Insight

January 25, 2019

More Evidence of The Need for Structural Reform in Medicare Part D

Executive Summary

- A Wall Street Journal report details how private insurers that offer plans through Medicare Part D are leveraging the program’s structure to contain their losses and increase their profits, resulting in $9.1 billion in extra subsidies.

- Medicare Part D’s costs are rising for a number of reasons, primarily as a result of an increase in spending in the “catastrophic” phase of the insurance plans—the area of the program that insurers are using to contain their losses.

- The existing evidence on the program’s rising costs and misaligned incentives, including the Journal’s report, demonstrates the importance of restructuring the program to realign incentives for all stakeholders. One such proposal is detailed here.

Introduction

A recent Wall Street Journal investigative report made a dramatic claim in its headline: “The $9 Billion Upcharge—How Insurers Kept Extra Cash From Medicare.” In this article, the Journal examines how insurers set Medicare Part D premiums so as to increase the likelihood that they will earn a profit on those plans at the expense of federal taxpayers.

The Medicare Part D program provides Medicare beneficiaries with access to subsidized outpatient prescription drug coverage through private insurance plans, and the program’s costs are rising. In 2018, 43.9 million seniors (or 73 percent of all Medicare beneficiaries) enrolled in Part D, and enrollment—and therefore cost—is expected to increase each year for the foreseeable future.[1] These rising program costs have raised concerns among policymakers, and the Journal report highlighted one area of concern: reinsurance.

The federal government covers most of the costs in the final, “catastrophic” phase of Part D coverage—the reinsurance phase. The recent exposé depicts insurers as exploiting the reinsurance structure to guard against losses while using another aspect of the program’s structure—risk corridors—to boost their profits illegitimately. Yet in structuring their plans the way they are, insurers are legally and rationally responding to the program’s incentives. To stop this practice and contain costs more broadly within the Medicare Part D program requires reforms to the program’s structure. One such reform option is outlined below.

Rising Reinsurance Costs

Overall program expenditures grew at an average annual rate of 6 percent between 2007 and 2016, almost exclusively as a result of rising reinsurance expenditures. The program’s rising reinsurance costs are a function of both continued growth in the number of beneficiaries who reach the catastrophic threshold as well as continued growth in the amount of spending for each of those enrollees. Expenditures for such high-cost enrollees rose at an annual rate of 10.4 percent between 2010 and 2015; in contrast, average expenditures for the remainder of enrollees actually declined by an average of 2.1 percent each year during that period.[2] Consequently, spending above the catastrophic threshold has also been rising more rapidly over this period relative to before 2010: 26.6 percent compared with 12 percent previously.[3] Ultimately, high-cost enrollees accounted for 57 percent of program expenditures in 2015, despite being only 28 percent of beneficiaries.[4]

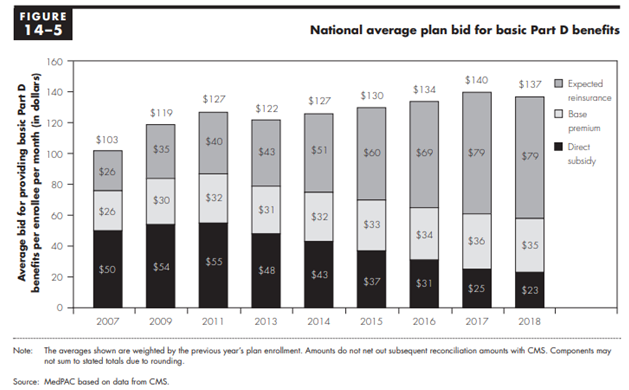

The growth in the cost of high-cost enrollees not only increases the federal government’s cost to subsidize the program, but also changes how the federal government subsidizes the program. This rising spending has led to a dramatic increase in the share of the federal government’s subsidy being paid through reinsurance rather than premium subsidies: Reinsurance payments accounted for less than one-third (31 percent) of the federal government’s share of the program’s cost in 2007, but more than two-thirds of the cost in 2016 (68 percent).[5]

While the program has been largely successful, these and other trends over the past several years have highlighted the need for structural reforms to eliminate perverse incentives.

