The Daily Dish

May 27, 2022

The Myth of Market Concentration

A central plank of administration policy, congressional legislative efforts, and the progressive view of the universe is that a recent history of increasing market concentration has left American consumers helpless. As the president put it in his executive order on competition: “A fair, open, and competitive marketplace has long been a cornerstone of the American economy, while excessive market concentration threatens basic economic liberties, democratic accountability, and the welfare of workers, farmers, small businesses, startups, and consumers.” He added: “Yet over the last several decades, as industries have consolidated, competition has weakened in too many markets, denying Americans the benefits of an open economy and widening racial, income, and wealth inequality.”

Increasing concentration in U.S. industries is such a crucial element of the current policy dialogue that it makes sense to check on the facts in this area. In his first publication for AAF, Fred Ashton does exactly that: examines the data for evidence of increasing concentration. Specifically, he uses newly released Census data (collected from 2002 to 2017) to calculate the fraction of sales accounted for by the top four firms in each industry. (Note: four is not a magic number. One can use many other integers and get the same basic result.)

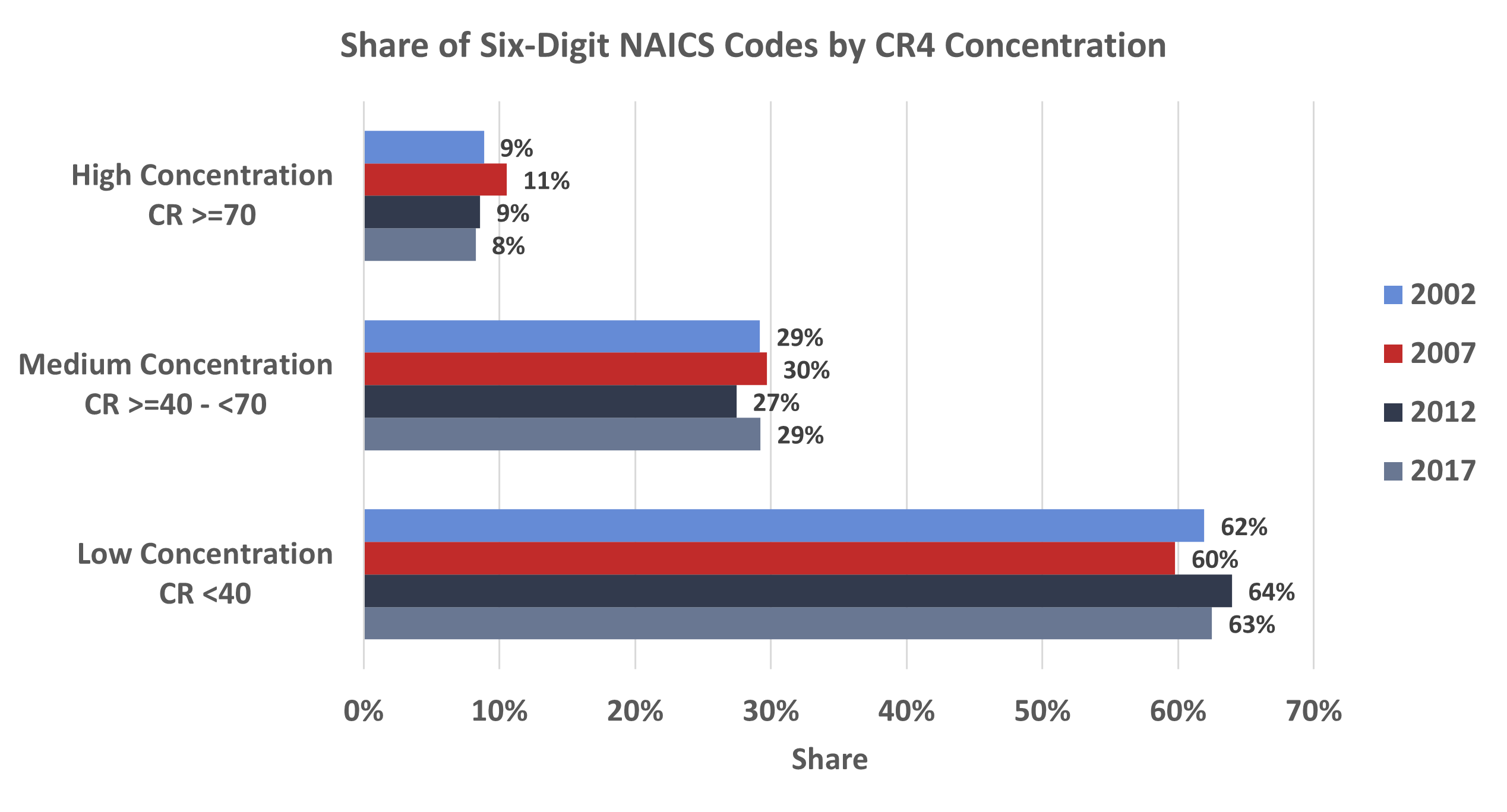

These results are shown below (which is Figure 1 in Ashton’s paper). In the lingo of this research area, CR4 is the said fraction of sales by the top four firms; NAICS (North American Industry Classification System) identifies industries, with more digits (six versus four, for example) being a finer classification, and the cutoff; and the cutoffs for medium and high concentration set at 40 percent and 70 percent, respectively.

As an example, in 2002, 9 percent of 6-digit industries were highly concentrated, while in 2017, the fraction was 8 percent.

Take a moment to examine the figure (waiting, waiting, waiting … ).

The basic result is that all of the bars are essentially the same length in 2002, 2007, 2012, and 2017. Put another way, concentration in the U.S. economy HAS. NOT. CHANGED. ONE. BIT.

There are lots and lots of robustness checks – different industry breakdowns, using more or fewer firms in the concentration ratio, and so forth. These don’t alter the basic picture. It is important to add, however, that this does not rule out any competition problem whatsoever. For a given concentration, there might be conduct problems now that were not present previously. Or, the real market power might be in a particular area of geography that gets masked by the aggregate analysis.

Those caveats notwithstanding, its strikes Eakinomics that those who invoke rising concentration as the rationale to assault successful companies, torch existing antitrust standards, and ramp up federal micromanaging of the economy are doing the public a real disservice. First get the facts right, please.

Fact of the Day

Since January 1, the federal government has published rules that impose $86.7 billion in total net costs and 48.5 million hours of net annual paperwork burden increases.