Insight

February 29, 2024

Capital One’s Acquisition of Discover Could Inject Competition Into Payments Market

Executive Summary

- On February 19, 2024, Capital One announced a $35 billion all-stock acquisition of Discover Financial Services, a deal that would join two of the largest credit card issuers into a single payment system firm that could inject competition to the payments network market.

- The deal’s announcement comes as federal banking regulators and the Department of Justice have warned banks of a more stringent and slower merger review process; it was also immediately met with criticism from some in Congress that the merger would further consolidation in the banking industry.

- While the deal would, in fact, create a bigger bank, the more important effect would be the likely creation of a viable alternative to Visa and Mastercard’s prominence in the payments network market that could yield more favorable terms to merchants while expanding access to Discover’s network.

Introduction

On February 19, 2024, Capital One announced it would acquire Discover Financial Services in a $35 billion all-stock deal. It would be the largest deal among credit card firms since Bank of America purchased MBNA Corporation in 2005. The firms expect the deal to close in late 2024 or early 2025.

The deal’s announcement comes as federal banking regulators, including the Federal Reserve, the Office of the Comptroller of the Currency (OCC) and the Department of Justice (DOJ), have warned banks of a more severe and slower merger review process, reflecting the Biden Administration’s broad distrust of mergers and acquisitions.

Moreover, the deal was immediately met with criticism from some in Congress. Senator Elizabeth Warren (D-MA) along with 12 other members of Congress sent a letter to the Federal Reserve and the OCC urging the agencies to block the merger, claiming that it would further consolidation in the banking industry by “combin[ing] two of the largest credit card issuers” and “leave the industry with fewer competitors….” They also asserted the merger would introduce systemic risk to the banking system.

Congressional critics of the merger focused on how it would create the third-largest credit card issuer by purchase volume in the United States and the sixth largest bank. The potential benefits of the transaction—for both merchants and consumers—appear to have been overlooked, however. The merger would vertically integrate Capital One’s breadth of credit card issuance with Discover’s payments network. Transitioning a portion or all of Capital One’s existing credit cards and issuing new credit cards using Discover’s payment network would increase the volume of Discover’s payments network and could create a third major player in the market currently dominated by Visa and Mastercard. If the merger were approved, it could provide a market solution to Congress’ longstanding concerns – some articulated in the Credit Card Competition Act of 2023, which would mandate that certain credit card issuers accept payments over multiple networks – over the current lack of competition in the payments network market. Such heightened competition could force the industry to provide more favorable terms to merchants while expanding Discover’s payments network availability for customers.

The Business of Capital One and Discover

Capital One and Discover are best known for their credit card businesses. Both, however, offer a full range of banking services including home loans, auto loans, and checking and savings accounts.

The acquisition of Discover by Capital One would join the 27th and ninth largest banks, respectively, as measured by domestic assets, according to data from the Federal Reserve. The newly formed firm would leapfrog Goldman Sachs, Truist, and PNC to become the sixth-largest bank with nearly $625 billion in domestic assets. The combined firm would still be dwarfed by JPMorgan Chase’s $2.6 trillion and Bank of America’s $2.4 trillion in domestic assets. Rivals Wells Fargo ($1.7 trillion), Citibank ($1.0 trillion), and US Bank ($641 billion) round out the top five.

Merging domestic deposits, a key metric in the merger review process used by federal banking regulators and the DOJ, would put the duo in the same sixth position. Together, Capital One and Discover would have domestic deposits of $480 billion, less than one-quarter the size of JPMorgan Chase with $2.02 trillion.

Narrowing the scope of the market to just credit cards, Capital One was the fourth largest and Discover was sixth by purchase volume in 2021. Yet there is a major distinction in the credit card business between the firms. Both are credit card issuers, meaning they provide customers with credit, maintain accounts, and pay the merchant bank when a card is used. Discover, however, operates its own payments network, an intermediary that verifies the accounts involved in the transaction and ensures that the merchant bank is paid by the issuer. American Express is similarly vertically integrated.

Capital One’s acquisition of Discover has both horizontal and vertical implications that would inject competition into multiple markets.

Basics of Credit Card Transactions

There are several parties involved in a credit card transaction. First is the cardholder, who uses a credit card to pay for goods and services from a second party, the merchant. The hardware needed to process the transaction is from a payment processor. The information collected by the processor is transmitted via a payments network – Visa, Mastercard, American Express, and Discover – to the issuing bank (the bank that provided the credit card) and the merchant’s bank. The payments network ensures that the merchant bank is paid by the issuing banks.

