Insight

December 6, 2022

Differences in Assessing Horizontal and Vertical Mergers for Competitive Effects

Executive Summary

- President Biden’s executive order on Promoting Competition in the American Economy tasked the antitrust enforcement agencies, the Federal Trade Commission (FTC) and Department of Justice (DOJ), to review and consider revising their horizontal and vertical merger guidelines.

- The agencies’ Horizontal Merger Guidelines and Vertical Merger Guidelines explain how they will analyze potential mergers; while different, they share the overarching goal of protecting competition for the benefit of consumers.

- The success of the revisions rests upon the FTC and DOJ creating a credible and predictable set of rules incorporating the nuances applicable to a vertical or horizontal merger evaluation, and whether these new guidelines are recognized by the courts.

Introduction

President Biden’s executive order (EO) on Promoting Competition in the American Economy steered antitrust policy toward an aggressive “whole-of-government” approach to mitigate the effects of market concentration. Among the priorities outlined in the EO was a directive tasking the “Attorney General and the Chair of the FTC…to review the horizontal and vertical merger guidelines and consider whether to revise those guidelines.” [1] The Federal Trade Commission (FTC), joined by the Department of Justice (DOJ), heeded President Biden’s directive and announced their intention to review and update both sets of guidelines.[2]

The horizontal merger guidelines (HMG) and vertical merger guidelines (VMG) outline the “principal analytical techniques, practices, and enforcement policies” of both the FTC and DOJ with respect to mergers of competitors and mergers of firms at different stages in the supply chain. The guidelines were constructed with the overarching goal of protecting consumers from increased prices, decreased output, and stifled innovation.

Both sets of guidelines are updated as needed to reflect new economic learning and agency practice. As explained in prior research from the American Action Forum (AAF), these incremental improvements guided by the overarching principle of protecting consumer welfare were critical to the parameters set forth in both sets of guidelines being routinely cited by the courts. The most recent iteration of the HMG that set evaluation criteria for mergers of competitors was jointly published by the two agencies in 2010.[3] The latest version of the VMG that provides methods to assess mergers of companies at different stages of the supply chain was jointly issued in 2020.[4] Soon after the VMG’s release, the FTC reversed course on the guidelines and, in a split decision along partisan lines, the agency “voted to withdraw its approval of the Vertical Merger Guidelines.” In a press release, the FTC asserted that the VMG included “unsound economic theories that are unsupported by the law or market realities” and vowed to “work with the DOJ to update the merger guidance to better-reflect market realities.”[5]

Withdrawing the merger guidelines signified that the FTC is likely to intensify its scrutiny of vertical integration. The FTC has also initiated a 6(b) study of pharmacy benefit managers. Section 6(b) of the FTC Act gives the agency the authority to “issue an order to require a company to file annual or special reports…to answer specific questions about various aspects of the company’s business conduct.”[6] The inquiry explicitly indicates that vertical tie-ups between health insurance companies and pharmacy benefit managers, such as UnitedHealthcare and Optum, are a potential target.[7]

As the agencies work to revise the guidelines, their success rests upon creating a credible and predictable set of rules that incorporate the nuances pertaining to a vertical or horizontal merger evaluation, as well as whether these new policies are recognized by the courts.