Understanding Medicare Part D’s Structure

Medicare Part D Bids

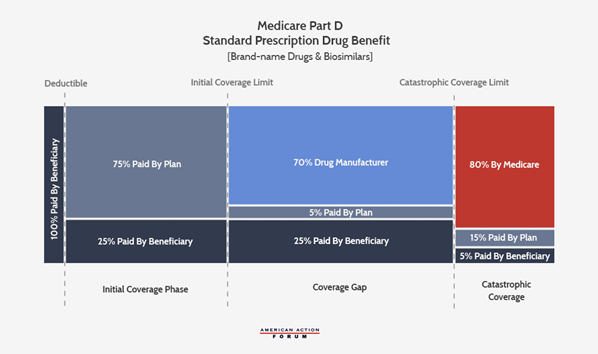

In order to participate in the program and receive government subsidies for the coverage offered, Part D plan sponsors (i.e. insurers) must submit a bid to the Centers for Medicare & Medicaid Services (CMS) estimating their cost to provide the plan’s covered benefits for each enrollee. Specifically, a sponsor’s bid reflects the estimated cost of providing the “basic benefit” to an average beneficiary plus, if it chooses, the estimated cost of any supplemental or enhanced benefits.[6] The cost of the basic benefit is based on the plan’s required liability under each phase of coverage, as shown in the chart below—including plans’ 15 percent liability in the catastrophic phase.[7]

The Government Subsidy

The government subsidy has two components: the direct subsidy of the premium and the reinsurance subsidy of excess catastrophic costs. The direct subsidy covers 74.5 percent of the national average bid for the basic benefit; it is paid to plans each month and does not change throughout the year. Enrollees cover the difference between the direct subsidy and the premium. If an enrollee chooses a plan with a lower-than-average bid, they may not have to pay any premium, whereas enrollees in plans with a higher-than-average bid will have to pay a larger premium.

If a plan’s costs for providing the basic benefit are above or below their estimated costs, the direct subsidy payments are reconciled with the plan’s actual costs at the end of the year—but only under certain circumstances, as discussed below in the “Risk Corridors” section. The circumstances create the room that insurers are using to make more money, as the Journal reported.

The reinsurance subsidy covers 80 percent of costs over the catastrophic coverage threshold beyond the amounts estimated in the bid for the basic benefit. Unlike the direct subsidy, the reinsurance subsidy is always reconciled with actual costs such that plans are protected from ever having to pay more than 15 percent of each beneficiary’s catastrophic costs.

The total government subsidy is supposed to cover 74.5 percent of the program’s costs; however, this percentage is not set in law.

Risk Corridors

When Congress and the Bush Administration were creating Part D, there was concern among policymakers that few insurers would offer plans because they would struggle to predict costs, and thus they would face a substantial potential to lose money. Simply, if a plan’s actual costs were more than expected, the direct subsidy payment would not cover as much of their costs as intended; alternatively, if a plan’s actual costs were less than estimated, the subsidy would be more than needed and the plan sponsor would gain a profit. Accordingly, a risk corridor program was included to guard against substantial financial losses while also preventing equally substantial profits at the expense of beneficiaries and taxpayers.

The risk corridor established limits on both financial gains and losses for a plan. If a plan’s actual costs for the basic benefit are within five percent in either direction of the sponsor’s estimated costs, there is no reconciliation of direct subsidy payments: The plan is responsible for all the loss it incurs or may keep all of the additional subsidy payments as profit. If a plan’s actual costs are more than 5 percent but less than 10 percent above or below the sponsor’s bid, the first 5 percent is treated the same, and the portion of loss or profit between 5 percent and 10 percent is split between the plan and Medicare 50/50. Similarly, if a plan’s costs differ from the bid by more than 10 percent, the initial 10 percent is treated as just described and the plan is responsible for 20 percent of the losses over 10 percent if costs are higher than expected (or may keep 20 percent of the savings from the higher-than-needed direct subsidy payments over 10 percent). The following chart from the Medicare Payment Advisory Commission (MedPAC) provides a helpful visual.[8]

The Impact: Why This Matters

Government Subsidy of Part D Increasingly Consumed by Reinsurance

As noted, the growth in Part D spending is the result of continued increases in both the number of high-cost enrollees and the total amount spent for each of those high-cost enrollees. The program’s own structure, however, has allowed for a third factor to increase program costs.

