Insight

April 4, 2023

Addressing U.S. Drug Shortages and Drug Recalls

Executive Summary

- Even as the COVID-19 pandemic winds down, drug shortages persist for generic drugs with low-profit margins and significant manufacturing complexity.

- The Food and Drug Administration (FDA) receives relevant information on the global drug supply chain and active pharmaceutical ingredients used to produce many essential medicines but lacks the capacity to properly analyze these data to mitigate or avoid potential drug shortages; industry, too, lacks critical visibility into these supply chains.

- To address this problem FDA could standardize the submission of information manufacturers already provide on potential drug shortages; once that data is usable, Congress could allow public disclosure of shortage information to alert manufacturers and increase competition in specific drug markets.

Introduction

While the COVID-pandemic exacerbated weaknesses in the supply chain for a wide variety of goods, including drugs and healthcare supplies, drug shortages of generic drugs with low-profit margins and significant manufacturing complexity have persisted before, during and after the crisis. According to a recent report from the Senate Committee on Homeland Security and Governmental Affairs (HSGA), “between 2021 and 2022, new drug shortages increased by nearly 30 percent. At the end of 2022, drug shortages reached a five-year high of 295….”[1]

Indeed, drug shortages for antibiotics[2] used to treat a range of childhood bacterial ear, sinus, and pneumonia infections spiked late last year. One of the most prescribed antibiotics used to treat these conditions is amoxicillin – accounting for 30 percent of all antibiotic prescriptions in the United States – but it has only one domestic manufacturer in the country.[3] To mitigate the shortage of amoxicillin,[4] the Academy of Pediatrics[5] published a list of recommendations to advise providers who were unable secure the medication in oral form (powder or liquid) for young patients who may struggle to take a tablet.[6]

The HSGA report highlighted three key challenges facing the U.S. drug supply chain. First, the majority of key raw materials and active pharmaceutical ingredients (APIs) used to create medicines are sourced overseas, primarily in China and India. Second, most drugs in shortage are older generics that require complex manufacturing but have low-profit margins. Third, U.S. government agencies and private industry do not have sufficient information regarding the locations of key raw materials production or APIs to anticipate or mitigate future shortages. The HSGA report emphasized that the pharmaceutical marketplace may appear diverse for a specific product but, in practice, numerous finished-dose manufacturers are contracted with one API supplier. Drug shortages can occur due to limited manufacturer access to production materials as well as quality issues or product contamination. The scarcity of these products can negatively impact or limit the care a patient receives if no alternative treatment is available.[7]

To address the drug shortage problem, FDA could standardize the use of information manufacturers already provide on potential drug shortages; once that data is usable, Congress could allow public disclosure of shortage information to alert manufacturers and increase competition in specific drug markets. This information could be used by the government and industry to limit the severity or duration of a shortage of an essential medicine.

Drug Shortages and Quality Challenges

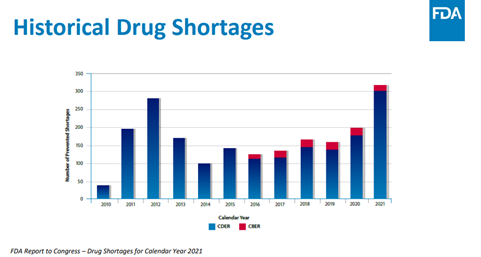

On August 6, 2020, President Trump issued an executive order[8] requiring FDA to “identify a list of essential medicines, medical countermeasures and critical inputs that are medically necessary to have available at all times in an amount adequate to serve patient needs and in the appropriate dosage form.” The HSGA report found, however, that this list does not include information related to life-supporting or life-sustaining drugs. Moreover, the report noted that “nearly half of the antimicrobial agents” on the list “have no domestic API manufacturing.” The report also noted that some drug shortages for anesthetic, antimicrobials and chemotherapy medicines have persisted for some products over a decade. Below is a graph from the FDA’s 2021 report to Congress on drug shortages recorded by the FDA’s Center for Drug Evaluation and Research (CDER) [9], which regulates over-the-counter and prescription drugs, and the Center for Biologics Evaluation and Research [10], which regulates biological products.

