Insight

June 24, 2020

An Update on the Congressional Review Act in 2020

EXECUTIVE SUMMARY

- It now appears that any federal rulemaking published on or after May 13 could be subject to rescission under the Congressional Review Act (CRA), although volatility will remain for predicting the exact date.

- Potential targets under the CRA falling after May 13 could include deregulatory actions with an estimated combined savings of $11.7 billion as well as several actions instituting hotly debated social and legal policies.

- Outside of some unforeseen issue that requires Congress to officially convene more than expected, any final rule published from now through the end of the year likely could be subject to CRA scrutiny in 2021.

INTRODUCTION

As noted two months ago, one under-appreciated policy implication of the COVID-19 pandemic is how it will affect the reach of the Congressional Review Act (CRA), one of Congress’s most powerful instruments for addressing the administrative state. With the House of Representatives set to return (to the extent that it can given the threat of the virus) for its most substantive legislative period in several weeks, it is worth reexamining where the potential CRA situation stands. Evolving circumstances have caused – and possibly could cause going forward – some variance in the likely CRA “window,” but that overall picture is becoming more well-defined. While some of the most notable Trump Administration rules now appear safe from the Act’s grasp, it is now clear that (barring some truly extraordinary change in Congress’s schedule) there are a handful of significant rules from the spring that remain likely targets, and every Trump Administration rule from here on out is likely vulnerable.

THE BASIC DYNAMICS OF THE CRA

From the outset, it is important to note that this discussion is largely only relevant if the Democrats hold the presidency and majorities in both chambers of Congress come 2021, as the Republicans did in 2017. The CRA allows Congress to pass joint resolutions of disapproval that vacate a regulation in its entirety. Since these resolutions are still subject to a presidential veto, however, their passage is historically uncommon since a sitting president is not exactly keen to eliminate his own administration’s actions.

Thanks to the CRA’s “look-back” period, though, there is a scenario following a presidential transition that makes action in the CRA realm more plausible. The look-back provision essentially dictates that any rule published within 60 session days of a Congress adjourning sine die then gets rolled over to the following Congress. In 2017, the Republican majorities in Congress and President Trump passed an unprecedented amount of CRA resolutions into law, thereby rescinding a whole series of significant Obama-era regulations. If there is a President Biden and Democratic majorities in both chambers, a similar dynamic could ensue.

Another important aspect of the CRA is the process that it, at least temporarily, establishes in the Senate. Starting on the 15th session day of the newly convened Senate and going out 60 session days from then, a CRA resolution bypasses the normal cloture process that requires a 60-vote threshold and can pass by a simple majority. Therefore, even the slimmest of Democratic majorities could vote through such resolutions. For instance, the efforts to overturn the tranche of Obama-era rules in 2017 included Senate votes that involved Vice President Pence breaking a 50-50 tie.

NOTABLE SHIFTS IN RECENT MONTHS

The April review of how the shifting circumstances under COVID-19 could affect a potential CRA look-back window indicated that May 20 would be the cut-off date; rules published on or after that date could be subject to the CRA next year. Given the various disruptions to Congress’s ability to operate under COVID-19, this projection was subject to a high degree of possible variance based upon shifting assumptions. It turns out that that variance presented itself in the intervening months.

At the end of May, House Majority Leader Steny Hoyer released an updated projected House schedule in light of Congress’s limited ability to safely and fully convene due to COVID-19. The most important difference in that updated calendar was that the House was expected to convene only for one day in the month of June. The previous calendar had 16 session days in the month of June. This 15 session-day difference thereby pushed the CRA cut-off date to April 17. The most significant implication of this shift was that two of the Trump Administration’s most consequential deregulatory actions – “The Safer Affordable Fuel-Efficient (SAFE) Vehicles Rule” and its update of the “Definition of ‘Waters of the United States’ (WOTUS)” – were now vulnerable under the CRA.

