Insight

August 7, 2025

AI Data Centers: Which Factors Determine Their Location?

Executive Summary

- The artificial intelligence (AI) boom is driving states to compete for the data centers on which AI systems rely – and the large investments, infrastructure advances, and economic growth they bring – but what do developers prioritize in determining building locations?

- The top U.S. data center markets are Phoenix, Chicago, Dallas, Portland and Eastern Oregon, and Silicon Valley, with the Commonwealth of Virginia leading by a wide margin in existing, pending, and upcoming capacity.

- This insight explores the key factors that determine the location of a data center – including power availability, utility partnership, fiber optics cable availability, proximity to customers, regulatory landscape, and geographic location – and explains why Virginia is a dominant market for data centers.

Introduction

The artificial intelligence (AI) boom is driving states to compete for data center development by offering incentives to attract large investments to spur local economic growth. Pennsylvania, an emerging market for data center development, energy and AI projects, has been moving fast to offer incentives such as updating permitting law to fast-track approval for data center projects. Investors have recently announced $92 billion projects in new data centers and energy and AI projects in the state.

As states compete to appeal to data center developers, it is helpful for them to understand the key factors in determining location for data centers, which include power availability, utility partnership, fiber optics cable availability, proximity to customers, regulatory landscape, and various environmental conditions.

Top U.S. metropolitan areas for data center development are Phoenix, Chicago, Dallas, Portland and Eastern Oregon, and Silicon Valley. The Commonwealth of Virginia, dubbed “Data Center Alley,” is the world’s top data center market, due to its geographical location and robust fiber optic cable infrastructure.

A previous American Action Forum (AAF) analysis explains why AI data centers consume so much energy. This insight discusses the key factors developers consider when situating data center locations, and provides an overview of the primary and secondary U.S. data center markets. An upcoming insight will analyze the challenges data centers pose to the grid and how tech companies are approaching purchasing electricity to power their AI data centers.

Key Location Factors

Power availability

Power availability is an important factor in determining the location of data centers. Previous American Action Forum analysis explains that AI data centers require enormous amounts of electricity, and their consumption is expected to grow rapidly from 4.4 percent of total U.S. electricity in 2023 to between 6.7–12 percent by 2028. AI data centers also need reliable electricity supply to power the continuous, real-time workloads for AI inference. It’s crucial for data centers to have access to plentiful and cost-effective power sources to ensure uninterrupted operation.

Data center developers must consider both power availability and the types of power-generation energy sources when making location decisions. While baseload power sources such as natural gas and coal provide continuous electricity supply for data centers, intermittent renewable energy sources such as solar and wind are important for lowering their carbon footprints. Electricity-generation energy sources vary widely depending on the regional grid. For example, natural gas still dominates many grids along the mid-eastern coast, coal remains prominent in the Midwest and South, while nuclear power is more common in the mid-Atlantic and Northeast.

Utility partnership

Electric utilities are a critical player in the power sector. They typically cover some or all aspects of the electricity market including generation, transmission, and distribution. Companies that are looking to build new data centers must rely on strong utility partnerships, which are essential to ensuring access to reliable and scalable power sources. For instance, Dominion Energy – an energy utility company that supplies most of its electricity to Virginia – plans to invest $50 billion between 2025–2029 to support the growth of data centers in the region. Similarly, American Electric Power, one of the largest electric utility companies in the country, plans to spend approximately $43 billion by 2028, with about 22 percent of the investment ($9 billion) allocated for renewable energy, and the rest for improving infrastructure to support the growing demand of data centers. These large-scale investments highlight the growing collaboration between utilities and the data center industry to meet increasing energy demands.

Fiber optics cable availability

The availability of fiber optic cable infrastructure is a key factor in determining data center location and performance, especially for those that rely on high-speed connectivity to provide services for their customers. Fiber optic cables are used by internet service providers to transmit information over long distances. For example, Dark Fiber and Infrastructure, a company that owns and operates dark fiber network (fiber-optic strands that have not been utilized yet), has more than 70,000 underground fiber stands available within Virginia, useful for the dense data center development in the commonwealth.