The HSGA report found that manufacturers of products including “IV saline, sterile water, propofol and…sterile injectable drugs that cost less than 50 cents per unit but involve complex manufacturing” often exit the market due to low profitability. Furthermore, the HSGA report found that “60 percent of drugs that experienced shortages were because of quality issues.”[12] For example, the White House’s 2021 report[13] cited a 2013 study that found “when drug shortages peaked, 56 percent of the shortages for sterile injectables were due to quality related failures of manufacturing” in 2011.[14] Furthermore, the authors found that “a single quality problem at a single facility can contribute to a national shortage. In the case of norepinephrine, two manufacturers temporarily halted or experienced delays in production in 2010 and 2011.”[15] In the case of norepinephrine, manufacturing pauses as a result of a quality issue resulted in supply chain problems that were not immediately alleviated by competitors in those markets.

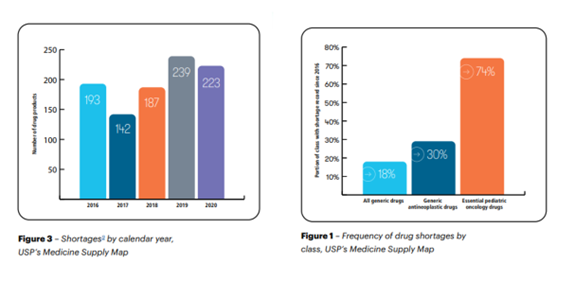

Although manufacturers approved for a specific drug product must follow the FDA’s current good manufacturing practices as a baseline, no additional quality data is used to indicate if a product is produced at a higher standard or is consistently available. Furthermore, the White House report argued that “the core of these [drug shortage] failures is the inability of the market to reward quality.” Without pricing structures to reflect the quality of a product, purchasers within the marketplace cannot assess the reliability or consistency of a specific product. Below is a drug shortage graph taken from a report published by U.S. Pharmacopeia.

In November 2022, the FDA Pharmaceutical Science and Clinical Pharmacology Advisory Committee agreed that CDER should establish a program for Quality Management Maturity (QMM), which FDA defined as “the state attained when drug manufacturers have consistent, reliable, and robust business processes to achieve quality objectives and promote continual improvement.” The creation of a QMM program will improve the FDA and industry’s understanding of quality metrics used to assess the manufacturing process of a product. Yet, some industry experts are concerned that QMM may not be reflective of the quality of the product or process to manufacture it.[17] Moreover, this process will take time as FDA and industry stakeholders continue to develop criteria for a QMM rating program.

In a recent academic publication, the QMM program was envisioned as “a holistic approach that utilizes quality metrics to inform decision-making but also focuses on effective quality management practices.” FDA is working on a framework to better understand the appropriate assessment tools to foster a broad QMM program.

Data Rich, Information Poor

Since the first passage of the Generic Drug User Free Agreements in 2012,[18] FDA has been directed, through additional statutory amendments, to “prioritize generic drug applications for products on the drug shortage list”[19]. The CARES Act, passed in the early days of the COVID-19 pandemic in March 2020, further required API suppliers and certain manufacturers to provide information to the agency on their ability “maintain and implement risk management plans.”[20] FDA provided guidance in October 2021 to assist industry in “submitting FDA reports on the amount of each drug manufactured, prepared, propagated, compounded, or proposed for commercial distribution.” The HSGA report found from expert testimony that the FDA’s reports are “data rich, but information poor,” highlighting that the data provided to FDA cannot be used to map out or model the drug supply chain as “FDA is unable to utilize this information in analyses because it is ‘unstructured’ and ‘buried in PDFs in individual applications.’” Even if FDA could analyze the submitted data, the HSGA report noted that the agency “is constrained by statutory requirements and agreements with companies on what information they are able to share with federal partners.” While FDA could certainly figure out how to access and analyze this data under its existing authority, it would require congressional action to publicly disclose as well as amend information sharing across federal agencies certain supply chain information.[21]