Horizontal Versus Vertical Mergers

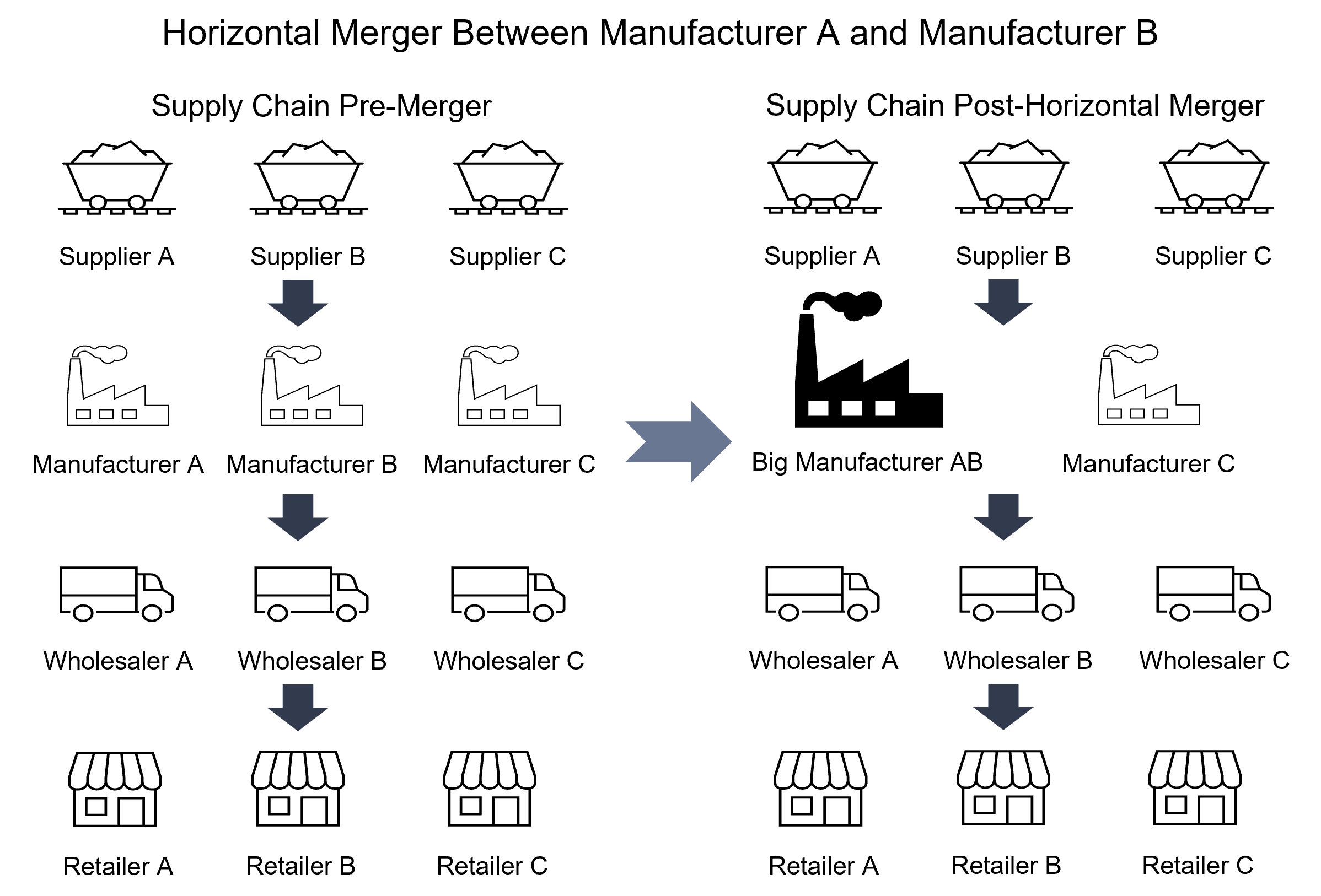

A horizontal merger is a combination of two existing rival firms, or firms that could potentially become rivals, known as nascent competition. These competitors operate within a similar industry or have like products. A completed horizontal merger leaves the market with one less competitor and a larger combined firm.

