Insight

May 25, 2022

Highlights of CBO’s Budget and Economic Outlook for 2022-2032

Executive Summary

- According to new projections from the Congressional Budget Office (CBO), the national debt will eclipse the highest levels in U.S. history by the end of fiscal year 2031.

- Since CBO’s last baseline update in July, improved economic growth and inflation have increased revenue collections, but the combination of more deficit-financed spending, interest costs, and other economic factors has contributed an estimated $2.4 trillion in higher deficits on net, with debt service payments increasing by over $1.8 trillion over a comparable period.

- The CBO outlook shows a federal budget that reflects the risks from running structural deficits with high levels of indebtedness.

Introduction

For the first time since July of 2021, the Congressional Budget Office (CBO) updated its budget and economic outlook, which provides Congress with 10-year budget and economic projections. Since July of last year, the United States has grappled with new challenges in the form of rapidly rising inflation and war in Europe, while continuing to contend with successive waves of COVID-19 and attendant disruptions. The budgetary and economic outlook reflects the costs of those recent challenges. Budget deficits are projected to fall significantly – but to substantially elevated levels that will ultimately drive the debt to its highest level in U.S. history. Despite the rapid recovery from the pandemic-induced recession, the United States is grabbling with new challenges in the form of significant price growth, and the response from the U.S. central bank. These pressures similarly animate budgetary flows – increasing tax revenues as well as outlays, most conspicuously debt service. Today’s baseline update reflects new economic challenges in the face of longstanding fiscal pressures.

What’s Changed?

The May 2022 CBO budget outlook is in many ways worse than CBO’s projections released last July. Stronger economic growth, all else equal, leads to higher tax collections and lower expenditures on many transfer programs. The expiration of multitrillion-dollar emergency COVID-related spending has necessarily reduced deficits. But Congress’ appetite for deficit spending, rising interest rates and increased debt service costs have worsened the budget outlook more than other conditions have improved it. CBO has also marked up its inflation projections, which are reflected in its estimates for interest rates. Indeed, compared to its last baseline estimate, CBO has increased its 10-year deficit projection by $2.4 trillion. Over a comparable period, debt service costs have been upwardly estimated by over $1.8 trillion. Essentially, despite improved economic and technical conditions that would have otherwise reduced projected deficits by $3.4 trillion, higher inflation, interest rates, and deficits spending added $5.8 trillion to CBO’s deficit projections for a net deficit increase of $2.4 trillion.

The Budget Outlook: By the Numbers

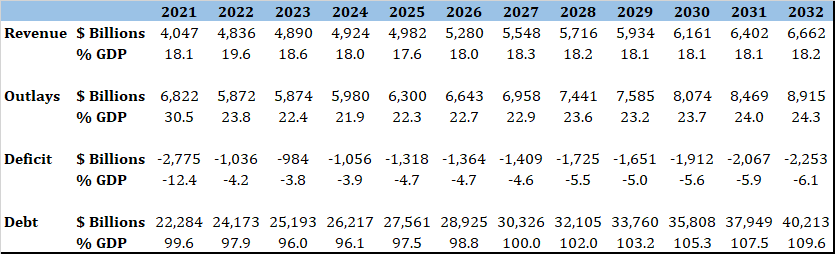

Taxes: By the end of the 10-year budget window, tax revenues will amount to 18.2 percent of gross domestic product (GDP). Tax revenues will average 18.1 percent of GDP over the next 10 years, well above the 17.3 percent historical average. CBO previously estimated that tax revenues would average 17.8 percent of GDP over the budget window.

Spending: CBO estimates that, by the end of the budget window, overall spending will total 24.3 percent of GDP, nearly 4 percentage points higher than the historical average of 20.4 percent. Entitlement, or mandatory, spending will continue to remain roughly two-thirds of federal outlays over the next decade. It comprised 70 percent of federal outlays in 2021, up from 56 percent in 2011 and 35 percent in 1971.

Deficits: The federal budget deficit is estimated to be $1 trillion in 2022, or 4.2 percent of GDP. This follows a $3.1 trillion deficit record in 2020, and a $2.8 trillion deficit recorded in 2021, the highest nominal deficit ever previously recorded was $1.4 trillion in 2009. As a share of GDP, the 2021 deficit of 12.4 percent of GDP is the highest observed other than that of 2020 and those run during World War II. The deficit will average 5.1 percent of GDP over the 2022-2032 period and will fall below $1 trillion in only one of those years.

Interest Payments: Interest payments on the debt will reach $1.2 trillion in 2032. Compared to CBO’s last forecast, interest payments in 2031 are projected to increase by over $1.8 trillion over the next decade due to higher interest rates and increased debt. By comparison, the Tax Cuts and Jobs Act was estimated to cost $1.45 trillion. Interest payments are projected to more than double as a share of federal outlays, rising from 5 percent of total federal spending in 2021 to over 13 percent of federal spending in 2032.

Debt Held by the Public: Borrowing from the public is projected to increase as a share of the economy under current law, reaching 109.6 percent of GDP in 2032. The debt surpassed 100 percent of the economy in 2020, the first time since 1946. By the end of the budget window, the debt is expected to reach the highest level as a share of GDP in U.S. history – and in 2031 will surpass the 106.1 percent record from 1946 following the end of World War II.

The Economic Outlook: By the Numbers

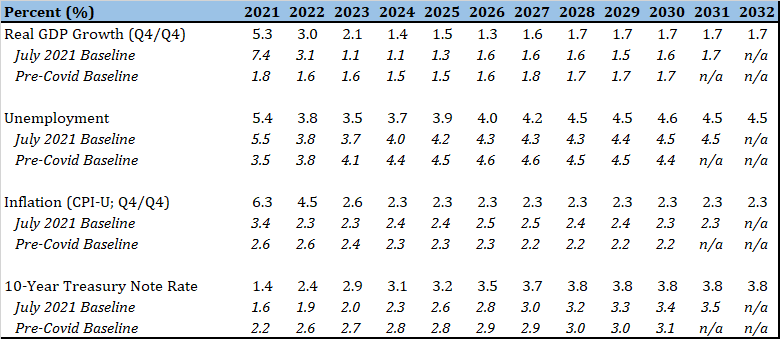

CBO projects real GDP growth to average 1.7 percent over the budget window. It forecasts that unemployment will match its pre-pandemic forecast of 3.8 percent in 2022. It currently stands at 3.6 percent.

The largest departures from CBO’s prior forecast reflect price growth and changes in monetary policy. CBO has marked up its near-term inflation forecast relative to its July 2021 estimate substantially. Indeed, CBO estimates that CPI-U (consumer price index for urban consumers) inflation will rise by two percentage points above its prior forecast over the course of 2022, before assuming monetary policy reduces the rate of price growth. CBO forecasts that PCE (personal consumption expenditures) inflation, the preferred measure of the Federal Reserve, does eventually return to its target rate of 2 percent. CBO has relatedly increased its relative estimates of interest rates – with the agency estimating the rate on the10-year Treasury to average 600 basis points higher than previously forecast over the budget window.