Domestic Manufacturing Outlook

The American Action Forum has explored the challenges facing the global drug supply chain and the potential negative economic impacts of forcing drug manufacturers to move API production to the United States. Although “Buy American” or “Made in America” initiatives have gained broad support from some policymakers and within both the Trump[22] and Biden[23] Administrations, so far, there is little evidence that shifting production to the United States alone would alleviate or prevent future drug shortages.

In 2019, the U.S.-China Economic and Security Review Commission released its annual report stating that “China is the world’s largest producer of APIs…. Drug companies are not required to list the API country of origin on their product labels; therefore, U.S. consumers may be unknowingly accepting risks associated with drugs originating from China.”[24] Similarly, the HSGA report found that the lack of visibility by private industry and government agencies into the geographic location of key raw materials and APIs reduced their ability to anticipate and mitigate potential drug shortages.

Currently, the Department of Health and Human Services (HHS) is consolidating certain “activities into a new program office to align resources and strategic intent to build domestic manufacturing capacity.”[25] In May 2020, the Biomedical and Advanced Research and Development Authority initiated “strategic partnerships to expand Pharmaceutical Manufacturing in America.” It is likely that any effort to encourage domestic manufacturing of key raw materials or APIs will take a significant amount of time.

Conclusion

In the United States, production challenges hamper manufactures from producing low-profit but essential generic drugs with complex manufacturing requirements. This problem is in part a function of the conditions of the global supply chain, in which manufacturers may be reliant on a limited number of key raw material and/or API suppliers. Over the past few years, several federal legislative packages have funded the FDA and other HHS-governed agencies to encourage the domestic manufacturing of these products. Increasing domestic production of these products could take many years, however, and would not necessarily prevent future shortages. The single most efficient and straightforward step that FDA could take to mitigate drug shortages would be to standardize the use of the information manufacturers already provide on potential drug shortages.[26] Once that data is usable, Congress could consider allowing public disclosure of shortage information that could inform manufacturers and allow for competition in specific drug markets that are subject to disruption. Policymakers will ultimately need to consider several different solutions to mitigate drug shortages and recalls.

[1] Homeland Security & Governmental Affairs, Short Supply: The Health and National Security Risks of Drug Shortages, pg. 3.

[2] ASHP, Amoxicillin Oral Presentations March 2023.

[3] USAntibiotics, Press Release USAntibiotics, the Nation’s Sole Amoxicillin Manufacturing Facility, Launches Production to Secure Critical Supply Chain.

[4] American Academy of Pediatrics, new resource provides alternatives to amoxicillin suspension during shortages.

[5] American Academy of Pediatrics, new resource provides alternatives to amoxicillin suspension during shortages.

[6] The Mayo Clinic, Antibiotic shortage what to know if you can’t find amoxicillin.

[7] The FDA noted in 2021 report, that the agency sought “the voluntary recall of more than 190 hand sanitizer.” The FDA does have the authority to recall “food products, biological products (such as vaccines), medical devices and controlled substances.” Currently, the Food and Drug Administration (FDA) does not have the authority to recall drugs but only can recommend companies act after a patient quality or safety issue arises.

[8] President Trump, Executive Order August 6, 2020 on Ensuring Essential Medicines, Medical Countermeasures, and Critical Inputs Are Made in the United States

[9] The scope of the CDER is broader than just medicines. The CDER also regulates “CDER regulates over-the-counter and prescription drugs, including biological therapeutics and generic drugs. This work covers more than just medicines. For example, fluoride toothpaste, antiperspirants, dandruff shampoos and sunscreens are all considered drugs.”

