Insight

August 16, 2023

DOJ Signals More Scrutiny of Bank Mergers

Executive Summary

- In June, Department of Justice (DOJ) Antitrust Division Assistant Attorney General Jonathan Kanter announced plans to broaden the existing framework used in bank merger evaluations; several banking regulators are also looking to reform the current bank merger guidelines.

- While the changes have not yet been formalized, the DOJ has suggested that it will broaden the scope of its competitive factors report, as well as move away from negotiating remedies in the case of proposed mergers.

- The DOJ’s proposed bank merger enforcement reforms preempt official changes to the 1995 Bank Merger Guidelines and – because the agency has offered no clarity on what these changes would do – would likely lead to longer review periods and greater unpredictability in bank mergers.

Introduction

In June 2023, Department of Justice (DOJ) Antitrust Division Assistant Attorney General Jonathan Kanter delivered a speech on promoting competition in banking and announced plans to expand the scope of what the agency considers when evaluating bank mergers. The remarks were made as the DOJ, as well as several banking regulators, work to reform the existing framework used to evaluate bank mergers.

The DOJ’s assumption of a more assertive role in bank mergers reflects policy priorities outlined in President Biden’s executive order (EO) on Promoting Competition in the American Economy. As part of the EO, leadership at the DOJ, the Board of Governors of the Federal Reserve System (the Fed), Federal Deposit Insurance Corporation (FDIC), and the Office of the Comptroller of the Currency (OCC) were directed to “review current practices and adopt a plan…for the revitalization of merger oversight” of the banking system to “ensure Americans have choices among financial institutions and to guard against excessive market power.”

The DOJ’s proposed changes to bank merger enforcement preempt official changes to the 1995 Bank Merger Guidelines but, critically, the DOJ has not clarified what these changes will entail or how they will be measured. This lack of clarity is likely to lead to longer review periods and greater unpredictability in bank mergers at a time when Biden Administration officials are expecting an increase in merger activity. Furthermore, proposed changes could undermine other factors considered by banking regulators – including financial stability – when evaluating proposed banking mergers.

The Executive Order and the Current State of Banking

In July 2021, President Biden issued an executive order on Promoting Competition in the American Economy, the principal concern of which was market concentration. President Biden asserted that market concentration had become “excessive” and “threaten[ed] economic liberties, democratic accountability, and the welfare of workers, farmers, small businesses, startups, and consumers.” Prior American Action Forum (AAF) research casts doubt over this claim of increased market concentration, however.

The EO provided a directive to the attorney general of the United States, the Fed, the Federal Deposit Insurance Corporation, and the Office of the Comptroller of the Currency to “ensure Americans have choices among financial institutions and to guard against excessive market power” through the “revitalization of merger oversight.” Current banking industry dynamics displayed in Figures 1–3 show that, generally, concentration and merger activity in the banking industry is not excessive; rather, the regulatory regime is hampering new market entrants.