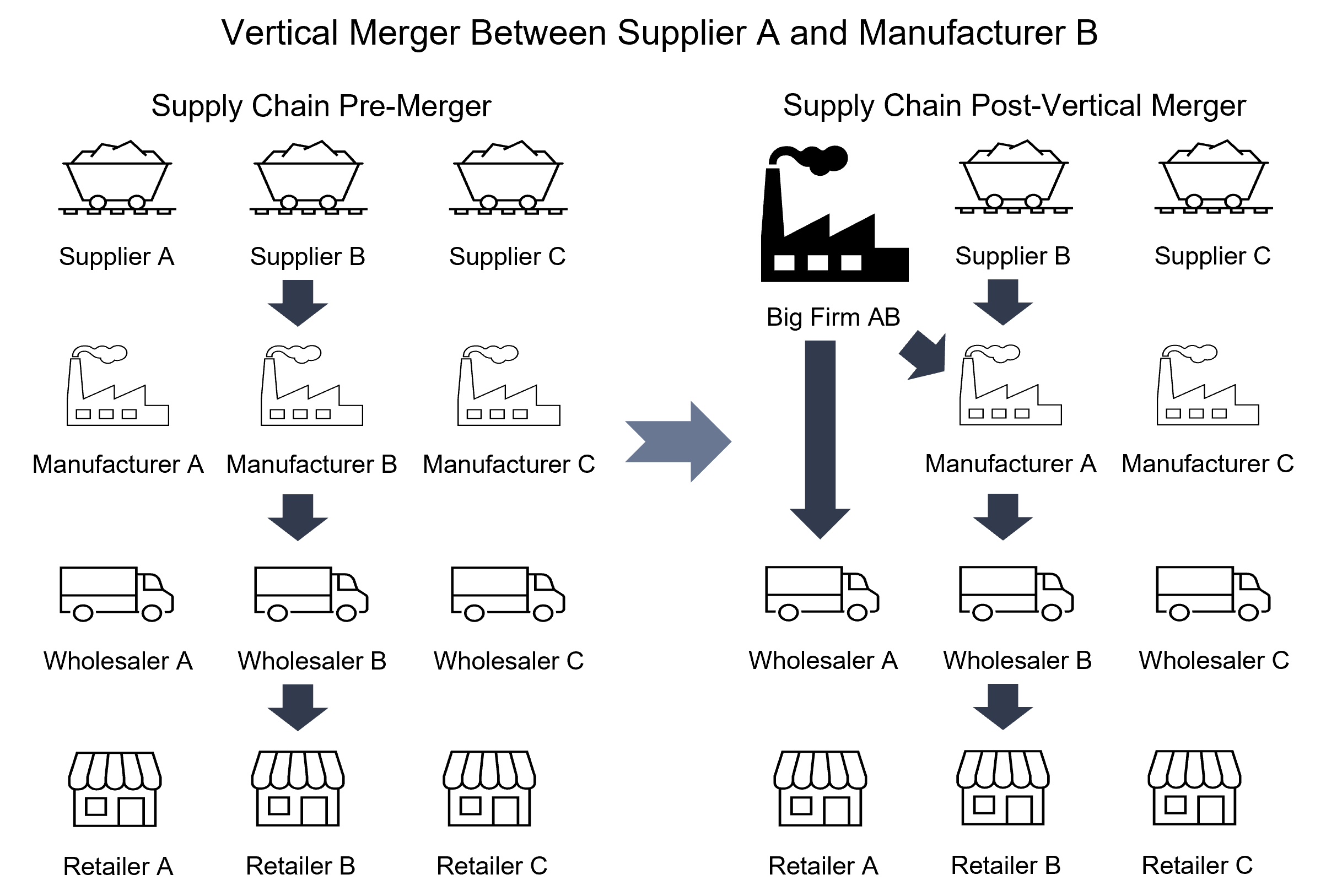

A vertical merger is a combination of firms at different levels of the supply chain. These firms do not directly compete or sell like products, but rather have a buyer-supplier relationship.

Figure 1 depicts the transformation of a market resulting from a horizontal merger. In this elementary example of an economy, the left panel shows a particular market that has three firms at each stage of the supply chain—suppliers, manufacturers, wholesalers, and retailers. In this example, two competing manufacturers, Manufacturer A and Manufacturer B, merge to form Big Manufacturer AB. The recently announced merger between airline competitors JetBlue and Spirit is an example of a horizontal merger.

Figure 1

The economy displayed in Figure 2 has the same initial conditions—three firms at each stage of the supply chain. In this example, Supplier A merges with Manufacturer B to form Big Firm AB. This transformation leaves part of the economy with a firm participating in both an upstream activity (supplier) and a downstream function (manufacturing). A recent example is the merger between upstream firm Illumina with downstream firm Grail. Illumina supplies DNA sequencing instruments used by Grail in the firm’s development of a multi-cancer early detection test.

Figure 2

There is a clear distinction between the two transactions. The merger between JetBlue and Spirit (Figure 1) would leave the firm in the same place in the supply chain, albeit one with fewer competing airlines and with the merged firm controlling a larger share of the market. Conversely, Illumina/Grail (Figure 2), a combination of two firms with a buyer-supplier relationship, now competes in two parts of the supply chain.

Why Evaluation Criteria for Horizontal and Vertical Mergers Must Differ

The examples in Figure 1 and Figure 2 show the distinction between the two types of mergers, and thus the respective analyses are necessarily different.

In a horizontal merger, the concern among the antitrust agencies is whether eliminating a competitor in conjunction with a larger firm would enable that new firm to exercise market power. A firm able to wield market power could put upward pressure on prices and limit the quantity of goods supplied to the market. Previous research from AAF examined the details of a horizontal merger review process.

Analysis of a vertical merger focuses on assessing the procompetitive effects and efficiencies gained through the transaction with the anticompetitive incentives created.