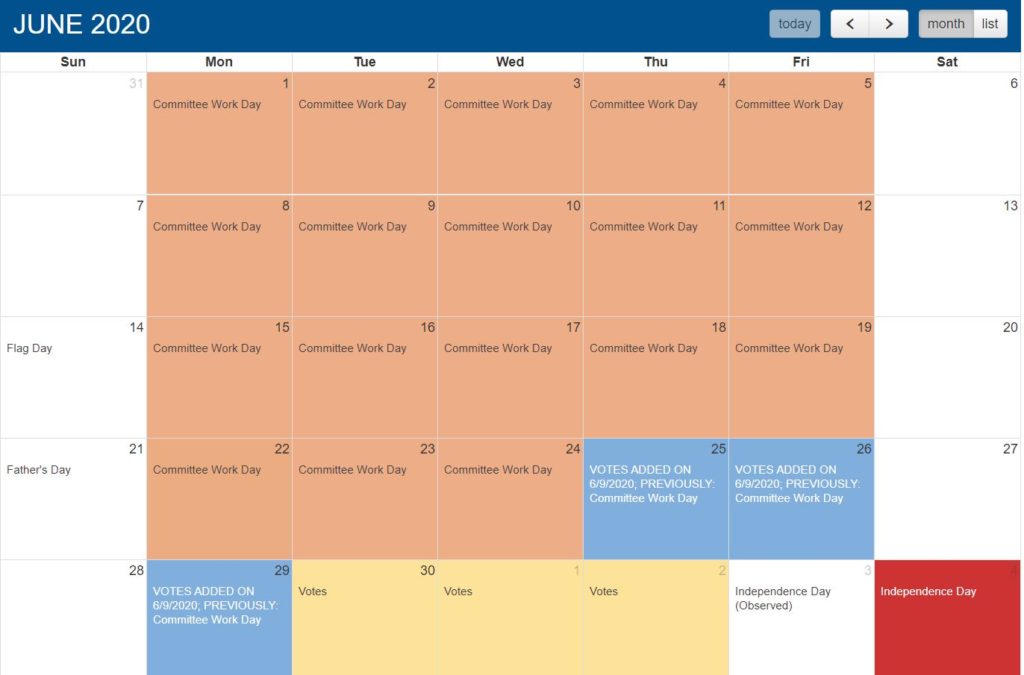

Then June actually happened. As it turns out, the House ended up technically convening for 7 days so far in the month, albeit largely on a perfunctory basis to allow for the consideration of various minor matters. Regardless of their significance, however, these days apply to the CRA countdown. Additionally, as the following calendar indicates, that chamber’s return was bumped up by 3 days.

As a result, instead of only having one session day in June, the House will have had 11. This 10-day swing necessarily pushes the CRA cut-off later into calendar year 2020. Under these changes, and assuming the House follows this updated calendar going forward, May 13 is the new 60-day cut-off point. This date is slightly earlier than the April projection, but not early enough to endanger either the SAFE rule or the WOTUS redefinition.

WHAT THE CURRENT PROJECTED “WINDOW” MEANS

Even though those two major rules are now seemingly outside of the CRA window, there are a handful of notable rules that likely remain liable to CRA action in 2021. As part of its ongoing RegRodeo project, the American Action Forum tracks all federal rulemakings that have some quantified economic impact estimate. Many of the Trump Administration’s deregulatory actions have drawn some level of criticism from Democratic lawmakers. As such, one would expect that those actions would be among the first that a Democratic majority would target. The following table includes the top five deregulatory actions, in terms of quantified net present value savings, published from May 13 through last week.

There may be varying levels of enthusiasm, however, toward even this set of rules. For instance, the Default Electronic Disclosure rule makes the relatively mundane shift from plan disclosures via paper to electronic versions. Contrast that with the Nondiscrimination rule that touches upon contentious social and legal issues.

There are also at least some rules that, while they are net-regulatory in economic terms, establish certain policies Democrats largely disagree with. A couple have already received explicit criticism from Democratic lawmakers and officials. Notable examples here include a recent update to Community Reinvestment Act regulations and the Trump Administration’s changes to standards regarding sexual harassment adjudication on college campuses.

Additionally, it is relatively safe to assume that any of the final rules published going forward in 2020 would be subject to the CRA. There have been 15 session days between the currently estimated May 13 cut-off and now. For rules published now to be safe from CRA review, a scenario would have to unfold that involved the House meeting for at least 16 more days than currently expected. For reference, there are only 45 more planned days on the House calendar; such a relatively large span getting added on top of that is possible but would also be quite extraordinary. Furthermore, that number would have to continue to grow in order to push the cut-off even later.

CONCLUSION

There is good reason why the CRA is often described as “little known” or “rarely utilized.” It focuses on a very mundane policy area, administrative rulemaking, and requires a unique political balance to ever be effective. As Congress works on other business, however, it could affect the CRA’s relevance next year. Even shifts in when Congress technically “meets” could have significant implications for Trump-era regulatory actions, with billions of dollars in economic impact hanging in the balance.