The Daily Dish

May 26, 2022

The Budget and Economic Outlook

Yesterday the Congressional Budget Office (CBO) released its latest “baseline” outlook for the federal budget and U.S. economy. (A baseline is constructed by assuming that current law on the books remains unaltered for the next 10 years.) AAF’s Gordon Gray has a nice summary of the report and points out the following:

- Since CBO’s last baseline update in July, improved economic growth and inflation have increased revenue collections, but the combination of more deficit-financed spending, interest costs, and other economic factors has contributed an estimated $2.4 trillion in higher deficits on net, with debt service payments increasing by over $1.8 trillion over a comparable period.

- The national debt will eclipse the highest levels in U.S. history by the end of fiscal year 2031.

- The CBO outlook shows a federal budget that reflects the risks from running structural deficits with high levels of indebtedness.

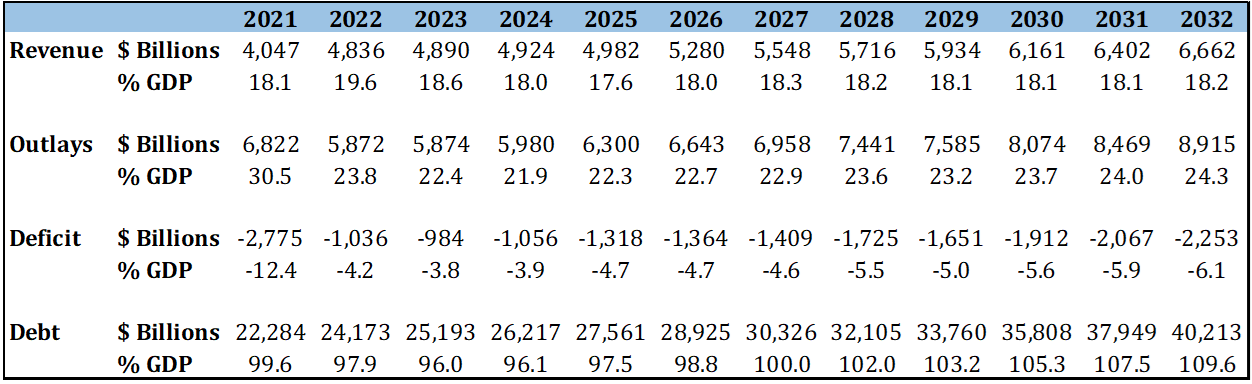

The key table in Gray’s piece is reproduced below.

The Budget Outlook: By the Numbers

Three things jump out. First, deficits decline over the next two years, but only because of the end of the massive pandemic response. They remain elevated and are rising both in absolute magnitude and relative to gross domestic product (GDP) as time passes. Second, outlays remain at a very high level (reaching 24 percent of GDP in 2032), despite the end of the pandemic-related spending. The lesson here is that the rising spending on Social Security, Medicare, Medicaid, the Affordable Care Act and other “entitlements” is driving the budget outlook. Finally, the level of debt is very, very high and makes the entire budget highly exposed to interest rate risk.

Indeed, among the most important changes to the outlook since the last CBO projection in July 2021 is much higher interest costs. CBO has increased its 10-year deficit projection by $2.4 trillion, of which debt service costs contribute over $1.8 trillion. For perspective, this is roughly the same deficit impact as passing another Tax Cuts and Jobs Act!

The other key element of the report is a revised economic outlook. In many ways, it is now unsurprising that CBO sees high inflation in 2022, which ultimately diminishes to the Fed’s 2.0 percent target over the next 3-4 years. Put differently, CBO anticipates a sustained fight against inflation for a number of years and in this report the agency estimates the rate on the 10-year Treasury to average 60 basis points higher than previously. In the process of this effort, economic growth will slow from 3.0 percent this year to as low as 1.3 percent in 2026.

The economic outlook has become familiar, even if slowing growth and high inflation are an unappetizing combination. The budget outlook is daunting, if not surprising. What would be surprising is if Congress woke up and actually did something about it.

Fact of the Day

Anti-circumvention tariffs on solar cell and modules from Cambodia, Malaysia, Thailand, and Vietnam could decrease solar deployment in the United States by 46 percent over the next two years.