A payments network will charge the merchant an interchange fee, also known as a swipe fee, ranging from 2 percent to 4 percent of the credit card transaction. This means that on a $100 dollar sale, the merchant will keep $96–$98. The payments network keeps a portion of these fees while the rest are paid to the bank that issued the credit card and the merchant bank for accepting payment. According to the National Retail Federation, credit card processing fees totaled $126.4 billion in 2021. Visa and Mastercard accounted for $93.2 billion, up from $25.6 billion in 2009.

The State of the Market

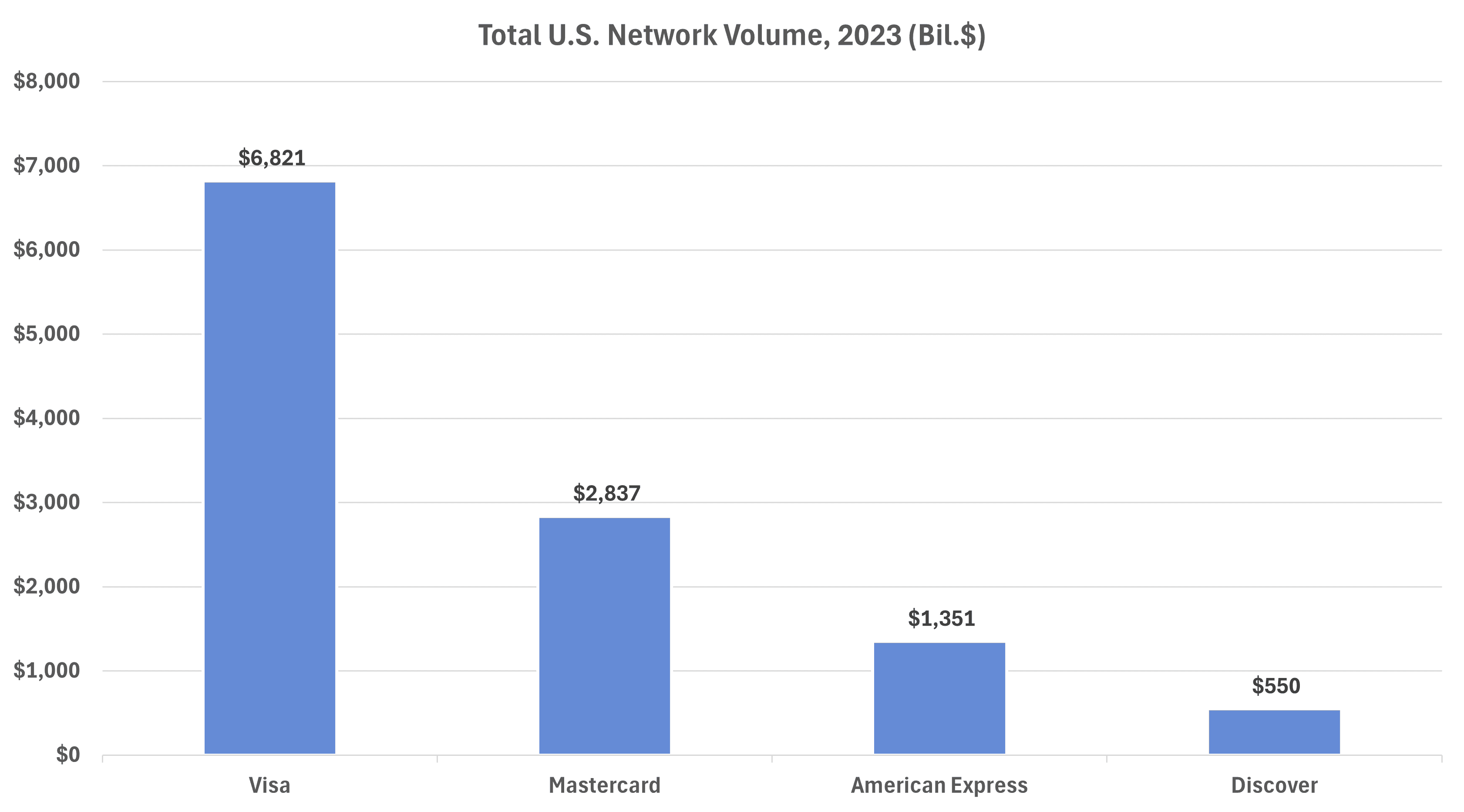

In 2023, Discover operated the fourth largest payments network by transaction volume with a market share of about 5 percent. Visa and Mastercard, meanwhile, process more than 80 percent of transaction volume.