The federal government is supposed to cover 74.5 percent of all program costs (excluding beneficiary cost-sharing, Low-Income Subsidy cost-sharing subsidies, and the coverage gap rebates), and that percentage must be split between the direct premium subsidy, the additional low-income premium subsidies, and the reinsurance costs. In order for this percentage to remain fixed, the federal government’s direct premium subsidies must decrease as reinsurance costs increase. This cost-shifting can be seen in the following chart from MedPAC’s March 2018 Report to Congress, showing the government’s declining direct subsidy of the premiums and increasing reinsurance subsidies, as well as the base premium paid by beneficiaries.[9]

Because of the existence and nature of the risk corridors along with the fact that this overall subsidy rate is not set in law, the federal government has actually covered more than 74.5 percent of the program’s costs in most years.[10] That is, the structure and limited application of the risk corridors to the direct subsidy payments allows plan sponsors to underestimate their catastrophic coverage expenditures and be made whole for most of their additional costs, while simultaneously overestimating their other expenditures without having to pay back all of the excess premium subsidies. The result is that rising catastrophic costs spill into rising overall program costs.

The Latest Findings

While MedPAC had previously noted the possibility for plans to design their bids in such a way, they were unable to find specific evidence of such behavior; MedPAC noted that to the extent such behavior was occurring, it was likely limited. The Wall Street Journal, however, found evidence that insurers were in fact using these allowances to minimize the threat of financial losses and maximize gains. Part D plan sponsors overestimated their basic benefit costs, and as a result of the risk corridors they were able to keep an additional $9.1 billion beyond what they would have if they had accurately estimated their costs.[11] On the other hand, plan sponsors also underestimated their reinsurance costs by $27.8 billion from 2006-2015, and Medicare reimbursed plans for all of these additional costs.

The Need for Reform (And How to Do It)

In structuring their bids this way, the insurers’ behavior is both fully legal and the rational result of the incentives established by the program’s structure. If policymakers find this behavior to be undesirable, they should change the program to eliminate the incentives to behave this way.

One way to alter incentives would be to increase plan sponsors’ liability in the catastrophic coverage phase. AAF has previously proposed this and other comprehensive reforms of the Part D program. Those proposals are detailed here. The aim of this proposal is to realign the incentives of plan sponsors with those of the beneficiaries and taxpayers in order to bring down program costs for all parties. This proposal includes the introduction of a cap on beneficiary out-of-pocket costs, moving mandatory drug manufacturer rebates to the catastrophic phase, and increasing insurers’ liability in the catastrophic phase while reducing the government’s reinsurance liability.

CMS has also just proposed a new voluntary demonstration program for the Part D program that attempts to address the issue of rising reinsurance costs. Under this demo, Part D plan sponsors would take on increased liability in the catastrophic coverage phase in exchange for the possibility of shared savings. CMS would determine the expected expenditure rate absent the demo and plans would be able to share in any savings below the expected expenditure amount; plans would also be liable for additional costs if expenditures exceeded the expected rate.

Current trends and projections, including the drugs currently in development and their expected costs, all indicate that the need for reform will continue to grow.

[1] https://www.cms.gov/Research-Statistics-Data-and-Systems/Statistics-Trends-and-Reports/ReportsTrustFunds/Downloads/TR2018.pdf

[2] http://www.medpac.gov/docs/default-source/reports/mar18_medpac_ch14_sec.pdf (pg. 421)

[3] http://www.medpac.gov/docs/default-source/reports/mar18_medpac_ch14_sec.pdf (pg. 423)

[4] http://www.medpac.gov/docs/default-source/reports/mar18_medpac_ch14_sec.pdf (Pg. 399)

[5] http://www.medpac.gov/docs/default-source/reports/mar18_medpac_ch14_sec.pdf (pg 420)

[6] A risk adjustment program is used to increase or decrease payments to plans based on an enrollee’s health to mitigate any additional costs that may be incurred if enrollees are sicker than average or vice versa.

[7] Plans may choose different benefit designs with varying degrees of liability, but any variation must still be actuarially equivalent to this standard benefit design.

[8] Chart from MedPAC June 2015 report, Chapter 6. Edited for space, eliminating the visual of the structure of the risk corridors in 2006 and 2007.

[9] http://www.medpac.gov/docs/default-source/reports/mar18_medpac_ch14_sec.pdf

[10] http://www.medpac.gov/docs/default-source/reports/mar18_medpac_ch14_sec.pdf (page 419)

[11] https://www.wsj.com/articles/the-9-billion-upcharge-how-insurers-kept-extra-cash-from-medicare-11546617082