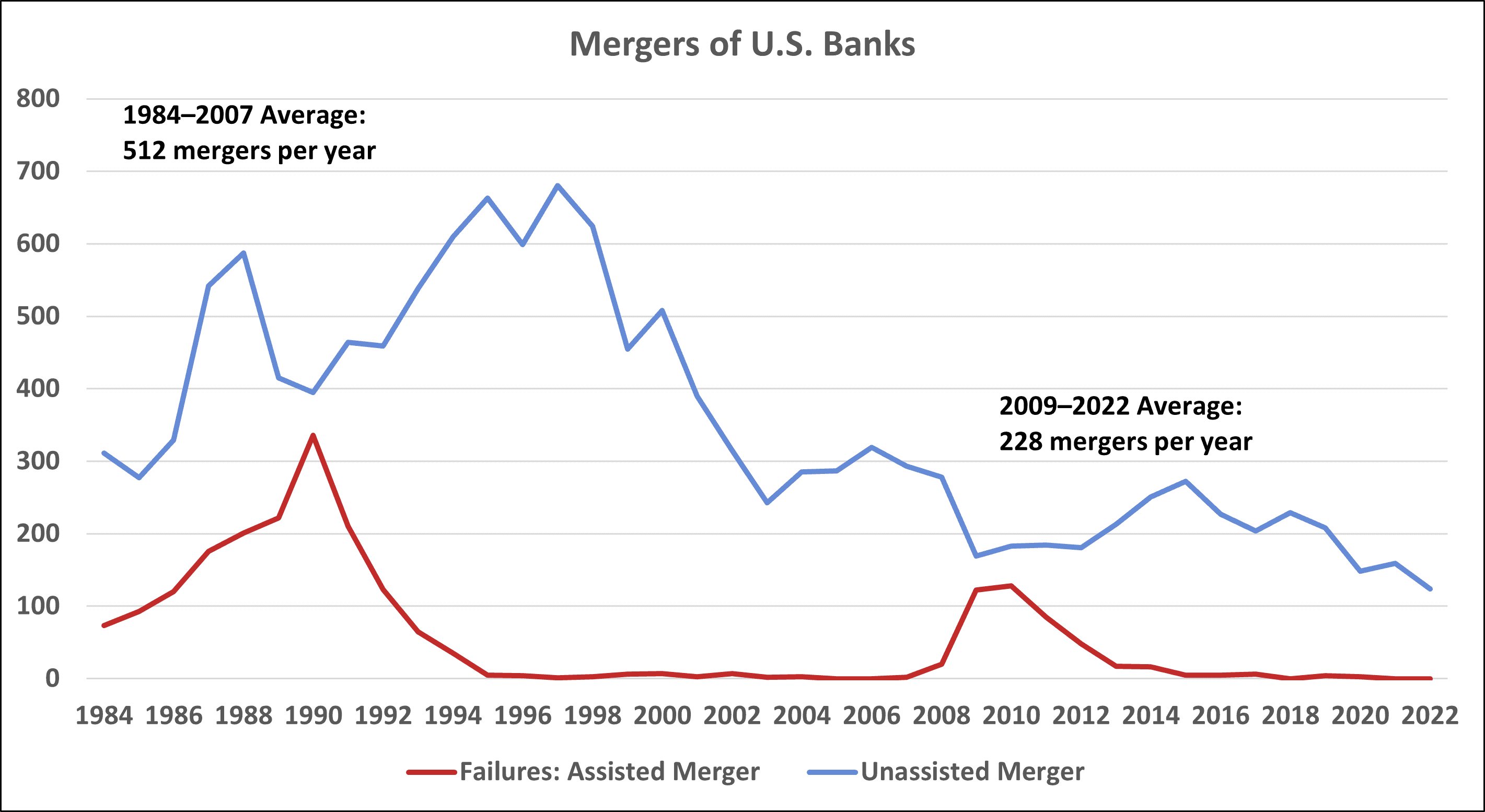

Amid the rise of interstate banking beginning in the mid-1980s, the number of bank mergers surged. Between 1984–2007, there was an average of 512 mergers per year. Yet as shown in Figure 1, merger activity began to cool in the early 2000s. That pace slowed to an average of 228 per year between 2009–2022.

Figure 1

*Source: Federal Deposit Insurance Corporation

New market entrants helped to offset some of the merger consolidation of the 1980s and 1990s. As shown in Figure 2, between 1984–2007, 170 new bank charters were issued each year, on average. The current banking system is suffering from a dearth of new entrants with only an average of seven new bank charters issued each year between 2009–2022. Previous AAF research found that regulations – most noticeably those enacted at the end of the financial crisis of 2008 and 2009 – likely increased barriers to entry into the market and quashed potential entrants.

