Insight

January 8, 2020

Do Crude Oil Futures Prices Serve as a Recessionary Indicator?

Summary

- Unrest in the Middle East has caused crude oil futures prices to rise in the United States, raising the question of whether the spike could be a harbinger of an economic recession.

- Recessions typically follow 90+ percent spikes in oil futures prices.

- Prices in early January 2020 rose about 7 percent, and they would need to continue growing dramatically in order to suggest a recession may be on the horizon.

Introduction

Iranian Maj. Gen. Qassem Soleimani’s assassination on January 3, 2020, and the resulting tension in the Middle East have driven up crude oil futures prices, raising the question of whether this spike is an indicator of a forthcoming recession in the United States. The presumption here is that unrest in the Middle East will continue and impact the production of OPEC members, constricting global supply. And to make the fear all the more real, President Trump threatened Iraq, OPEC’s second largest producer with sanction following its vote to expel US troops, and these sanctions could target oil like those imposed on Iran.

Learning from Past Recessions

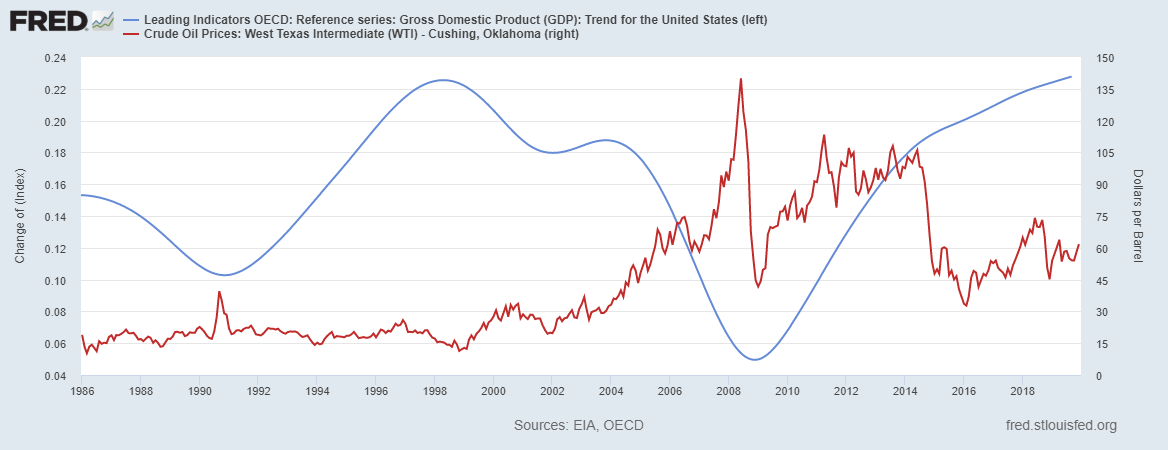

While there are many contributing factors to a recession, the last few recessions in the United States were preceded by a spike of more than 90 percent in oil futures prices.[1] In 2008, both Brent and West Texas Intermediate (WTI) futures prices peaked at over $100/barrel (bbl). Between January 2-6, 2020, however, Brent crude futures prices, an indicator of prices abroad, grew from about $66/bbl to about $70/bbl.

The Energy Information Administration’s contract dataset for Cushing Crude Oil Futures (a domestic indicator of pricing) clarifies the relationship between futures prices and recessions. The Cushing peak in 2008 marked a 98 percent increase when looking back 12 months, as shown below. Similarly, the recessions of 1990 and 2001 were both preceded by an over 100 percent increase in prices.

Prices in Perspective

Both Brent and Cushing prices rose approximately 8 percent in the past month – far from the 90 percent that has historically preceded a recession. Considering the lowest futures price within the past 18 months was about $49/bbl, just over a year ago in December 2018, prices would need to rise to about $100/bbl to suggest a recession is imminent. In other words, the market would need to see significant continued growth in prices in the coming months for a recession to be likely.

The recent rise is about $1 higher than the spike in prices following the September 2019 attack on the Abqaiq-Khurais oil fields in Saudi Arabia. And while Iraq as a whole produced 4.6 million barrels per day (bpd) of petroleum in 2018, the Abqaiq-Khurais fields alone produced 8.45 million bpd.[1] Following the attack in Saudi Arabia, authorities assured the expedient repair of the fields and restoration of production. Prices fell in the following weeks, just as prices appear to be falling now.

Domestic Production and Political Threats

As of 2019, with the growth of domestic production, the United States is no longer a net importer of oil. Because oil is a globally traded commodity, domestic production doesn’t shield consumers from increased prices at the pump, but the limited production capacity abroad may lead to investment in domestic producers.[2] Nevertheless, the situation in the Middle East is in flux, oil producers are withdrawing their staff from Iraqi fields, and the administration’s actions could still impact Iraqi exports.[3]

While the threat of sanctions may be an effective diplomatic tool, acting on that threat may come at the expense of the global energy markets and the domestic economy. The administration’s rhetoric surrounding sanctions on Iraq may prove to be market moving but will hopefully remain nothing more than rhetoric.

[1] https://www.eia.gov/beta/international/rankings/#/?cy=2018, https://www.nytimes.com/2019/09/14/world/middleeast/saudi-arabia-refineries-drone-attack.html

[2] https://blogs.wsj.com/economics/2020/01/07/newsletter-gold-oil-uncertainty-and-iran/?guid=BL-REB-39688&dsk=y

[3] Chevron pulls U.S. workers out of Iraq, Politico, https://subscriber.politicopro.com/article/2020/01/chevron-pulls-us-workers-out-of-iraq-3975397

[1] https://www.federalreserve.gov/pubs/ifdp/2014/1114/ifdp1114.pdf