Comments for the Record

June 6, 2019

Comments on the Part D Reform Discussion Draft

Chairman Neal, Chairman Pallone, Ranking Member Brady, and Ranking Member Walden,

Thank you for your interest in and the opportunity to comment on policy proposals to lower the cost of prescription drugs for American consumers, specifically Medicare beneficiaries through reform of the Part D program. For more than a decade, Medicare Part D has helped millions of beneficiaries access the medications they need. In the 16 years since the program’s creation, however, the prescription drug market and the insurance structure and pricing practices have changed. Patterns have emerged over the past several years that make it clear the current system is encouraging undesirable behaviors, resulting in suboptimal outcomes. Reforming the benefit structure in a way that realigns the financial incentives of both the insurers and drug manufacturers may help to reverse these trends by putting downward pressure on drug prices, ultimately reducing costs for patients and the government.

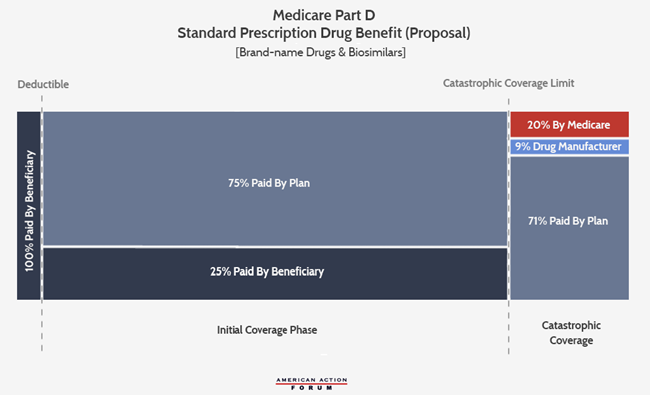

The Committees recently released draft legislation that would provide beneficiaries with an out-of-pocket (OOP) cap on their prescription drug expenditures and rearrange stakeholders’ liability in the catastrophic phase of the Part D benefit, reducing the government’s share from 80 percent to 20 percent while increasing insurer’s liability from 15 percent to 80 percent. These two changes are a move in the right direction but alone are insufficient to provide significant relief for beneficiaries or put enough downward pressure on drug prices.

An OOP cap in the Part D program would certainly strengthen the value of the benefit and provide much-needed financial protection for beneficiaries with high medication costs. Most insurance plans are required to have an OOP limit, as mandated by the Affordable Care Act. Medicare Advantage plans also offer enrollees an OOP limit. The Part D program should be no exception. Determining where to set the limit, though, is more challenging, and depends on other aspects of benefit reform.

Less than 10 percent of Part D enrollees currently reach catastrophic coverage, and more than two-thirds of those individuals are eligible for the Low Income Subsidy (LIS) which limits their financial exposure.[1] The only real beneficiaries of an OOP cap set at the current catastrophic threshold limit would be the estimated 1.1 million beneficiaries who currently exceed that threshold and are responsible for 5 percent of all additional costs for the remainder of the year.[2] The more beneficiaries Congress wishes to protect with an OOP cap, the lower the threshold needed. Congress should keep in mind, however, that there is a trade-off for providing an OOP cap: The lower the cap, the more premiums will increase because ultimately an OOP cap is simply a cost-shift to insurers and the federal government, and based on the Committees’ proposal, the brunt of that cost-shift would fall to the insurers. As insurer liability increases, so do premiums. But this is an important aspect of insurance design: In a market where everyone pays the same premium, the higher the premium, the more evenly the risk is spread. The lower the premium, the more higher-cost patients will have to pay OOP and the less valuable the insurance plan is to them.

The Committees’ proposal to increase insurer liability in the catastrophic phase while reducing government liability should help restore the intended subsidy balance for the program. At the program’s outset, the government’s reinsurance subsidy accounted for 26 percent of the overall subsidy; by 2018, reinsurance comprised 73 percent of the overall subsidy, essentially flipping the subsidy structure on its head.[3] Because of the structure of Part D’s risk corridor program, the more program costs incurred in the catastrophic phase, the more likely it is that the government’s overall program subsidy will surpass the intended subsidy level of 74.5 percent, as explained here.[4] Further, as more costs shift to the catastrophic phase where insurers currently have limited liability, the less incentive they have to keep costs down, undermining the key foundational principles upon which the program is built. As shown in Figure 14-5 of MedPAC’s March 2019 report, the share of the benefit for which plans are at risk has declined from 75 percent in 2007 to 46 percent in 2017.[5] Thus, increasing insurer liability in the catastrophic phase should increase their incentives to keep costs down; however, as noted previously, when costs are shifted to insurers, those costs are ultimately reflected in higher premiums and thus passed back to consumers and the government.

