The Daily Dish

October 29, 2025

So Long, QT!

The Federal Reserve Board’s two-day meeting of the Federal Open Market Committee (FOMC) concludes today. Analysts expect the decision – announced at 2:00 – to be a 25 basis-point cut in the target federal funds rate. This will leave the range at 3.75 percent to 4.0 percent. But there may be another bit of news as well. The Financial Times is reporting: “The Federal Reserve is expected to end a three-year phase of quantitative tightening this week, easing pressures on banks amid concerns that funding is getting too tight in money markets.”

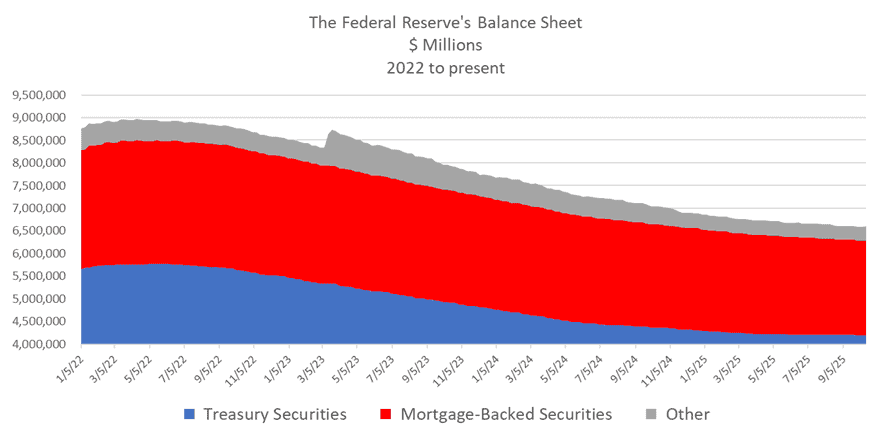

Quantitative tightening (QT) is the pair to quantitative easing (QE). QE was used extensively as part of the Fed’s response to the COVID-19 recession. Each month it, figuratively speaking, it printed $90 billion in cash and used it to purchase $60 billion in Treasury securities and $30 billion in mortgage-backed securities. QE flooded financial markets with liquidity and, simultaneously, greatly expanded the balance sheet of the Fed.

QE was very successful in 2020, but was also part of the overly easy FOMC policy that accommodated the American Rescue Plan and fueled inflation in 2021. Since 2022, the Fed has been reversing this error and using QT to reduce its balance sheet. (See below, reproduced from AAF’s tracker.)

The FT’s reporting suggests the consensus is that QT is over:

It’s quickly become close to consensus that the Fed will wrap up QT this month,” said Krishna Guha, vice-chair at Evercore ISI.

“It’s a close call,” said Rich Clarida, a former Fed vice-chair who is now at Pimco. “Even if we don’t get a formal decision, we’ll have a very strong hint that they’ll end it in December.”

The only missing piece is inflation back at the 2-percent target.

Fact of the Day

In FY 2025, the federal government spent $970 billion on interest payments on the national debt – equivalent to roughly $7,300 per household.