Figure 2

*Source: Federal Deposit Insurance Corporation

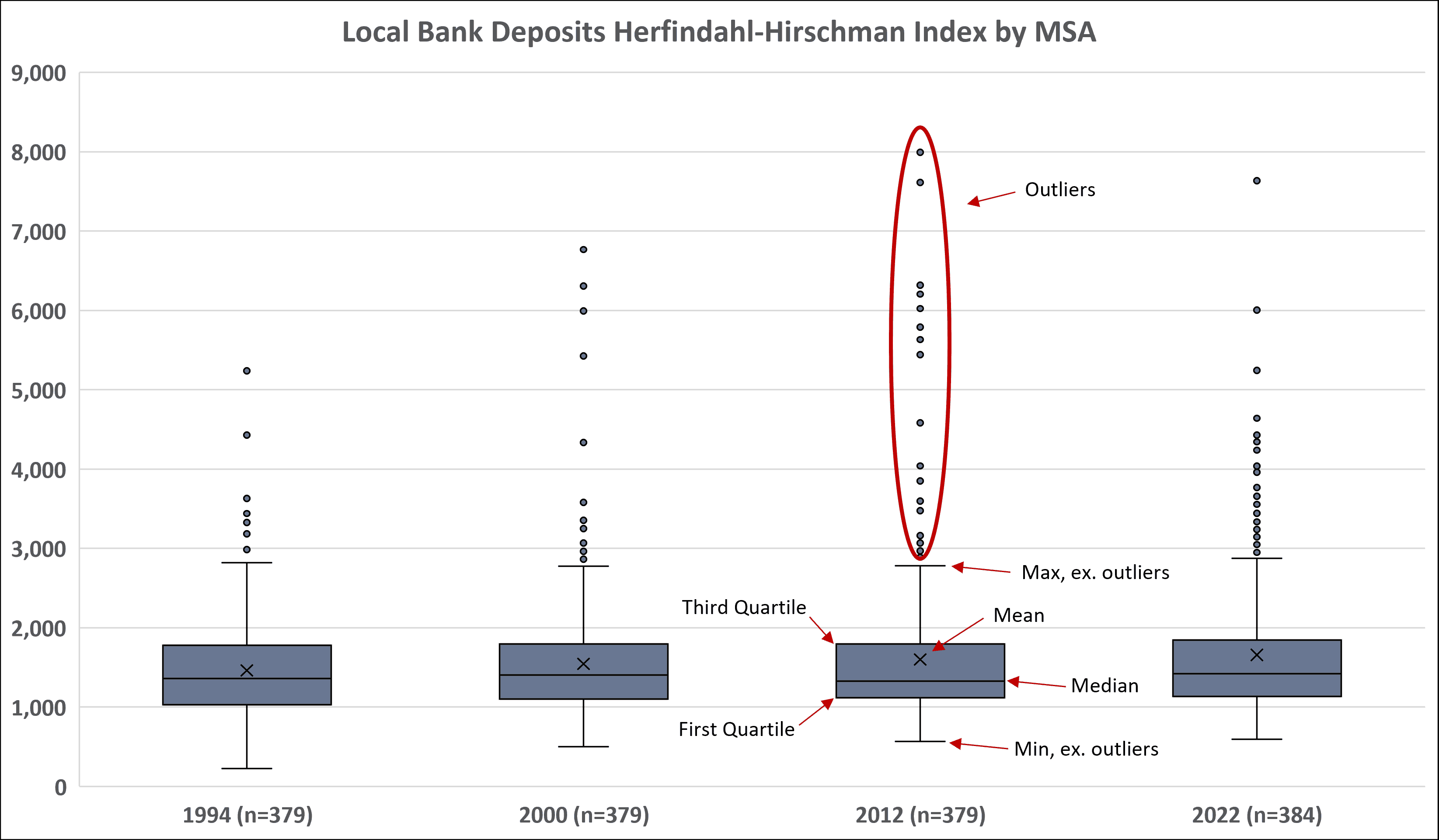

Irrespective of increased mergers and a low number of new entrants, analysis of local bank deposit data for approximately 380 metropolitan statistical areas (MSA), as displayed in Figure 3, shows the average market concentration, measured using the Herfindahl-Hirschman Index (HHI), remained mostly steady between 1994–2022. The average HHI increased just 196 points during that period, from 1,462 to 1,658. Similarly, the distribution – as denoted by the first and third quartiles as well as the minimum and maximum excluding outliers – has changed little (Figure 4).

Figure 3

*Source: Federal Deposit Insurance Corporation, data exclude Puerto Rico

*Identifying Outliers: Outliers fall outside 1.5 times the interquartile range (IQR) above the upper quartile (Q3 + 1.5*IQR) or below the lower quartile (Q1 – 1.5*IQR)

Figure 4

Descriptive Statistics of HHI Data by MSA

|

1994 |

2000 | 2012 |

2022 |

|

| Average |

1,462 |

1,544 | 1,598 |

1,658 |

| Median |

1,362 |

1,401 | 1,325 |

1,420 |

| Quartile 1 |

1,029 |

1,100 | 1,116 |

1,135 |

| Quartile 3 |

749 |

692 | 677 |

709 |

| IQR |

749 |

692 | 677 |

709 |

| Upper limit |

2,901 |

2,831 | 2,808 |

2,906 |

| Lower limit |

-94 |

61 | 101 |

72 |

| Max, ex. Outliers |

2,819 |

2,776 | 2,782 |

2,906 |

| Min, ex. Outliers |

224 |

498 | 566 |

595 |

| Count of Outliers |

12 |

16 | 26 |

30 |

| Number of Obs. |

379 |

379 | 379 |

384 |

Market concentration data, as measured using the HHI, likely underestimates the competitive environment of banking. In other words, the current HHI values are likely too high. Internet banking, nonbank financial institutions, and financial technology firms all offer competing services to those of the traditional banking industry and are not captured using the HHI measure.

Current Evaluation Process and the DOJ’s Role in Bank Mergers

Bank mergers are regulated by the Bank Merger Act (12 U.S. Code §1828(c)) and the Bank Holding Company Act (12 U.S. Code §1842). Federal banking agencies – the Fed, FDIC, and OCC – approve bank mergers.

The primary screening apparatus used by the banking agencies, known as Screen A, and outlined in the 1995 Banking Guidelines, is to calculate the HHI using deposits based on predefined markets developed by the Federal Reserve. These markets are generally at the MSA level. The DOJ explains that “if the calculation…does not result in a post-merger HHI over 1800 and an increase of more than 200, the banking agencies are unlikely to further review the competitive effects of the merger,” with the condition that the post-merger market share does not exceed 35 percent. If the calculated HHIs exceed the thresholds, the agencies will move to Screen B. This screening is similar but will focus on a narrower geographic market.