For this reason, these changes alone will not suffice to provide significant program cost reductions. These reforms should be coupled with another reform: eliminating the coverage gap and moving the existing Coverage Gap Discount Program (CGDP) to the catastrophic phase, as detailed here and illustrated below.[6] Because the coverage gap covers a limited amount of expenditures, the coverage gap rebate amount is also limited. In 2020, the most that a drug manufacturer will be required to pay in coverage gap rebates for a single drug, now that the rebate is required to be 70 percent, is $3,698.[7] Any drug costing $9,303 or more will require a payment of this amount, and manufacturers will pay that amount whether the drug costs $9,303 or $90,000. Because a manufacturer’s cost burden in Part D is limited to the finite space of the coverage gap, the existing CGDP does not provide any incentive to drug manufacturers to limit prices beyond the catastrophic limit. By requiring the discount to instead be paid in the catastrophic phase, which has no limit other than the end of the year, a manufacturer’s rebate requirement will increase with the price of the drug. This should—at least more than the current system—discourage price growth.

Further, the types of drugs for which a rebate will be required to be paid will change under this structure, arguably more appropriately targeting costlier drugs. MedPAC has illustrated that under the current CGDP, diabetic therapies are responsible for 31 percent of rebates paid; drugs treating asthma and chronic obstructive pulmonary disease (COPD) are responsible for 12 percent while 11 percent are paid for anti-coagulants.[8] These drugs are not considered specialty medicines; the average price of these medicines is $480-$580 per claim.[9] Alternatively, if the rebates were collected in the catastrophic phase, MedPAC estimates that antineoplastics (chemotherapy) would account for 20 percent of the rebates; antivirals would be responsible for 15 percent of the rebates; diabetic therapies 11 percent (a significant reduction); analgesics (pain relievers) and anti-inflammatory drugs would account for 9 percent; central nervous system agents another 9 percent; and Multiple Sclerosis drugs would account for 8 percent.[10] The price of these drugs ranges from a few thousand to more than $30,000.[11]

If the OOP limit and catastrophic coverage threshold was set at $2,500, the total amount of drug expenditures that would be incurred at that point would equal $8,695 in 2020. For comparison, under current law, beneficiaries themselves are expected to spend $2,652 OOP before reaching catastrophic coverage in 2020—with a True OOP (TrOOP) of $6,350—and total drug expenditures would equal $9,303, if the beneficiary was only taking brand-name drugs.[12]

According to analysis by actuarial accounting firm Milliman, a 9 percent rate was estimated to be the discount rate at which overall manufacturer rebates would be roughly equal to what they are expected to be under current law.[13]

This provides a useful starting point for additional analysis to assist in choosing the appropriate rate. If the manufacturer rebate were moved to the catastrophic phase and set at a rate of 9 percent with a catastrophic threshold limit of $2,500, the break-even price at which point the rebate would be equal to the amount that would otherwise be required under current law (70 percent in the coverage gap) in 2020 is $49,784. Every manufacturer with a drug costing more than this will pay more under these parameters than under the current system. Every manufacturer with a drug costing more than $8,695 will pay something, though it will be less than what they pay now if the cost is below that break-even price.

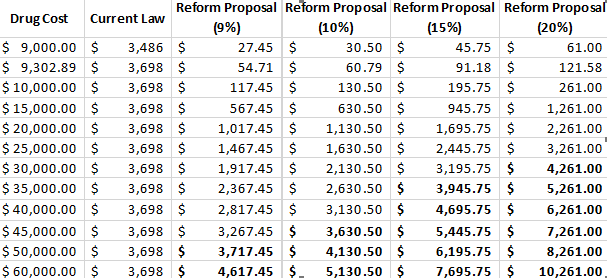

Of course, holding the industry harmless as a whole is not the same as holding individual drug manufacturers harmless. Some would fare better and some would fare worse depending on the prices of their drugs and their utilization rates. The table below shows the various rebate amounts that would be required for drugs at different price points under current law compared with various discount rates if the rebate was moved to the catastrophic phase with an OOP threshold of $2,500, based on a standard benefit design in 2020. As previously stated, if the discount rate is set at 9 percent in the catastrophic phase, the break-even price is $49,784. If the discount rate is set at 10 percent, the break-even price drops slightly to $45,675. At 15 percent, the break-even price is $33,348; and at 20 percent, it is $27,185.