Proximity to customers

Proximity to customers is a key factor in locating data centers, as it directly affects service speed and user experience. The closer a data center is to its customers, the lower the latency, which is the time it takes for data to travel from one point to another. Google found that for every one-second delay in a page load, user satisfaction can drop by 20 percent. Locating data centers close to end users helps ensure faster, more reliable service and a better overall digital experience.

Regulatory environment

Regulatory environment plays a significant part in determining whether to build a data center at a specific location. Data centers are subject to a great variety of regulations at federal, state, and local levels, including data privacy and security regulations, environmental regulations, building codes and safety regulations, and industry-specific regulations and standards.

Regulations and permitting processes vary depending on the local jurisdiction. Data center developers are required to navigate complex local zoning and permitting laws and environmental regulations to obtain approval for project development and operation. States such as Texas, Virginia, and Illinois are enacting or trying to enact regulations that add additional oversight and accountability to data center development.

In addition to regulatory compliance, data center developers may also need to get involved in community engagement to ensure project approval. From May 2024 to March 2025, growing local opposition to the environmental and community impacts of data centers has led to $64 billion worth of data center projects to being blocked or delayed in the United States.

Environmental conditions

Environmental conditions are another important factor, as they reflect whether the location is vulnerable to natural disasters or a hotter climate, as well as whether there are abundant water supplies for cooling the data centers.

Nearly 45 percent of the respondents in a 2021 survey reported experiencing an extreme weather event that threatened operations, with 8.8 percent reporting outages or significant disruptions, highlighting the importance of avoiding disaster-prone areas. Meanwhile, cooler climates offer an advantage through “free cooling,” using naturally cool air, which saves up to 68 percent more energy compared to conventional mechanical systems. Yet even with energy-saving strategies, data centers require vast amounts of water to maintain optimal temperatures. For example, Google reported using 5.2 billion gallons of water for its data centers alone in its 2023 Environmental Report.

Top U.S. Data Center Metropolitan Areas

As shown in the map below, primary U.S. metropolitan areas for data center development are Phoenix, Chicago, Dallas, Portland and Eastern Oregon, Silicon Valley, and the Commonwealth of Virginia, whereas secondary metropolitan areas are Atlanta, Columbus, Austin, San Antonio, and northern New Jersey and New York.