Figure 1

*Source: Recreated from Capital One Investor Presentation using Visa: Quarterly Reports, Q1, Q2, Q3, Q4, data are total volume; Mastercard: Quarterly report, data for all Charge, Debit, and Prepaid Programs; American Express: 10-K report, Data are for Network volumes less Billed business for International Card Services; Discover: Quarterly report, data are Total network volume less Diners Club International

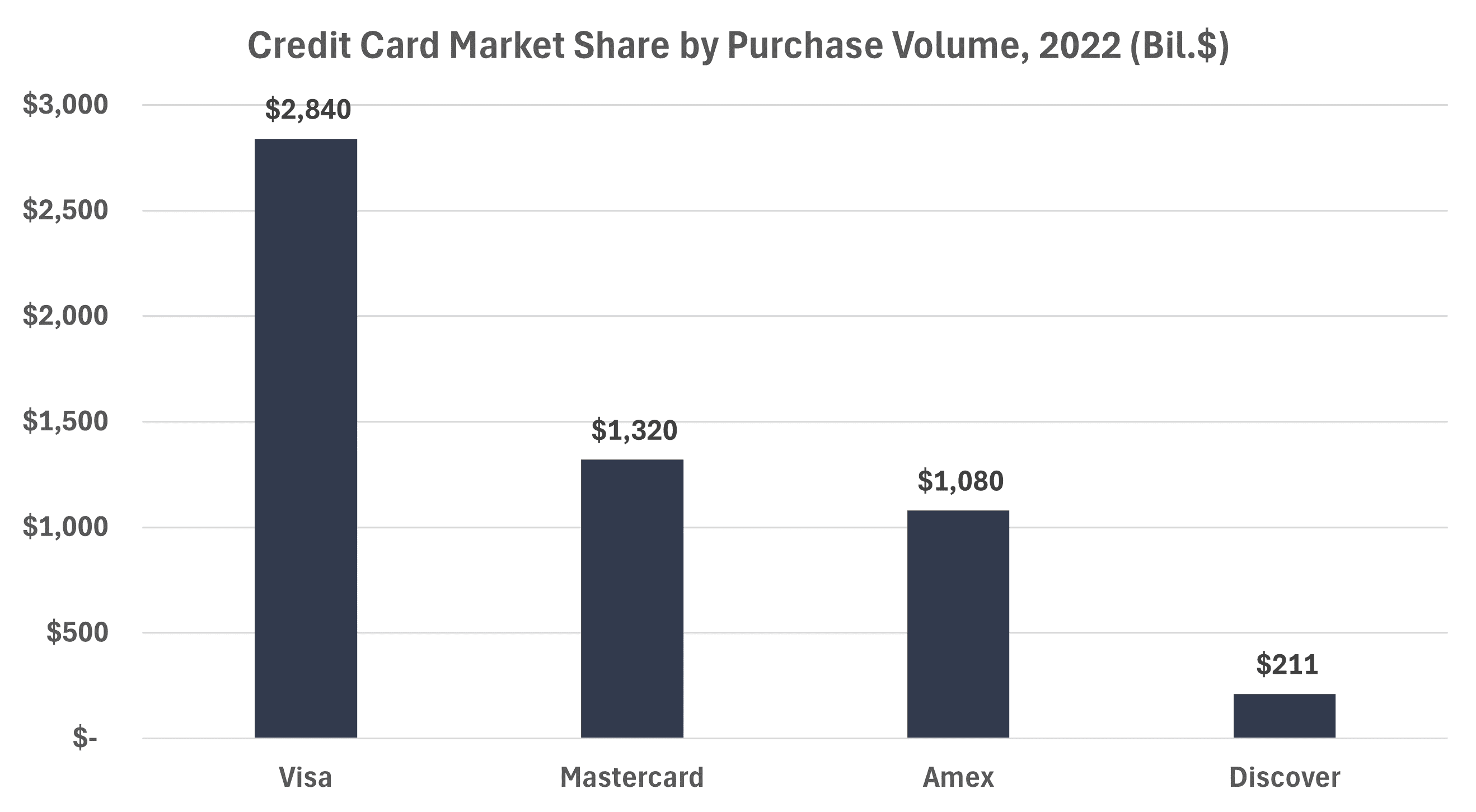

Narrowing the market to strictly credit card transactions does little to change the story.

Figure 2

*Source: Credit and Debit Card Market Share by Network and Issuer

Over half of credit card purchase volume in the United States is processed by Visa while one-quarter is processed by Mastercard. Discover only accounted for 4 percent of credit card transaction purchase volume.

