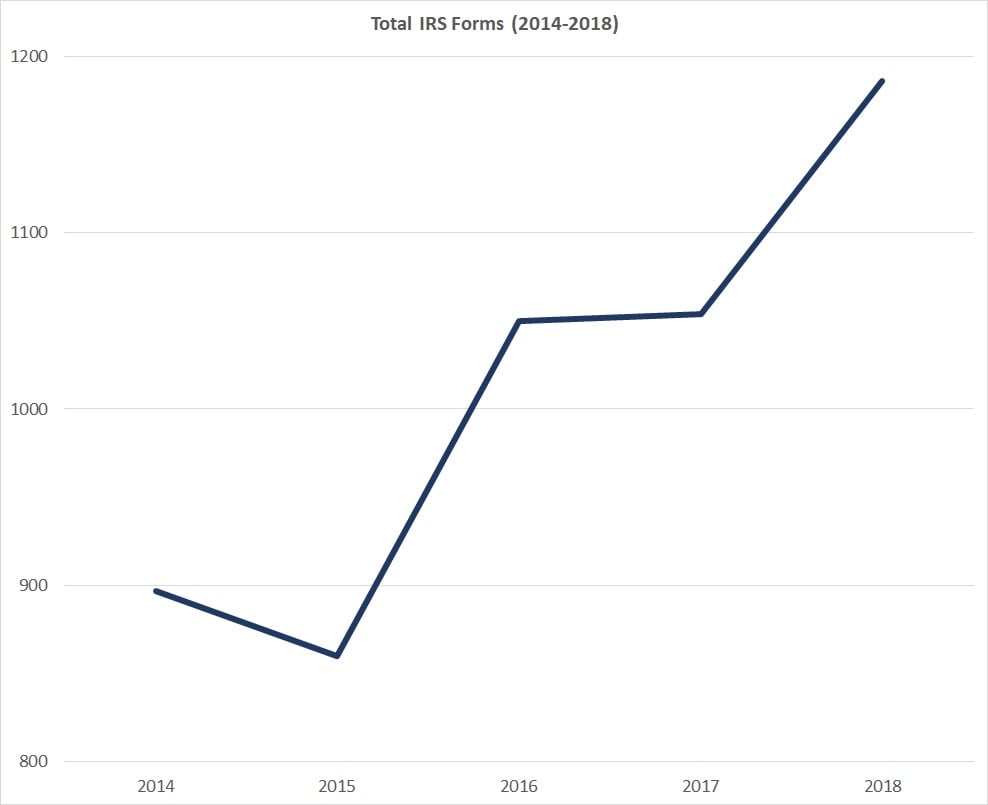

FORMS

The total number of forms issued by the IRS is at its highest amount in the five years AAF has researched tax paperwork burdens. The number of forms increased to 1,186 – a 13 percent rise from this time last year. Since 2014, only once did the number of forms decrease (2015). The chart below illustrates the overall increase in IRS forms since 2014.

The business and individual tax returns continue to create the most forms, with 366 and 196, respectively. The next three collection requests are all associated with well-known IRS tax provisions: tax-exempt organization returns (23), the estate tax (23), and quarterly employer returns (15).

The tax reform passed at the end of 2017 was originally intended to simplify taxes and returns. It will be worth monitoring how its implementation in 2018 affects the number of forms in 2019.

ALTERNATIVE MEASURES OF TAX COMPLIANCE COSTS

As noted by the Taxpayer Advocate Service (TAS), many entities have attempted to estimate the total cost of tax compliance, and experts have embraced a range of methodologies for these calculations.[1] TAS, for example, estimated the 2015 cost of income-tax compliance at $195 billion. The Tax Foundation has estimated that compliance costs amounted to $406 billion in 2016.[2] Including additional cost considerations and alternative approaches to monetizing the hours spent complying with the tax code alters these estimates considerably. Fichtner and Feldman completed a thorough assessment of the costs that the U.S. tax code extracts from the economy through complexity and inefficiency, beyond TAS’s estimate. According to the authors, in addition to time and money expended in compliance, foregone economic growth and lobbying expenditures amount to hidden costs estimated to range from $215 billion to $987 billion. [3]

Other measurements beyond mere time and pecuniary estimates reflect an increasingly burdensome tax code. TAS has reported that tax compliance is so onerous for individual taxpayers that over 90 percent used a preparer or tax software to submit their returns. The tax code has also become so onerous that the IRS struggles to administer it. TAS uses the IRS’s ability to answer taxpayer telephone calls and its ability to respond to taxpayer correspondence as key metrics for taxpayer service. TAS reports the IRS received 74.5 million calls to its customer service lines in fiscal year 2017, down considerably from over 104 million in FY2016, when over 47 percent of toll-free calls went unanswered. TAS reports that over 77 percent of calls from the toll-free number were answered in FY2017, with an average speed of an answer at just over 8 minutes, about half that of FY2016. For FY2018, however, TAS reports that the IRS estimates this rate will fall below 40 percent, commensurate with increased expected call volume.[4]

CONCLUSION

As Americans complete their filing for tax year 2017, the cost of compliance and the number of IRS forms continue to climb. Many will watch closely whether the major tax overhaul implemented for tax year 2018 will make any substantive difference.

[1]National Taxpayer Advocate. “Annual Report to Congress.” Taxpayeradvocate.irs.gov. Internal Revenue Service Web. https://taxpayeradvocate.irs.gov/Media/Default/Documents/2016-ARC/ARC16_Volume1.pdf; See also Government Accountability Office (GAO), GAO-05-878, Tax Policy: Summary of Estimates of the Costs of

the Federal Tax System (Aug. 2005), http://www.gao.gov/new.items/d05878.pdf.

[2] https://taxfoundation.org/compliance-costs-irs-regulations/

[3] Fichtner, Jason J. and Jacob M. Feldman, “The Hidden Costs Of Tax Compliance.” Mercatus Center 2015 Web. http://mercatus.org/sites/default/files/Fichtner-Hidden-Cost-ch1-web.pdf

[4] https://taxpayeradvocate.irs.gov/Media/Default/Documents/2017-ARC/ARC17_Volume1.pdf