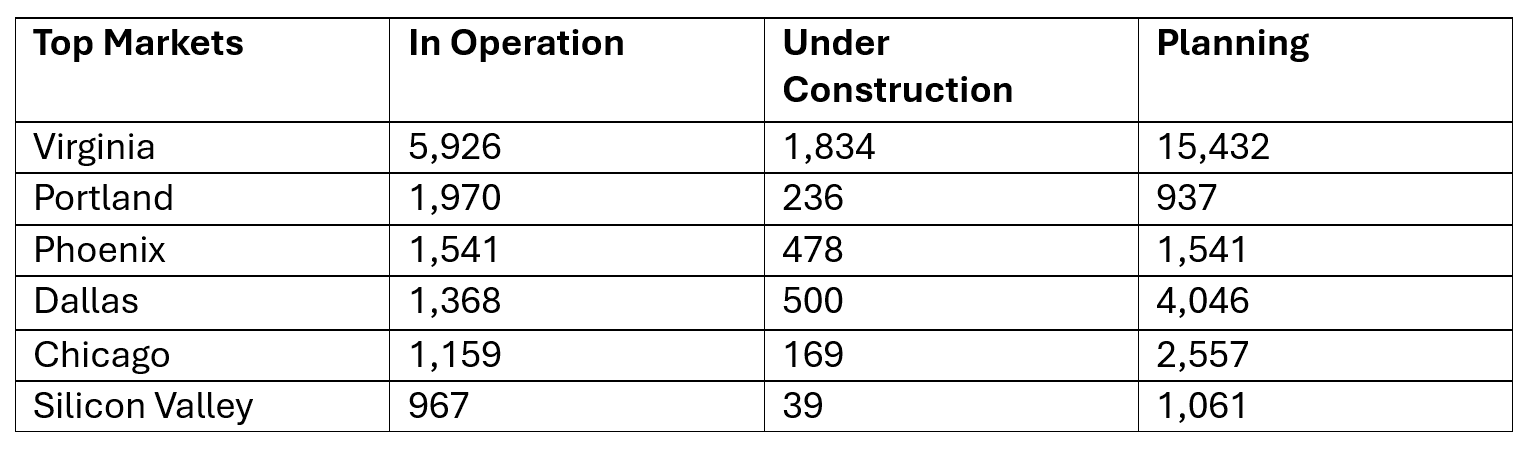

The table below highlights the current (in operation), upcoming (under construction), and future (planning) development of data centers across six primary U.S. markets based on Cushman & Wakefield’s data. Virginia leads by a wide margin in all three categories, signaling its dominance in the data center industry. Dallas, Phoenix, and Chicago also show significant growth potential, particularly in planned capacity, while Portland has steady but more moderate growth. Silicon Valley has the smallest presence overall, suggesting the area is experiencing slower growth compared to other top markets.

Data Center Capacity by Primary U.S. Markets: In Operation, Under Construction, and Planning

2024, Megawatts (MW)

Source: Cushman & Wakefield, America’s Data Center H2 2024 Update, Cushman & Wakefield, Americas Data Center Markets Map

Notes: The data are based on large, active data centers that host cloud (e.g. Amazon or Google), colocation (leasing space from a data center services provider), edge (smaller, local) and telecom facilities. They do not include private, company-only centers or IT departments. Capacity is divided into three categories: “In Operation” refers to data centers that are already built and actively running; “Under Construction” refers to data centers that are currently being built but not yet online; “Planning” represents proposed or approved projects that have not yet broken ground. Capacity refers to a data center’s total capacity including computing, footprint, power load, and cooling capacity.

Virginia, Data Center Alley

Virgina is often referred to as “Data Center Alley” for having a concentrated number of data centers in its northern region, through which about 70 percent of global internet traffic flows through. Approximately 80 percent of the Virginia’s data centers are located in Loudoun County.

The number of data centers in Virginia varies from 200 to 600 depending on one’s definition of data centers, in which the former figure considers only hyperscale data centers, whereas the latter includes both hyperscale and colocation data centers.

As shown in the table above, Virginia currently leads the market for data centers in the United States, with 5,926 MW of operational capacity, 1,834 MW of capacity under construction, and 15,432 MW of planned capacity. Dominion Energy projected that data centers will be the key driver for growing energy demand in Virginia over the next 15 years.

As of 2023, Virginia ranks first nationally in the amount of electricity it requires to operate its data centers. Data centers in Virginia consumed about 34 million MWh per year in 2023, 35 percent higher than data centers’ electricity consumption in the second ranking state, Texas, and more than three times the amount as the third-ranking state, California.

Two key factors make Virginia an attractive location for data center development. The first factor is environmental conditions, arguably the most important factor that makes the region appealing for data center development, with one important consideration that northern Virginia is very close to Washington, D.C., which hosts federal agencies, defense contractors, and large technology, financial, and consulting firms in the metro area. Other favorable conditions in Virginia include that it is optimally located to serve other big cities on the east coast, has plenty of flat land, access to abundant water resources for cooling, and is largely shielded from natural disasters.

Virginia has a high concentration of high-speed fiber optic infrastructure, as well, which is critical for the operation of data centers. Northern Virginia’s vast dark fiber network (internet cables that are still functional but not being used) originated from the region’s history of technology and innovation and can be utilized by data centers.

Conclusion

As demand for AI tools increases, so does the demand for large-scale data centers. States such as Pennsylvania are positioning themselves to compete for data center development, but Virginia leads the pack due to, among other things, its combination of power availability, robust utility partnerships, and extensive fiber optic infrastructure. The top metropolitan areas for data center development all demonstrate how important these factors are to developers as they seek future sites. Where developers decide to situate data centers is based on a calculation much more complex than land and construction costs and instead considers factors including energy access, network speed, and market proximity.