Note: The bolded numbers in the table highlight the approximate price points at which the required rebate under the various proposed discount rates would meet or exceed the required rebate amount under current law.

According to the Centers for Medicare and Medicaid Services (CMS) Drug Spending Dashboard for 2017, there were 361 drugs for which spending per beneficiary for the year exceeded $8,695, and thus would be required to pay some rebate amount if the mandatory rebate were moved to the catastrophic coverage phase with an OOP threshold of $2,500.[14] These drugs were provided to more than 1.5 million beneficiaries at a total cost of $49.9 billion. It is estimated that nearly $36.4 billion would have been spent on these drugs in the catastrophic phase at that threshold. Based on this estimate and assuming rebates were required for all beneficiaries—not just non-LIS beneficiaries as is required under current law, a 9 percent rebate would result in $3.3 billion in mandatory rebates being paid (though this does not account for the enrollment growth and price growth that has occurred since 2017). If the discount rate was increased to 10 percent, the rebates would total $3.6 billion. At 15 percent, the rebates would equal $5.5 billion, and at 20 percent, the rebates would equal $7.3 billion (again, not accounting for growth in enrollment—which is expected to increase 10 percent between 2017 and 2020—or prices since 2017). It is estimated that coverage gap rebates totaled nearly $6 billion in 2017.[15]

If the prices for these drugs increased 5 percent between 2017 and 2020 and the number of beneficiaries increased by the same rate that overall enrollment is expected to have increased during this period (10 percent), then an additional 17 drugs provided to an additional 216,000 beneficiaries would be subject to the rebate. The total estimated spending for these drugs based on these assumed growth rates would equal $58.2 billion, of which, roughly $42.8 billion would occur in the catastrophic phase. A 9 percent discount rate would yield $3.9 billion in rebates for these drugs. A 10 percent discount rate, $4.3 billion; 15 percent, $6.4 billion; and 20 percent, $8.6 billion. This does not account for any new drugs that have or will come to market since 2017 which may also exceed the threshold.

The aforementioned analysis by Milliman also estimated the likely impact of such a design change on beneficiary and government costs, assuming the reforms led to reductions in brand-name price growth of 5 percent.[16] Milliman found that beneficiary premiums would rise by $33.9 billion over the 10-year period, 2020-2029, but that OOP costs would be reduced $41.3 billion, for an overall savings to beneficiaries of $7.4 billion. The federal government would also experience significant savings. The direct premium subsidy for both LIS and non-LIS beneficiaries would increase by $637.4 billion, but that would be offset by reinsurance savings of $473.2 billion and reductions in LIS cost-sharing subsidies of $1887.6 billion.

It is up to Congress to decide what the appropriate thresholds are, but this analysis seeks to lay out the potential impacts of the various options. As with any policy proposal, it is important to carefully consider the trade-offs that are required from any change in addition to the likely benefits. The benefit structure described here would provide a simplified benefit, reducing the insurers’ administrative burden of having to track a beneficiary through so many phases and providing for a uniform coinsurance rate between the deductible and the catastrophic phase. The OOP cap would provide beneficiaries with true financial protection rather than open-ended costs. Finally, the realignment of the liabilities in the catastrophic phase would encourage both insurers and drug manufacturers to keep costs down while protecting taxpayers from rising reinsurance costs. The trade-off is that premiums will likely rise under such a proposal as more liability is shifted to the insurers. It is estimated, though, that overall savings in OOP expenditures will more than offset any premium increases. The federal government is also expected to save money based on assumed behavioral changes. Overall, the benefits of such a change to the Part D program are expected to outweigh potential consequences. This change is also likely to target the program’s benefits and mandatory drug rebates more appropriately than the current structure.