Similarly, the DOJ will conduct an HHI analysis using bank deposit data. The DOJ is not limited to the predefined geographic markets used by the Fed, however, and will review the competitive effects on retail and small business banking. Consequently, mergers that are below the HHI thresholds used by the banking regulators may still raise competitive concerns during the DOJ review. To address the competitive concerns, the agency will often propose bank branch divestitures as a remedy. The merging parties will enter into a Letter of Agreement with the DOJ that dictates the terms of the divestiture agreement.

After the DOJ conducts its competitive analysis and, if necessary, agrees with the merging parties over specific remedies, the agency will submit a competitive factors report to the banking regulators. The banking regulators will use this information, and their own analysis, to approve or reject a merger. Even if the banking regulator accepts a merger, the DOJ still has the authority to challenge a merger in court.

The criteria used to assess bank mergers and the number of agencies involved in the transaction results in a more rigorous review process than those governing other sectors of the economy, generally. The 2010 Horizontal Merger Guidelines, used by the DOJ and the Federal Trade Commission in merger review of most other industries, considers mergers to be potentially anticompetitive if the post-merger HHI falls in a range of 1500–2500 with a change of 100. While the change in HHI outlined in the Bank Guidelines is more relaxed, the threshold for what is considered highly concentrated is more stringent than the 2500 used for mergers outside the banking system. Additionally, the Bank Merger Act prohibits mergers if the firm post-merger would control “more than 10 percent of the total amount of deposits of insured depository institutions of the United States.” This nationwide market share cap is unique to bank mergers. Moreover, with several agencies involved in bank mergers, only one is needed to block the process.

Potential Changes and Conflicts

In September 2020, the DOJ announced it was seeking public comments into whether the 1995 Banking Guidelines should be revised. More than a year later, and without any finalized policy changes, the DOJ again asked for comments relevant to the Banking Guidelines and its competitive analysis process in December 2021. The banking agencies and the DOJ are still working on updating the merger guidelines.

Kanter preempted any potential changes to the bank merger guidelines during a June 2023 speech on bank competition in which he outlined changes to the DOJ’s approach of merger reviews and the corresponding competitive factors report.

Kanter promised to expand the scope of the report to include an assessment of all “relevant competition in retail banking, small business banking, and large- and mid-size business banking in any given transaction.” He minimized the importance of the local deposit concentration levels, and instead said the DOJ will focus on the “many ways in which competition manifests itself in a particular banking market – including through fees, interest rates, branch locations, product variety, network effects, interoperability, and customer service.” The speech provided few details as to how the agency would measure these factors.

Kanter also made clear that the DOJ will move away from branch divestitures as a remedy in proposed mergers. He stated that the job of the DOJ is law enforcement and claimed that “branch divestitures are not always adequate to address the broader range of competitive concerns…” He commented that the agency’s job is “enforcing the law, not micromanaging or regulating the private sector.” This sentiment is consistent with a speech made to the New York State Bar Association in which Kanter expressed concern that “merger remedies short of blocking a transaction too often miss the mark.” Moreover, he reaffirmed the agency’s commitment to challenging bank mergers under the antitrust law, even if approved by the banking regulators.

The speech’s lack of details, the promise of fewer remedies, and a potential for more court battles leaves the banking industry uncertain. This uncertainty comes at a period when more bank mergers are likely on the horizon following the collapse of Silicon Valley Bank and other regional banks. Treasury Secretary Janet Yellen told bank CEOs in May 2023 that “more [bank] mergers may be necessary after a series of bank failures.” In testimony before the House Financial Services Committee, Acting Comptroller of the Currency Michael J. Hsu testified that the “OCC is committed to being open-minded when considering merger proposals and to acting in a timely manner on applications.” Both statements conflict with the expectation of Biden Administration officials and could be complicated by the likely prolonged merger review proposed by the DOJ.

Competitive effects is only one factor in the laws governing bank mergers. Section (c)(5) of the Bank Merger Act prohibits anticompetitive mergers unless that “effects of the proposed transactions are clearly outweighed in the public interest by the probable effect of the transaction in meeting the convenience and needs of the community to be served.” Furthermore, the act permits mergers to maintain the “stability of the United States banking or financial system.” These considerations are outside the scope of the competitive factors report, leaving many mandates outside the purview of the DOJ.

Conclusion

DOJ Antitrust Division Assistant Attorney General Jonathan Kanter signaled that the DOJ will assume a more assertive role in bank mergers, announcing that the agency will broaden the scope of what it will consider in its competitive factors report and move away from negotiating remedies in bank mergers.

The DOJ has not, however, provided any details on what these changes will include. This lack of clarity will likely lead to longer merger review periods and an era of unpredictability in bank mergers — a particularly problematic scenario as Biden Administration officials are expecting a wave of merger activity.