[10] The FDA stats that the “CBER is the Center within FDA that regulates biological products for human use under applicable federal laws, including the Public Health Service Act and the Federal Food, Drug and Cosmetic Act. CBER protects and advances the public health by ensuring that biological products are safe and effective and available to those who need them.”

[11] https://www.fda.gov/advisory-committees/advisory-committee-calendar/november-2-3-2022-pharmaceutical-science-and-clinical-pharmacology-advisory-committee-meeting.

[12] In her HSGA committee testimony, Erin Fox, Associate Chief Pharmacy Officer, Shared Services at the University of Utah Health explained that “Purchasing medications is different from other products as there is no requirement for the manufacturer to publicly disclose which company made the product and where the product was made. Currently, price is the only differentiating factor for pharmacy buyers.”

[13] Ibid. The White House report cited data from: Woodcock, Wosinska, Economic and Technological Drivers of Generic Sterile Injectable Drug Shortages, Nature Publishing, 93(2): Feb 2013.

[14] 100-Day Reviews under Executive Order 14017 and Report.

[15] Ibid.

[16] https://www.usp.org/sites/default/files/usp/document/supply-chain/pediatric-oncology-drugs-and-supply-chain.pdf.

[17] One concern that arose during the meeting was that a proposed rating system could “reflect QMM at a manufacturing site and not the quality of the product or process.”

[18] Congress first enacted Generic Drug User Free Agreements (GUFDA) in 2012. This act was reauthorized in 2017 and 2022.

[19] FDA Reauthorization Act of 2017 (FDARA).

[20] Section 3112€ of the Coronavirus AID, Relief and Economic Security (CARES)which amended 510(j)(3) of the Federal Food, Drug, and Cosmetic Act (FD&C Act) (21 U.S.C. 360(j)(3)).

[21] According to FDA, the agency can “FDA may share certain non-public information pursuant 21 CFR 20.88 with state and local officials, including those officials who are not commissioned. This is called a 20.88 agreement. Trade secrets and information prohibited from disclosure under the Privacy Act may not be shared under 20.88 agreements. ORA’s Office of Partnerships has established a number of 20.88 agreements which provide a streamlined process for information sharing related to food (including animal feed) and cosmetics.” For inter-agency information sharing, the FDA “under 21 C.F.R. § 20.85 (Federal)FDA may share certain non-public information to the other Federal agency under 21 C.F.R. § 20.85 (Disclosure to other Federal government departments and agencies).”

[22] President Trump, Executive Order on Buy American and Hire American.

[23] President Biden, Executive Order on Ensuring the Future Is Made in All of America by All of America’s Workers.

[24]Furthermore, in 2011, the FDA issued a report, stating that “Both India and China offer a number of cost advantages, most notably the cost of skilled labor. India in particular trains six times the number of chemists annually than the U.S. produces and companies can access this talent for 10% of the cost of the same talent in America.”

[25] In terms of advance manufacturing HHS is working to develop and deploy “1) platform technologies that enable on-demand, continuous practice (cGMP)-compliant production of pharmaceuticals, and 2) a platform technology that enables distributed on-demand production of cGMP-compliant intravenous saline solution and other supportive care fluids.”

[26] Homeland Security & Governmental Affairs, Short Supply: The Health and National Security Risks of Drug Shortages, pg. 4. The authors found that “While the FDA retains certain data from manufacturers on the pharmaceutical supply chain, such as key starting materials needed to make drug substances, that data is currently not provided or stored in a useable format to aid supply chain visibility: The FDA has data from manufacturers’ submissions, including applications and drug master files, which include information on the raw materials needed to make drug products, such as key starting materials used to make APIs. However, in response to questions from Majority Committee staff, the FDA acknowledged that it has been unable to use this data to conduct analyses or predictive modeling because the information is “unstructured” and “buried in PDFs within individual drug applications.”