[1] MedPAC Report to Congress. The Medicare prescription drug program (Part D): Status Report, March 2019 http://www.medpac.gov/docs/default-source/reports/mar19_medpac_ch14_sec.pdf?sfvrsn=0 (pg. 412)

[2] MedPAC Report to Congress. The Medicare prescription drug program (Part D): Status Report, March 2019 http://www.medpac.gov/docs/default-source/reports/mar19_medpac_ch14_sec.pdf?sfvrsn=0 (pg. 412)

[3] Spitalnik, Paul. “The Financial Status of Medicare.” Office of the Actuary, Centers for Medicare and Medicaid Services. June 6, 2018. http://www.aei.org/events/the-2018-medicare-trustees-report-fiscal-challenges-and-future-reforms/

[4] Hayes, Tara O’Neill. “More Evidence of the Need for Reform in Medicare Part D.” American Action Forum. January, 25, 2019. https://www.americanactionforum.org/insight/evidence-for-structural-reform-part-d/

[5] MedPAC Report to Congress. The Medicare prescription drug program (Part D): Status Report, March 2019 http://www.medpac.gov/docs/default-source/reports/mar19_medpac_ch14_sec.pdf?sfvrsn=0 (pg. 410)

[6] Hayes, Tara O’Neill. “Redesigning Medicare Part D to Realign Incentives.” American Action Forum. August 14, 2018. https://www.americanactionforum.org/research/redesigning-medicare-part-d-realign-incentives-1/

[7] In 2020, a beneficiary will reach the coverage gap after $4,020 in total drug expenditures, of which the beneficiary will have paid $1,390 in OOP expenses. The beneficiary will exit the coverage gap after $6,350 in TrOOP costs, $2,652 of which will be paid by the beneficiary and $3,698 of which will be paid by drug manufacturers if the beneficiary is taking only brand-name drugs. If the beneficiary is taking just one drug, then this is the maximum amount a manufacturer would have to pay for a given drug per beneficiary. (Calculations my own. 2020 plan information found here: https://q1medicare.com/PartD-The-2020-Medicare-Part-D-Outlook.php)

[8] Schmidt, Rachel and Shinobu Suzuki, MedPAC. “Options to increase the affordability of specialty drugs and biologics in Medicare Part D.” April 5, 2019. http://www.medpac.gov/docs/default-source/default-document-library/options-to-increase-the-affordability-of-specialty-drugs-in-pt-d—final.pdf?sfvrsn=0 (Slide 9)

[9] Schmidt, Rachel and Shinobu Suzuki, MedPAC. “Options to increase the affordability of specialty drugs and biologics in Medicare Part D.” April 5, 2019. http://www.medpac.gov/docs/default-source/default-document-library/options-to-increase-the-affordability-of-specialty-drugs-in-pt-d—final.pdf?sfvrsn=0 (Slide 9)

[10] Schmidt, Rachel and Shinobu Suzuki, MedPAC. “Options to increase the affordability of specialty drugs and biologics in Medicare Part D.” April 5, 2019. http://www.medpac.gov/docs/default-source/default-document-library/options-to-increase-the-affordability-of-specialty-drugs-in-pt-d—final.pdf?sfvrsn=0 (Slide 13)

[11] Schmidt, Rachel and Shinobu Suzuki, MedPAC. “Options to increase the affordability of specialty drugs and biologics in Medicare Part D.” April 5, 2019. http://www.medpac.gov/docs/default-source/default-document-library/options-to-increase-the-affordability-of-specialty-drugs-in-pt-d—final.pdf?sfvrsn=0 (Slide 13)

[12] Note that TrOOP includes the rebate amounts provided by manufacturers. If the manufacturer rebates are moved from the coverage gap to the catastrophic phase, manufacturer rebates would no longer count toward a beneficiary’s TrOOP. That is why a lower OOP threshold, relative to the current TrOOP threshold, is needed to achieve a similar level of OOP spending directly by the beneficiary.

[13] http://us.milliman.com/uploadedFiles/insight/2018/restructuring-Medicare-Part-D-benefit.pdf

[14] https://www.cms.gov/Research-Statistics-Data-and-Systems/Statistics-Trends-and-Reports/Information-on-Prescription-Drugs/MedicarePartD.html

[15] https://www.americanactionforum.org/insight/understanding-the-policies-that-influence-the-cost-of-drugs/#_ednref11

[16] http://us.milliman.com/uploadedFiles/insight/2018/restructuring-Medicare-Part-D-benefit.pdf

March 27, 2024

Comments for the Record

Comments on the Rural Digital Opportunity Fund

Jeffrey Westling

COMMENTS OF JEFFREY WESTLING[1] The Federal Communications Commission designed the Rural Digital Opportunity Fund (RDOF) to ensure continued and rapid…