Evaluating the Balance of Procompetitive Effects and Anticompetitive Incentives of a Vertical Merger

An FTC or DOJ challenge of a vertical merger is tasked with showing that the anticompetitive incentives created by the merger outweigh the procompetitive efficiencies using guidance outlined in the VMG.

Like a horizontal merger, the VMG details how agencies are to define the relevant market. With a vertical merger, the relevant markets can be upstream, downstream, or both. As shown in Figure 2, both the upstream market of the suppliers and the downstream market of the manufacturers would be considered by the agencies.

Similar to the HMG, the VGM considers both unilateral and coordinated effects on competition in the relevant market. The unilateral and coordinated effects in the VGM are tailored to a vertical transaction.

Unilateral effects “diminish competition between one merging firm and rivals that trade with, or could trade with, the other merging firm.”[8] The agencies consider two types of unilateral effects: 1) foreclosure and raising rivals’ costs; and 2) access to competitively sensitive information.

First, the agencies will determine whether the new firm has the ability to foreclose and raise rivals’ costs. The vertically merged firm is considered able to foreclose or raise rivals’ cost if “by altering the terms by which it provides a related product to one or more of its rivals” causes a rival “to lose significant sales in the relevant market…or to otherwise compete less aggressively for customers’ business.” The VMG explains that the condition would not be satisfied “if rivals [can] readily switch purchases to alternatives to the related product, including self-supply, without any meaningful effect on the price, quality, or availability of products or services in the relevant market.”[9]

Additionally, the firm must have an incentive to foreclose on and raise rivals’ cost. This condition would be met if the firm “would likely find it profitable to foreclose rivals, or offer inferior terms for the related product….”[10]

Foreclosing on or raising the costs of rival firms was the centerpiece of the FTC’s unsuccessful challenge to the vertical merger of Illumina and Grail because Illumina supplied the market with the only DNA sequencing equipment necessary for the multi-cancer early detection test.

Businesses and antitrust practitioners seeking guidance can leverage the examples that explain the agencies’ approach to various scenarios involving unilateral effects concerning foreclosure and raising rivals’ costs.

Second, the agencies will consider whether the vertical merger gives the “combined firm access to and control of sensitive business information about its upstream or downstream rivals that was unavailable to it before the merger.”[11] By merging with Illumina, Grail may acquire information via the merger about its rival trying to develop multi-cancer early detection tests. Armed with this newfound knowledge, Illumina/Grail could alter its business practices to thwart competition from the remaining test developers.

In addition to unilateral effects, the agencies will also consider coordinated effects that “diminish competition by enabling or encouraging post-merger coordinated interaction among firms in the relevant market that harms consumers.” [12] The VMG defers to section 7.1 and 7.2 of the HMG for much of the discussion concerning coordinated effects. It does add that “Coordinated effects may also arise…when changes in market structure or the merged firm’s access to confidential information facilitate (a) reaching a tacit agreement among market participants, (b) detecting cheating on such an agreement, or (c) punishing cheating firms.”[13]

In conjunction with inspecting the vertical merger transaction for anticompetitive harms, the agencies will gauge procompetitive effects, the most recognized of which is the elimination of double marginalization. Double marginalization occurs when two firms can individually set a price that includes a markup. When this markup is applied at each stage of the supply chain, the product sold to the final consumer will be at a higher price because it includes all these markups. In the case of a separated Illumina and Grail, Grail will pass on two markups to doctors purchasing the multi-cancer detection tests. The first markup will come from Grail’s purchase of Illumina’s DNA sequencing equipment, and the second will be their own markup. If the firms were to merge, Grail would receive the DNA sequencing equipment at cost, and therefore only one markup would be passed on to doctors. A vertically integrated firm will often result in the merged firm’s incurring lower costs for the upstream input than the downstream firm would have paid absent the merger.” This is because the downstream firm will now “have access to the upstream input at cost, whereas” prior to the merger, the “downstream firm would have paid a price that included a markup.”[14]

As noted in the VMG, however, “Since the same source drives any incentive to foreclose or raise rivals’ costs, the evidence needed to assess those competitive harms overlaps substantially with that needed to evaluate the procompetitive benefits likely to result from the elimination of double marginalization.”