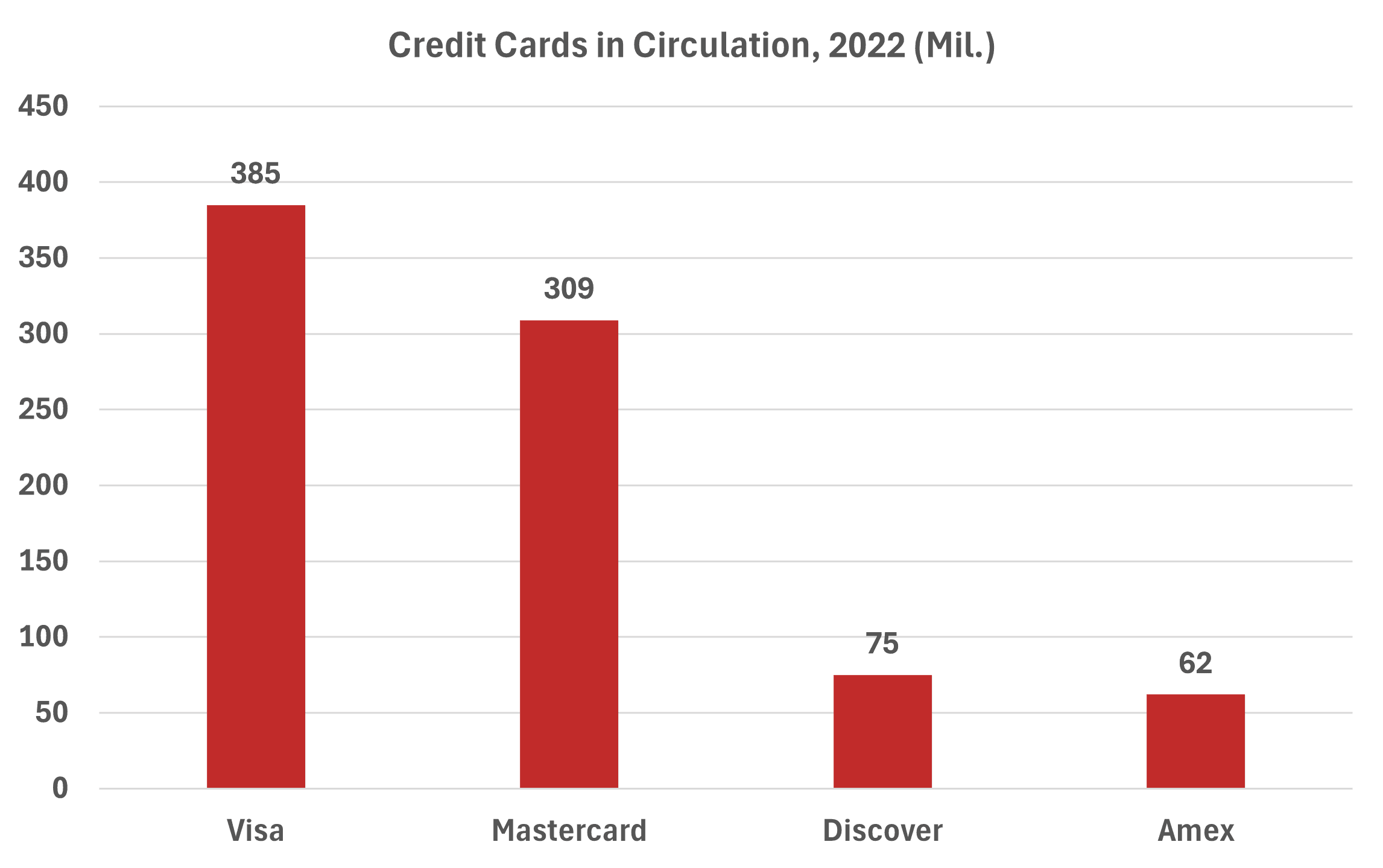

Visa, Mastercard, American Express, and Discover frequently advertise the breadth of their payments network, and merchants often partner with Visa and Mastercard because of their significant transaction volume and the number of potential customers using these cards.

In 2022, there were five times as many Visa cards and four times as many Mastercard cards in circulation as Discover.

Figure 3

*Source: Credit and Debit Card Market Share by Network and Issuer

Payments networks also compete on fee structure and there are various aspects that determine interchange fees charged to merchants. Data from 2021 show the average fees charged by the various networks.