Makan Delrahim, former assistant attorney general at the Antitrust Division of the U.S. Department of Justice, notes that the agencies seek three types of evidence to use the elimination of double marginalization as an “affirmative defense.” First, the agency looks at whether “characteristics of the relevant markets caused both parties to mark up prices pre-merger. Second, the parties should show they were unable to reach the joint profit-maximizing arrangement through a contract, [and] unlike to do so in the future absent a merger. Third, how much of the elimination of double marginalization is likely to affect the downstream price to the consumer….” Using this evidence, the agency will “credit the price reduction against any harms likely to flow from the merger.” [15]

Additionally, vertical integrations could lend to the development of “innovative products in ways that would not likely be achieved through arm’s-length contracts.” This procompetitive effect was highlighted in the Illumina/Grail merger case with the firms asserting that Grail could leverage Illumina’s existing regulatory infrastructure to accelerate the approval and adoption of a cancer screening test that is not yet commercially available.

The task of the antitrust enforcement agencies is to assess the procompetitive effects with the unilateral and coordinated anticompetitive harms that could arise from the vertical integration.

Potential for the FTC and DOJ Rewrite of the Vertical Merger Guidelines

The FTC did not provide any superseding guidance following the agency’s withdrawn support of the VMG. Commissioners Noah Joshua Phillips and Christine S. Wilson criticized the agency’s decision as “Sowing confusion regarding the legality of vertical mergers…” that “threatens to chill legitimate merger activity….”[16]

The majority statement, supported by Chair Lina Khan and Commissioners Rohit Chopra and Rebecca Kelly Slaughter, rescinding support of the VGM explained that the statutes governing mergers do not “contain exceptions for mergers that lessen competition but also create some sort of efficiency.”[17] This statement directly targets the elimination of double marginalization defense. The majority added that “The VMG’s reliance on the [elimination of double marginalization] is theoretically and factually misplaced.”[18]

It is unclear what other changes the majority at the FTC has in mind for newly revised VMG. Given the FTC’s recent focus on the technology sector, the access to competitively sensitive information section of the VMG could be expanded.

Conclusion

President Biden’s executive order on Promoting Competition in the American Economy tasked the antitrust enforcement agencies, the FTC and DOJ, to review and consider revising the horizontal and vertical merger guidelines. The agencies followed this directive and are in the process of updating both sets of guidelines.

With its revisions of the VMG, the FTC has signaled that it is set to ramp up its scrutiny of vertical mergers, as evidenced by its initiation of a 6(b) study into pharmacy benefit managers’ tie-ups with health insurers.

The competitive effects of the incentives created in a vertical merger and increased industry concentration following a horizontal merger are the focal points of the FTC and DOJ analysis, with the overarching goal of protecting competition to the benefit of the consumers. Helping businesses understand the agencies’ analysis are the Horizontal Merger Guidelines and Vertical Merger Guidelines.

The success of these revisions rests upon the FTC and DOJ creating a credible and predictable set of rules incorporating the nuances applicable to a vertical or horizontal merger evaluation, and whether these new guidelines are recognized by the courts.

[1] https://www.whitehouse.gov/briefing-room/presidential-actions/2021/07/09/executive-order-on-promoting-competition-in-the-american-economy/

[2] https://www.ftc.gov/news-events/news/press-releases/2022/01/federal-trade-commission-justice-department-seek-strengthen-enforcement-against-illegal-mergers

[3] https://www.justice.gov/atr/horizontal-merger-guidelines-08192010

[4] https://www.ftc.gov/system/files/documents/public_statements/1580003/vertical_merger_guidelines_6-30-20.pdf

[5] https://www.ftc.gov/news-events/news/press-releases/2021/09/federal-trade-commission-withdraws-vertical-merger-guidelines-commentary

[6] https://www.ftc.gov/system/files/attachments/press-releases/ftc-examine-past-acquisitions-large-technology-companies/tech_platform_6b_draft_faqs_02-11-2020.pdf

[7] https://www.ftc.gov/news-events/news/press-releases/2022/06/ftc-launches-inquiry-prescription-drug-middlemen-industry

[8] https://www.ftc.gov/system/files/documents/public_statements/1580003/vertical_merger_guidelines_6-30-20.pdf

[9] Id.

[10] Id.

[11] Id.

[12] Id.

[13] Id.

[14] Id.

[15] https://www.justice.gov/opa/speech/file/1132831/download

[16] https://www.ftc.gov/system/files/documents/public_statements/1596388/p810034phillipswilsonstatementvmgrescission.pdf

[17] https://www.ftc.gov/system/files/documents/public_statements/1596396/statement_of_chair_lina_m_khan_commissioner_rohit_chopra_and_commissioner_rebecca_kelly_slaughter_on.pdf

[18] Id.