Visa: 1.29 percent + $0.05 to 2.54 percent + $0.10

Mastercard: 1.29 percent + $0.05 to 2.64 percent + $0.10

American Express: 1.58 percent + $0.10 to 3.45 percent + $0.10

Discover: 1.48 percent + $0.05 to 2.53 percent + $0.10

Effects of the Acquisition and Antitrust Concerns

Bank mergers were a focal point of President Biden’s July 2021 executive order on Promoting Competition in the American Economy. The order directed the DOJ, the Federal Reserve, Federal Deposit Insurance Corporation, the Office of the Comptroller of the Currency (OCC) to “adopt a plan…for the revitalization of merger oversight” among financial institutions.

In response, DOJ Assistant Attorney General Jonathan Kanter announced plans to expand the scope of metrics used when evaluating bank mergers. Kanter minimized the importance of local bank deposit concentration levels – a metric heavily relied upon in bank merger evaluations – while emphasizing the importance of focusing on the “many ways in which competition manifests itself in a particular banking market – including through fees, interest rates, branch locations, product variety, network effects, interoperability, and customer service.” The American Action Forum previously provided an in-depth review of these proposed changes.

Furthermore, on January 29, 2024, the OCC announced a plan to remove the expedited review procedures that permits certain merger applications to get automatic approval on the 15th day after the close of the public comment period if the OCC fails to act by the deadline. Such a policy change will likely result in longer waiting periods. Given the heightened skepticism of mergers generally, and bank mergers specifically, from the Biden Administration, the deal between the two firms will likely face an antitrust investigation from various regulators.

Reacting to the announcement of Capital One’s acquisition of Discover, Representative Maxine Waters (D-CA) led 15 House Democrats in a letter urging the banking regulators and DOJ to “move quickly to update their outdated bank merger review procedures.”

Combining the overlapping banking and credit card businesses of Capital One and Discover would likely position the firm to better compete with the largest national banks while giving the newly formed bank little market power to harm consumers. In fact, customers of the bank would likely see benefits borne by Capital One’s 278 domestic branches joined with Discover’s fully digitized banking platform with no branch locations.

More noteworthy, however, is the union’s likely creation of a vertically integrated payments giant. The volume of credit cards issued by both firms and Discover’s payment network could create a third major player in the payments network market that could challenge Visa and Mastercard’s prominence.

Currently, Capital One uses a mix of Visa and Mastercard to process payments. Analysis from Bank of America estimated that Visa’s network was used for 42 percent of the $606 billion in Capital One credit card transactions while Mastercard’s share was 58 percent. Currently, Capital One plans to switch only a portion of its cards away from Visa and Mastercard to the Discover payments network. If Capital One decided to switch all of its cards to Discover’s network, however, it would put $351 billion of Mastercard’s volume (25 percent) and $255 billion of Visa’s volume (9 percent) at risk. The transfer would bring Discover’s credit card purchase volume to $817 billion. Visa’s credit card purchase volume would decrease from $2.8 trillion to $2.6 trillion and Mastercard’s would fall to $969 billion from $1.3 trillion.

With a possible $606 billion of Capital One credit card volume transitioning to the Discover payments network, the pool of merchants accepting them will likely expand. Over time, consumers will likely benefit from this increased acceptance of Discover cards.

Relatedly, the acquisition would incentivize Capital One to expand the number of merchants using the Discover network. Visa and Mastercard boast 130 million, and 100 million merchant locations, respectively. Discover has a distant 70 million. To penetrate the market, Capital One will compete on price, that is, lower swipe fees. Visa and Mastercard will likely need to respond in-kind to encourage merchants to continue accepting their cards.

Credit Card Competition Act

Congress is keenly concerned about competition in the payments network market. Most recently, Senator Richard Durbin (D-IL) proposed the Credit Card Competition Act of 2023. In a summary of the bill, Senator Durbin states that the act would require “the largest credit-card issuing financial institutions in the country – those with assets over $100 billion – to enable at least two credit card networks to be used on the credit card instead of just one, and at least one of those networks must be a network other than the Visa/Mastercard duopoly.”

The act, thus far, has not garnered much support in Congress. This merger, if approved by regulators, could provide a market-driven solution to the lack of competition.

Conclusion

The announcement of Capital One’s acquisition of Discover Financial Services comes as banking regulators and the DOJ have warned banks of a more severe and slower merger review process. At the same time, some in Congress were quick to condemn the deal as increasing systemic risk and decreasing competition.

Yet the acquisition could alleviate Congress’ concerns by providing market-driven competition in the sector.

The merger would create the third-largest credit card issuer by purchase volume in the United States and give Capital One a direct relationship with merchants via Discover’s payments network. The potential for added volume to Discover’s payments network could create a third major player in the market currently led by Visa and Mastercard. Heightened competition could force the industry to provide more favorable terms to merchants while expanding Discover’s payments network availability for customers.